PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773322

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773322

Peptide-Based Nanomaterials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

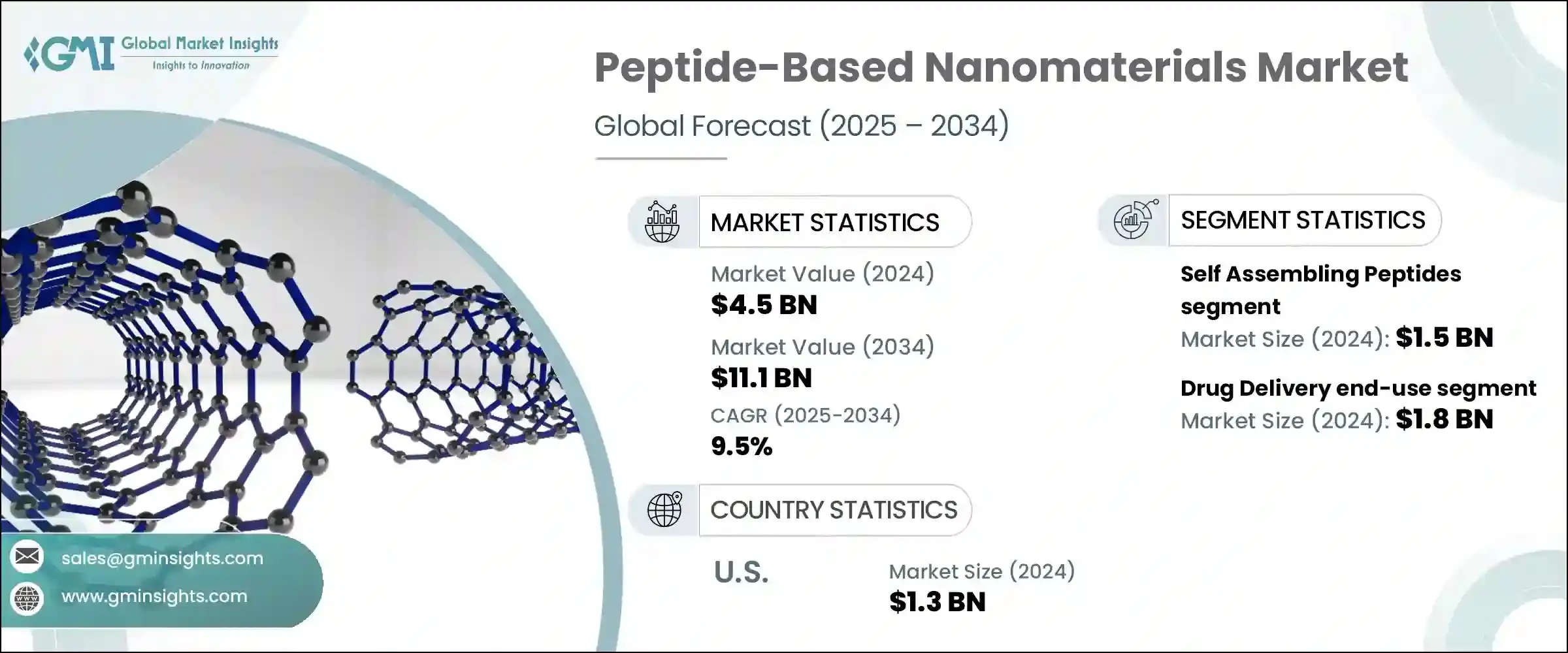

The Global Peptide-Based Nanomaterials Market was valued at USD 4.5 billion in 2024 and is estimated to grow at a CAGR of 9.5% to reach USD 11.1 billion by 2034. This market is gaining momentum as the medical industry shifts towards precision medicine and targeted therapy. Peptide-based nanomaterials are gaining attention due to their multifunctional capabilities in drug delivery, imaging, transdermal therapeutics, and tissue engineering. Their ability to act as biocompatible drug carriers and support advanced treatment platforms has made them an attractive alternative to traditional therapies. Increasing private investments and government funding are accelerating the pace of innovation in nanomedicine.

Healthcare systems globally are evolving with a renewed emphasis on advanced medical tools, biologically responsive materials, and nanoscale therapeutics that offer improved efficacy with fewer side effects. The rising demand for smart drug systems, particularly those that can localize and minimize exposure to healthy tissue, is contributing significantly to the adoption of these technologies. In addition, increased interest from investors and public healthcare agencies in biopharmaceutical innovation is giving rise to specialized detection systems, intelligent drug formulation methods, and modular nanostructures aimed at revolutionizing how diseases are treated at the molecular level.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.5 billion |

| Forecast Value | $11.1 billion |

| CAGR | 9.5% |

The self-assembling peptides segment generated USD 1.5 billion in 2024 and is forecast to grow at a CAGR of 8.7% through 2034. The popularity of this segment is driven by the growing demand for controlled-release and site-specific delivery systems. With more than 300 peptide-based carriers in either preclinical or clinical stages, targeted therapeutics-especially for cancer and gene therapy-are key growth areas. Developers are focusing on formulating peptide nanostructures that are biocompatible and biodegradable, allowing for safer drug transport. Innovations are now spilling over into adjacent fields such as diagnostics and molecular imaging, which are seeing interest from both researchers and regulatory stakeholders.

In 2024, the drug delivery application segment held a market value of USD 1.8 billion, representing a 39.3% share and growing at a CAGR of 6.1% through 2034. The pharmaceutical and biotech sectors are the major end-users, heavily investing in developing safe, personalized delivery platforms. Around 60% of biotechnology firms have already incorporated peptide-based systems during early research phases. Beyond pharma, uptake is also growing among healthcare equipment manufacturers and research institutes due to favorable regulatory developments. The cosmetics and food industries are also exploring bioactive peptides, creating opportunities for market expansion among newer entrants.

United States Peptide-Based Nanomaterials Market generated USD 1.3 billion in 2024 and is projected to grow at a CAGR of 9.1%, accounting for 29.3% by 2034. With significant R&D expenditure and a well-established biopharma ecosystem, the US stands as a leader in peptide-based nanomaterials development. More than 35% of nanomedicine-related patents originate from the US, indicating high research intensity and technological capability. Domestic manufacturing is robust, backed by FDA-approved clinical trials and strong initiatives around personalized medicine, reducing reliance on imported solutions.

Key players shaping the Peptide-Based Nanomaterials Market include Genscript Biotech Corporation, PolyPeptide Group, Anika Therapeutics, Inc., PeptiDream Inc., and Bachem Holding AG. To maintain competitiveness, companies in the peptide-based nanomaterials market are prioritizing investments in scalable R&D, focusing on therapeutic versatility and regulatory compliance. Strategic collaborations with pharmaceutical firms, academic institutions, and clinical research organizations help accelerate product development pipelines. Many are also enhancing their production capabilities with advanced peptide synthesis technologies to meet rising global demand. Intellectual property protection is a key focus, as companies strengthen their patent portfolios for novel nanomaterials. Further, market players are expanding their application reach beyond drug delivery into diagnostics, regenerative medicine, and cosmeceuticals.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO Perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Self assembling peptides

- 5.3 Peptide amphiphiles

- 5.4 Peptide polymer conjugates

- 5.5 Peptide nanoparticle hybrids

- 5.6 Cyclic peptide nanostructures

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Nanostructure Morphology, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Nanofibers & nanotubes

- 6.3 Nanospheres & vesicles

- 6.4 Hydrogels & scaffolds

- 6.5 Nanoparticles

- 6.6 2d nanosheets & films

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Drug delivery

- 7.2.1 targeted cancer therapeutics

- 7.2.2 gene & nucleic acid delivery

- 7.2.3 other drug delivery applications

- 7.3 Tissue engineering & regenerative medicine

- 7.4 Biosensing & diagnostics

- 7.5 Antimicrobial applications

- 7.6 Bioimaging & theranostics

- 7.7 Other applications

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Pharmaceutical & biotechnology

- 8.3 Healthcare & medical devices

- 8.4 Research & academic institutions

- 8.5 Cosmetics & personal care

- 8.6 Food & agriculture

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Ferring Pharmaceuticals

- 10.2 3D Matrix Medical Technology

- 10.3 Nanovesicular (NVS) Technologies

- 10.4 CellMark Medical

- 10.5 Nanomatrix Therapeutics

- 10.6 Anika Therapeutics, Inc.

- 10.7 Nanoviricides, Inc.

- 10.8 Peptron, Inc.

- 10.9 Ambiopharm, Inc.

- 10.10 Bachem Holding AG

- 10.11 PolyPeptide Group

- 10.12 Nanosphere Health Sciences, Inc.

- 10.13 Peptide Solutions, LLC

- 10.14 PeptiDream Inc.

- 10.15 Genscript Biotech Corporation

- 10.16 Peptisyntha (Solvay Group)

- 10.17 Pepscan

- 10.18 Nanopartz Inc.

- 10.19 CPC Scientific Inc.

- 10.20 Advanced Peptides