PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773331

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773331

Industrial Furnaces Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

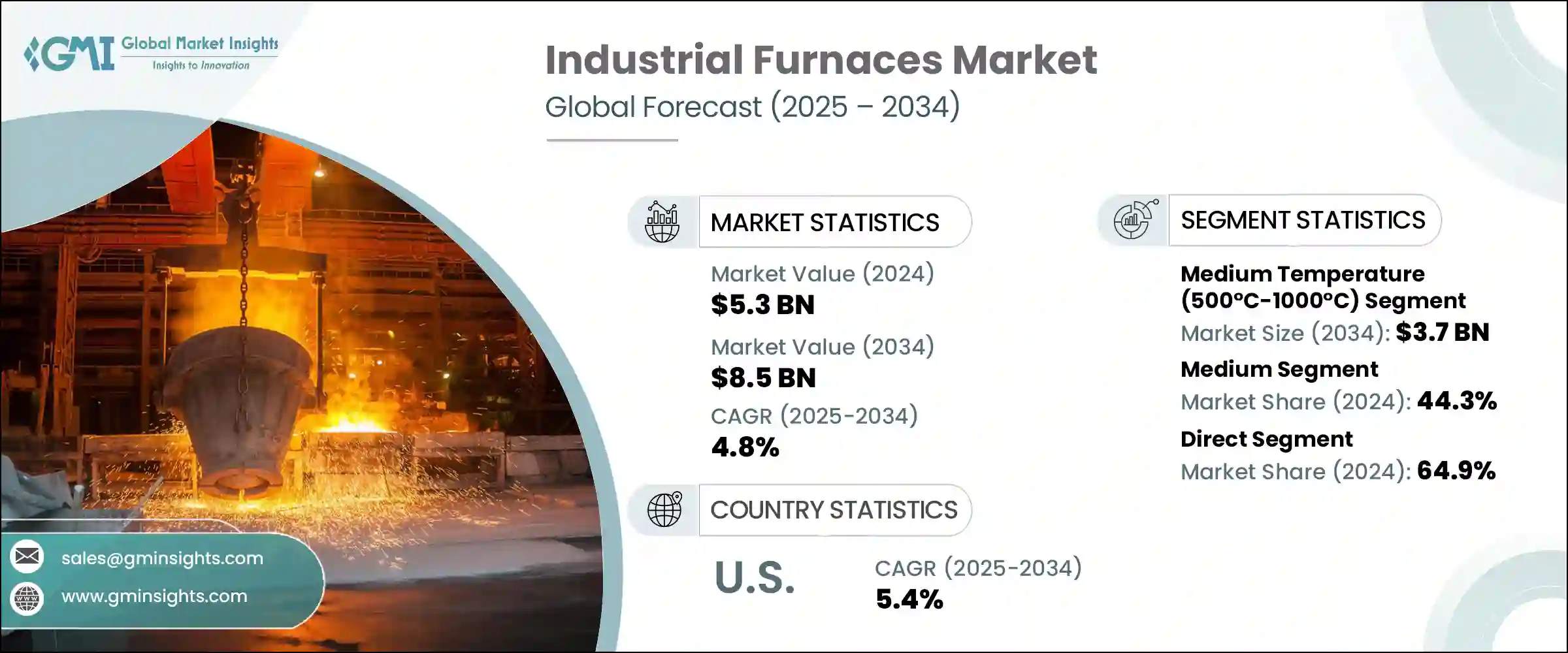

The Global Industrial Furnaces Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 8.5 billion by 2034. The metal and steel industries are key contributors to this growth, as industrial furnaces are essential for high-temperature processes such as melting, annealing, and tempering, which are required for shaping and treating metals. Rising demand for infrastructure, automotive production, and industrial development, particularly in regions like China, India, and the U.S., is driving the need for more efficient and durable furnaces. The increasing adoption of electric arc furnaces (EAFs), which offer lower emissions and higher energy efficiency compared to traditional blast furnaces, is another important trend. EAFs now account for approximately 30% of global steel production, further increasing the demand for advanced furnace technologies worldwide.

In addition to the rising focus on decarbonization, industries are increasingly turning to alternative heating technologies like hydrogen flames and electric arcs to reduce their carbon footprint. These alternatives are seen as key solutions in the transition to more sustainable manufacturing processes. Hydrogen flames, for example, offer a clean burning option that emits only water vapor, making them an attractive choice for reducing emissions in high-temperature processes. Electric arc furnaces (EAFs), already popular in steel production, are also being explored for their ability to reduce carbon emissions compared to traditional furnace technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $8.5 Billion |

| CAGR | 4.8% |

The medium-temperature segment of the industrial furnaces market generated USD 2.2 billion in 2024 and is expected to reach USD 3.7 billion by 2034. Medium-temperature furnaces, which operate between 500°C and 1000°C, remain a dominant segment in the global market due to their versatility and ability to handle various heat-treatment processes. These furnaces are widely used across industries, from automotive and aerospace to electronics manufacturing, due to their ability to process metals and alloys.

The medium-capacity segment accounted for a 44.3% share in 2024 and is expected to grow at a CAGR of 4.4% through 2034. These furnaces are particularly favored for mid-sized industrial applications that require frequent temperature cycling and moderate throughput. Industries such as machinery manufacturing, auto parts production, and foundries rely on medium-temperature furnaces for consistent quality control and fulfilling production requirements.

United States Industrial Furnaces Market was valued at USD 700 million in 2024, with projections showing strong growth at a CAGR of 5.4% through 2034. The U.S. continues to lead the North American industrial furnaces market due to its advanced manufacturing capabilities and the increasing adoption of energy-efficient furnace technologies. Metal processing plants, aerospace workshops, and the automotive industry are driving demand for new, high-efficiency industrial furnaces, as these sectors work to reduce emissions and improve productivity. North America, particularly the U.S., Canada, and Mexico, holds a significant share of the global market due to the region's mature manufacturing base and focus on sustainable production practices.

Key players in the Industrial Furnaces Market include Harper International, SECO/WARWICK S.A., Tenova S.p.A., Despatch Industries, Carbolite Gero, Lindberg/MPH, Gasbarre Thermal Processing Systems, Nabertherm GmbH, Inductotherm Group, Surface Combustion, Inc., ABB, Ipsen International GmbH, Wisconsin Oven Corporation, Nutec Bickley, and ANDRITZ AG. Companies in the industrial furnaces market are adopting several key strategies to strengthen their position. One of the main approaches is focusing on technological innovation, such as the development of more energy-efficient and sustainable furnaces.

Companies are investing heavily in research and development to improve the performance of electric arc furnaces (EAFs) and explore alternatives like hydrogen flames to meet decarbonization targets. Additionally, these companies are working on expanding their global footprint through strategic partnerships and collaborations with manufacturers in key industries, such as automotive, aerospace, and metal processing. Another strategy is offering customized solutions to meet the specific needs of various industries, enhancing their market appeal and ensuring long-term customer relationships.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Furnace type

- 2.2.3 Temperature

- 2.2.4 Capacity

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code- 8417)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Furnace Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Electric furnaces

- 5.3 Gas furnaces

- 5.4 Oil furnaces

- 5.5 Coal furnaces

- 5.6 Induction furnaces

- 5.7 Arc furnaces

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Temperature, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Low temperature (Below 500°C)

- 6.3 Medium temperature (500°C - 1000°C)

- 6.4 High temperature (Above 1000°C)

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Small

- 7.3 Medium

- 7.4 Large

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace

- 8.4 Non-Ferrous metals

- 8.5 Chemical and petrochemical

- 8.6 Oil and gas

- 8.7 Food and beverage

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 UAE

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 ANDRITZ AG

- 11.3 Carbolite Gero

- 11.4 Despatch Industries

- 11.5 Gasbarre Thermal Processing Systems

- 11.6 Harper International

- 11.7 Inductotherm Group

- 11.8 Ipsen International GmbH

- 11.9 Lindberg/MPH

- 11.10 Nabertherm GmbH

- 11.11 Nutec Bickley

- 11.12 SECO/WARWICK S.A.

- 11.13 Surface Combustion, Inc.

- 11.14 Tenova S.p.A.

- 11.15 Wisconsin Oven Corporation