PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773334

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773334

E-compass Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

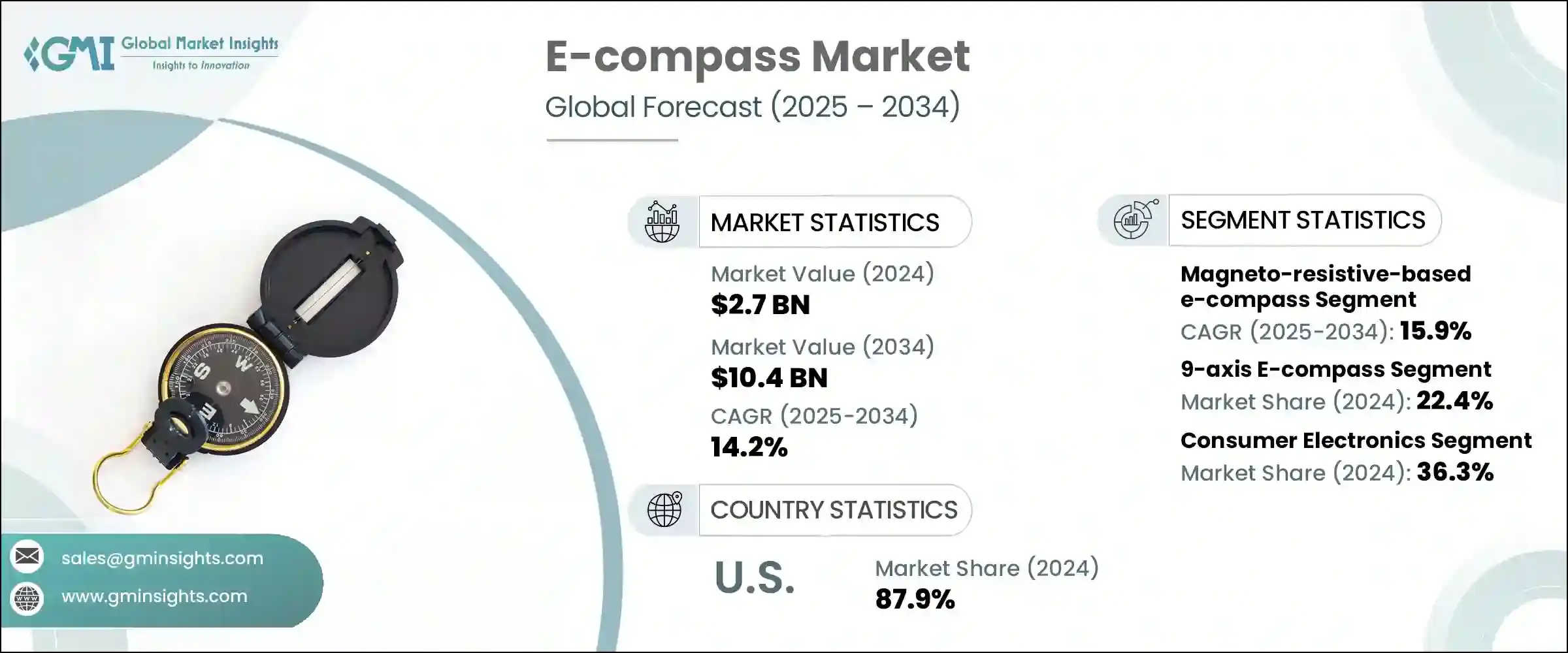

The Global E-compass Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 14.2% to reach USD 10.4 billion by 2034. This remarkable growth is driven by the increasing adoption of autonomous vehicles and advanced driver-assistance systems (ADAS), which rely heavily on precise orientation and directional data for functions such as lane-keeping, automated navigation, and obstacle detection. The integration of e-compass technology significantly enhances real-time spatial awareness, improving safety and decision-making capabilities in vehicles. Additionally, the growing commercial applications of drones and unmanned aerial vehicles (UAVs) further fuel demand. These aerial systems depend on accurate navigation and orientation, particularly in GPS-compromised environments, for tasks including aerial surveying, agricultural monitoring, and infrastructure inspections.

As more industries adopt drones to enhance operational efficiency and reduce costs, the demand for compact, dependable orientation sensors such as e-compasses continues to surge. These sensors play a crucial role in ensuring precise navigation and stable flight, especially in complex or GPS-limited environments. Their lightweight design allows drones to maintain optimal performance without compromising battery life or payload capacity, making them indispensable for a wide range of commercial applications-from aerial surveying and agriculture to infrastructure inspection and delivery services. This growing reliance on e-compasses to provide accurate directional data is fueling rapid market growth, as manufacturers and service providers seek advanced solutions that improve flight control, safety, and reliability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $10.4 Billion |

| CAGR | 14.2% |

The magneto-resistive-based segment is expected to grow at an impressive CAGR of 15.9% through 2034. These sensors are gaining traction due to their superior sensitivity and precision, making them ideal for industrial machinery and drone navigation where accurate heading detection is critical. Ongoing advancements in magnetic distortion correction and thermal stability continue to enhance their performance, broadening their adoption in sophisticated navigation systems.

Meanwhile, the 6-axis e-compass segment, combining a 3-axis magnetometer with a 3-axis accelerometer, is anticipated to register a CAGR of 14.9%. These compact systems are widely used in smartphones, wearable technology, and gaming devices, offering an excellent balance between size and functionality for orientation and motion sensing in consumer electronics.

U.S. E-compass Market held an 87.9% share in 2024. Growth in the region is propelled by cutting-edge developments in autonomous vehicles, consumer electronics, and military navigation technologies. Significant investment in research and development, alongside the widespread adoption of wearable and Internet of Things (IoT) devices, is fueling demand for e-compass modules integrated into AI-driven, GPS-independent navigation platforms.

Key players in the market include Allegro Microsystems, Asahi Kasei Microdevices, Bosch Sensortec, Althen, Honeywell, Lars Thrane, and Jewell Instruments, all competing to expand their influence through innovation and strategic partnerships. To solidify their foothold in the e-commerce market, companies are focusing on a blend of innovation, strategic alliances, and diversification.

Leading manufacturers invest heavily in R&D to improve sensor accuracy, reduce power consumption, and enhance thermal and magnetic distortion resistance. Collaborations with automotive, drone, and consumer electronics firms help integrate e-compass modules into emerging technologies like autonomous navigation and wearable devices. Expanding into untapped markets and broadening application segments, especially in industrial and military domains, is also a common approach.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Sensor technology trends

- 2.2.2 Number of axes trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO Perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for autonomous vehicles and ADAS technologies

- 3.2.1.2 Increasing use of drones and UAVs for commercial applications

- 3.2.1.3 Expansion of wearable devices and fitness trackers

- 3.2.1.4 Surge in demand for navigation in robotics and industrial automation

- 3.2.1.5 Rising defense and aerospace investments in navigation systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced e-compass modules for precision applications

- 3.2.2.2 Limited adoption in low-cost consumer electronics

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price Trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing Strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and IP analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market Concentration Analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates & Forecast, By Sensor Technology ,2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Fluxgate-based e-compass

- 5.3 Hall effect-based e-compass

- 5.4 Magneto-resistive -based e-compass

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Number of Axes, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 1-axis e-compass

- 6.3 2-axis e-compass

- 6.4 3-axis e-compass

- 6.5 6-axis e-compass

- 6.6 9-axis e-compass

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Consumer electronics

- 7.2.1 Smartphones

- 7.2.2 Wearable devices (smartwatches, fitness bands)

- 7.3 Automotive

- 7.3.1 Advanced driver assistance systems (ADAS)

- 7.3.2 In-vehicle navigation systems

- 7.3.3 Others

- 7.4 Aerospace & defense

- 7.4.1 UAVs & drones

- 7.4.2 Avionics & navigation equipment

- 7.5 Industrial

- 7.5.1 Robotics

- 7.5.2 Marine instruments

- 7.5.3 Others

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Allegro Microsystems

- 9.2 Althen

- 9.3 Asahi Kasei Microdevices

- 9.4 Bosch Sensortec

- 9.5 Honeywell

- 9.6 Jewell Instruments

- 9.7 Lars Thrane

- 9.8 Ricoh Imaging

- 9.9 Rohm Semiconductor

- 9.10 Shenzhen Rion Technology

- 9.11 Skymems

- 9.12 STMicroelectronics

- 9.13 Truenorth Technologies

- 9.14 Wuxi Bewis Sensing Technology