PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773340

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773340

Dental Caries Detectors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

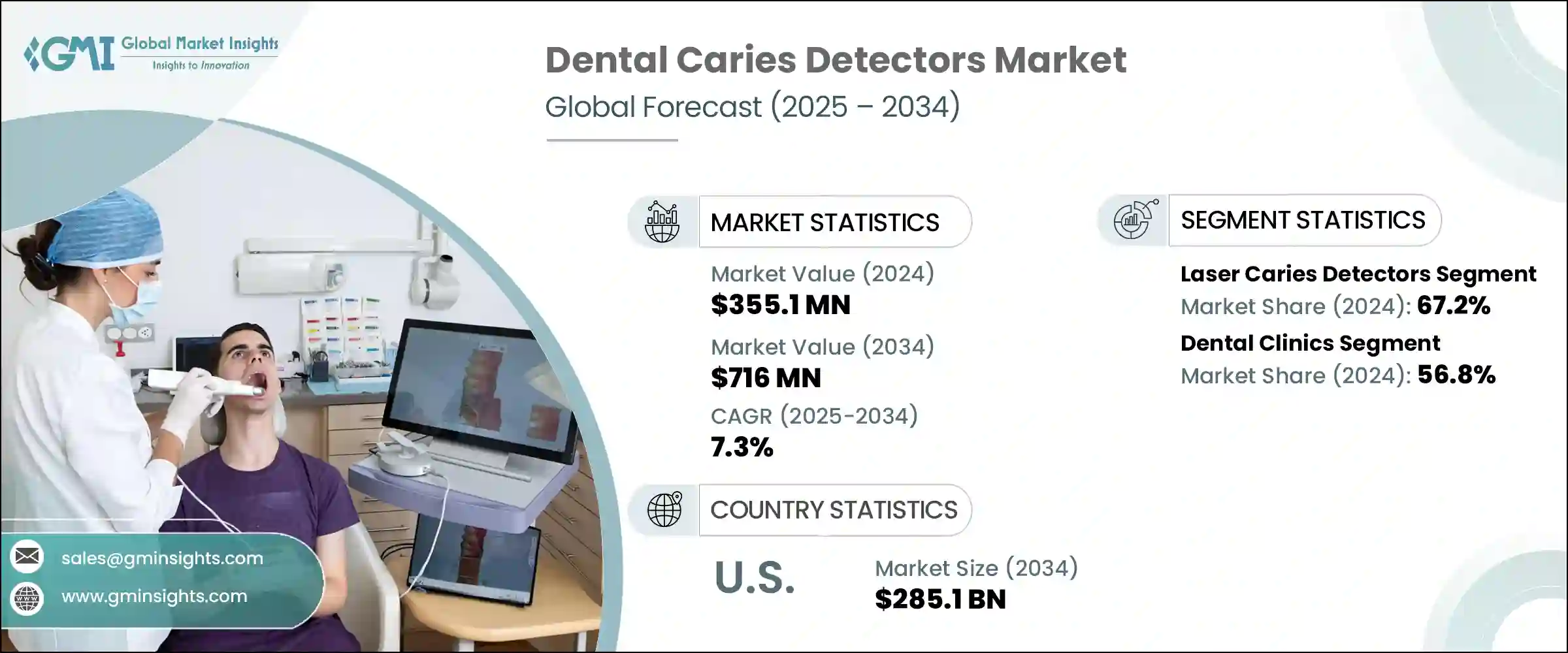

The Global Dental Caries Detectors Market was valued at USD 355.1 million in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 716 million by 2034. Rising incidences of dental caries, particularly among aging populations and younger age groups, continue to drive the need for advanced diagnostic tools. As untreated cavities often lead to complex oral health issues and higher treatment costs, there is a growing focus on early-stage, non-invasive detection methods. Patients and providers alike are increasingly turning to caries detection devices for faster, more accurate assessments.

Advancements in oral care awareness and the integration of preventive measures into both individual and public health systems are reshaping how oral diseases are managed. With improved access to modern technologies and a shift toward early intervention, dental care is becoming more proactive than reactive. This market's growth is also supported by a wider interest in overall well-being, encouraging dentists to implement forward-thinking tools that help detect, monitor, and prevent oral health issues efficiently. Additionally, digital platforms and evolving patient care models are transforming the way dental practitioners approach diagnosis, enabling better clinical outcomes and long-term cost reduction across patient populations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $355.1 Million |

| Forecast Value | $716 Million |

| CAGR | 7.3% |

Technology-driven innovation is at the core of this market, with devices offering enhanced speed and diagnostic precision through methods like digital radiography, laser fluorescence, and near-infrared imaging. These advancements are empowering practitioners to identify lesions before they progress, enabling interventions that prioritize preservation and minimal invasion. As interest in complementary care and holistic health grows, dental offices are incorporating early detection tools that align with broader treatment goals, including comfort, longevity, and patient satisfaction. With a rising emphasis on long-term health savings and education around oral hygiene, these detection technologies are becoming key components in routine exams, improving access and optimizing early-stage care strategies.

The laser caries detection tools segment accounted for a 67.2% share in 2024, solidifying its lead within the global market. These systems are becoming the preferred choice due to their ability to identify lesions before visible decay develops. The trend toward minimally invasive procedures is fueling demand for devices that preserve natural enamel and allow early preventive intervention. Laser technologies often rely on fluorescence, providing a reliable, pain-free method to differentiate between healthy and decayed tissue. As confidence grows in the clinical reliability of fluorescence for identifying occlusal and interproximal caries, laser-based systems are gaining broader acceptance across practices. Dentists are investing in these tools not only to increase diagnostic precision but also to enhance patient comfort and experience during routine checkups.

The dental clinics segment held a 56.8% share in 2024. Clinics are under increasing pressure to validate their diagnostic accuracy with evidence-based practices, particularly as insurance and care delivery systems evolve. Integrating advanced detection systems helps providers align with modern care protocols while reinforcing patient trust and reducing the risk of overtreatment. Many clinics are shifting toward data-driven treatment planning, where accurate detection supports conservative management of carious lesions and personalized care approaches. With early diagnosis being key to effective treatment, clinics are positioning themselves as leaders in preventive dental care.

United States Dental Caries Detectors Market is projected to reach USD 285.1 million by 2034. Despite being a high-income nation, the U.S. faces a significant oral health burden, particularly among children, seniors, and underrepresented communities. Barriers to preventive dental visits-such as cost and limited access-make early detection critical in managing widespread decay. The adoption of diagnostic tools is increasing across both private clinics and public health settings to control long-term healthcare costs and support broader preventive care goals. The role of diagnostic innovation is pivotal in mitigating untreated dental issues and improving oral health outcomes nationwide.

Prominent players operating in the Dental Caries Detectors Market include Ivoclar Vivadent, Quantum Dental Technologies, Planmeca, AdDent, Biolase, Dentsply Sirona, Centrix, Kuraray, Acteon Group, Hu-Friedy, DentLight, KaVo Kerr, Vatech, Air Techniques, and GreenMark Biomedical. Leading companies in the dental caries detectors market are focusing on advancing diagnostic precision and user-friendly designs to enhance clinical workflows.

Many are integrating AI-powered analytics and real-time imaging to improve caries identification and support evidence-based dentistry. Strategic investments in R&D aim to deliver compact, non-invasive, and cost-effective devices suited for diverse clinical environments. Companies are also forming partnerships with dental schools and health systems to increase product adoption and educational outreach. Expanding product portfolios to include multifunctional diagnostic tools further strengthens their competitive position.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of dental caries globally

- 3.2.1.2 Rising awareness about oral health and preventive dentistry

- 3.2.1.3 Technological advancements in imaging and laser-based detection

- 3.2.1.4 Growing number of dental clinics and professionals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced caries detection devices

- 3.2.2.2 Lack of reimbursement policies

- 3.2.3 Market opportunities

- 3.2.3.1 AI-Powered Diagnostic Solutions for Early Caries Detection

- 3.2.3.2 Portable and Teledentistry-Compatible Caries Detection Devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Reimbursement scenario

- 3.7.1 Impact of reimbursement policies on market growth

- 3.8 Future market trends

- 3.9 Consumer behaviour analysis

- 3.10 Patent analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Laser caries detectors

- 5.3 Fiber optic transillumination (FOTI) devices

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dental clinics

- 6.3 Hospitals

- 6.4 Academic and research institutes

- 6.5 Diagnostic centers

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Mexico

- 7.5.2 Brazil

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Acteon Group

- 8.2 AdDent

- 8.3 Air Techniques

- 8.4 Biolase

- 8.5 Centrix

- 8.6 DentLight

- 8.7 Dentsply Sirona

- 8.8 GreenMark Biomedical

- 8.9 Hu-Friedy

- 8.10 Ivoclar Vivadent

- 8.11 KaVo Kerr

- 8.12 Kuraray

- 8.13 Planmeca

- 8.14 Quantum Dental Technologies

- 8.15 Vatech