PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773342

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773342

Western Europe Hospital Information System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

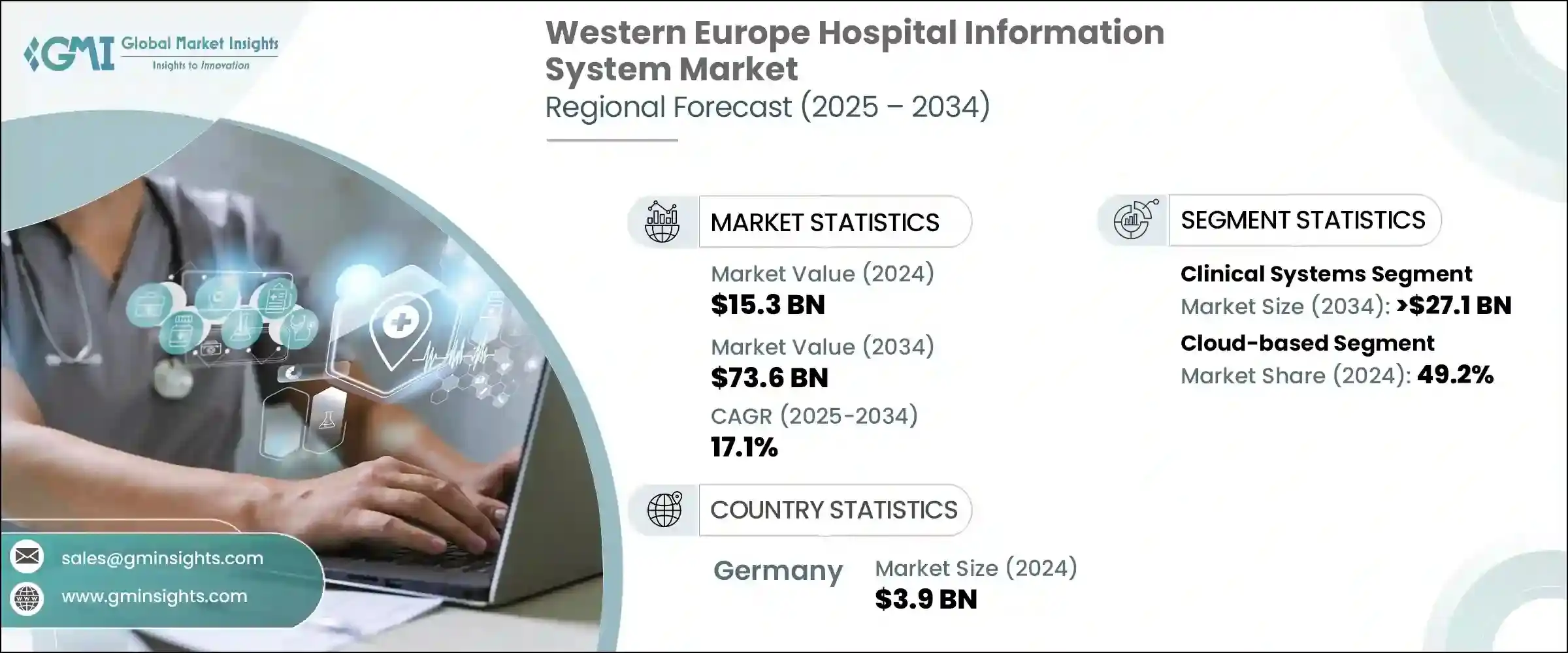

Western Europe Hospital Information System Market was valued at USD 15.3 billion in 2024 and is estimated to grow at a CAGR of 17.1% to reach USD 73.6 billion by 2034. This notable growth is largely fueled by an increasing focus on digital transformation across healthcare facilities, strong public sector initiatives, and mounting pressure on hospitals to streamline operations while delivering improved patient care. Healthcare providers in the region are increasingly relying on advanced information systems to optimize resource utilization, enhance workflow efficiency, and gain actionable insights through data-driven decision-making. As the need for interoperability, real-time access to patient information, and coordinated care rises, the role of comprehensive HIS platforms is becoming more pronounced across all tiers of the healthcare ecosystem.

Growing demand for digital infrastructure has prompted hospitals to adopt smart systems that reduce administrative burden, minimize clinical errors, and improve overall treatment quality. Digitalization efforts are being reinforced by national strategies aimed at healthcare modernization, with particular emphasis on standardized records and integrated platforms that ensure seamless communication between departments. As aging populations and chronic disease prevalence continue to climb, the pressure on providers to manage growing caseloads while maintaining high-quality standards has intensified. In response, hospitals are investing in robust HIS solutions that offer long-term scalability and better continuity of care across outpatient and inpatient services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.3 Billion |

| Forecast Value | $73.6 Billion |

| CAGR | 17.1% |

The shift toward intelligent, tech-enabled solutions is also gaining momentum through the integration of next-generation technologies such as artificial intelligence and cloud computing. These technologies are enhancing both clinical decision-making and administrative performance while also enabling institutions to centralize data, minimize infrastructure costs, and increase system accessibility across distributed care networks. As digital health maturity becomes a priority for regional institutions, HIS platforms that can support predictive analytics, population health management, and interoperability are in high demand.

Within the Western Europe HIS market, the system component segment includes clinical systems, administrative/back-office systems, operational systems, patient-facing technologies, integration layers, and data and security modules. Among these, the clinical systems segment stands out, projected to grow at a CAGR of 17.3% and reach over USD 27.1 billion by 2034. These systems are instrumental in delivering evidence-based, patient-centric care by improving clinical documentation, treatment accuracy, and coordination across care teams. Solutions such as pharmacy information systems, radiology information systems, and laboratory management software are being rapidly deployed to streamline clinical workflows and support safer and more effective medical interventions. Clinical systems also play a vital role in enabling interoperability between departments and institutions, helping to unify care delivery under a single, cohesive digital framework.

Deployment-wise, the market is segmented into cloud-based, web-based, and on-premise models. Among these, cloud-based solutions led the market in 2024, accounting for 49.2% of total revenue. Their popularity continues to rise due to their scalability, flexibility, and cost-efficiency. Healthcare organizations across Western Europe are leveraging cloud-based platforms to bypass traditional IT hardware investments while enabling secure, remote access to patient data. These systems also facilitate real-time collaboration between facilities, which is crucial for both urban and rural healthcare delivery in the region.

In terms of country-level analysis, Germany represents a key market in Western Europe. The German hospital information system market was valued at USD 3.9 billion in 2024. Germany's leadership in the regional market can be attributed to its comprehensive healthcare infrastructure and strong governmental backing for digital health initiatives. A large number of hospitals have been incentivized to modernize their digital systems to overcome existing interoperability gaps and improve data sharing capabilities. This has driven an accelerated adoption of HIS platforms across the country, supporting its goal of elevating hospital digital maturity.

The Western Europe HIS landscape remains fragmented, with both established players and emerging companies contributing to ongoing innovation. Major vendors in the region are focusing on the development of integrated and scalable platforms that address clinical, administrative, and operational needs. Leading providers continue to refine their offerings to ensure they align with evolving industry standards, regulatory requirements, and the growing expectations of healthcare providers seeking to improve patient outcomes while maintaining cost efficiency.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.1.1 Business trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of digital health solutions

- 3.2.1.2 Government initiatives and regulations

- 3.2.1.3 Rising expenditure on healthcare

- 3.2.1.4 Surging demand for integrated healthcare systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation and maintenance costs

- 3.2.2.2 Data security and privacy concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Consumer behaviour and trends

- 3.8 No. of hospitals in Western Europe, by Country

- 3.9 Overview of hospital digital ecosystem

- 3.9.1 Electronic medical records (EMR)/electronic health records (EHR)

- 3.9.2 Telemedicine and remote patient monitoring

- 3.9.3 Cybersecurity and data protection

- 3.9.4 List of key players for the following applications in the Western Europe region

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Gap analysis

- 3.13 Integration of AI in EMR

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Western Europe

- 4.3.1.1 Germany

- 4.3.1.2 France

- 4.3.1.3 UK

- 4.3.1.4 Italy

- 4.3.1.5 Spain

- 4.3.1.6 Netherlands

- 4.3.1.7 Switzerland

- 4.3.1.8 Belgium

- 4.3.1.9 Austria

- 4.3.1.10 Sweden

- 4.3.1.11 Denmark

- 4.3.1.12 Norway

- 4.3.1.13 Finland

- 4.3.1.14 Portugal

- 4.3.1.15 Ireland

- 4.3.1 Western Europe

- 4.4 Company matrix analysis

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By System Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Clinical systems

- 5.2.1 Electronic medical records (EMR)/electronic health records (EHR)

- 5.2.2 Radiology information system (RIS)

- 5.2.3 pharmacy information system

- 5.2.4 Laboratory information system (LIS)

- 5.2.5 Other clinical systems

- 5.3 Administrative/Back-office systems

- 5.3.1 Finance and billing

- 5.3.2 Supply chain management

- 5.3.3 Facilities management/Human resources

- 5.4 Operational systems

- 5.4.1 Admission, discharge and transfer (ADT)/Bed management systems (BMS)

- 5.4.2 Operational standards support/Scheduling systems

- 5.5 Patient-facing technologies

- 5.5.1 Mobile health applications

- 5.5.2 Patient portals

- 5.6 Integration layer

- 5.6.1 Interface engines/APIs

- 5.6.2 Health information exchange (HIE)

- 5.7 Data and security

- 5.7.1 Clinical data repository

- 5.7.2 Identity and access management (IAM)

- 5.7.3 General data protection regulation (GDPR)

Chapter 6 Market Estimates and Forecast, By Deployment, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cloud-based

- 6.3 Web-based

- 6.4 On-premise

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Western Europe

- 7.2.1 Germany

- 7.2.2 France

- 7.2.3 UK

- 7.2.4 Italy

- 7.2.5 Spain

- 7.2.6 Rest of Western Europe

Chapter 8 Company Profiles

- 8.1 AGFA Healthcare

- 8.2 CAMBIO

- 8.3 ChipSoft

- 8.4 CompuGroup Medical

- 8.5 Dedalus

- 8.6 Epic

- 8.7 InterSystems

- 8.8 Maincare

- 8.9 Meierhofer AG

- 8.10 NextGen Healthcare

- 8.11 Nexus

- 8.12 ORACLE

- 8.13 SECTRA