PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773344

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773344

Coding, Labelling and Inspection Packaging Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

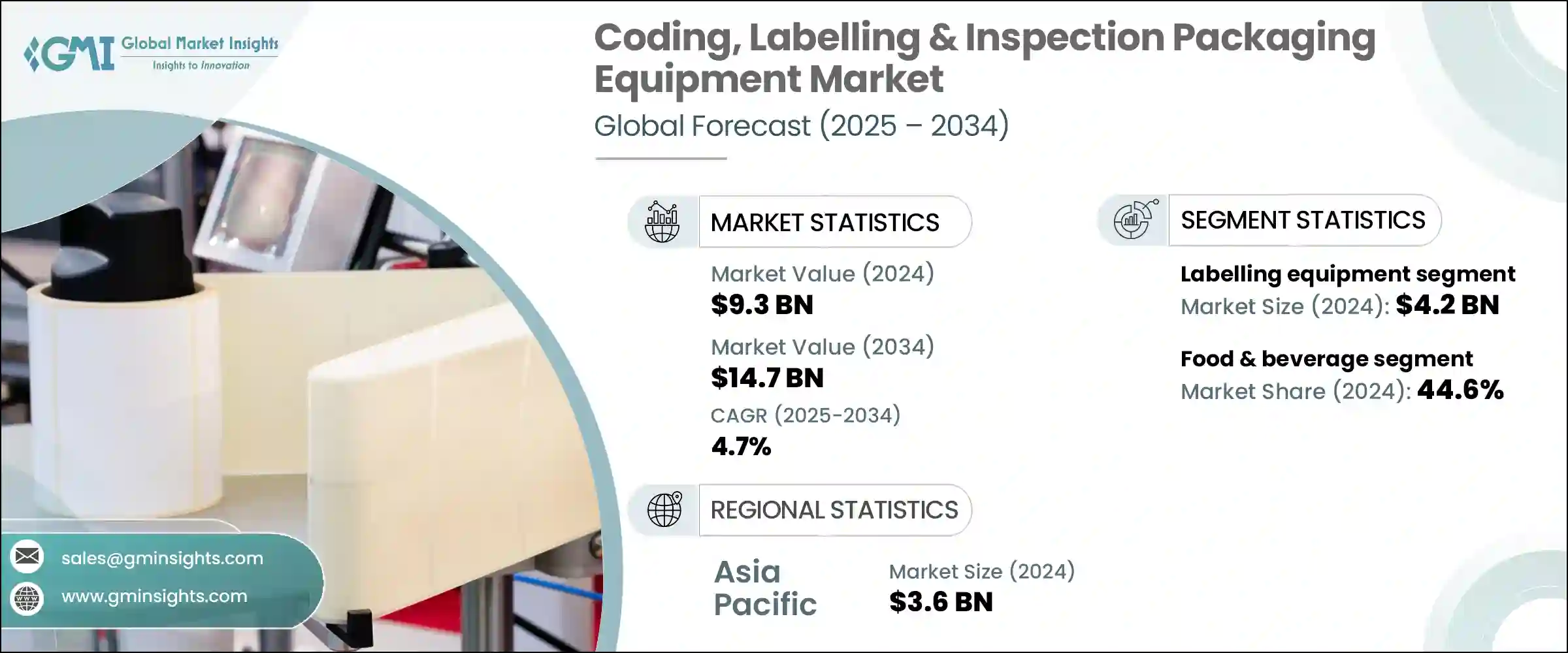

The Global Coding, Labelling and Inspection Packaging Equipment Market was valued at USD 9.3 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 14.7 billion by 2034. These systems are vital components across industries such as pharmaceuticals, consumer goods, cosmetics, and food and beverages, supporting packaging and supply chain processes. Coding and labeling systems produce durable, high-quality labels that not only ensure compliance with diverse regulatory standards worldwide but also enhance brand identity and customer trust. Traceability remains a key factor, helping manufacturers efficiently manage product recalls and monitor batch information. Meanwhile, inspection equipment equipped with advanced cameras checks for defects in packaging, seals, and printed codes to maintain product integrity. Innovations like IoT integration, Industry 4.0 capabilities, and machine learning are significantly enhancing inspection precision and operational efficiency.

The market features numerous global players providing customizable and scalable equipment tailored to specific industry demands. These companies are actively expanding their portfolios with modular platforms that can be adapted to different product sizes, production speeds, and regulatory requirements. Manufacturers are focusing on solutions that can integrate seamlessly with existing automation infrastructures, allowing for greater flexibility and reduced downtime during equipment upgrades or format changes. Many players are also leveraging smart technologies-such as AI-driven inspection, cloud-based data analytics, and real-time monitoring systems-to enhance accuracy, efficiency, and traceability across supply chains.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.3 Billion |

| Forecast Value | $14.7 Billion |

| CAGR | 4.7% |

In 2024, the labeling equipment segment generated USD 4.2 billion. Labeling plays a crucial role in product visibility and consumer decision-making by conveying essential details such as price, quantity, and quality. As industries aim to boost inventory management, verify product authenticity, and improve customer engagement, demand for automated and smart labeling solutions is on the rise. Sectors like pharmaceuticals, personal care, and food are major drivers for labeling equipment, pushing the adoption of innovative technologies.

The food & beverage segment accounted for 44.6% share and generated USD 4.1 billion in 2024. Growing consumer demand for transparency, traceability, and compliance with stringent safety regulations is pushing food manufacturers to invest heavily in high-precision labeling systems like wrap-around and sticker labeling machines. Regulatory requirements in regions such as North America and Europe are motivating companies to adopt advanced solutions capable of handling high-volume production without compromising compliance.

United States Coding, Labelling & Inspection Packaging Equipment Market held a 64% share in 2024. The U.S. market's growth is driven by strict labeling regulations and large-scale manufacturing operations. Key industries, including food, pharmaceuticals, and logistics, increasingly depend on sophisticated labeling and inspection systems to streamline their production and distribution workflows.

Leading companies in the Coding, Labelling & Inspection Packaging Equipment Market include Domino, Leibinger, Markem-Imaje, Videojet, Accutek Packaging Equipment, SATO, HERMA, Hitachi IESA, Korber AG, Romaco Group, Uhlmann Group, CVC Technologies, Marchesini Group, GEA, and Paxiom. To strengthen their market position, companies focus on several strategic approaches. Innovation remains a priority, with investments in R&D to develop smarter, faster, and more flexible equipment that integrates seamlessly with digital supply chains and Industry 4.0 technologies.

Firms are expanding their global footprint through strategic partnerships, acquisitions, and enhanced after-sales services to build closer customer relationships and ensure long-term loyalty. Customization and modular design are emphasized to meet the specific needs of diverse industries. Additionally, manufacturers prioritize sustainability by creating energy-efficient systems and reducing waste.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Packaging type

- 2.2.4 Operation mode

- 2.2.5 End use industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for labelling equipment from food & beverages industry

- 3.2.1.2 Growth of e-commerce and logistics

- 3.2.1.3 Rising demand for product authentication & anti-counterfeiting

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Integration complexity

- 3.2.2.2 Fluctuating raw material prices

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 – 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Coding equipment

- 5.2.1 Inkjet coders

- 5.2.2 Laser coders

- 5.2.3 Others

- 5.3 Labeling equipment

- 5.3.1 Pressure-sensitive

- 5.3.2 Shrink sleeve

- 5.3.3 Print and apply

- 5.3.4 Others

- 5.4 Inspection equipment

- 5.4.1 Machine vision systems

- 5.4.2 Leak detection

- 5.4.3 Checkweighers

- 5.4.4 Metal detectors

- 5.4.5 Others

Chapter 6 Market Estimates and Forecast, By Packaging Type, 2021 – 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Primary

- 6.3 Secondary

- 6.4 Tertiary

Chapter 7 Market Estimates and Forecast, By Operation Mode, 2021 – 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Manual

- 7.3 Semi-automatic

- 7.4 Automatic

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Food & beverage

- 8.3 Pharmaceuticals

- 8.4 Cosmetics & personal care

- 8.5 Electronics

- 8.6 Chemicals

- 8.7 Industrial products

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.1.1 Direct sales

- 9.1.2 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Accutek Packaging Equipment

- 11.2 CVC Technologies

- 11.3 Domino

- 11.4 GEA

- 11.5 HERMA

- 11.6 Hitachi IESA

- 11.7 Korber AG

- 11.8 Leibinger

- 11.9 Marchesini Group

- 11.10 Markem-Imaje

- 11.11 Paxiom

- 11.12 Romaco Group

- 11.13 SATO

- 11.14 Uhlmann Group

- 11.15 Videojet