PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773350

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773350

Medical, Legal, and Regulatory Review Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

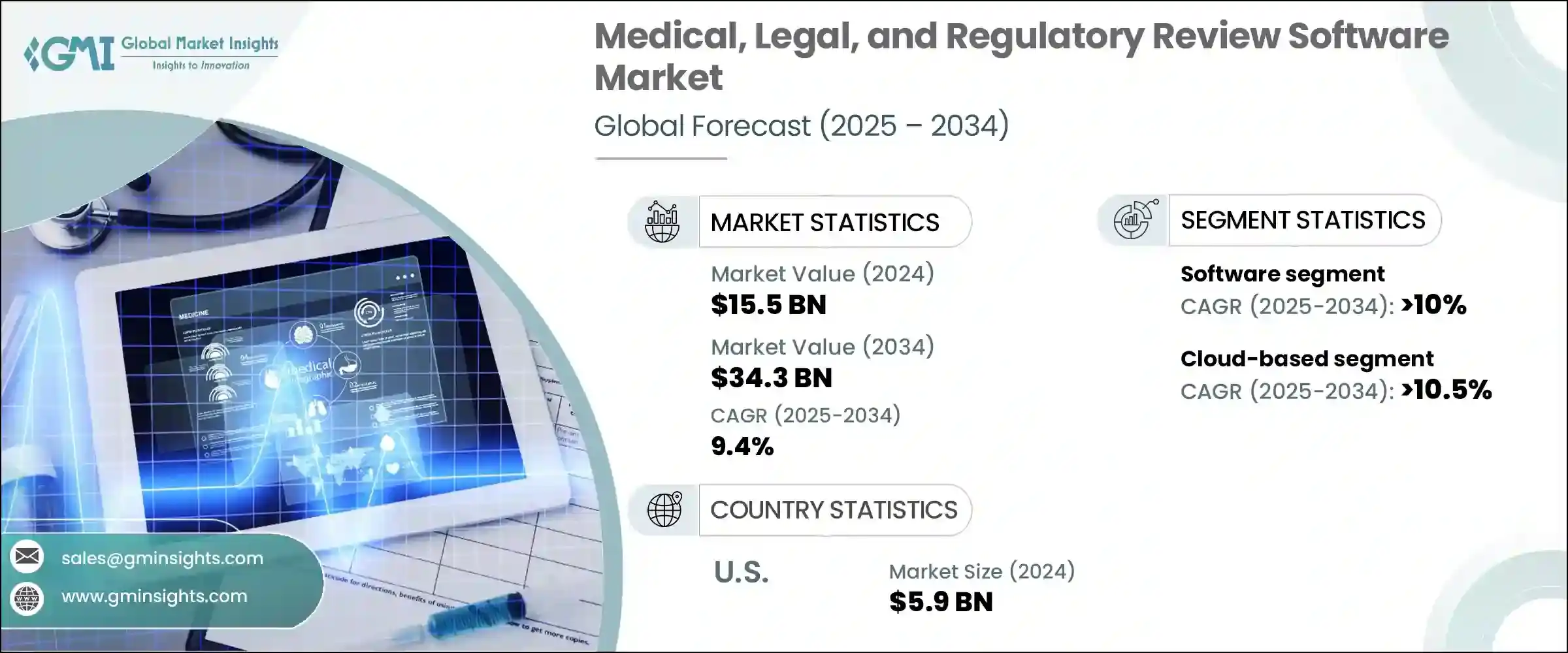

The Global Medical, Legal, and Regulatory Review Software Market was valued at USD 15.5 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 34.3 billion by 2034. This steady growth trajectory is fueled by the rising need for compliant, collaborative, and context-aware content review processes within the pharmaceutical and life sciences sectors. As companies accelerate their digital strategies and navigate complex regulatory frameworks, the demand for integrated MLR platforms that streamline review workflows has grown significantly. Traditionally, many life sciences organizations relied on manual, paper-based, or email-driven MLR review processes. However, those outdated systems are rapidly being replaced by intelligent software tools offering real-time collaboration, AI-based compliance verification, and automated audit trails. These capabilities are helping MLR teams boost operational efficiency, reduce legal exposure, and bring products to market more swiftly and confidently.

With the increasing push for digital and multichannel marketing, life sciences companies are under pressure to rapidly review and approve diverse content formats while staying aligned with regional regulatory requirements. Whether it's content for websites, emails, or social media platforms, there is a growing emphasis on ensuring every promotional or scientific asset undergoes a thorough compliance review. MLR software systems serve as a centralized platform to manage this complexity, ensuring accuracy, legality, and regulatory adherence before any content reaches the public domain. The shift toward these systems is not just about automation; it's about meeting the expectations of a fast-paced, digitally connected ecosystem that leaves no room for error.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.5 Billion |

| Forecast Value | $34.3 Billion |

| CAGR | 9.4% |

In terms of components, the software segment led the global MLR review software market in 2024, accounting for nearly 68% of the total market value. This segment is anticipated to grow at a CAGR of over 10% through 2034. The expanding adoption of end-to-end digital tools that offer version control, integrated audit functionality, and collaborative content review features is driving this trend. Enterprises are increasingly investing in cloud-based platforms that can scale across global teams, reduce manual review errors, and enable real-time feedback loops. The preference for digital transformation has further encouraged organizations to move away from fragmented systems toward unified software ecosystems that support higher volumes of content across multiple stakeholders and teams.

From a deployment perspective, cloud-based solutions dominated the market in 2024, capturing approximately 64% of the total share. This segment is projected to register a CAGR exceeding 10.5% throughout the forecast period. The widespread shift to cloud infrastructure is allowing pharmaceutical and biotech companies to centralize content management, streamline regulatory workflows, and significantly reduce internal IT maintenance costs. Cloud platforms provide consistent, secure access across departments and geographies, ensuring that stakeholders remain aligned with current regulatory guidance at all times. As companies expand into new markets, cloud-based MLR tools provide the adaptability and responsiveness needed to operate within diverse and evolving compliance landscapes.

Functionality-wise, regulatory review emerged as the leading segment in 2024. Compared to legal or medical assessments, which primarily focus on scientific credibility or intellectual property protection, regulatory review is centered on ensuring full alignment with region-specific marketing, promotion, and submission rules. To meet these regulatory expectations, more organizations are turning to software solutions equipped with automation capabilities such as version tracking, content tagging, audit documentation, and regulatory information system integration. These features not only improve the accuracy and speed of the review cycle but also prepare organizations for possible regulatory audits by ensuring that all materials are thoroughly documented and easily retrievable.

Geographically, the United States dominated the market in 2024, contributing around USD 5.9 billion in revenue, which translates to a commanding 88.3% share of the North American region. This dominance can be attributed to the stringent regulatory requirements imposed by federal agencies, which demand that content undergo rigorous validation before public dissemination. The reliance on advanced MLR software tools is growing as pharmaceutical and medical device companies seek to manage high volumes of marketing and scientific materials while minimizing legal and compliance risks. The availability of sophisticated cloud-based systems and AI-integrated platforms has significantly supported this transformation.

Leading vendors in the MLR review software landscape are actively pursuing strategic partnerships, acquisitions, and product innovation to expand their capabilities and market footprint. With increasing regulatory complexity, companies are doubling down on R&D to build smarter platforms that support greater automation, traceability, and real-time collaboration. Key areas of investment include AI-powered compliance checks, modular content workflows, and cloud-native architectures that allow companies to adapt to global regulatory nuances. Vendors are focusing on creating configurable platforms that accommodate jurisdiction-specific guidelines while maintaining global consistency, helping life sciences organizations minimize risk, speed up approvals, and stay audit-ready across regions.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Mode

- 2.2.4 Functionality

- 2.2.5 Enterprise Size

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shift towards digital and multichannel marketing

- 3.2.1.2 Rising adoption of cloud-based platforms

- 3.2.1.3 AI and automation in review processes

- 3.2.1.4 Growing compliance awareness among SMEs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complex regulatory landscape

- 3.2.2.2 Data privacy and compliance risks

- 3.2.3 Market opportunities

- 3.2.3.1 Surging pharma and biotech pipelines

- 3.2.3.2 Growing remote and decentralized collaboration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software development & licensing cost

- 3.8.2 Deployment & integration cost

- 3.8.3 Maintenance & support cost

- 3.8.4 Cybersecurity & compliance cost

- 3.8.5 Training & change management cost

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

- 5.3.1 Professional

- 5.3.2 Managed

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cloud-based

- 6.3 On-premises

Chapter 7 Market Estimates & Forecast, By Functionality, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Medical review

- 7.3 Legal review

- 7.4 Regulatory review

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large enterprises

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Pharmaceutical companies

- 9.3 Biotechnology companies

- 9.4 Medical device manufacturers

- 9.5 Contract Research Organizations (CROs)

- 9.6 Regulatory consulting firms

- 9.7 Healthcare marketing agencies

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Nordics

- 10.3.7 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 3M Health Information Systems

- 11.2 Allscripts

- 11.3 Change Healthcare

- 11.4 Epic Systems

- 11.5 Experian Health

- 11.6 GE Healthcare

- 11.7 Health Catalyst

- 11.8 IBM Watson Health

- 11.9 Inovalon Holdings

- 11.10 LexisNexis Risk Solutions

- 11.11 McKesson Corporation

- 11.12 Medtronic

- 11.13 Nuance Communications

- 11.14 Optum

- 11.15 Oracle Health

- 11.16 Philips Healthcare

- 11.17 Siemens Healthineers

- 11.18 Thomson Reuters

- 11.19 Verisk Analytics

- 11.20 Wolters Kluwer