PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773356

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773356

Pet Therapeutic Diet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

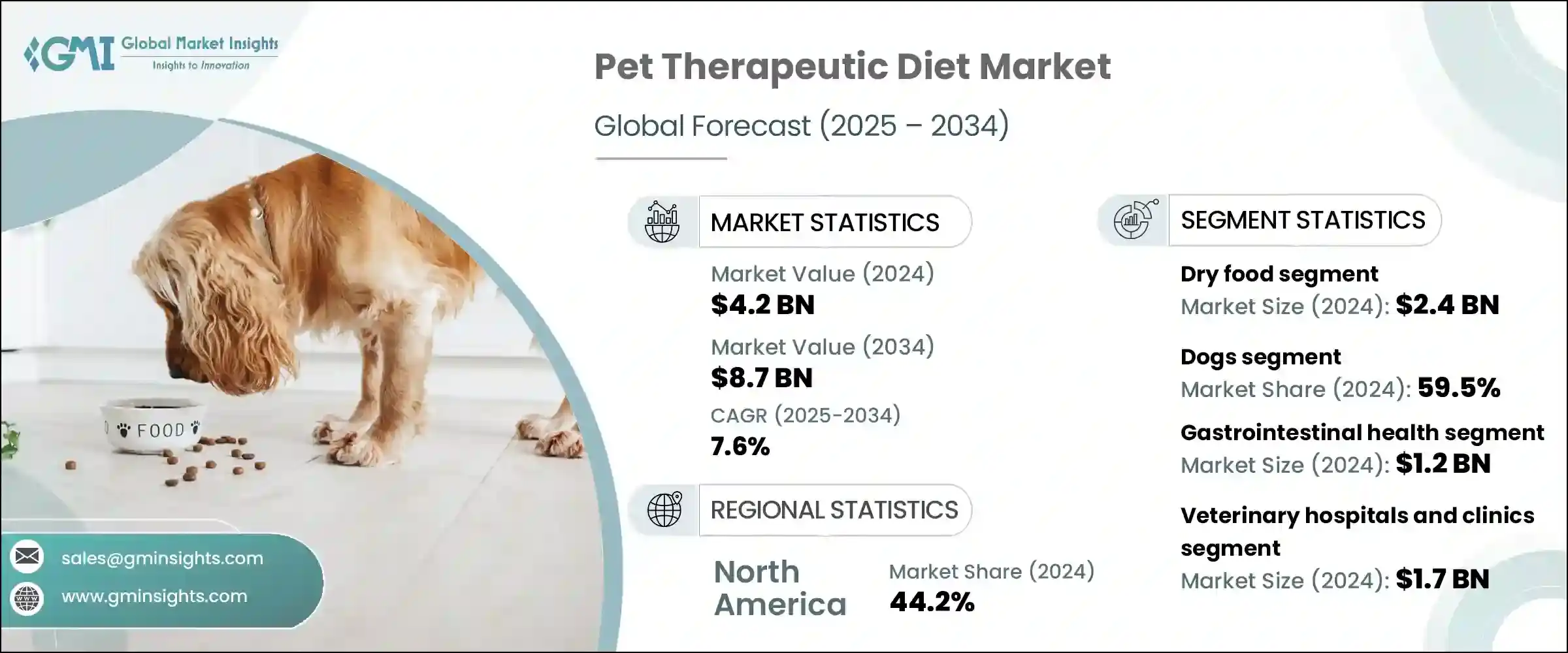

The Global Pet Therapeutic Diet Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 8.7 billion by 2034. Increasing chronic health issues in companion animals-such as obesity, diabetes, kidney disease, and gastrointestinal disorders-are driving the demand for targeted nutritional solutions. As pet owners increasingly adopt a family-centric approach to pet care, they're more willing to invest in specialized diets that offer both preventive and therapeutic benefits. Rising awareness about responsible pet ownership and a shift toward proactive health management are reinforcing this trend.

The broader adoption of therapeutic nutrition is further fueled by growing veterinary guidance and a demand for more holistic care options. Many pet parents now view nutrition as an essential tool for managing conditions and ensuring the long-term wellness of their animals. The trend toward pet humanization has elevated expectations for quality and clinical efficacy in pet food. As a result, more consumers are turning to condition-specific diets to support recovery and ongoing health, positioning therapeutic diets as a core component of companion animal healthcare strategies in both emerging and developed markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 7.6% |

Pet therapeutic diets represent a specialized segment within the animal nutrition sector, tailored to help treat, manage, or prevent specific medical conditions in pets. These formulations play a key role in veterinary care, delivering nutritional benefits designed to support recovery, reduce symptoms, and promote overall well-being.

The dry food category segment led the market in 2024, reaching a valuation of USD 2.4 billion. Pet owners and veterinarians prefer dry food due to its cost-effectiveness, long shelf life, and ease of storage. These products offer reliable portion control and are ideal for pets requiring consistent therapeutic nutrition, especially those managing chronic conditions. Designed to address health issues like obesity, kidney disease, or gastrointestinal imbalances, dry formulations make daily feeding routines easier while ensuring pets receive the necessary nutrients for ongoing care.

The dogs segment held a 59.5% share in 2024. A growing number of health concerns in dogs-particularly obesity, which is exacerbated by inactive lifestyles and diets high in artificial ingredients-are fueling demand for therapeutic food products. The natural tendency of dogs to consume food frequently increases the importance of feeding them balanced, health-oriented diets. Their dietary habits and nutritional needs are increasingly influencing pet food choices, encouraging owners to turn to specialized therapeutic options to maintain long-term health.

United States Pet Therapeutic Diet Market reached USD 1.7 billion in 2024. Rising pet adoption and the growing population of aging animals are major contributors to market expansion. Many pets now require specialized diets to manage cardiovascular conditions, joint problems, and other chronic illnesses. An increased focus on preventive health measures for pets is also boosting demand for therapeutic diets. The highly developed veterinary network in the U.S. incorporates these diets into long-term treatment plans, making them a standard part of disease management and routine animal care. Greater awareness and access to pet insurance are also enabling more owners to explore premium dietary solutions.

Companies leading the global market include Veterinary Nutrition Group, JustFoodForDogs, Open Farm, Diamond Pet Foods, Mars Petcare, Hill's Pet Nutrition, EmerAid, Stella and Chewy's, United PetFood, Eden Holistic Pet Foods, Blue Buffalo (General Mills), Virbac, Ziwi, Nestle, and iVet.com. To strengthen their market presence, companies in the pet therapeutic diet space are investing heavily in research and development to formulate science-backed, condition-specific diets. Many firms are expanding product lines to cover a wider range of health issues, including renal support, digestive care, metabolic health, and joint wellness. Collaborations with veterinarians and veterinary clinics are enhancing product credibility and reach. Strategic marketing efforts emphasize clinical efficacy and quality ingredients to build trust among consumers. Players are also adopting transparent labeling and clean formulations to align with the expectations of health-conscious pet owners.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Animal type

- 2.2.4 Health condition

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Aging pet population

- 3.2.1.2 Rising pet ownership and pet humanization

- 3.2.1.3 Growing prevalence of chronic disease in companion animals

- 3.2.1.4 Product innovation and customization

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and reliability concerns

- 3.2.2.2 Limited awareness and education

- 3.2.3 Market opportunities

- 3.2.3.1 Rising pet ownership and urbanization in developing regions

- 3.2.3.2 Growing demand for clean-label, organic and plant-based therapeutic diets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technological landscape

- 3.6 Pricing analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key development

- 4.6.1 Mergers and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dry food

- 5.3 Wet/ canned food

- 5.4 Other product types

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cats

- 6.3 Dogs

- 6.4 Other animals

Chapter 7 Market Estimates and Forecast, By Health Condition, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Renal health

- 7.3 Gastrointestinal health

- 7.4 Cardiovascular health

- 7.5 Weight management

- 7.6 Joint care

- 7.7 Other health conditions

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 E-commerce

- 8.4 Retail pharmacies

- 8.5 Other distribution channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Blue Buffalo (General Mills)

- 10.2 Diamond Pet Foods

- 10.3 Eden Holistic Pet Foods

- 10.4 EmerAid

- 10.5 Hill's Pet Nutrition

- 10.6 iVet.com

- 10.7 JustFoodForDogs

- 10.8 Mars Petcare

- 10.9 Nestle

- 10.10 Open Farm

- 10.11 Stella and Chewy's

- 10.12 United PetFood

- 10.13 Veterinary Nutrition Group

- 10.14 Virbac

- 10.15 Ziwi