PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773366

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773366

Sheep and Goat Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

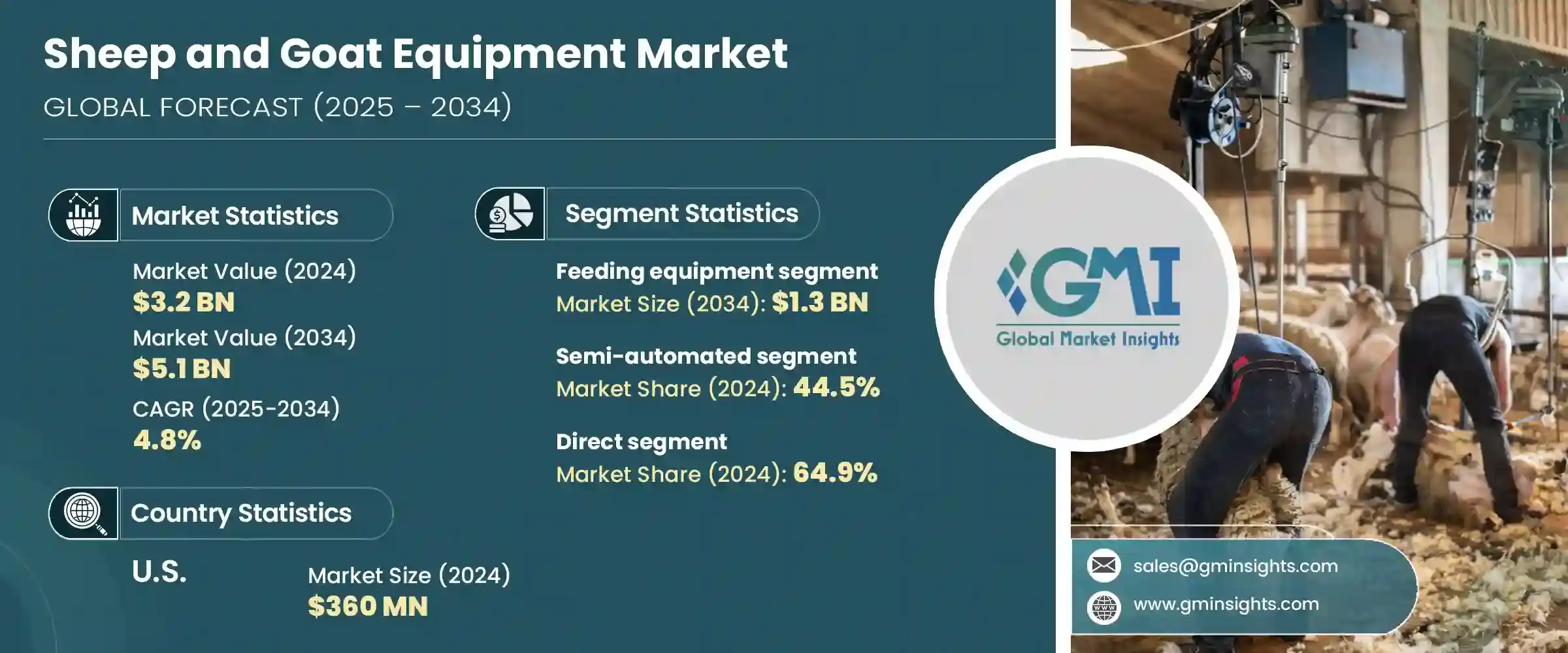

The Global Sheep and Goat Equipment Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 5.1 billion by 2034. The industry is undergoing a major transformation as farming practices continue to modernize and adopt more efficient methods for managing livestock. Farmers are increasingly turning to innovative equipment solutions that improve productivity and reduce the reliance on manual labor. With the growing need to streamline daily operations, equipment like mechanized feeding tools, advanced shearing systems, and precision monitoring devices is becoming an essential component of livestock farms.

The adoption of automated systems is rising as producers recognize the benefits of consistency in feeding routines, time savings in labor-intensive tasks, and enhanced animal welfare. Farmers are focusing on optimizing their resources, especially as livestock feed accounts for a large portion of operational expenses. Technological integration in equipment is not only helping reduce feed waste and labor costs but also supports better health management of animals through early disease detection and behavioral tracking. These innovations are reshaping how livestock operations are managed, pushing the market toward consistent growth over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 4.8% |

In terms of equipment type, feeding equipment held a dominant position, with the segment valued at USD 800 million in 2024. This category is projected to grow steadily and reach USD 1.3 billion by 2034. Equipment designed for feed management continues to see strong demand as it helps producers reduce feed loss and improve distribution efficiency. Automatic dispensers, precision feeders, and other feeding tools are being preferred due to their ability to support healthier animal growth and minimize feed waste, which remains one of the highest operational costs in livestock farming.

The market based on operation mode shows that semi-automated equipment accounted for approximately 44.5% of the global revenue share in 2024. This segment is expected to expand at a CAGR of 4.4% during the forecast period. These systems are becoming increasingly attractive to mid-scale and large-scale farmers who seek to strike a balance between automation and manual control. Their ability to offer improved operational speed, consistent performance, and reduced dependence on manual labor makes them an efficient alternative, especially in regions facing agricultural workforce shortages.

Distribution channels play a key role in determining product accessibility and service quality. In 2024, the direct distribution segment dominated the market with a share of around 64.9%. This model allows manufacturers to engage directly with end users, enabling better customization of equipment and providing the opportunity to address specific farming needs. It also supports real-time feedback collection, allowing manufacturers to adapt their offerings based on changing market dynamics. The direct channel also benefits logistics, ensuring quicker deliveries and smoother inventory flow, particularly during seasonal demand spikes.

Regionally, the United States held a strong presence in the global landscape, with the market valued at USD 360 million in 2024. The country is expected to see growth at a CAGR of 5.1% between 2025 and 2034. The U.S. livestock sector continues to expand, bolstered by modern farming infrastructure and rising demand for meat, milk, and wool. The availability of high-performance equipment tailored to U.S. farming practices contributes significantly to the industry's upward trajectory.

North America as a whole is also witnessing steady progress, supported by policies that encourage sustainable agriculture and innovations in livestock management. The emphasis on responsible resource use and digital integration in farm equipment is strengthening the region's position in the global market.

In this evolving market, manufacturers are concentrating on offering energy-efficient systems, enhanced durability, and tailored features that cater to the diverse requirements of sheep and goat farmers. There is also an increasing emphasis on after-sales services and regional support infrastructure. In emerging markets, demand is growing for cost-effective yet reliable equipment such as feeders, fencing units, electronic identification (EID) scales, and mobile handling systems. These priorities continue to shape the strategic direction of key industry participants as they expand their portfolios and cater to the needs of the global livestock community.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Operation mode

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistic

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Equipment Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Feeding equipment

- 5.2.1 Feed mixers

- 5.2.2 Feed dispensers

- 5.2.3 Hay feeders

- 5.2.4 Mineral feeders

- 5.3 Handling equipment

- 5.3.1 Gates and panels

- 5.3.2 Chutes

- 5.3.3 Sorting systems

- 5.3.4 Loading ramps

- 5.4 Shearing equipment

- 5.4.1 Electric shears

- 5.4.2 Manual shears

- 5.4.3 Shearing platforms

- 5.4.4 Others

- 5.5 Weighing equipment

- 5.5.1 Digital livestock scales

- 5.5.2 Platform scales

- 5.5.3 Mobile weighing systems

- 5.5.4 Portable weight crates

- 5.5.5 Walk-through weighing systems

- 5.5.6 Others

- 5.6 Trimming equipment

- 5.6.1 Hoof trimmers

- 5.6.2 Wool shears

- 5.6.3 Electric clippers

- 5.6.4 Others

- 5.7 Watering equipment

- 5.7.1 Automatic waterers

- 5.7.2 Water troughs

- 5.7.3 Water filtration systems

- 5.7.4 Others

- 5.8 Breeding equipment

- 5.8.1 Artificial insemination tools

- 5.8.2 Ultrasound machines

- 5.8.3 Lambing pens

- 5.8.4 Heat detection devices

- 5.8.5 Others

- 5.9 Health management equipment

- 5.9.1 Vaccination guns

- 5.9.2 Drenching equipment

- 5.9.3 Medical supplies storage

- 5.9.4 Others

Chapter 6 Market Estimates & Forecast, By Operation Mode, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual equipment

- 6.3 Semi-automated equipment

- 6.4 Fully automated equipment

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Individual farmers

- 7.3 Cooperatives

- 7.4 Commercial farming operations

- 7.5 Slaughterhouses

- 7.6 Research facilities

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trend

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 UAE

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Allflex Livestock Intelligence

- 10.2 Arrowquip

- 10.3 Gallagher

- 10.4 Heiniger

- 10.5 IAE

- 10.6 Kerbl

- 10.7 Lister Shearing

- 10.8 Premier 1 Supplies

- 10.9 Priefert

- 10.10 Ritchie Agricultural

- 10.11 Stockpro

- 10.12 Sydell Inc.

- 10.13 Te Pari Products

- 10.14 Tru-Test (Datamars)

- 10.15 WOPA