PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773368

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773368

Complete Premixes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

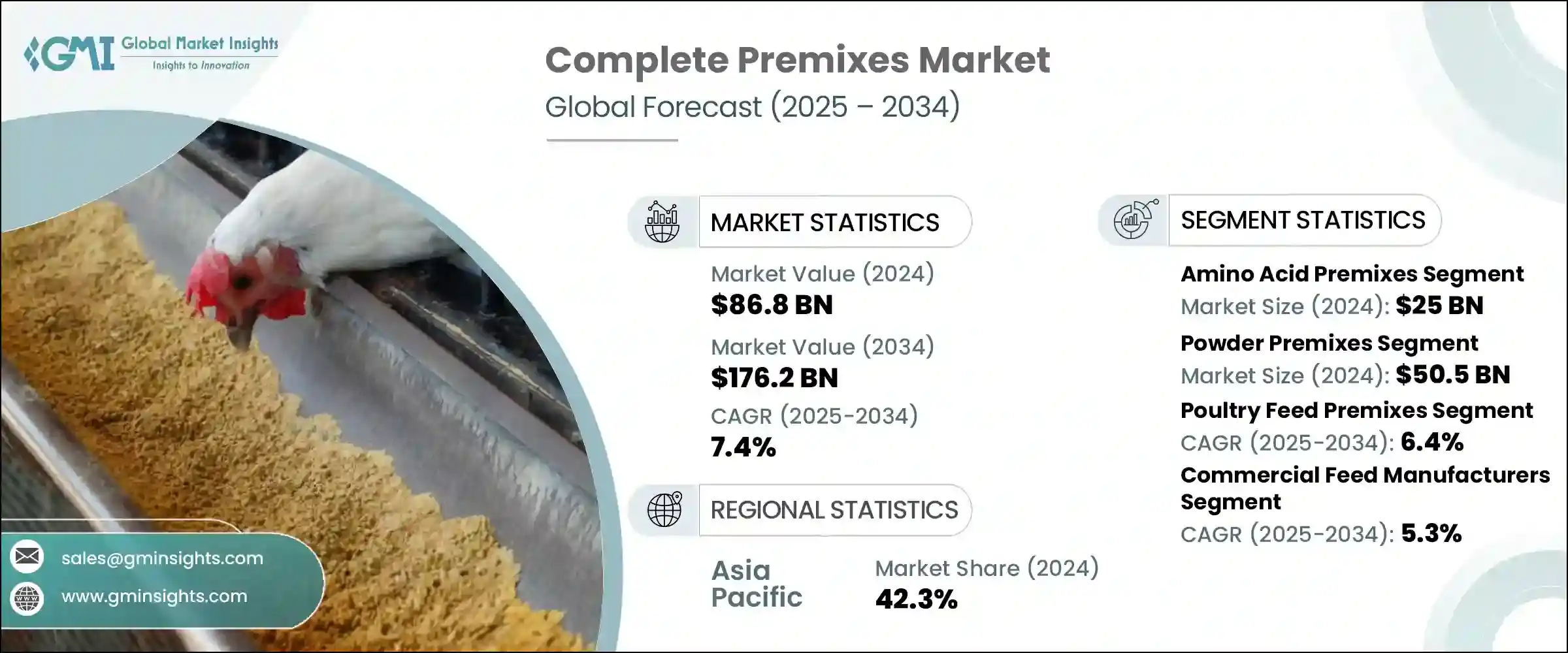

The Global Complete Premixes Market was valued at USD 86.8 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 176.2 billion by 2034. Complete premixes are meticulously blended mixtures containing essential nutrients such as vitamins, minerals, amino acids, enzymes, and other functional ingredients that ensure precise and uniform nutrition in both pet and human foods. These premixes play a significant role in improving animal health, supporting growth, enhancing immunity, and boosting productivity. Additionally, they help address micronutrient deficiencies in fortified food systems. The market for complete premixes is gaining momentum globally due to advancements in technology, a rise in protein-rich diets, and increased awareness surrounding health and nutrition.

Growth opportunities in the market are being driven by the rise of commercial livestock farming, the growing demand for customized pet nutrition, and food fortification initiatives in developing nations. There is also an increasing demand for organic, specialized, and non-GMO premixes, including medicated blends. Emerging markets in regions such as Asia-Pacific, Africa, and Latin America are seeing rising demand due to urbanization and nutritional initiatives supporting the health food sector. The market is expected to experience long-term growth fueled by innovations in formulation and automation within the complete premixes industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $86.8 Billion |

| Forecast Value | $176.2 Billion |

| CAGR | 7.4% |

The amino acid premixes segment held a 28.8% share in 2024, valued at USD 25 billion. This segment continues to dominate due to the rising need for essential amino acids, such as lysine, methionine, and threonine, used in poultry and swine feeds to improve growth and feed conversion rates. Non-essential amino acids are also gaining popularity for their role in supporting metabolic processes. The increasing focus on protein balance and precision nutrition within the agricultural sector has contributed to the segment's expansion.

The powder premixes segment led the market with a 58.1% share in 2024, valued at USD 50.5 billion. Powdered premixes are highly favored due to their long shelf life, ease of transportation, precise dosing, and cost-effectiveness. They are extensively used in livestock feed, pet foods, and human nutrition, particularly in dry feed and instant food formulations. Powdered premixes are also compatible with bulk mixing systems, making them ideal for commercial feed manufacturers and on-farm mixing operations.

Asia-Pacific Complete Premixes Market held a 42.3% share in 2024. The region's growing livestock sector, demand for fortified nutrition products, and government-backed programs aimed at improving food security and feed efficiency are key factors driving the market's growth. Additionally, factors such as rising disposable incomes, an expanding population, and the increasing popularity of aquaculture and pet foods contribute to the demand for high-quality functional premixes in both the food and feed sectors.

Companies like Nutreco N.V., DSM-Firmenich, Cargill Incorporated, BASF SE, and Archer Daniels Midland Company (ADM) lead the market through innovation and distribution. Their continued investment in research and development, along with the establishment of strong global distribution channels, has helped solidify their presence in the complete premixes market. To strengthen their market positions, leading companies in the complete premixes industry focus on a variety of strategies. These include strategic partnerships with key suppliers, increasing their R&D efforts to create customized and organic premixes, and expanding their geographic reach through acquisitions and mergers. They are also enhancing product offerings with specialized solutions such as non-GMO and medicated blends. Automation of production processes and the introduction of smart blending technologies further help companies streamline operations and improve efficiency.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Form

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Vitamin premixes

- 5.2.1 Fat-soluble vs water-soluble

- 5.3 Mineral premixes

- 5.3.1 Macro vs micro mineral segmentation

- 5.3.2 Chelated vs inorganic forms

- 5.4 Amino acid premixes

- 5.4.1 Essential vs non-essential amino acids

- 5.5 Complete vitamin-mineral premixes

- 5.5.1 Customized vs standard formulations

- 5.6 Specialty premixes

- 5.6.1 Organic premixes

- 5.6.2 Non-GMO premixes

- 5.6.3 Medicated premixes

- 5.6.4 Performance enhancement premixes

Chapter 6 Market Estimates and Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Powder premixes

- 6.3 Liquid premixes

- 6.4 Granular premixes

- 6.5 Pelletized premixes

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Poultry feed premixes

- 7.3 Swine feed premixes

- 7.4 Ruminant feed premixes

- 7.5 Aquaculture feed premixes

- 7.6 Pet food premixes

- 7.7 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Commercial feed manufacturers

- 8.3 Livestock integrators

- 8.4 On-farm mixers

- 8.5 Pet food manufacturers

- 8.6 Specialty feed producers

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 DSM-Firmenich

- 10.2 Cargill, Incorporated

- 10.3 Archer Daniels Midland Company (ADM)

- 10.4 Nutreco N.V.

- 10.5 BASF SE

- 10.6 Glanbia Nutritionals

- 10.7 Alltech Inc.

- 10.8 Kemin Industries

- 10.9 Biomin Holding GmbH

- 10.10 Lallemand Inc.