PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773374

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773374

Portable Lamp Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

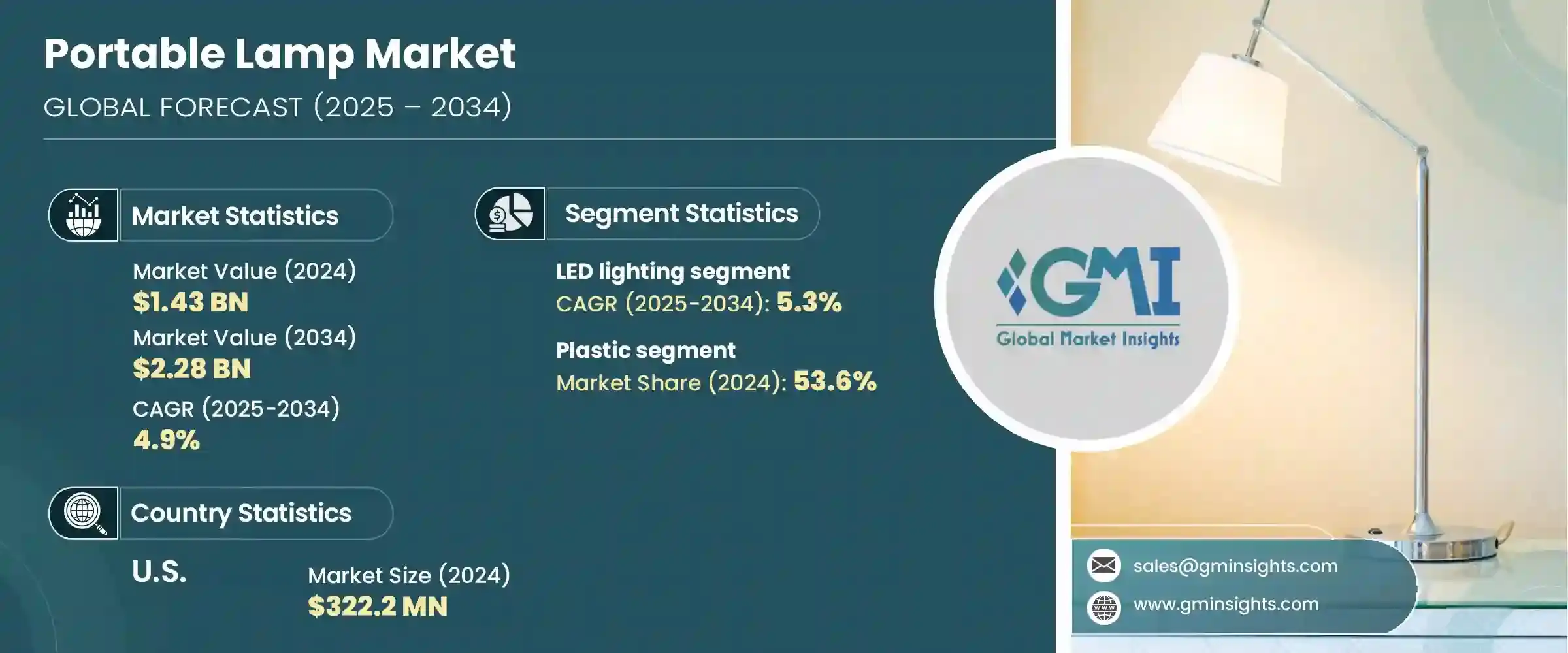

The Global Portable Lamp Market was valued at USD 1.43 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 2.28 billion by 2034. Rising demand for space-saving lighting options and user-friendly designs is fueling market growth. Consumers today prioritize flexibility, mobility, and compact solutions in both home and office setups. Urban living, particularly in smaller residential spaces such as dormitories and apartments, continues to amplify the need for versatile and movable lighting sources. Portable lamps are gaining attention due to their ability to adapt to different environments without permanent installation. Whether cordless or plug-in, these lamps are ideal for limited-space settings like desks, bedside tables, patios, and even for on-the-go use. The trend toward modular, cordless lighting is popular, offering convenience for modern, fast-paced lifestyles that require flexible illumination.

Contemporary consumer habits that emphasize easy customization and efficient utility are also playing a significant role in this market's evolution. Today's buyers are seeking lighting solutions that not only serve functional needs but also align with their personal aesthetics and dynamic lifestyles. The demand for lamps that can be easily adjusted in brightness, color temperature, or positioning reflects the growing expectation for products that offer multi-purpose use in compact formats.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.43 Billion |

| Forecast Value | $2.28 Billion |

| CAGR | 4.9% |

Portable lamps with modular components, USB charging, foldable arms, or detachable bases are becoming especially popular among consumers who value versatility and modern design. As users increasingly expect home products to complement both interior decor and technological ecosystems, manufacturers are prioritizing smart features, minimalist design, and compact, adaptable forms. These evolving preferences are reshaping the portable lamp market toward more interactive, user-centered innovation.

In 2024, the LED lighting segment accounted for USD 849.7 million and is projected to rise at a CAGR of 5.3% from 2025 to 2034. The energy-saving nature of LED lights, combined with long life spans and durability, makes them a top choice among buyers. LEDs not only help cut energy costs but also last significantly longer than traditional incandescent options, reducing the frequency of replacements. This makes them ideal for manufacturers and end-users who prefer low-maintenance lighting options. Lightweight and slim LED lamp designs have become particularly appealing, supporting consumer demand for portability, aesthetic appeal, and efficiency. Most LED portable lamps now come equipped with dimmable settings, tunable color temperatures, and smart-home integration, making them adaptable for various environments and mobile use cases.

The plastic material segment captured a 53.6% share in 2024 and is forecasted to grow at a CAGR of 5.3% from 2025 to 2034. Plastic is driving substantial momentum in the portable lighting space due to its affordability, durability, and versatility. Compared to alternatives like ceramic, glass, or metal, plastic allows manufacturers to experiment with more innovative shapes, designs and finishes at lower production costs. Its lightweight properties also make it easier for consumers to carry, reposition, and store their lamps across a variety of settings, including homes, offices, outdoor spaces, and while traveling. This material's ease of use and manufacturing scalability contribute to its popularity in mass-market segments.

United States Portable Lamp Market was valued at USD 322.2 million in 2024 and is expected to grow at a CAGR of 5.2% between 2025 and 2034. Consumer preferences in the region are shifting toward smart, multi-use, and energy-efficient lighting products. Lamps that offer app compatibility, voice activation, and customizable brightness are gaining strong traction. The do-it-yourself mindset and a rising focus on home aesthetics further accelerate demand for visually appealing, functional lighting options. Additionally, a shift toward remote working has increased the need for personalized lighting setups that support extended home office hours. The growing online retail ecosystem in the region also plays a crucial role in offering access to a wider variety of portable lamp styles and features.

Leading players shaping the Portable Lamp Industry landscape include Cree Lighting, IKEA, Feit Electric, OSRAM, Acuity Brands, Wipro Consumer Lighting, Panasonic, Havells India, GE Lighting, Zumtobel Group, Thorn Lighting, Legrand, Signify, Syska LED, and Cooper Lighting. To strengthen their position, companies in the portable lamp market are emphasizing innovation in design, material selection, and smart technology integration.

Many are expanding their product lines to include LED-based and modular lighting solutions with smart features such as voice control and app syncing. Manufacturers are investing in sustainable materials and energy-efficient technologies to align with eco-conscious consumer preferences. Companies are also focusing on affordable yet stylish product designs that appeal to the growing base of urban and younger customers. Strategic partnerships, direct-to-consumer sales models, and a strong presence in e-commerce channels are enhancing brand visibility and market reach.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Light technology

- 2.2.5 Power source

- 2.2.6 Application

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for flexible and compact lighting solutions

- 3.2.1.2 Growth in outdoor and travel activities

- 3.2.1.3 Smart & rechargeable lamp adoption

- 3.2.1.4 Battery limitations and frequent recharging needs

- 3.2.1.5 Intense price competition in the low-end segment

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Battery limitations and frequent recharging needs

- 3.2.2.2 Intense price competition in the low-end segment

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 LED lighting

- 5.3 Metal halide lighting

- 5.4 Incandescent lighting

- 5.5 Fluorescent lighting

- 5.6 Others (halogen, etc.)

- 5.7 Market Estimates & Forecast, By Light Technology, 2021 - 2034, (USD Million) (Thousand Units)

- 5.8 Key trends

- 5.9 LED

- 5.10 CFL (Compact Fluorescent Lamps)

- 5.11 Halogen

- 5.12 Incandescent

Chapter 6 Market Estimates & Forecast, By Power Source, 2021 - 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Battery-powered

- 6.3 Rechargeable (USB/solar)

- 6.4 Electric-powered (corded)

- 6.5 Hybrid (battery + solar)

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Plastic

- 7.3 Metal

- 7.4 Wood

- 7.5 Glass

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Indoor

- 8.2.1 Residential (bedrooms, living rooms, etc.)

- 8.2.2 Commercial (hotels, offices, libraries)

- 8.3 Outdoor

- 8.3.1 Camping

- 8.3.2 Garden/patio

- 8.3.3 Emergency use

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Households

- 9.3 Commercial

- 9.4 Hospitality

- 9.5 Educational institutions

- 9.6 Industrial (worksite, emergency use)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Acuity Brands

- 12.2 Cooper Lighting

- 12.3 Cree Lighting

- 12.4 Feit Electric

- 12.5 GE Lighting

- 12.6 Havells India

- 12.7 IKEA

- 12.8 Legrand

- 12.9 OSRAM

- 12.10 Panasonic

- 12.11 Signify

- 12.12 Syska LED

- 12.13 Thorn Lighting

- 12.14 Wipro Consumer Lighting

- 12.15 Zumtobel Group