PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773377

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773377

Process Plants Gas Turbine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

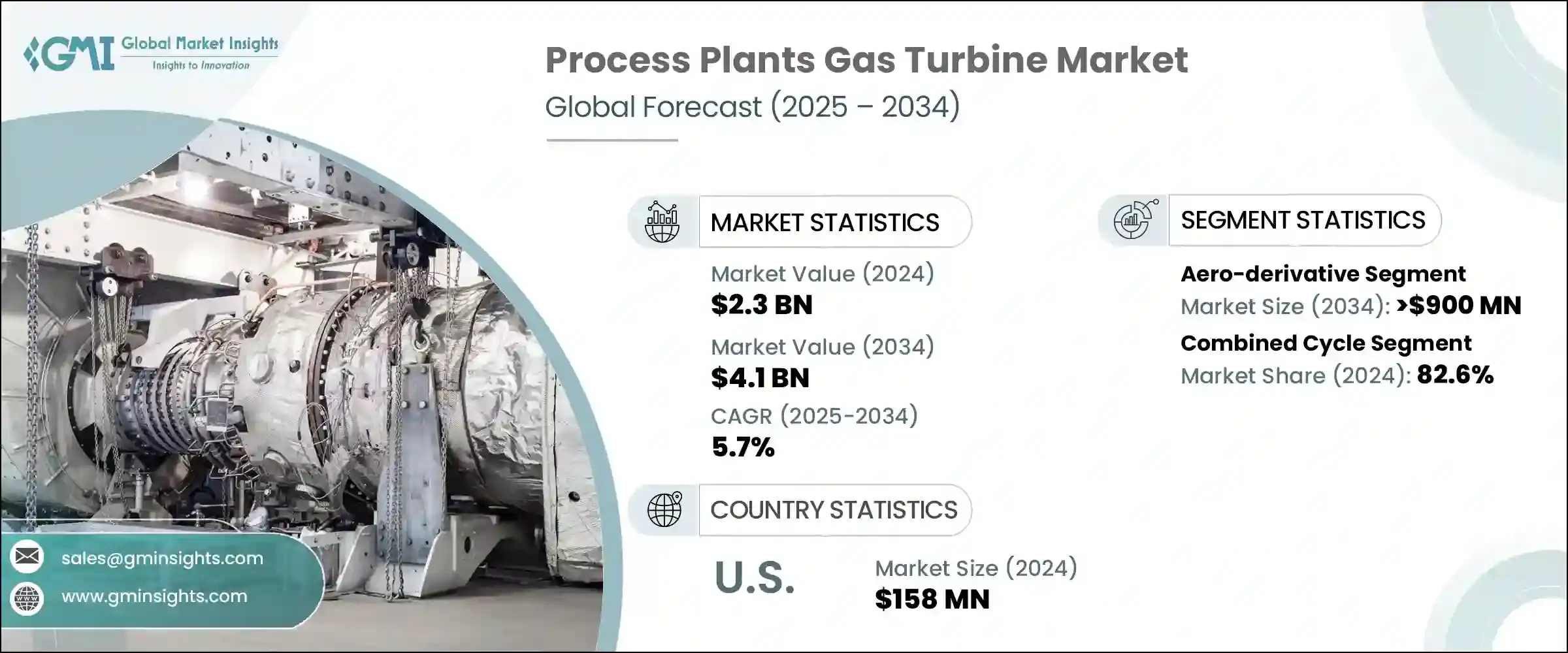

The Global Process Plants Gas Turbine Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 4.1 billion by 2034. Process industries are increasingly choosing gas turbines for on-site power generation to reduce dependence on unreliable grid infrastructure, particularly in areas with frequent power disturbances. The growing use of these turbines in captive power applications supports uninterrupted operations and safeguards against production losses, contributing directly to market expansion. These systems are commonly used in combined heat and power (CHP) setups, where they simultaneously generate electricity and steam, enhancing overall plant efficiency. This dual functionality is a critical factor driving gas turbine installations across industrial facilities.

Small and mid-sized process facilities are fueling demand for compact and modular turbine packages that offer rapid deployment and limit the need for extensive civil works. Turbines are also being deployed in temporary or remote sites, including mobile chemical or pipeline operations, where conventional infrastructure is not viable. These turbines are directly integrated into manufacturing processes to power mechanical systems or deliver heat energy for specialized functions in sectors such as cement, glass, and petrochemicals. The heat from exhaust gases is increasingly being utilized for drying, calcining, or steam cracking, offering added efficiency benefits to process industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 5.7% |

Heavy-duty gas turbines segment is forecasted to grow at a CAGR of 5.5% through 2034. These turbines are widely installed in heavy industrial environments such as steelworks, cement facilities, and petrochemical complexes, where base-load power demand is continuous. Their integration with cogeneration solutions supports the simultaneous delivery of electricity and thermal energy, providing an efficient energy loop at large industrial hubs and reinforcing long-term growth in this segment.

The open cycle segment is expected to grow at a CAGR of 5.5% through 2034. These configurations are favored for their ability to start rapidly, making them suitable for peak load and backup applications. Industries facing unstable power supply are turning to open-cycle gas turbines to secure operations and prevent power interruptions, which continues to strengthen market dynamics.

U.S. Process Plants Gas Turbine Market was valued at USD 158 million in 2024. The nation's focus on industrial electrification and the need to modernize aging combined cycle assets are encouraging the integration of gas turbines with renewable sources. Regulatory measures from environmental agencies are further accelerating the replacement of outdated turbine systems in segments such as fertilizers and chemical manufacturing, pushing U.S. adoption forward.

Key players in the Global Process Plants Gas Turbine Market include MAN Energy Solutions, Mitsubishi Heavy Industries, Siemens Energy, Baker Hughes, Rolls Royce, GE Vernova, and several others. Leading companies in the process plants gas turbine market are focused on product optimization, expanding localized manufacturing, and deepening application-specific customization. Investments in R&D are aimed at developing turbines with lower emissions, enhanced fuel flexibility, and greater modularity. Many players are actively forming partnerships with EPC contractors and process plant operators to offer turnkey turbine packages and long-term service agreements. To cater to evolving industrial demands, manufacturers are integrating digital diagnostics and predictive maintenance capabilities into turbine platforms. Expanding production footprints in regions such as Asia-Pacific and the Middle East also remains a strategic priority.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 ≤ 50 kW

- 5.3 > 50 kW to 500 kW

- 5.4 > 500 kW to 1 MW

- 5.5 > 1 MW to 30 MW

- 5.6 > 30 MW to 70 MW

- 5.7 > 70 MW to 200 MW

- 5.8 > 200 MW

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 Aero-derivative

- 6.3 Heavy duty

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Open cycle

- 7.3 Combined cycle

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Russia

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.3.7 Finland

- 8.3.8 Greece

- 8.3.9 Denmark

- 8.3.10 Romania

- 8.3.11 Poland

- 8.3.12 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Indonesia

- 8.4.6 Thailand

- 8.4.7 Malaysia

- 8.4.8 Bangladesh

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Kuwait

- 8.5.5 Oman

- 8.5.6 Egypt

- 8.5.7 Turkey

- 8.5.8 Bahrain

- 8.5.9 Iraq

- 8.5.10 Jordan

- 8.5.11 Lebanon

- 8.5.12 South Africa

- 8.5.13 Nigeria

- 8.5.14 Algeria

- 8.5.15 Kenya

- 8.5.16 Ghana

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

- 8.6.3 Peru

- 8.6.4 Chile

Chapter 9 Company Profiles

- 9.1 Ansaldo Energia

- 9.2 Baker Hughes

- 9.3 Bharat Heavy Electricals

- 9.4 Capstone Green Energy

- 9.5 Destinus Energy

- 9.6 Doosan

- 9.7 Flex Energy Solutions

- 9.8 GE Vernova

- 9.9 Harbin Electric

- 9.10 IHI Corporation

- 9.11 Kawasaki Heavy Industries

- 9.12 MAN Energy Solutions

- 9.13 Mitsubishi Heavy Industries

- 9.14 Nanjing Turbine & Electric Machinery

- 9.15 Rolls Royce

- 9.16 Shanghai Electric Gas Turbine

- 9.17 Siemens Energy

- 9.18 Solar Turbines

- 9.19 Vericor

- 9.20 Wartsilä