PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773378

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773378

Pallet Jacks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

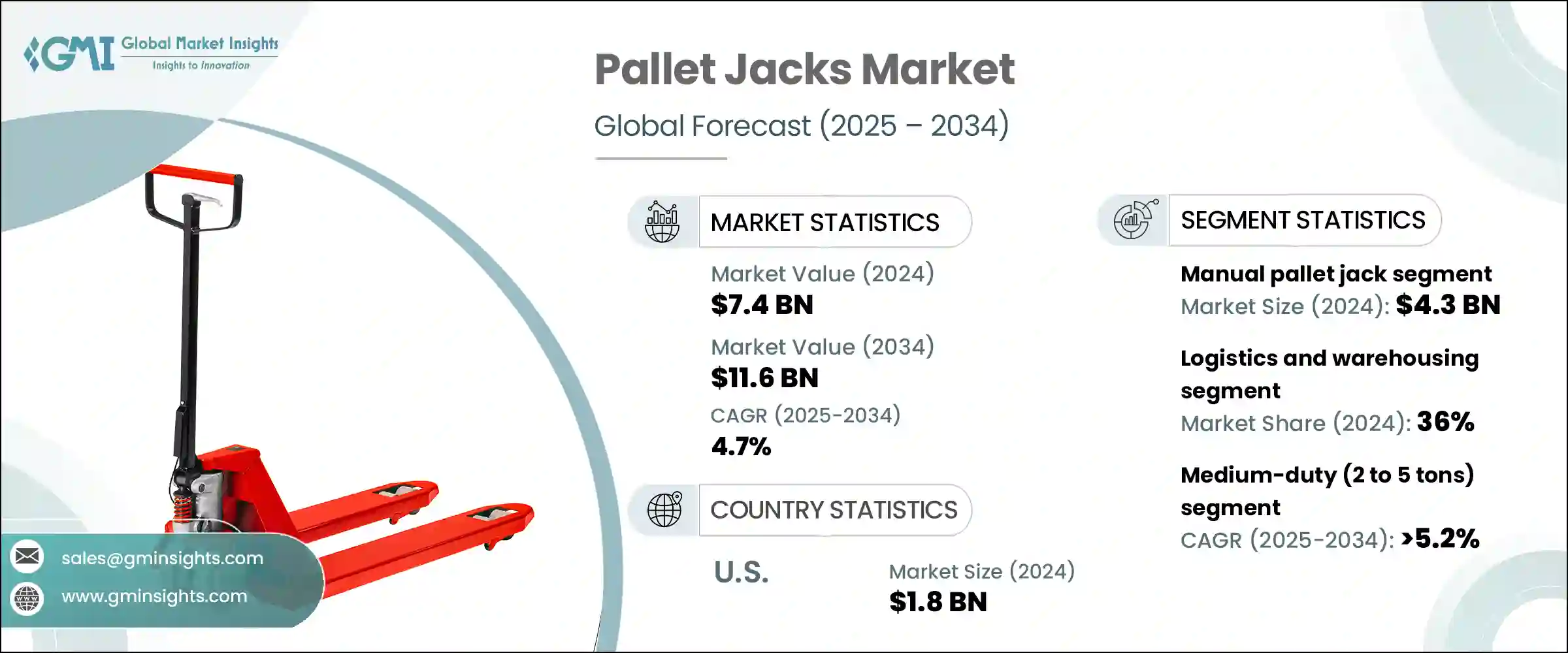

The Global Pallet Jacks Market was valued at USD 7.4 billion in 2024 and is estimated to grow at a CAGR of 4.7% to reach USD 11.6 billion by 2034. This growth is largely driven by the increasing demand for material handling equipment and the rapid expansion of warehouses and distribution centers, particularly in emerging markets. As businesses seek to improve operational efficiency and reduce lead times, the need for advanced material handling solutions, including pallet jacks, is on the rise. The global warehousing industry, particularly in regions such as the UK and Ireland, is undergoing a significant transformation.

For example, Ireland's ongoing economic expansion is driving an increased demand for warehousing space, as businesses look to scale their operations and meet the growing needs of both domestic and international markets. The expansion is not only fueling the demand for more storage but also encouraging innovations in logistics and supply chain management to ensure smoother, more efficient distribution processes. As companies adapt to new trade regulations and supply chain challenges, they are prioritizing investments in warehouses and distribution centers within their borders. This shift has had a profound effect on the logistics landscape, pushing businesses to secure more resilient, self-sufficient supply chains. The UK's logistics sector, one of the most established and advanced in Europe, has seen accelerated growth in response to these challenges.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.4 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 4.7% |

The logistics and warehousing segment held a 36% share in 2024 and is forecasted to grow at a CAGR of 5% from 2025 to 2034. This growth is primarily fueled by the surge in global trade, the expansion of third-party logistics providers, and the increasing need for efficient material handling solutions. Pallet jacks are becoming indispensable in optimizing supply chains, improving operational efficiency, and reducing the need for manual labor in these growing sectors. Additionally, the continuous expansion of the e-commerce industry is driving significant demand for enhanced logistics and warehousing operations worldwide.

Regarding product categories, the medium-duty (2 to 5 tons) pallet jacks segment is expected to grow at a CAGR of 5.2% from 2025 to 2034, primarily due to its versatility in handling a variety of loads across different industries. The incorporation of electric-powered systems into these pallet jacks is also expected to drive adoption further, as they improve operational performance, reduce manual effort, and enhance user convenience.

U.S. Pallet Jacks Market held an 82% share and generated USD 1.8 billion in 2024. This dominance is largely attributed to the rapid expansion of warehouses and distribution centers worldwide. With the growing demand for faster inventory turnover and more efficient storage solutions, businesses are increasingly investing in advanced material handling equipment, like pallet jacks, to stay competitive in a booming market. The demand for pallet jacks is also driven by the broader trends of automation and digitization within the U.S. logistics industry.

Key players in the Global Pallet Jacks Market include Howard Handling, Jungheinrich, CUBLIFT, Toyota Material Handling, Doosan, Linde Material Handling, Hyster-Yale Materials Handling, Allman, Raymond Corporation, Vestil, Crown Equipment Corporation, RICO, HU-LIFT, and Mobile Industrial Robots. To strengthen their market presence, companies in the pallet jacks industry are adopting a variety of strategies. These include expanding their product portfolios to include electric-powered and automated pallet jacks, as well as focusing on product innovation to meet the evolving needs of customers.

Partnerships and collaborations with key logistics players, especially third-party logistics providers, help companies enhance their distribution channels. Additionally, investments in research and development are enabling companies to offer more efficient, cost-effective solutions. Expanding into emerging markets and strengthening their manufacturing capabilities through local production are other strategic moves to tap into growing demand. Marketing strategies that emphasize the operational benefits of pallet jacks, including reduced labor costs and increased efficiency, also play a crucial role in boosting their market position.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 By regional

- 2.2.2 By type

- 2.2.3 By operation

- 2.2.4 By capacity

- 2.2.5 By end use industry

- 2.2.6 By distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Rider pallet jack

- 5.3 Center rider pallet jack

- 5.4 Weighing scale pallet jack

- 5.5 Low profile pallet jack

- 5.6 All-terrain pallet jack

- 5.7 Others (multi-directional pallet jack etc.)

Chapter 6 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Manual pallet jack

- 6.3 Electric pallet jack

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Light duty (below 2 tons)

- 7.3 Medium-duty (2 to 5 tons)

- 7.4 Heavy-duty (above 5 tons)

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Retail

- 8.3 Logistics and warehousing

- 8.4 Food and beverages

- 8.5 Automotive

- 8.6 Steel plants

- 8.7 Others (manufacturers etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Allman

- 11.2 Clark

- 11.3 Crown Equipment Corporation

- 11.4 CUBLIFT

- 11.5 Doosan

- 11.6 Howard Handling

- 11.7 HU-LIFT

- 11.8 Hyster-Yale Materials Handling

- 11.9 Jungheinrich

- 11.10 Linde Material Handling

- 11.11 Mobile Industrial Robots

- 11.12 Raymond Corporation

- 11.13 RICO

- 11.14 Toyota Material Handling

- 11.15 Vestil