PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773380

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773380

Hollow Bricks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

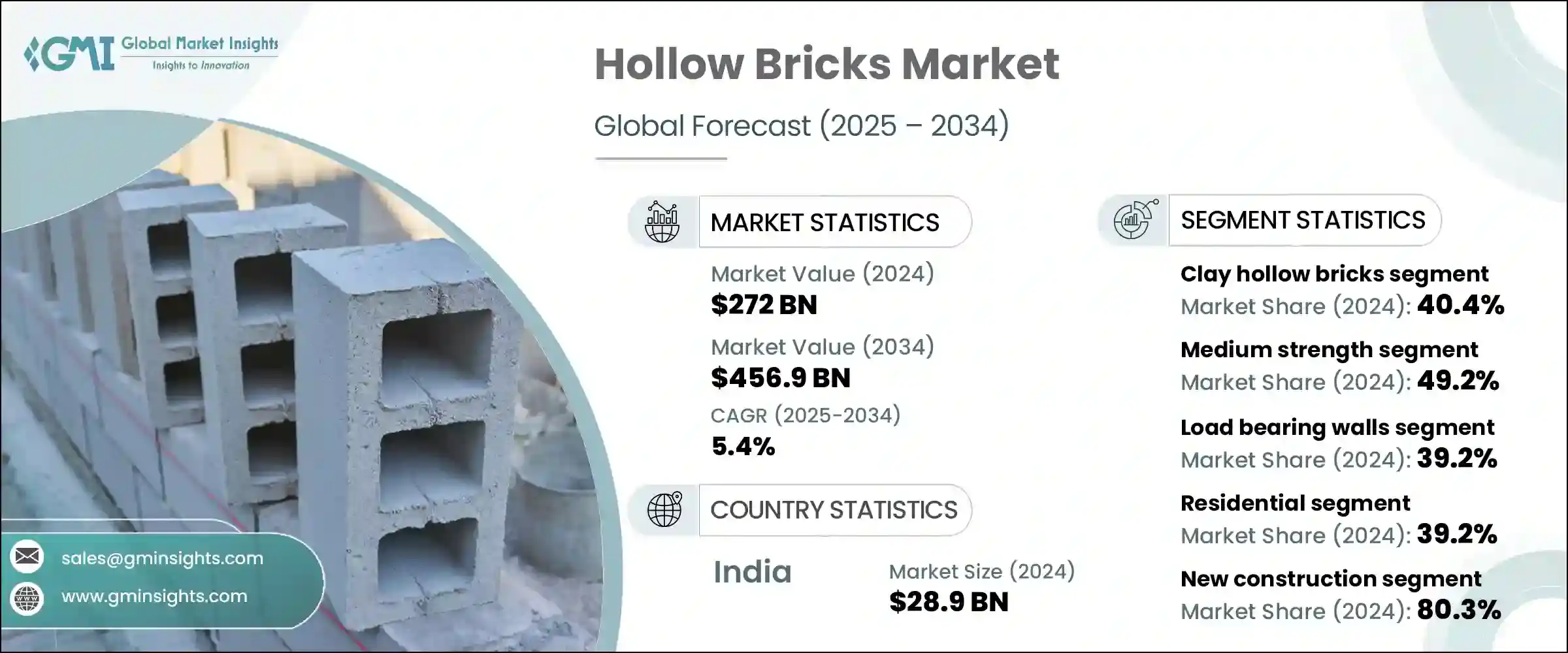

The Global Hollow Bricks Market was valued at USD 272 billion in 2024 and is estimated to grow at a CAGR of 5.4 % to reach USD 456.9 billion by 2034. The rising demand for new residential and commercial structures, particularly in metropolitan and suburban areas, is significantly boosting the need for hollow bricks. Their ease of installation and cost-effectiveness make them an ideal choice for large-scale construction projects. Government-backed affordable housing initiatives have also contributed to this upward trend by encouraging the use of economical and sustainable building materials. Hollow bricks provide natural insulation against heat and cold, making them energy efficient. Their ability to help reduce cooling and heating costs aligns with the growing focus on green buildings and energy-efficient construction, making them preferred material among environmentally conscious developers.

These bricks help regulate indoor temperatures and noise levels, making buildings more comfortable in urban environments with fluctuating climates and higher sound levels. Their structure reduces the need for excess mortar and minimizes the demand for high-strength materials, which cuts down overall construction costs. Lightweight properties make transportation and assembly faster and more resource-efficient, especially where labor and budgets are tight. Moreover, the growing adoption of modular and prefabricated construction techniques is further increasing the demand for hollow bricks due to their compatibility with modern construction practices and their contribution to accelerated project timelines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $272 Billion |

| Forecast Value | $456.9 Billion |

| CAGR | 5.4% |

In 2024, the clay hollow bricks segment held a 40.4% share. The demand for these bricks continues to rise across various material types as the construction industry shifts toward high-strength yet lightweight options. Clay-based variants remain a dominant choice, particularly in low-rise developments, due to their wide availability and cost-efficient manufacturing processes. Their thermal performance and strength properties support their widespread use in both rural and developing urban regions, especially in emerging economies where affordability and access to materials are critical.

Hollow bricks used in the load-bearing walls segment contributed a 39.2% share in 2024. These walls are a fundamental part of modern building design, providing durability and essential structural support for residential and commercial projects alike. While load-bearing applications dominate, there is also notable growth in the use of hollow bricks in non-load-bearing interior walls due to their ease of use and lightweight nature. Their growing popularity is tied to evolving design needs that favor faster installation and versatile layout options in new buildings.

India Hollow Bricks Market held an 82% share and generated USD 28.9 billion in 2024. The country's leadership is driven by rapid urban growth, widespread construction activities, and the momentum created by public infrastructure and housing schemes. India's robust manufacturing ecosystem and ample availability of strength-class raw materials further strengthen its market dominance. Additionally, rising adoption in smaller cities and tier-two markets has broadened the domestic consumption base. Meanwhile, policy efforts aimed at promoting sustainable and energy-efficient building materials have further accelerated the use of hollow bricks across various regions.

Some of the most influential players shaping the Hollow Bricks Industry include Xella Group, H+H International A/S, UltraTech Cement Ltd, Biltech Building Elements Limited, and Wienerberger AG. These companies are actively contributing to the market's evolution through product innovation and strategic presence across key regions. To solidify their positions in the hollow bricks market, leading manufacturers are leveraging multiple growth strategies. These include setting up regional manufacturing hubs to reduce logistics costs and improve distribution efficiency, investing in automated production to scale output while maintaining consistency, and introducing advanced product variants with enhanced strength and thermal performance. Partnerships with real estate developers and construction firms have also proven effective in driving adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Strength Class

- 2.2.4 Application

- 2.2.5 End use industry

- 2.2.6 Production process

- 2.2.7 Distribution channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing construction industry

- 3.2.1.2 Increasing focus on energy efficiency

- 3.2.1.3 Cost-effectiveness and reduced material usage

- 3.2.1.4 Superior thermal and acoustic insulation properties

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from alternative building materials

- 3.2.2.2 Fluctuating Strength Class prices

- 3.2.2.3 Regional building code compliance

- 3.2.2.4 Quality control and consistency issues

- 3.2.3 Market opportunities

- 3.2.3.1 Development of eco-friendly hollow bricks

- 3.2.3.2 Expansion in emerging markets

- 3.2.3.3 Technological advancements in manufacturing

- 3.2.3.4 Integration with modern construction techniques

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Clay hollow bricks

- 5.3 Concrete hollow blocks

- 5.4 Fly ash hollow bricks

- 5.5 AAC (Autoclaved Aerated Concrete) hollow blocks

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Strength Class, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Low strength

- 6.3 Medium strength

- 6.4 High strength

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Load bearing walls

- 7.2.1 External load bearing walls

- 7.2.2 Internal load bearing walls

- 7.2.3 Others

- 7.3 Non-load bearing walls

- 7.3.1 Partition walls

- 7.3.2 Infill walls

- 7.3.3 Others

- 7.4 Foundations

- 7.5 Columns and pillars

- 7.6 Lintels and beams

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Residential

- 8.2.1 Single-family homes

- 8.2.2 Multi-family buildings

- 8.2.3 Affordable housing

- 8.2.4 Others

- 8.3 Commercial

- 8.3.1 Office buildings

- 8.3.2 Retail spaces

- 8.3.3 Hospitality

- 8.3.4 Healthcare facilities

- 8.3.5 Educational institutions

- 8.3.6 Others

- 8.4 Industrial

- 8.4.1 Manufacturing facilities

- 8.4.2 Warehouses

- 8.4.3 Others

- 8.5 Infrastructure

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Construction Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 New construction

- 9.3 Renovation and retrofitting

Chapter 10 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Distributors and wholesalers

- 10.4 Home improvement stores

- 10.5 Online retail

- 10.6 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 AERCON AAC

- 12.2 Biltech Building Elements Limited

- 12.3 Eco Green Products Pvt. Ltd

- 12.4 Fusion Blocks

- 12.5 H+H International A/S

- 12.6 Infra.Market

- 12.7 Jindal Mechno Bricks Private Limited

- 12.8 Magicrete Building Solutions Pvt. Ltd

- 12.9 MRF Bricks

- 12.10 NICBM

- 12.11 Paver India

- 12.12 SOLBET

- 12.13 UltraTech Cement Ltd

- 12.14 Wienerberger AG

- 12.15 Xella Group