PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773381

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773381

LCD TV Core Chip Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

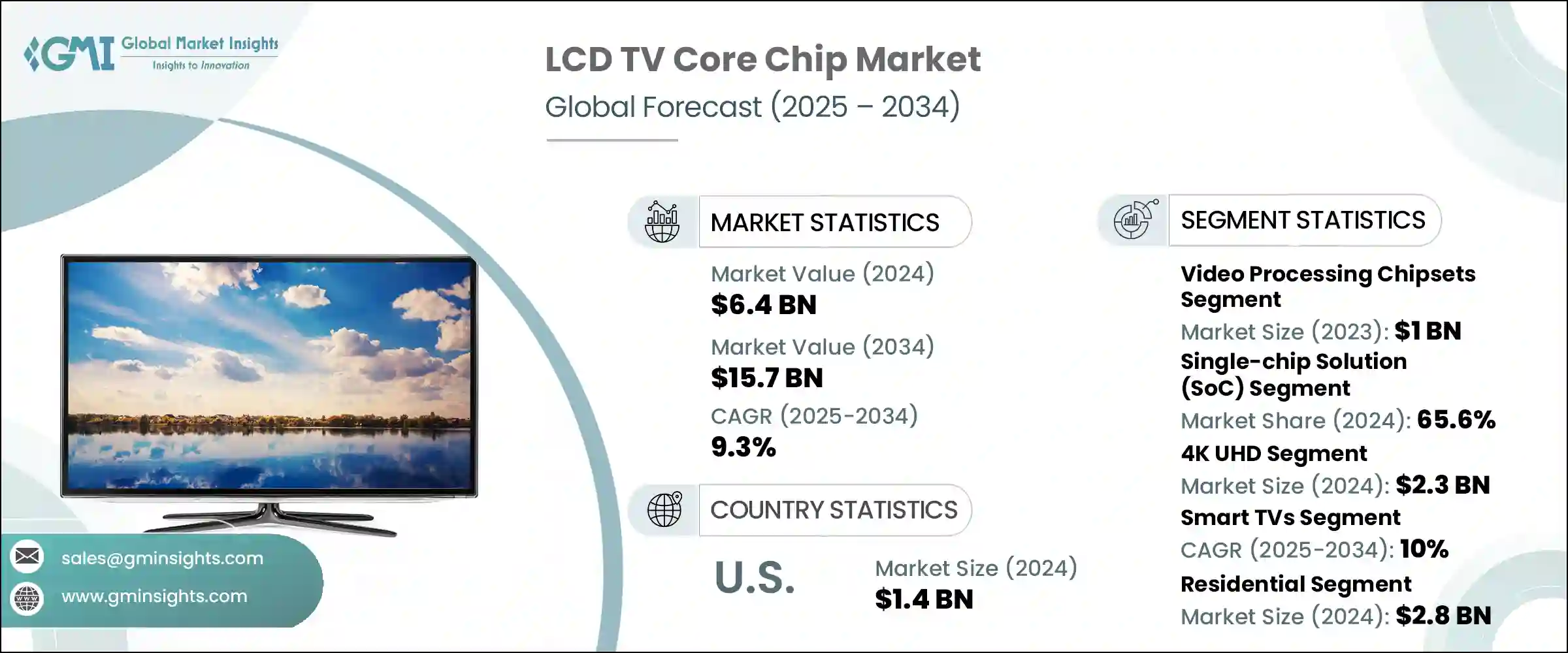

The Global LCD TV Core Chip Market was valued at USD 6.4 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 15.7 billion by 2034. Rapid adoption of smart and connected TVs continues to fuel this growth, as users seek seamless integration with streaming platforms, AI-powered voice assistants, internet connectivity, and responsive multitasking. In response, manufacturers are designing high-performance processing chips to support complex functions, including ultra-high-definition video decoding, advanced content rendering, and app-based user interfaces.

The growth of IoT and smart home ecosystems has further amplified the demand for chips that are not only more powerful but also energy efficient. As consumers gravitate toward 4K and 8K resolutions, core chips must deliver significantly enhanced computing capabilities to manage the high bandwidth, compression, and image processing needs associated with these formats. This evolution is positioning next-generation chips at the heart of the television experience, transforming how users interact with content, apps, and smart features. As the demand for faster, smarter, and more energy-efficient TVs grows, advanced core processing units are becoming central to performance and innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.4 Billion |

| Forecast Value | $15.7 Billion |

| CAGR | 9.3% |

System-on-chip (SoC) solutions are driving much of this shift, valued at USD 1.2 billion in 2022. These integrated chipsets combine critical functions-such as central processing, graphics rendering, memory management, and connectivity-into a single platform, drastically simplifying internal architecture. This integration allows for quicker data transmission, reduced latency, and smoother multitasking, all of which contribute to a superior viewing experience. SoCs enable smart TVs to operate streaming platforms, AI features, and interactive services efficiently, making them essential in today's connected living rooms.

In 2024, the single-chip solutions segment held a 65.6% share, reinforcing its role in advancing TV performance. These compact chips reduce the need for multiple components, minimizing power consumption and space on circuit boards. Their efficiency and design flexibility make them highly favored in mid-range to premium LCD TVs, where manufacturers strive to deliver sleek aesthetics, lightning-fast operation, and competitive production costs without compromising on smart capabilities.

U.S. LCD TV Core Chip Market was valued at USD 1.4 billion in 2024, driven by strong consumer preference for advanced smart TVs featuring high-definition displays and embedded streaming technologies. With continuous innovation and robust consumption levels, the U.S. market is a leading hub for chip demand and development. Investments in R&D and the presence of major global suppliers have further solidified the country's position in this space.

Top companies in the LCD TV Core Chip Market include Novatek Microelectronics Corp., MediaTek Inc., and Realtek Semiconductor Corp. Key strategies adopted by companies in the LCD TV core chip market include the integration of AI-driven enhancements and support for ultra-high-resolution content formats, such as 8K and UHD. Major players are developing customized chips that minimize energy use while maximizing processing power, tailored to smart TV ecosystems. Many focus on partnerships with leading TV manufacturers to co-develop feature-rich platforms. Additionally, companies are prioritizing system-level integration and faster time-to-market, offering SoCs that combine multiple functionalities like memory, display control, and connectivity in one unit. Ongoing investment in R&D and next-gen compression algorithms also strengthens their competitive edge in a rapidly evolving digital entertainment environment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.6.1 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Key news & initiatives

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Proliferation of smart and connected TVs

- 3.4.1.2 Transition to higher display resolutions

- 3.4.1.3 Integration of AI capabilities

- 3.4.1.4 Emergence of OTT platforms

- 3.4.1.5 Global expansion of middle-class consumers

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 Price pressure and margins

- 3.4.2.2 Semiconductor supply chain volatility

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Emerging business models

- 3.10 Compliance requirements

- 3.11 Sustainability measures

- 3.12 Consumer sentiment analysis

- 3.13 Patent and IP analysis

- 3.14 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type of Chipset, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Video processing chipsets

- 5.3 Audio processing chipsets

- 5.4 Tuner & demodulator chipsets

- 5.5 Power management ICs

- 5.6 Timing Controller (TCON) ICs

- 5.7 System-on-Chip (SoC)

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Single-chip Solution (SoC)

- 6.3 Multi-chip solution

Chapter 7 Market Estimates & Forecast, By Resolution, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 HD (720p)

- 7.3 Full HD (1080p)

- 7.4 4K UHD

- 7.5 8K UHD

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Smart TVs

- 8.3 Non-smart (Conventional) LCD TVs

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Analog Devices Inc.

- 11.2 Broadcom Inc.

- 11.3 Hisilicon (Huawei Technologies)

- 11.4 Innosilicon

- 11.5 MediaTek Inc.

- 11.6 Novatek Microelectronics Corp.

- 11.7 NXP Semiconductors

- 11.8 Parade Technologies

- 11.9 Realtek Semiconductor Corp.

- 11.10 ROHM Semiconductor

- 11.11 Samsung Electronics (System LSI)

- 11.12 Skyworks Solutions

- 11.13 Socionext Inc.

- 11.14 Sony Semiconductor Solutions

- 11.15 STMicroelectronics

- 11.16 Synaptics Inc.

- 11.17 Texas Instruments

- 11.18 Toshiba Electronic Devices & Storage Corporation