PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773387

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773387

Plasma Lighting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

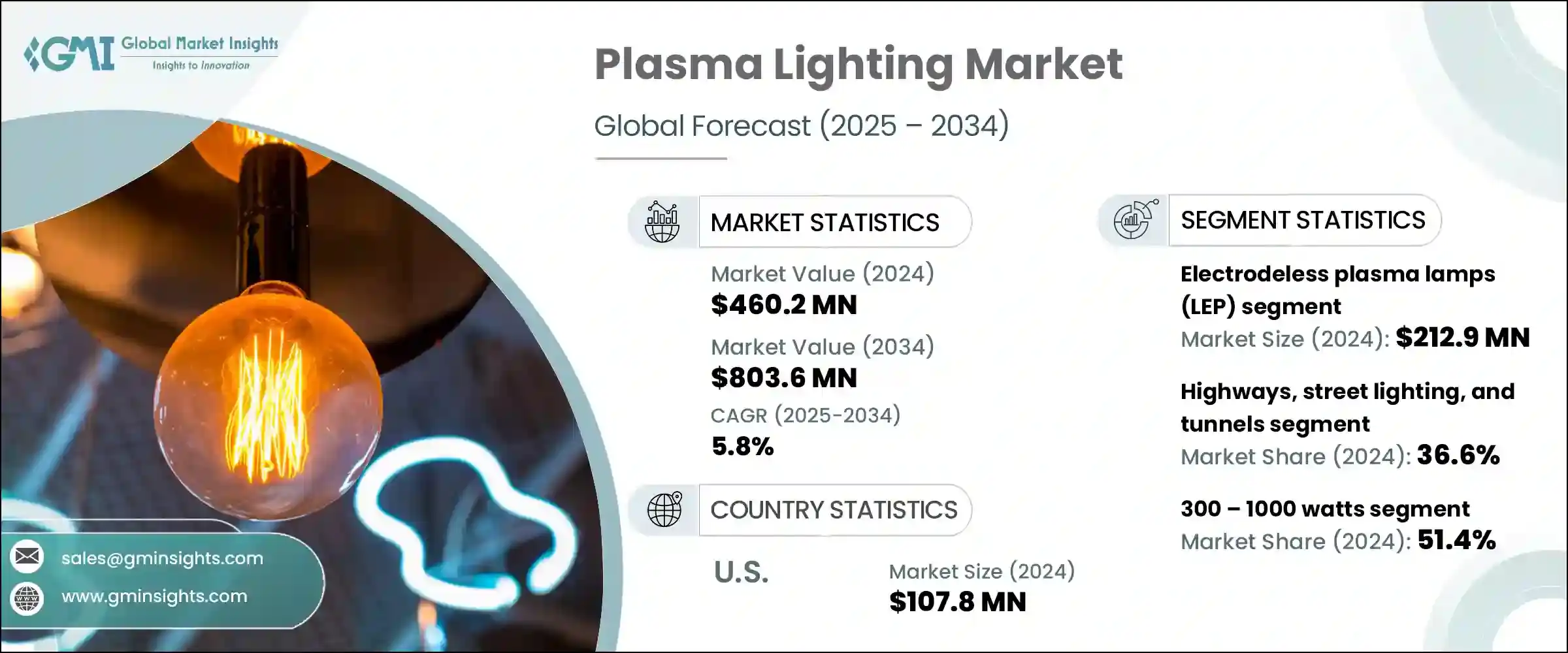

The Global Plasma Lighting Market was valued at USD 460.2 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 803.6 million by 2034. This growth is fueled by rising demand from both horticultural lighting and industrial and outdoor sectors. The expansion of controlled environment agriculture (CEA), vertical farming, and greenhouse farming systems is a significant factor driving the need for plasma lighting in horticulture.

Plasma lights produce a broad spectrum of light closely resembling natural sunlight, which promotes healthier plant growth and higher yields. Their long lifespan, energy efficiency, and robust durability make them highly suitable for environments that require consistent, continuous lighting. Meanwhile, industrial and outdoor applications demand lighting solutions that deliver high-lumen output and long operational life under tough conditions. Plasma lighting fits these requirements perfectly due to its high color rendering index (CRI), resistance to shocks, and ability to withstand temperature fluctuations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $460.2 Million |

| Forecast Value | $803.6 Million |

| CAGR | 5.8% |

Infrastructure modernization and energy-efficient initiatives led by governments are significantly accelerating the transition from traditional metal halide and HID lighting systems to advanced plasma lighting technologies across various sectors. These policy-driven efforts focus on reducing energy consumption and lowering carbon footprints while enhancing lighting quality and durability. As a result, plasma lighting, with its superior energy efficiency, longer lifespan, and better light quality, is becoming the preferred choice for public infrastructure projects.

The electrodeless plasma lamps (LEP) segment held a market value of USD 212.9 million in 2024, dominating the plasma lighting market because of its dependable technology and widespread adoption in municipal and industrial lighting applications. LEP lamps offer a consistent light output and long service life, making them ideal for locations demanding steady, high-intensity illumination. However, their growth faces challenges from increasing operational costs and rising competition from emerging lighting technologies.

The highways, street lighting, and tunnels segment dominated the market in 2024, holding a significant 36.6% share, driven primarily by the surge in infrastructure development projects demanding dependable, high-intensity, and low-maintenance lighting solutions. Public authorities and municipalities favor plasma lighting because of its exceptional longevity and robust performance under tough outdoor conditions, such as in tunnels, bridges, and busy roadways, where both safety and operational cost savings are paramount. This preference is reinforced by plasma lighting's ability to deliver consistent illumination with minimal maintenance, reducing downtime and replacement costs in critical infrastructure settings.

United States Plasma Lighting Market was valued at USD 107.8 million in 2024, fueled by proactive government investments in modernizing infrastructure alongside widespread applications in industrial and horticultural sectors. The country's early embrace of cutting-edge lighting technologies has accelerated the integration of plasma lighting into smart city projects and controlled environment agriculture systems. These initiatives emphasize energy efficiency, precise light spectrum control, and long-lasting solutions, further increasing the demand for plasma lighting across diverse applications. The combination of robust infrastructure spending, technological innovation, and sector-specific demand is set to sustain strong growth momentum in the U.S. plasma lighting market over the coming years.

Leading companies in the Plasma Lighting Industry include LG Electronics, Gavita International B.V., and Ushio Inc., which hold significant market positions through continuous innovation and strategic market outreach. To strengthen their market presence and build a competitive edge, companies in the plasma lighting sector focus on multiple strategic initiatives. Innovation plays a central role, with firms investing heavily in developing more energy-efficient, longer-lasting plasma lighting solutions that meet the evolving needs of horticultural and industrial applications. Partnerships and collaborations with agricultural technology providers, infrastructure developers, and municipal authorities allow companies to expand their reach and tailor products to specific client demands. Expanding product portfolios to include smart, controllable lighting systems helps tap into emerging trends like precision agriculture and smart city infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Type trends

- 2.2.2 Power trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Million)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for horticultural lighting

- 3.2.1.2 Superior energy efficiency and lifespan

- 3.2.1.3 Environmental compliance pressure

- 3.2.1.4 Increasing demand from industrial & outdoor applications

- 3.2.1.5 Growing investments in sustainable lighting

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Competition from LED technology

- 3.2.2.2 Limited vendor ecosystem

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.13 Consumer sentiment analysis

- 3.14 Patent and ip analysis

- 3.15 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital Transformation Initiatives

- 4.5 Emerging/ Startup Competitors Landscape

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Electrodeless plasma lamps (LEP)

- 5.3 Microwave plasma lighting

- 5.4 Radio frequency (RF) plasma lighting

Chapter 6 Market Estimates & Forecast, By Power, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Less than 300 watts

- 6.3 300 – 1000 watts

- 6.4 Above 1000 watts

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Highways, street lighting, and tunnels

- 7.3 Industrial

- 7.4 Sports & entertainment

- 7.5 Horticulture

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alphalite Inc.

- 9.2 Gavita International B.V.

- 9.3 Green De Corp

- 9.4 Hive Lighting

- 9.5 LG Electronics

- 9.6 Lumartix SA.

- 9.7 pinkRF

- 9.8 Plasma International GmbH

- 9.9 PlasmaBright

- 9.10 Ushio Inc.

- 9.11 WAVEPIA CO., LTD.

- 9.12 Solaronix SA