PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773388

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773388

Intra-Oral Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

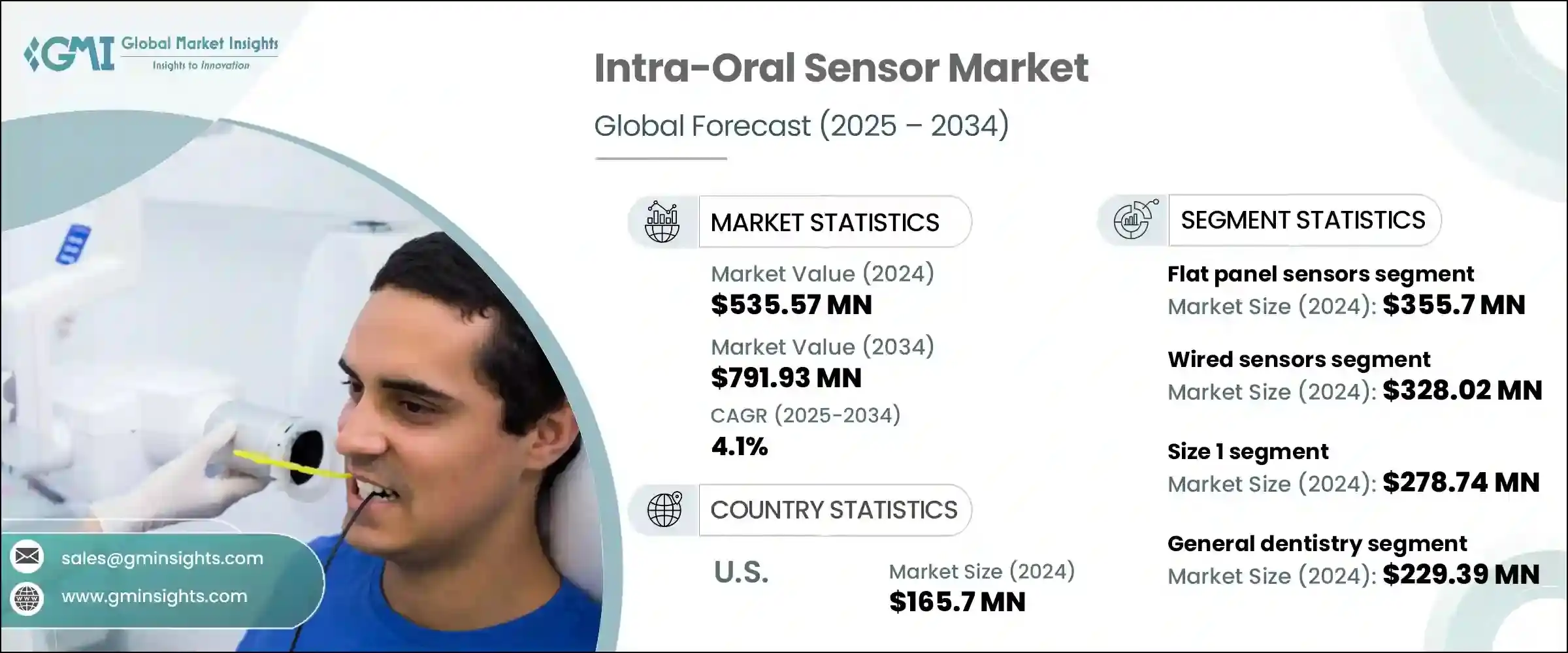

The Global Intra-Oral Sensor Market was valued at USD 535.57 million in 2024 and is estimated to grow at a CAGR of 4.1% to reach USD 791.93 million by 2034. This expansion is driven by a rising incidence of dental disorders and a growing demand for early and accurate diagnosis. Intra-oral sensors play an essential role in capturing high-resolution digital images of teeth and surrounding structures, enabling improved diagnostic accuracy, more precise treatment planning, and enhanced patient outcomes. As dental professionals seek better diagnostic tools-especially in detecting age-related conditions-advanced imaging systems are becoming indispensable. Technologies such as AI-integrated 3D imaging and Cone Beam Computed Tomography (CBCT) have improved image fidelity and diagnostic speed, reducing patient discomfort and streamlining dental workflows.

The rapid adoption of AI-powered intra-oral sensors is transforming dental clinics worldwide by elevating diagnostic precision and improving overall patient care. These advanced systems leverage artificial intelligence to automatically detect anomalies, streamline image analysis, and reduce human error, allowing practitioners to deliver faster and more accurate diagnoses. As AI continues to evolve, sensors equipped with machine learning algorithms can now identify early signs of cavities, gum disease, and bone loss with minimal manual input.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $535.57 million |

| Forecast Value | $791.93 million |

| CAGR | 4.1% |

The flat panel sensors segment in the intra-oral sensor market generated USD 355.7 million in 2024. Their rise in popularity is largely driven by high-definition image output, which allows for enhanced visualization of fine dental structures. These sensors integrate seamlessly into digital workflows, making them indispensable in modern dental environments where precision, speed, and interoperability with practice management systems are essential. Dental professionals increasingly favor these sensors due to their ability to improve diagnostic accuracy and patient communication, especially during treatment planning and consultations. Additionally, their ergonomic design and real-time image delivery make them both patient- and operator-friendly.

The wired sensors segment secured a valuation of USD 328.02 million in 2024 and continues to hold a strong market position. Known for their durability, dependable image consistency, and ease of integration into existing dental software ecosystems, wired sensors remain a top choice among practitioners who prioritize reliability over wireless flexibility. These systems operate with continuous power and real-time data transfer, minimizing disruptions during procedures. Their cost-effectiveness, minimal maintenance needs, and proven track record further reinforce their preference, especially in clinics that require budget-friendly, scalable imaging solutions.

Germany Intra-Oral Sensor Market was valued at USD 30.27 million in 2024, propelled by the nation's advanced healthcare system and robust dental equipment production base. Backed by strong insurance frameworks and national digitization strategies, the adoption of cutting-edge dental technologies continues to rise. Government policies encouraging digital health solutions have led to a steady increase in the replacement of traditional imaging tools with digital sensors. Additionally, stringent clinical guidelines and rigorous training standards in dentistry push clinics to frequently upgrade their imaging capabilities, ensuring both diagnostic excellence and compliance with evolving health regulations.

Prominent players in the market include FONA srl, Carestream Dental LLC., Acteon Group, Dexis LLC., Genoray Co., Ltd., Dentsply Sirona Inc. Manufacturers are focusing on integrating AI and CBCT technologies to offer enhanced diagnostic accuracy and faster imaging. Partnerships with dental software providers and imaging OEMs are creating comprehensive, easy-to-integrate imaging solutions. To meet growing demand, companies are expanding their product portfolios to include compact, wireless intra-oral sensors that prioritize patient comfort and clinic efficiency. They are also investing in R&D to improve sensor resolution and reduce radiation exposure. Educational initiatives and training programs for dental professionals help improve adoption rates and ensure effective utilization.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of dental disorders

- 3.2.1.2 Increasing adoption of digital dentistry

- 3.2.1.3 Technological advancements in imaging sensors

- 3.2.1.4 Growing geriatric population

- 3.2.1.5 Expanding dental care infrastructure in emerging markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced intraoral sensors

- 3.2.2.2 Limited adoption in developing regions due to lack of digital infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Flat panel sensors

- 5.2.1 CCD (charge-coupled device) sensors

- 5.2.2 CMOS (complementary metal-oxide semiconductor) sensors

- 5.3 Phosphor storage plate (PSP)

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Connectivity, 2021 - 2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Wired sensors

- 6.3 Wireless sensors

Chapter 7 Market Estimates and Forecast, By Sensor Size, 2021 - 2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 Size 0

- 7.3 Size 1

- 7.4 Size 2

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 General dentistry

- 8.3 Endodontics

- 8.4 Orthodontics

- 8.5 Periodontics

- 8.6 Implantology

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales (OEM to Buyer)

- 9.3 Distributors

- 9.4 Online retail platforms

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Acteon Group

- 11.2 Carestream Dental LLC.

- 11.3 Dentsply Sirona Inc.

- 11.4 Dexis LLC.

- 11.5 FONA srl

- 11.6 Genoray Co., Ltd.

- 11.7 Hamamatsu Photonics K.K.

- 11.8 ImageWorks Corporation

- 11.9 Midmark Corporation

- 11.10 MyRay

- 11.11 Owandy Radiology

- 11.12 Planmeca Oy

- 11.13 Trident S.r.l.

- 11.14 Vatech Co., Ltd.

- 11.15 XDR Radiology