PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773390

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773390

Low Code Development Platform Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

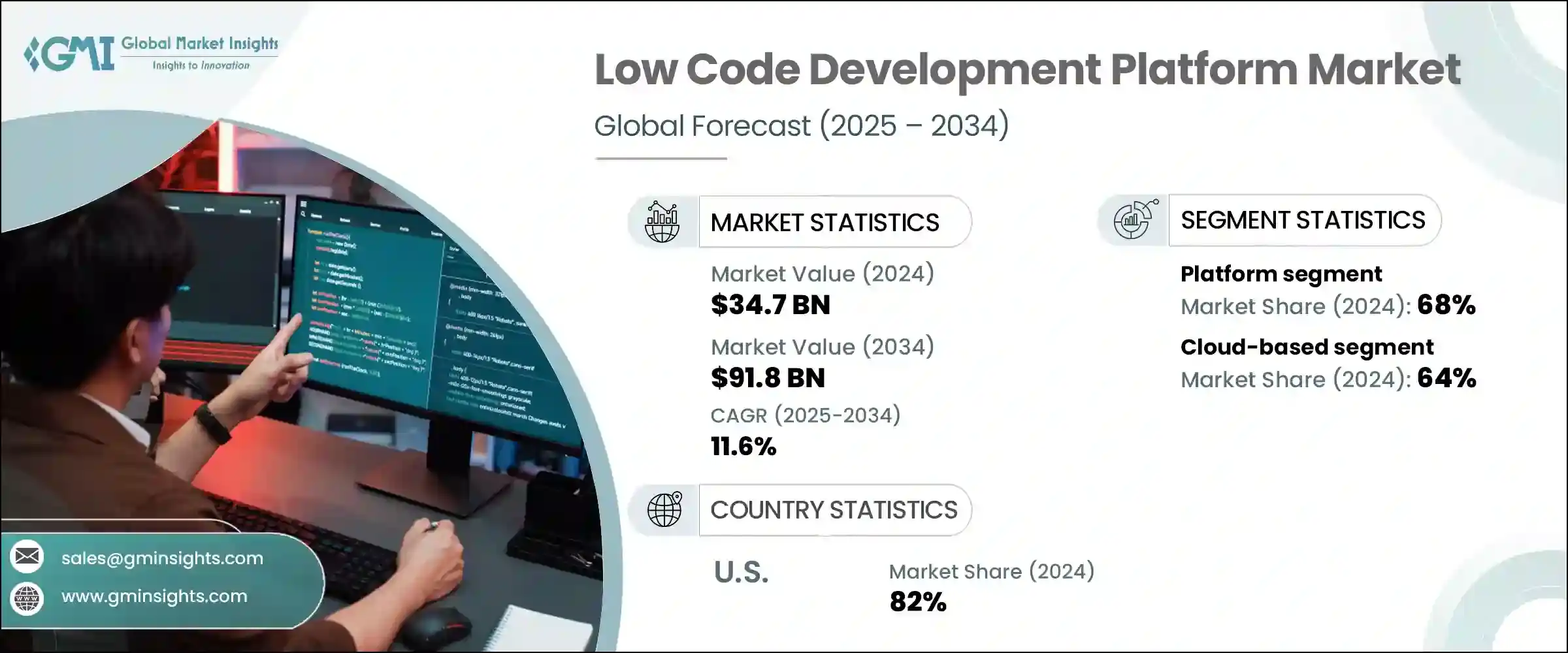

The Global Low Code Development Platform Market was valued at USD 34.7 billion in 2024 and is estimated to grow at a CAGR of 11.6% to reach USD 91.8 billion by 2034. This growth reflects the rising need for rapid software deployment in a fast-evolving digital world. As businesses intensify their focus on digital transformation, there's increasing demand for tools that allow for quicker development with minimal coding. Low-code platforms offer a streamlined path by reducing reliance on manual programming, using visual interfaces and drag-and-drop capabilities. This simplifies the development process, speeds up time to market, reduces costs, and allows new functionality to reach users more quickly. These platforms are especially vital in departments like HR, supply chain, and customer service, where adaptability and speed are critical.

The ability of low-code tools to empower non-technical users is also a game changer. These platforms let employees outside of IT build functional applications, relieving pressure on software teams and improving organizational responsiveness. In times of developer shortages and rising operational complexity, businesses benefit from allowing citizen developers to craft tailored tools that improve efficiency and spark innovation. When supported with appropriate training and governance, these solutions help scale development capacity beyond traditional IT boundaries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $34.7 Billion |

| Forecast Value | $91.8 Billion |

| CAGR | 11.6% |

In 2024, the platform solutions segment held 68% share and is expected to grow at a CAGR of 12% through 2034. These platforms are evolving beyond basic development environments into full-stack systems that integrate interface design, business logic, and deployment functions. This integration allows rapid progression from idea to functional software, helping even low-code users build scalable applications with minimal technical oversight. Companies that offer comprehensive, end-to-end solutions continue to lead the market.

Cloud-based deployment segment held a 64% share and is forecasted to grow at a CAGR of 13% through 2034. Cloud-native low-code platforms offer elasticity by automatically adjusting compute resources based on demand, which minimizes latency and costs while improving user experience. These systems remove the burden of infrastructure management and support seamless scaling for digital solutions. Technologies like serverless execution and containerization add another layer of flexibility, making cloud-based low-code systems ideal for dynamic, global applications.

U.S. Low Code Development Platform Market held an 82% share and generated USD 9.8 billion in 2024. Domestic firms are prioritizing digital innovation to boost operational efficiency, elevate service quality, and maintain competitive agility. Low-code tools fit well into these strategies by offering faster, more cost-effective alternatives to traditional development. The country continues to lead in the integration of emerging technologies like artificial intelligence and hyper-automation into low-code environments, further accelerating enterprise adoption.

Key market players in this industry include Zoho Corporation, Microsoft, Appian Corporation, SAP SE, ServiceNow, Oracle, and Salesforce. To strengthen their presence in the market, leading companies are focusing on continuous platform enhancements by embedding AI and machine learning capabilities to improve automation and user personalization. They're expanding their ecosystem through third-party integrations and app marketplaces to increase platform functionality. Cloud-native offerings remain a central priority, with firms optimizing infrastructure for performance and scalability. Additionally, vendors are investing in education and support programs to empower citizen developers and expand adoption. Strategic acquisitions are also being used to broaden product portfolios and accelerate go-to-market strategies, particularly across vertical-specific use cases. Enterprise-grade security and compliance support are increasingly integrated to attract regulated industries.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Mode

- 2.2.4 Application

- 2.2.5 Enterprise Size

- 2.2.6 Industry Vertical

- 2.2.7 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Accelerated digital transformation

- 3.2.1.2 Increased demand for business agility

- 3.2.1.3 Rising demand for cloud computing

- 3.2.1.4 Rising remote work and collaboration

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Security and governance concern

- 3.2.2.2 Limited customization and complex applications

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with AI and automation

- 3.2.3.2 Growing use in industry specific application

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Software development & licensing cost

- 3.8.2 Deployment & integration cost

- 3.8.3 Maintenance & support cost

- 3.8.4 Cybersecurity & compliance cost

- 3.8.5 Training & change management cost

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Use cases

- 3.12 Best-case scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Platform

- 5.3 Services

- 5.3.1 Consulting

- 5.3.2 Integration & implementation

- 5.3.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Web-based

- 7.3 Mobile-based

- 7.4 Desktop

- 7.5 Database

Chapter 8 Market Estimates & Forecast, By Organization Size, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 SME

- 8.3 Large Enterprises

Chapter 9 Market Estimates & Forecast, By Industry Vertical, 2021- 2034 (USD Million)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 IT & Telecom

- 9.4 Government & Defense

- 9.5 Healthcare

- 9.6 Retail & E-commerce

- 9.7 Manufacturing

- 9.8 Energy & utilities

- 9.9 Education

- 9.10 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021- 2034 (USD Million)

- 10.1 Key trends

- 10.2 Business user

- 10.3 Developers

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Nordics

- 11.3.7 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AgilePoint

- 12.2 Appian Corporation

- 12.3 Betty Blocks

- 12.4 Creatio

- 12.5 DWKit

- 12.6 Google Cloud

- 12.7 Joget

- 12.8 Kissflow

- 12.9 LANSA

- 12.10 Mendix

- 12.11 Microsoft

- 12.12 Nintex

- 12.13 Oracle

- 12.14 OutSystems

- 12.15 Quick Base

- 12.16 Salesforce

- 12.17 SAP SE

- 12.18 ServiceNow

- 12.19 Zoho Corporation