PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773391

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773391

Structural Bonding Agents Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

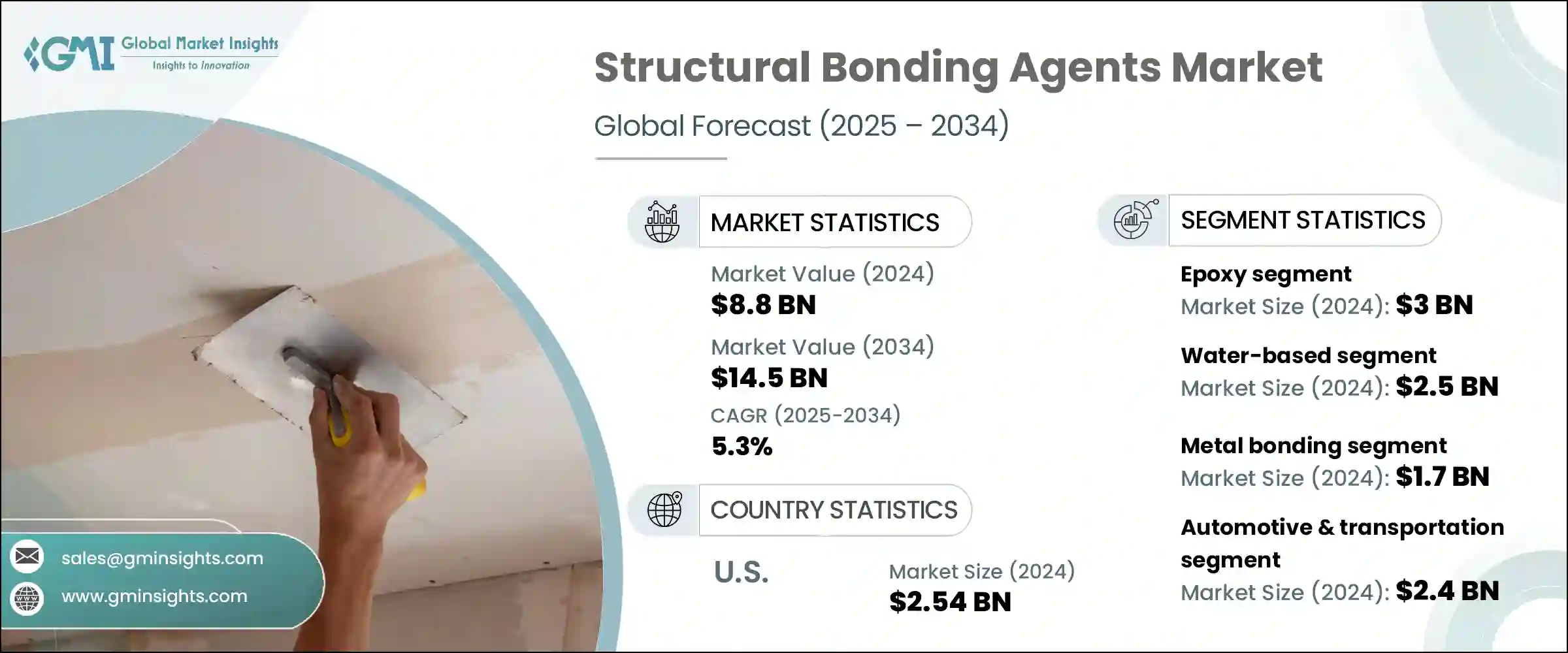

The Global Structural Bonding Agents Market was valued at USD 8.8 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 14.5 billion by 2034. The market expansion is driven by several factors, most notably the rising demand for lightweight materials in the automotive and aerospace industries. These sectors are increasingly incorporating bonding agents to support lighter composite materials, which help boost fuel efficiency and reduce emissions without sacrificing structural strength.

The growing adoption of composite materials across various applications also fuels market growth, thanks to their superior strength-to-weight ratio and durability. Structural bonding agents play a crucial role by enhancing the performance and acceptance of these materials in challenging environments. Additionally, ongoing global construction projects contribute significantly to demand, as bonding agents offer advantages over traditional mechanical fasteners in terms of load distribution, aesthetics, and resistance to environmental stressors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.8 Billion |

| Forecast Value | $14.5 Billion |

| CAGR | 5.3% |

Emerging trends also point toward sustainability, with manufacturers focusing on eco-friendly, low-VOC, and solvent-free adhesives to meet stricter regulations and consumer preferences. This shift is not only driven by environmental compliance but also by the increasing demand for healthier indoor air quality and reduced ecological impact. As green building certifications and emissions standards become more stringent, companies are proactively reformulating their bonding agents to align with evolving global benchmarks. The market is witnessing a growing preference for water-based and bio-based structural adhesives, particularly in sectors like construction, packaging, and transportation, where sustainability has become a core design consideration.

The epoxy segment held a market value of USD 3 billion in 2024 and is expected to grow at a 5% CAGR through 2034. Epoxy adhesives lead the market due to their wide-ranging applications in industries like aerospace, automotive, construction, and electronics. These adhesives provide excellent mechanical strength, chemical resistance, and the ability to bond both metals and lightweight composites, making them indispensable in high-growth sectors. Their ability to distribute loads effectively and deliver visually appealing finishes adds to their demand.

The water-based structural bonding agents segment accounted for USD 2.5 billion in 2024 and is anticipated to grow at a CAGR of 5.8% through 2034. Driven by stringent environmental regulations and a shift toward low-VOC formulations, water-borne adhesives are gaining traction, especially in the construction and packaging industries. These adhesives provide a safer, more environmentally friendly alternative without compromising bond strength or performance.

U.S. Structural Bonding Agents Market was valued at USD 2.54 billion in 2024 and is forecasted to grow at a CAGR of 4.8% from 2025 to 2034. Growth in the U.S. is largely fueled by the demand for high-performance, lightweight bonding solutions in the aerospace and automotive sectors, alongside substantial investments in infrastructure and construction projects. Innovation in adhesive technology and favorable government policies continue to bolster market expansion.

Leading players in the Global Structural Bonding Agents Market, such as Arkema Group, Henkel AG & Co. KGaA, 3M Company, Sika AG, and H.B. Fuller Company, are actively competing across several strategic dimensions. Companies in the structural bonding agents market strengthen their position by focusing on innovation and expanding product portfolios tailored to emerging industry needs, particularly lightweight and eco-friendly adhesives. They invest heavily in R&D to develop formulations that comply with environmental regulations while enhancing performance. Strategic collaborations and partnerships with key players in the automotive, aerospace, and construction sectors help expand market reach and credibility. Additionally, geographic expansion into fast-growing regions supports revenue growth.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 End Use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Epoxy

- 5.2.1 One-component epoxy

- 5.2.2 Two-component epoxy

- 5.2.3 Modified epoxy

- 5.3 Polyurethane

- 5.3.1 One-component polyurethane

- 5.3.2 Two-component polyurethane

- 5.4 Acrylic

- 5.4.1 Cyanoacrylates

- 5.4.2 Modified acrylics

- 5.5 Methyl methacrylate (MMA)

- 5.6 Silicone

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Water-based

- 6.3 Solvent-based

- 6.4 Hot melt

- 6.5 Reactive

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Metal Bonding

- 7.2.1 Steel

- 7.2.2 Aluminum

- 7.2.3 Other metals

- 7.3 Composite bonding

- 7.3.1 Carbon fiber composites

- 7.3.2 Glass fiber composites

- 7.3.3 Other composites

- 7.4 Plastic bonding

- 7.4.1 Thermoplastics

- 7.4.2 Thermosets

- 7.5 Wood bonding

- 7.6 Glass bonding

- 7.7 Concrete and stone bonding

- 7.8 Multi-material bonding

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Automotive & transportation

- 8.2.1 Passenger vehicles

- 8.2.2 Commercial vehicles

- 8.2.3 Electric vehicles

- 8.2.4 Rail

- 8.2.5 Others

- 8.3 Aerospace

- 8.3.1 Commercial aircraft

- 8.3.2 Military aircraft

- 8.3.3 General aviation

- 8.3.4 Space applications

- 8.4 Building & construction

- 8.4.1 Residential

- 8.4.2 Commercial

- 8.4.3 Industrial

- 8.4.4 Infrastructure

- 8.5 Wind Energy

- 8.5.1 Onshore wind

- 8.5.2 Offshore wind

- 8.6 Marine

- 8.6.1 Shipbuilding

- 8.6.2 Boat Building

- 8.6.3 Offshore structures

- 8.7 Electronics

- 8.7.1 Consumer electronics

- 8.7.2 Industrial electronics

- 8.8 Medical

- 8.9 Industrial assembly

- 8.10 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Henkel AG & Co. KGaA

- 10.2 3M Company

- 10.3 Sika AG

- 10.4 H.B. Fuller Company

- 10.5 Huntsman Corporation

- 10.6 Arkema Group

- 10.7 Lord Corporation (Parker Hannifin Corporation)

- 10.8 Ashland Global Holdings Inc.

- 10.9 Illinois Tool Works Inc.

- 10.10 Dow Inc.

- 10.11 Mapei S.p.A.

- 10.12 RPM International Inc.

- 10.13 Permabond LLC

- 10.14 Master Bond Inc.

- 10.15 Dymax Corporation

- 10.16 Jowat SE

- 10.17 Delo Industrial Adhesives

- 10.18 Pidilite Industries Ltd.

- 10.19 Parson Adhesives, Inc.

- 10.20 Hernon Manufacturing, Inc.