PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773393

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773393

Mycelium Bricks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

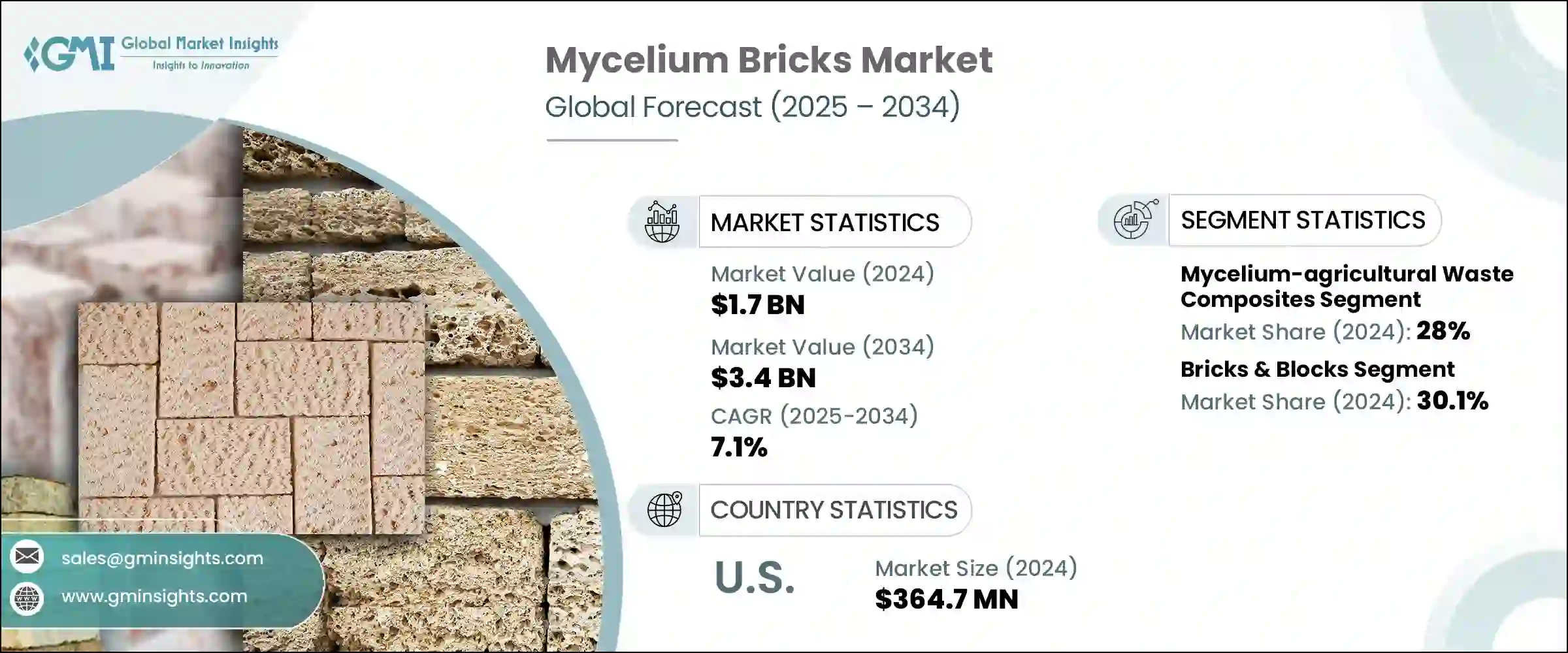

The Global Mycelium Bricks Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 3.4 billion by 2034. This growth reflects a growing shift toward sustainable, low-carbon construction materials. Made from fungal mycelium grown on agricultural waste, these biodegradable bricks deliver outstanding insulation and reduce environmental pollution while aligning with circular bioeconomy principles. Studies show mycelium composites have negative embodied carbon (approximately -39.5 kg CO2e/m3) and consume only 7.7 MJ/kg in production, far less than conventional insulation materials at 83.5 MJ/kg. Building on this momentum, advancements in cultivation methods are significantly enhancing the performance and affordability of mycelium-based materials, allowing manufacturers to produce carbon-negative insulation directly at construction sites.

This innovation not only reduces costs but also significantly lowers transportation emissions, making it a key component of sustainable construction practices. By enabling on-site production of carbon-negative insulation, it eliminates the need for long-distance transportation of bulky materials, thereby decreasing the carbon footprint associated with traditional supply chains. Furthermore, the reduction in manufacturing and transportation-related emissions contributes to greener building processes, aligning with the growing push toward low-impact, eco-friendly construction. The ability to produce mycelium-based products locally also ensures faster turnaround times and greater supply chain flexibility, while simultaneously supporting regional economies. This streamlined production approach not only improves overall sustainability but also enhances the scalability of mycelium as a viable alternative to conventional building materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 7.1% |

The mycelium-agricultural waste composites segment, holding a 28% share in 2024, continues to thrive due to its cost efficiency and the ready availability of raw materials like wheat straw and corn husks in developed Asia-Pacific countries. Their seamless integration into modular panel systems and insulation applications has made them a cornerstone of eco-friendly construction projects.

The bricks and blocks segment from the mycelium bricks market accounted for a 30.1% share in 2024, favored for their standardized dimensions and robust structural qualities. These attributes make them a straightforward substitute for traditional materials, allowing builders to adopt greener alternatives without compromising established construction workflows.

U.S. Mycelium Bricks Market, valued at USD 364.7 million in 2024, benefits from a strong regulatory environment, including green building incentives and LEED certifications. The growing presence of architecture firms and innovation centers focused on sustainable design, coupled with increasing urban demand-especially from environmentally conscious younger generations-is fueling steady growth in the use of biodegradable, aesthetically pleasing mycelium bricks across the country.

Prominent players include Biohm, MycoWorks, Ecovative Design, Grown Bio, and Mogu S.r.l. Companies in the mycelium bricks industry are strengthening their position by forming research partnerships to refine cultivation and production processes, investing in R&D to improve fire resistance and structural performance, and developing scalable manufacturing systems. They're also securing certifications (e.g., LEED, BREEAM) to enhance credibility in green construction markets, diversifying product lines with panel, insulation, and modular solutions, and pursuing collaborations with architects and builders to increase adoption. These strategies enhance market trust and ensure long-term growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Form method

- 2.2.3 Application

- 2.2.4 End use

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021–2034 (USD Billion) (Cubic Meters)

- 5.1 Key trends

- 5.2 Pure mycelium bricks

- 5.3 Mycelium-agricultural waste composites

- 5.3.1 Straw-based composites

- 5.3.2 Corn husk & stalk composites

- 5.3.3 Rice hulls & crop residue composites

- 5.3.4 Others

- 5.4 Mycelium-wood waste composites

- 5.4.1 Sawdust & wood chip composites

- 5.4.2 Paper & cardboard waste composites

- 5.4.3 Others

- 5.5 Mycelium-reinforced composites

- 5.5.1 Fiber-reinforced composites

- 5.5.2 Mineral-reinforced composites

- 5.5.3 Others

- 5.6 Specialized & engineered mycelium products

Chapter 6 Market Estimates and Forecast, By Form, 2021–2034 (USD Billion) (Cubic Meters)

- 6.1 Key trends

- 6.2 Bricks & blocks

- 6.2.1 Standard bricks

- 6.2.2 Interlocking blocks

- 6.2.3 Custom-shaped blocks

- 6.3 Panels & boards

- 6.3.1 Flat panels

- 6.3.2 Acoustic panels

- 6.3.3 Structural panels

- 6.4 Insulation materials

- 6.4.1 Loose fill insulation

- 6.4.2 Rigid insulation boards

- 6.4.3 Spray-applied insulation

- 6.5 3D-printed & custom forms

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021–2034 (USD Billion) (Cubic Meters)

- 7.1 Key trends

- 7.2 Building construction

- 7.2.1 Interior non-load bearing walls

- 7.2.2 Insulation

- 7.2.3 Acoustic

- 7.2.4 Structural components

- 7.2.5 Others

- 7.3 Interior design & furniture

- 7.3.1 Decorative elements

- 7.3.2 Furniture components

- 7.3.3 Others

- 7.4 Temporary structures & exhibitions

- 7.4.1 Exhibition displays

- 7.4.2 Temporary installations

- 7.4.3 Event structures

- 7.5 Packaging & protective materials

- 7.6 Art & design applications

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021–2034 (USD Billion) (Cubic Meters)

- 8.1 Key trends

- 8.2 Residential construction

- 8.3 Commercial construction

- 8.3.1 Office buildings

- 8.3.2 Retail & hospitality

- 8.3.3 Others

- 8.4 Institutional & public buildings

- 8.4.1 Educational facilities

- 8.4.2 Cultural & community buildings

- 8.4.3 Healthcare facilities

- 8.4.4 Others

- 8.5 Industrial & manufacturing

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021–2034 (USD Billion) (Cubic Meters)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Biohm

- 10.2 Biomyc

- 10.3 Ecovative Design

- 10.4 Grown Bio

- 10.5 Mogu S.r.l.

- 10.6 Mycel

- 10.7 Mycovation

- 10.8 MycoWorks