PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773394

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773394

Recycled Asphalt Pavement (RAP) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

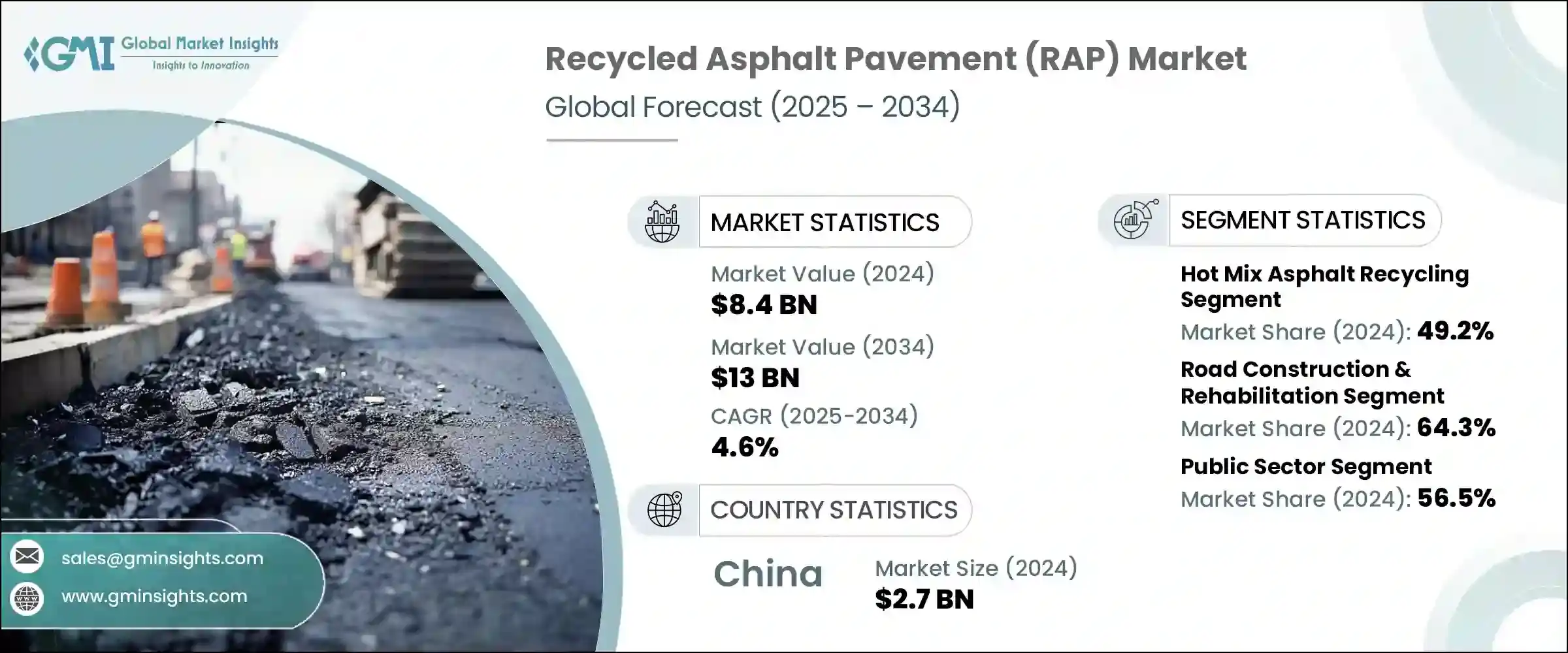

The Global Recycled Asphalt Pavement Market was valued at USD 8.4 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 13 billion by 2034. As demand for cost-effective and sustainable construction materials increases, the RAP industry is gaining significant traction across various infrastructure segments. Governments and contractors are increasingly embracing asphalt recycling to reduce dependence on virgin raw materials, lower project costs, and minimize environmental impact. The trend is driven by a growing focus on reducing landfill waste, improving energy efficiency, and limiting greenhouse gas emissions through the reuse of existing road materials. Regulatory bodies continue to emphasize environmental preservation through sustainable road construction practices, which has further solidified RAP's position in the global infrastructure sector.

In the pursuit of more sustainable road rehabilitation solutions, RAP presents considerable economic and ecological advantages. Recycled asphalt can be integrated into paving projects without compromising performance, offering a durable alternative to conventional asphalt. Its compatibility with existing batch and drum mix technologies makes it a practical choice for large-scale road construction. In recent years, the increased focus on reducing lifecycle emissions from infrastructure projects has also contributed to RAP's rising popularity. By incorporating reclaimed materials into construction workflows, contractors are able to lower their carbon footprints while maintaining high structural integrity. Moreover, the operational flexibility of RAP, such as its ability to be processed on-site using mobile recycling equipment, adds to its efficiency and widespread adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.4 Billion |

| Forecast Value | $13 Billion |

| CAGR | 4.6% |

Among recycling methods, hot mix asphalt (HMA) recycling has emerged as the leading process, accounting for 49.2% of the overall market share in 2024. HMA recycling stands out due to its ability to deliver near-virgin performance while significantly cutting down on both material costs and carbon emissions. Its adaptability to high-RAP-content mixes has made it the preferred method for highway resurfacing and road upgrades. Additionally, advances in technology have improved the consistency and quality of HMA recycling processes, making it feasible for use in structurally demanding road layers.

In terms of application, road construction and rehabilitation dominated the market, representing 64.3% of total demand in 2024. The increasing need for sustainable urban development and cost-effective roadway upgrades has led to a surge in RAP usage within this segment. Recycled materials are now widely incorporated into arterial and local roads, helping municipalities and private contractors meet environmental goals while optimizing resource use. The ability to maintain pavement performance using high percentages of recycled content has made RAP a key component in public and private infrastructure projects. Its integration into roadworks has become more strategic as more jurisdictions seek to align with long-term sustainability targets.

When segmented by end user, the public sector held the largest share of the RAP market in 2024, accounting for 56.5%. Government-backed infrastructure initiatives and sustainability mandates have made RAP a standard component in public works. Authorities at national and regional levels increasingly require the use of recycled materials in tender specifications, particularly for highways and municipal redevelopment projects. Public agencies are also prioritizing materials that contribute to environmental certifications and long-term performance, thereby reinforcing the value of RAP in procurement strategies.

Regionally, China led the global RAP market, with a valuation of USD 2.7 billion in 2024. The country's strong emphasis on infrastructure connectivity, urban renewal, and environmental responsibility has driven large-scale adoption of recycled asphalt across its provinces. Policy frameworks supporting recycled construction materials, coupled with the growth of modern recycling plants, continue to support RAP deployment in various projects. China's structured approach to integrating RAP in national highway development has contributed significantly to the region's dominant market share.

The competitive landscape of the recycled asphalt pavement industry is evolving as major infrastructure companies enhance their sustainability credentials. Market leaders are incorporating asphalt recycling into core operations, focusing on vertical integration to ensure quality control across the supply chain. From owning aggregate production units to operating asphalt mix plants and paving services, these companies have established streamlined processes to recover and reuse reclaimed asphalt efficiently.

Many are expanding their recycling capacity by setting up dedicated facilities, upgrading drum mixers, and utilizing mobile units for high-RAP applications. Technological integration is also becoming more prominent, with firms deploying digital tools for precise RAP dosing, temperature regulation, and emissions monitoring to support compliance with low-carbon construction standards. In addition, industry participants are collaborating with public agencies on research and pilot projects aimed at enhancing specifications for recycled asphalt use and optimizing full-depth recycling techniques.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Recycling Process

- 2.2.3 Application

- 2.2.4 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for road repair and infrastructure rehabilitation

- 3.2.1.2 Lower material and production costs compared to virgin asphalt

- 3.2.1.3 Stringent environmental regulations promoting recycled materials

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Initial investment costs for specialized recycling equipment and plant modifications

- 3.2.2.2 Inconsistent quality and performance of reclaimed asphalt material

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of government-funded sustainable infrastructure programs encouraging RAP integration

- 3.2.3.2 Rising adoption of cold-in-place and full-depth reclamation techniques in road construction

- 3.2.3.3 Development of performance-enhancing additives to improve high RAP mix quality

- 3.2.3.4 Increasing private sector interest in green construction materials for commercial projects

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Recycling Process, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Hot mix asphalt recycling

- 5.2.1 Batch plant

- 5.2.2 Drum plant

- 5.3 Cold mix asphalt recycling

- 5.3.1 In-place cold recycling

- 5.3.2 Central plant cold recycling

- 5.4 In-place recycling

- 5.4.1 Cold in-place recycling (CIR)

- 5.4.2 Full depth reclamation (FDR)

- 5.4.3 Hot in-place recycling (HIR)

- 5.5 Central plant recycling

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Road construction & rehabilitation

- 6.2.1 Highways and expressways

- 6.2.2 Urban roads and streets

- 6.2.3 Rural roads

- 6.3 Parking lots and pavements

- 6.4 Airport runways and taxiways

- 6.5 Pathways, bike lanes, and recreational surfaces

- 6.6 Other infrastructure (ports, industrial sites)

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Public sector

- 7.2.1 Departments of transportation (DOTs)

- 7.2.2 Municipalities and local governments

- 7.2.3 Airports and ports authorities

- 7.3 Private sector

- 7.3.1 Construction and engineering firms

- 7.3.2 Real estate developers

- 7.3.3 Industrial and commercial end use

- 7.4 Contractors and subcontractors

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Colas S.A.

- 9.2 Eurovia (VINCI Group)

- 9.3 Granite Construction Inc.

- 9.4 Oldcastle Materials (CRH)

- 9.5 LafargeHolcim Ltd.

- 9.6 CEMEX S.A.B. de C.V.

- 9.7 Vulcan Materials Company

- 9.8 Road Science

- 9.9 The Lane Construction Corporation

- 9.10 GreenRap

- 9.11 Downer Group (Reconophalt)

- 9.12 Gencor Industries

- 9.13 Phoenix Industries

- 9.14 Atmos Technologies