PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773395

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773395

U.S. Pregnancy Urine Rapid Diagnostic Test Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

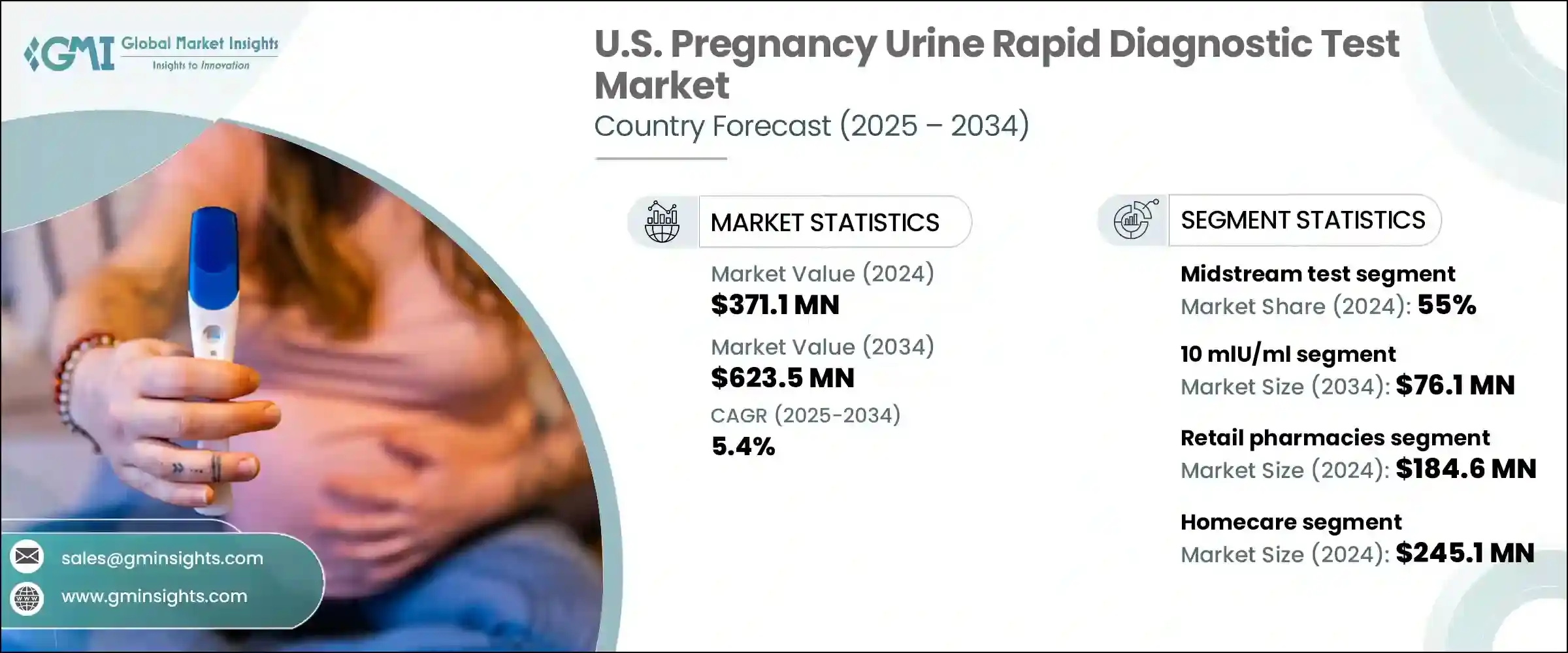

U.S. Pregnancy Urine Rapid Diagnostic Test Market was valued at USD 371.1 million in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 623.5 million by 2034. This steady growth is driven by a combination of social and technological factors. Increasing literacy among women is significantly influencing the demand for rapid diagnostic tools. As awareness and education levels improve, more women are capable of understanding how these tests work and interpreting their results accurately. This, in turn, fosters confidence in using at-home testing as a first step in confirming pregnancy.

The rising inclination toward personal healthcare management is also contributing to the market's growth, as consumers show a strong preference for solutions that offer privacy and convenience. Technological improvements in test sensitivity and usability have made modern urine-based tests far more accurate and user-friendly. These advancements are enabling faster detection and reducing the need for initial clinical consultations, which aligns with the growing consumer demand for self-diagnostic tools. The increased acceptance of home-based diagnostic kits also stems from the broader shift toward proactive health monitoring, which gained traction during the pandemic and continues to influence healthcare behavior.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $371.1 Million |

| Forecast Value | $623.5 Million |

| CAGR | 5.4% |

In terms of product type, the market is segmented into strip tests, cassette tests, and midstream test sticks. Among these, the midstream test segment accounted for the highest revenue share of 55% in 2024 and is projected to grow at a CAGR of 5.6% through 2034. Midstream test sticks have gained significant traction due to their ease of use, allowing users to collect samples directly without requiring additional containers. This design not only simplifies the process but also enhances hygiene and minimizes errors. Their intuitive format and minimal handling requirements make them ideal for users seeking convenience and quick results in home settings.

When analyzed by concentration, the 10 mlU/ml segment generated USD 44.8 million in revenue in 2024 and is expected to reach USD 76.1 million by 2034. Tests with this lower threshold are capable of detecting pregnancy hormones earlier than others, often within a week after ovulation. This heightened sensitivity is especially valued by users who seek early confirmation, and it is increasingly used in advanced clinical protocols that require prompt results. Moreover, this concentration is becoming a standard for women undergoing fertility treatments, where timely detection is crucial for determining subsequent medical steps.

The distribution of pregnancy urine rapid diagnostic tests is mainly divided among hospital pharmacies, retail pharmacies, and online platforms. In 2024, retail pharmacies led the market with a revenue share of USD 184.6 million and are anticipated to grow at a CAGR of 5.2% during the forecast period. Retail pharmacies continue to thrive due to their widespread availability and the ability to offer over-the-counter access to a variety of brands. Many consumers choose this channel for the privacy it ensures and the ease of immediate purchase. Moreover, competitive pricing strategies and promotional offerings further incentivize purchases from retail locations, reinforcing their position as the most preferred distribution point.

The market is also segmented based on end use, including hospitals, specialty clinics, homecare, and other facilities. The homecare segment dominated the landscape in 2024 with a valuation of USD 245.1 million and is projected to expand at a CAGR of 5.6% over the next decade. Home-based pregnancy testing solutions offer users the flexibility to test on their own terms, eliminating the need for early clinical appointments. This not only empowers individuals but also contributes to earlier health decision-making. Continued innovation in digital formats, ease of interpretation, and early detection capabilities have made home tests increasingly reliable and widely adopted. The preference for home-based testing remains strong, driven by evolving consumer expectations around healthcare accessibility.

The competitive environment in the U.S. pregnancy urine rapid diagnostic test market is shaped by leading manufacturers such as SPD Swiss Precision Diagnostics, Church & Dwight, Cardinal Health, QuidelOrtho, SEKISUI CHEMICAL, and Abbott Laboratories. These six companies collectively accounted for approximately 60% of the market share in 2024. Their dominance is supported by well-established product portfolios, trusted brand names, and consistent investment in research and development. Meanwhile, emerging players are adopting strategic initiatives like partnerships, acquisitions, and collaborations to enhance product availability and expand market reach. Supportive regulatory frameworks and quicker approval timelines are also encouraging new entrants to innovate and compete effectively in this dynamic space.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Concentration

- 2.2.3 Distribution channel

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising literacy rates among women

- 3.2.1.2 Technological advancements in rapid pregnancy diagnostics

- 3.2.1.3 Increasing demand for at-home testing solutions

- 3.2.1.4 Enhanced emphasis on early pregnancy detection

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Accuracy concerns in early detection

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Pricing analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Strip

- 5.3 Cassette

- 5.4 Midstream test stick

Chapter 6 Market Estimates and Forecast, By Concentration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 10 mlU/ml

- 6.3 20 mlU/ml

- 6.4 25 mlU/ml

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Specialty clinics

- 8.4 Homecare

- 8.5 Other end use

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Cardinal Health

- 9.3 Church & Dwight

- 9.4 Danaher Corporation

- 9.5 McKesson Corporation

- 9.6 Medline Industries

- 9.7 Meridian Bioscience

- 9.8 QuidelOrtho

- 9.9 Rapigen

- 9.10 SEKISUI CHEMICAL

- 9.11 SPD Swiss Precision Diagnostics

- 9.12 Thermo Fisher Scientific