PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773396

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773396

Tethered Drone Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

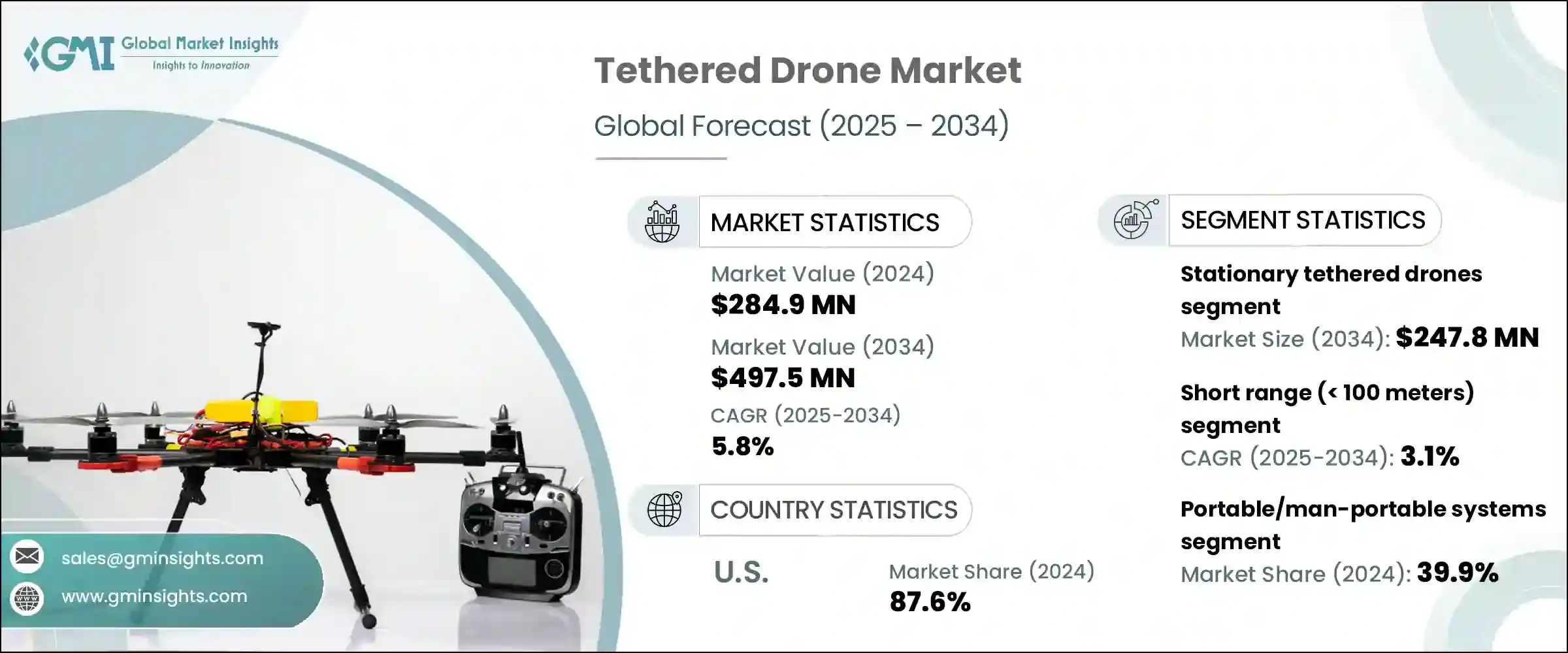

The Global Tethered Drone Market was valued at USD 284.9 million in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 497.5 million by 2034. This rise is fueled by the expanding use of tethered drones in defense, homeland security, and surveillance operations. Security forces worldwide are increasingly turning to tethered systems for their ability to support persistent aerial observation and tactical communication. These drones are preferred for mission-critical operations due to their continuous flight capabilities and real-time data transfer. Substantial government investment in national security and infrastructure protection continues to play a central role in boosting demand across regions.

Trade policy shifts, such as the US-imposed tariffs on imported electronic components, significantly impacted the drone manufacturing supply chain. These restrictions disrupted the flow of essential items like sensors and communications modules, delaying research, stalling innovation, and constraining smaller tech-driven firms in space. This led to a temporary dip in R&D spending and affected commercialization efforts across the tethered drone landscape, slowing innovation cycles and delaying the rollout of next-generation systems. Smaller firms faced budgetary constraints that disrupted prototyping, testing phases, and product launches. As a result, many companies had to reassess their production strategies, seek alternative sourcing for key components, and navigate supply chain disruptions that ultimately hindered the pace of market expansion and technological progress.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $284.9 Million |

| Forecast Value | $497.5 Million |

| CAGR | 5.8% |

Hybrid tethered drones segment a projected to grow at a CAGR of 8.1% through 2034. Their dual capability to operate both in tethered and untethered modes makes them versatile for a range of defense and emergency scenarios. These drones provide a strong mix of endurance and mobility, ideal for missions that require rapid deployment without compromising on operational longevity. Breakthroughs in automated tethering and energy management systems are also fueling adoption in complex operational environments that span land, sea, and air domains.

Short range ( < 100 meters) segment is projected to grow at a CAGR of 3.1% during 2025-2034. Their ease of deployment and compact form factor make them highly attractive for urban surveillance, event management, and critical infrastructure monitoring. These systems are becoming widely used in local law enforcement, emergency services, and safety inspections due to their maneuverability and convenience.

United States Tethered Drone Market held an 87.6% share in 2024. Rising investments in military and homeland security applications have pushed the country ahead, especially in areas focused on long-duration surveillance, border control, and disaster response. The leadership of domestic technology providers, combined with strong federal procurement initiatives, continues to reinforce the country's position in the advanced tethered unmanned systems sector.

Notable players active in the global market include Fotokite, FlyFocus, Bharat Electronics, Easy Aerial, Elistair, Acecore Technologies, and Aerial IQ. To strengthen market positioning, companies in the tethered drone industry are advancing their R&D efforts around energy efficiency, autonomous tethering, and AI-powered tracking systems. Many are diversifying product lines to include hybrid systems capable of switching between tethered and untethered modes. Partnerships with defense agencies and homeland security bodies play a key role in securing high-value contracts. Firms are also focusing on miniaturization of payloads and modular drone architecture to adapt to a variety of mission profiles. Several vendors are expanding globally by aligning with local manufacturing capabilities and leveraging government incentives for defense tech localization.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Regulatory support for aerial monitoring solutions

- 3.3.1.2 Growing adoption in defense and homeland security

- 3.3.1.3 Expansion of industrial infrastructure monitoring needs

- 3.3.1.4 Increased deployment for disaster management and emergency response

- 3.3.1.5 Growing investments in smart city and public safety initiatives

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Limited mobility and operational range

- 3.3.2.2 Dependence on ground power sources

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Stationary tethered drones

- 5.3 Mobile tethered drones

- 5.4 Hybrid tethered drones

Chapter 6 Market Estimates & Forecast, By Range, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Short-range (< 100 meters)

- 6.3 Mid- range (100 – 300 meters)

- 6.4 Long- range (> 300 meters)

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Portable/man-portable systems

- 7.3 Vehicle-mounted systems

- 7.4 Fixed ground station-based systems

- 7.5 Maritime

Chapter 8 Market Estimates & Forecast, By Technology Integration, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 AI-enabled tethered drones

- 8.3 Computer vision-enhanced systems

- 8.4 Automated launch & recovery

- 8.5 Real-time edge computing systems

- 8.6 Encrypted communication & cybersecurity features

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 Defense & security

- 9.2.1 Border surveillance

- 9.2.2 Military communications

- 9.2.3 Tactical operations

- 9.2.4 Others

- 9.3 Public safety & emergency response

- 9.3.1 Response

- 9.3.2 Disaster monitoring

- 9.3.3 Firefighting support

- 9.3.4 Crowd monitoring

- 9.3.5 Others

- 9.4 Commercial & industrial

- 9.4.1 Infrastructure & asset inspection

- 9.4.2 Broadcasting and media coverage

- 9.4.3 Recreational

- 9.4.4 Others

- 9.5 Environmental monitoring

- 9.5.1 Air quality measurement

- 9.5.2 Wildlife observation

- 9.5.3 Natural disaster assessment

- 9.5.4 Others

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Acecore Technologies

- 11.2 Aerial IQ

- 11.3 Bharat Electronics

- 11.4 Easy Aerial

- 11.5 Elistair

- 11.6 FlyFocus

- 11.7 Fotokite

- 11.8 Hoverfly Technologies

- 11.9 Maverick Drones and Technologies

- 11.10 Menet Aero

- 11.11 Mistral Solutions

- 11.12 Spooky Action

- 11.13 Teledyne FLIR

- 11.14 Unmanned Systems and Solutions

- 11.15 Volarious

- 11.16 Yuneec International

- 11.17 Zenith Aerotech