PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773401

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773401

Postnatal Probiotic Supplements Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

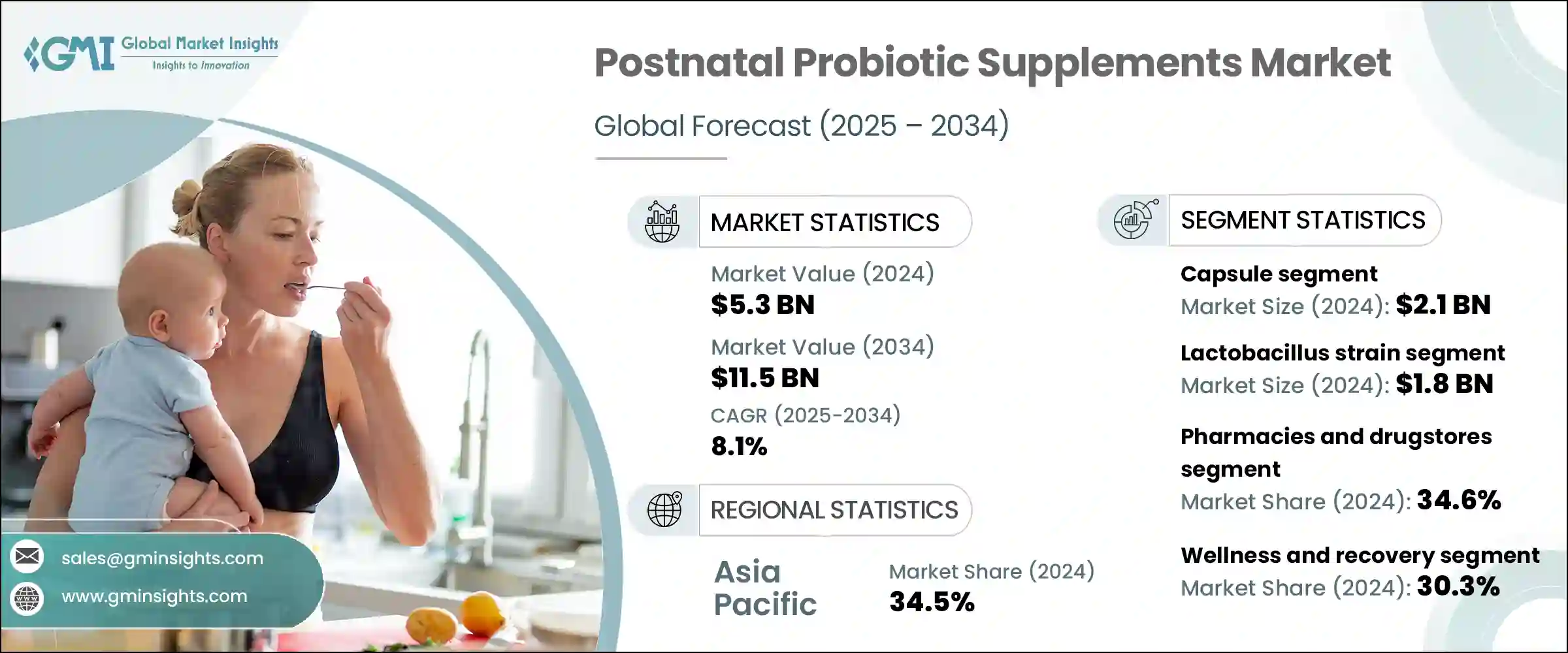

The Global Postnatal Probiotic Supplements Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 11.5 billion by 2034. These supplements are formulated with beneficial strains of bacteria, primarily from the Lactobacillus and Bifidobacterium families, to support postpartum wellness. They aid in restoring gut balance, enhancing immune response, preventing infections such as mastitis, and contributing to emotional and digestive well-being.

Rising consumer interest in natural and functional recovery options after childbirth is a key factor fueling growth. Growing awareness around maternal care, supported by increasing online and retail distribution, is also amplifying demand. In addition, emerging economies with high birth rates and improving access to maternal health programs present strong expansion opportunities. The need for personalized formulations and clinically validated, multi-strain solutions is further shaping the product landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 8.1% |

The market is set for accelerated innovation and broader adoption as more healthcare professionals endorse these products, and major brands continue to invest in expanding their portfolios. Clinical validation of strain-specific benefits is driving greater trust and demand, prompting companies to introduce targeted formulations tailored to postpartum needs such as hormonal balance, digestive support, and immune function.

Increasing research collaborations between biotech firms and academic institutions are also fueling product development rooted in science-backed outcomes. Simultaneously, expanding retail availability, especially through digital platforms, makes these supplements more accessible to new mothers globally. As awareness campaigns and educational outreach strengthen, the adoption of postnatal probiotic supplements is expected to rise significantly, turning them into a core component of modern maternal health routines.

The capsules segment held a 39.3% share and generated USD 2.1 billion in 2024. Their dominance is tied to ease of use, long shelf stability, precise dosing, and compatibility with multi-strain formulations. Capsules are particularly popular with postpartum consumers due to their ability to be taken with or without meals and their perceived reliability. Clinical settings and pharmacies also favor capsule delivery, which adds to their strong credibility and uptake. Many market-leading formulations include key bacterial strains that address gut and immune health in mothers following childbirth.

The Lactobacillus strain segment accounted for a 34.3% share in 2024, amounting to USD 1.8 billion. These strains-especially well-researched types like L. acidophilus, L. salivarius, and L. rhamnosus-are prominent due to their acid resistance, strong gut colonization ability, and proven benefits for postnatal health. They play a crucial role in reducing inflammation, improving digestion, and minimizing common postpartum issues, making them a preferred choice in most premium formulations targeting new mothers.

Asia Pacific Postnatal Probiotic Supplements Market held a 34.5% share in 2024. Countries across this region continue to dominate due to high awareness of postnatal recovery and the increasing use of functional nutrition solutions. Cultural practices centered on postpartum healing also create favorable conditions for the adoption of probiotic products that support digestion and immunity. This growth is further supported by growing access to supplements through pharmacies, online platforms, and wellness stores.

Prominent companies like Reckitt Benckiser Group plc, Danone S.A., Abbott Laboratories, Nestle S.A., and BioGaia AB have helped in driving distribution and innovation within the region through tailored product launches and growing consumer engagement. Leading brands in the postnatal probiotic sector are focused on personalized product development, strain-specific research, and partnerships with healthcare professionals to strengthen their market position. To stay competitive, companies are increasing R&D investments to develop clinically proven, multi-strain formulas targeting postpartum concerns like immunity and gut health. Many are also expanding their e-commerce footprint and direct-to-consumer sales to boost reach. Strategic marketing through parenting platforms, social media, and wellness influencers helps educate and attract new users.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Probiotic strain

- 2.2.4 Distribution channel

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Capsules

- 5.3 Powders

- 5.4 Gummies

- 5.5 Liquids

- 5.6 Others (soft gels, sachets)

Chapter 6 Market Estimates and Forecast, By Probiotic Strain, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Lactobacillus species

- 6.2.1 L. rhamnosus

- 6.2.2 L. salivarius

- 6.2.3 L. acidophilus

- 6.3 8.2 Bifidobacterium species

- 6.3.1 B. longum

- 6.3.2 B. lactis

- 6.4 Multi-strain formulations

- 6.5 Emerging strains

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Online retail

- 7.3 Pharmacies and drug stores

- 7.4 Supermarkets and hypermarkets

- 7.5 Specialty health stores

- 7.6 Healthcare facilities

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Digestive health support

- 8.3 Immune system enhancement

- 8.4 Mood and mental health support

- 8.5 Mastitis prevention and treatment

- 8.6 Overall wellness and recovery

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 BioGaia AB

- 10.3 Danone S.A.

- 10.4 Nestle S.A.

- 10.5 Bayer AG

- 10.6 Reckitt Benckiser Group plc

- 10.7 DuPont Nutrition & Biosciences