PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773403

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773403

Surgical Sutures Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

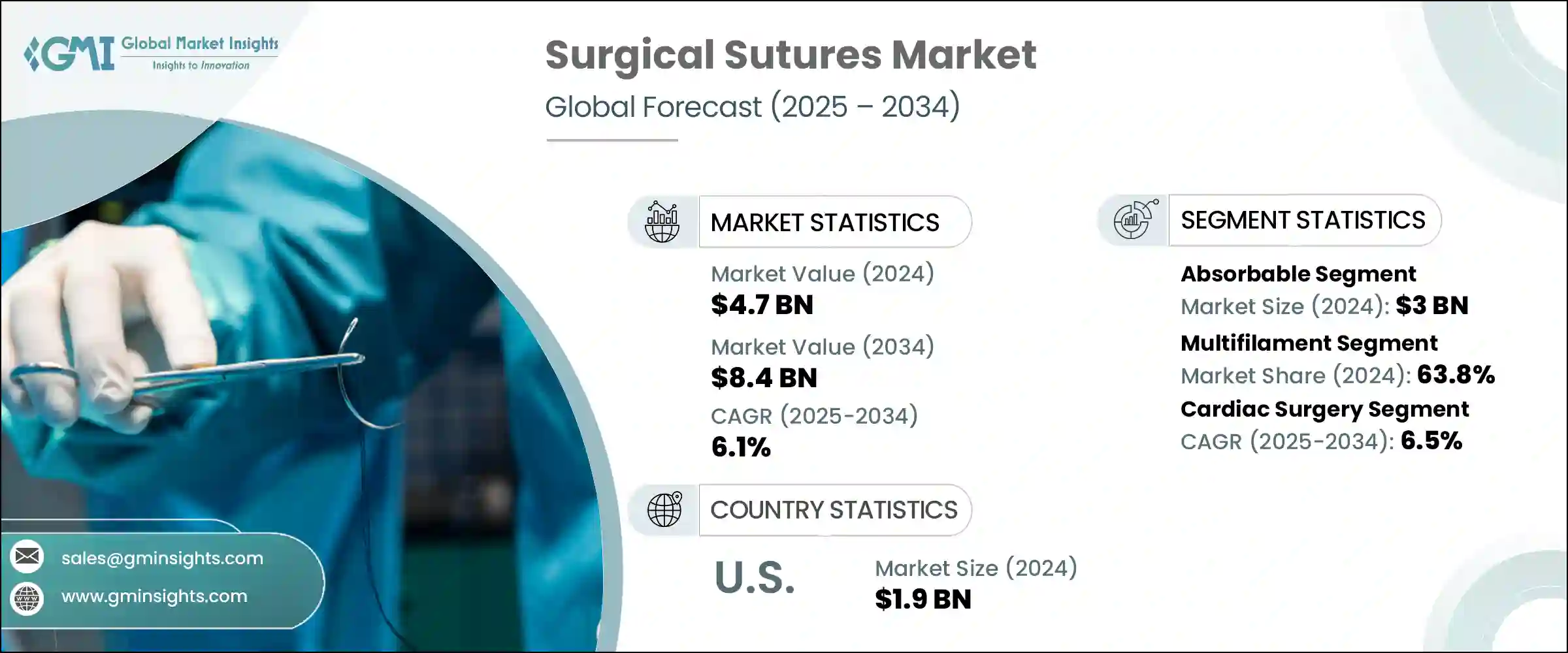

The Global Surgical Sutures Market was valued at USD 4.7 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 8.4 billion by 2034. Market growth is being driven by a rising elderly population and an increasing number of surgeries related to aging, such as orthopedic and abdominal procedures. As chronic conditions, including diabetes, cardiovascular disorders, and obesity, continue to climb globally, so does the demand for surgical interventions, directly fueling the need for sutures. The availability of next-generation surgical tools, combined with the growing trend toward minimally invasive operations, is accelerating innovation in the industry.

Advancements in synthetic absorbable materials are also transforming wound management practices. Hospitals and surgical centers are expanding their infrastructure to support rising procedure volumes, further boosting procurement. Healthcare professionals are increasingly adopting coated sutures that reduce infection risks, reflecting a broader shift toward infection control and faster healing. Both traditional and modern suture types are experiencing elevated demand across surgical specialties, positioning the market for sustained long-term expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $8.4 Billion |

| CAGR | 6.1% |

The absorbable sutures segment generated USD 3 billion in 2024. Their popularity lies in their ability to naturally degrade within body tissues, removing the need for physical extraction. This feature enhances patient comfort and shortens post-operative care, especially in internal procedures where suture removal is impractical. Surgeons increasingly prefer absorbable sutures in soft tissue operations and pediatric surgeries due to reduced infection risks and better biocompatibility. The segment's momentum is also supported by growing awareness around minimally invasive treatments and the rising burden of chronic diseases that require surgical resolution. These factors collectively support a shift in hospital procurement strategies toward absorbable, biodegradable options.

The multifilament sutures segment held a 63.8% share in 2024. These sutures are composed of braided or twisted strands, delivering superior tensile strength, knot security, and flexibility-key attributes that make them ideal for surgeries that demand reliable closure. Their structure allows for more precise control and easy handling during intricate operations, which is essential for procedures involving muscle, gastrointestinal tissue, or reproductive organs. Multifilament sutures are used extensively in general, orthopedic, gynecological, and gastrointestinal surgeries due to their ability to secure wounds effectively and resist breakage under pressure.

U.S. Surgical Sutures Market generated USD 1.9 billion in 2024. This growth is supported by the country's advanced healthcare infrastructure, an aging population, and high surgical volumes. The market presence of global leaders such as Medtronic, Ethicon (Johnson & Johnson), and Teleflex ensures that hospitals and surgical centers have prompt access to innovative suturing solutions. These players operate through well-established distribution networks, enabling rapid adoption of new technologies across public and private health systems. In the U.S., emphasis on post-operative outcomes, patient safety, and reduced infection rates is pushing demand for advanced coated and absorbable sutures across both inpatient and outpatient surgical settings.

Notable companies influencing the Surgical Sutures Market include Dolphin Sutures, Boston Scientific, Corza Medical, Smith and Nephew, B. Braun Melsungen, Kono Seisakusho, Integra Lifesciences, Advanced Medical Solutions, Teleflex, Zimmer Biomet, Healthium Medtech, Peters Surgical, Ethicon (Johnson & Johnson), CONMED, Medtronic, Stryker, and GPC Medical. These manufacturers are deeply embedded in the value chain and continue to expand their reach through innovation and global partnerships.

Major players in the surgical sutures market are focusing on continuous R&D to improve suture material properties-enhancing strength, biodegradability, and antimicrobial performance. Companies are actively expanding their portfolios to include coated, barbed, and drug-embedded sutures that support infection control and accelerate healing. Strategic acquisitions and partnerships help leading firms enter new regional markets and strengthen distribution. Localization of manufacturing and supply chains is being adopted to reduce costs and ensure product availability in high-demand areas.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Filament

- 2.2.4 Application

- 2.2.5 End use

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing growth in surgeries

- 3.2.1.2 Rising incidence of trauma

- 3.2.1.3 Technological advances in suture design and material

- 3.2.1.4 Growing geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Inconsistency in reimbursement for advanced suture types

- 3.2.2.2 Availability of alternative wound closure methods

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for customized and procedure specific sutures

- 3.2.3.2 Increasing preference toward minimally invasive surgical procedures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Patent analysis

- 3.8 Pricing analysis

- 3.8.1 By product type

- 3.8.2 By region

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTLE analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Absorbable sutures

- 5.2.1 Natural sutures

- 5.2.2 Synthetic sutures

- 5.3 Non-absorbable sutures

- 5.3.1 Nylon

- 5.3.2 Prolene

Chapter 6 Market Estimates and Forecast, By Filament, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Monofilament

- 6.3 Multifilament

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Ophthalmic surgery

- 7.3 Cardiac surgery

- 7.4 Orthopaedic surgery

- 7.5 Neurological surgery

- 7.6 Gynaecology surgery

- 7.7 Other surgeries

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Hospitals

- 8.2 Ambulatory surgical centers

- 8.3 Specialty clinics

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profile

- 10.1 Advanced Medical Solutions

- 10.2 B. Braun Melsungen

- 10.3 Boston Scientific

- 10.4 CONMED

- 10.5 Corza Medical

- 10.6 Dolphin Sutures

- 10.7 Ethicon (Johnson & Johnson)

- 10.8 GPC Medical

- 10.9 Healthium Medtech

- 10.10 Integra Lifesciences

- 10.11 Kono Seisakusho

- 10.12 Medtronic

- 10.13 Peters Surgical

- 10.14 Smith and Nephew

- 10.15 Stryker

- 10.16 Teleflex

- 10.17 Zimmer Biomet