PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773405

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773405

Unconcentrated Orange Juice Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

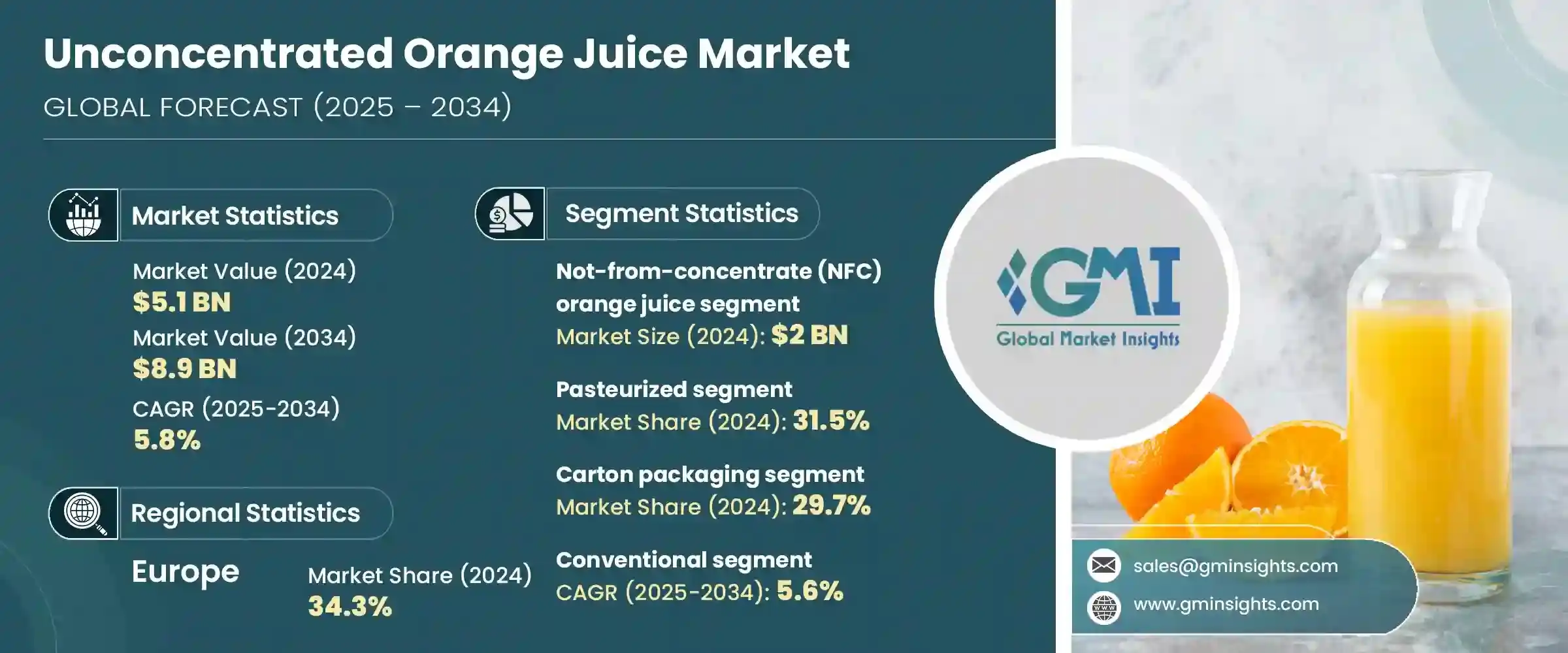

The Global Unconcentrated Orange Juice Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 8.9 billion by 2034. This growth is driven by rising consumer preference for fresh, minimally processed orange juice products that emphasize health and wellness. In North America and Europe, health-conscious consumers increasingly favor orange juice as a natural, fresh beverage alternative. Over the last decade, the trend toward additive-free, clean-label products has gained momentum, fueling demand for shelf-stable, chilled, ready-to-drink options.

Additionally, premium and organic not-from-concentrate (NFC) juices are capturing greater market interest globally. The increasing urbanization in developing countries, paired with advancements in cold chain logistics, has also helped overcome distribution challenges, enabling wider market penetration. Looking ahead, innovations in sustainable packaging, transparent sourcing, and e-commerce strategies are expected to open market opportunities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.9 Billion |

| CAGR | 5.8% |

Despite challenges such as fluctuating orange supplies and supply chain uncertainties, the unconcentrated orange juice sector offers promising potential for dynamic growth. These obstacles, while significant, are being addressed through innovative sourcing strategies and improved logistics that help stabilize supply and ensure consistent product availability. Advances in cold chain technology and better relationships with growers are enabling companies to overcome regional limitations and meet rising consumer demand more effectively. Furthermore, evolving consumer preferences toward natural, additive-free beverages continue to drive expansion, encouraging producers to invest in premium quality and organic offerings.

The not-from-concentrate (NFC) segment accounted for a 40% share in 2024, with a valuation of USD 2 billion. NFC orange juice remains the dominant product type due to its minimal processing and high nutritional content, appealing strongly to consumers seeking natural beverage options. Its popularity is rising in both retail and food service channels, especially in urban centers where fresh, wholesome products are highly valued.

The pasteurized orange juice segment represented a 31.5% share in 2024 and is expected to grow at a CAGR of 5.2%, expanding its consumer base. Pasteurization continues to be favored for its ability to extend shelf life and ensure microbial safety while maintaining an acceptable flavor profile and nutrient retention. Though unpasteurized juice attracts health-conscious buyers looking for the freshest taste, its shorter shelf life restricts its broader distribution.

Europe Unconcentrated Orange Juice Market held a 34.3% share in 2024. Regional demand varies significantly, shaped by local consumer preferences, orange availability, and retail developments. In North America, demand remains steady, with a gradual shift towards premium, organic, and NFC juices reflecting consumers' interest in clean-label, health-oriented products. Europe exhibits robust consumption patterns in countries where cold-pressed and freshly squeezed orange juices have gained popularity across retail and food service sectors.

Among the leading companies shaping the Unconcentrated Orange Juice Market are Louis Dreyfus Company (LDC), PepsiCo, Inc. (Tropicana), Florida's Natural Growers, The Coca-Cola Company (Simply Orange, Minute Maid), and Citrosuco. These major players compete fiercely on innovation, distribution networks, and sustainability initiatives to maintain and grow their market shares. To strengthen their foothold in the unconcentrated orange juice market, companies focus on continuous product innovation, developing organic and premium NFC juices to cater to evolving health-conscious consumers. Expanding distribution channels, especially through e-commerce and direct-to-consumer platforms, helps broaden their market reach. Investments in sustainable and eco-friendly packaging not only appeal to environmentally aware buyers but also align with global regulatory trends.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Liters)

- 5.1 Key trends

- 5.2 Not-From-Concentrate (NFC) orange juice

- 5.3 Freshly squeezed orange juice

- 5.4 Cold-pressed orange juice

- 5.5 Premium unconcentrated orange juice

Chapter 6 Market Estimates and Forecast, By Processing Method, 2021 - 2034 (USD Billion) (Thousand Liters)

- 6.1 Key trends

- 6.2 Pasteurized

- 6.3 Unpasteurized

- 6.4 High-pressure processing (HPP)

- 6.5 Pulsed electric field (PEF)

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Packaging Type, 2021 - 2034 (USD Billion) (Thousand Liters)

- 7.1 Key trends

- 7.2 Carton packaging

- 7.2.1 Tetra Pak

- 7.2.2 Pure-Pak

- 7.2.3 Others

- 7.3 Plastic bottles

- 7.3.1 PET bottles

- 7.3.2 HDPE bottles

- 7.3.3 Others

- 7.4 Glass bottles

- 7.5 Bulk packaging

- 7.5.1 Bag-in-Box

- 7.5.2 Aseptic tanks

- 7.5.3 Drums

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Nature, 2021 - 2034 (USD Billion) (Thousand Liters)

- 8.1 Key trends

- 8.2 Conventional

- 8.3 Organic

- 8.4 Natural/Clean label

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Liters)

- 9.1 Key trends

- 9.2 Supermarkets & hypermarkets

- 9.3 Convenience stores

- 9.4 Online retail

- 9.5 Specialty stores

- 9.6 Foodservice

- 9.6.1 HoReCa (Hotel, Restaurant, Cafe)

- 9.6.2 Institutional

- 9.6.3 Other foodservice

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Liters)

- 10.1 Key trends

- 10.2 Direct consumption

- 10.3 Culinary applications

- 10.4 Beverage blends

- 10.5 Functional beverages

- 10.6 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Liters)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.3.7 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 The Coca-Cola Company (Minute Maid, Simply Orange)

- 12.2 PepsiCo, Inc. (Tropicana)

- 12.3 Florida's Natural Growers

- 12.4 Citrosuco

- 12.5 Louis Dreyfus Company (LDC)

- 12.6 Sucocitrico Cutrale

- 12.7 COFCO International

- 12.8 Uncle Matt's Organic

- 12.9 Rauch Fruchtsafte GmbH & Co OG

- 12.10 Trade Winds Citrus Limited

- 12.11 Ventura Coastal LLC

- 12.12 Nestle S.A.

- 12.13 ITC Limited

- 12.14 Sumol + Compal Marcas S.A.

- 12.15 Huiyuan Juice Group Limited