PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773412

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773412

Cold Mix Asphalt Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

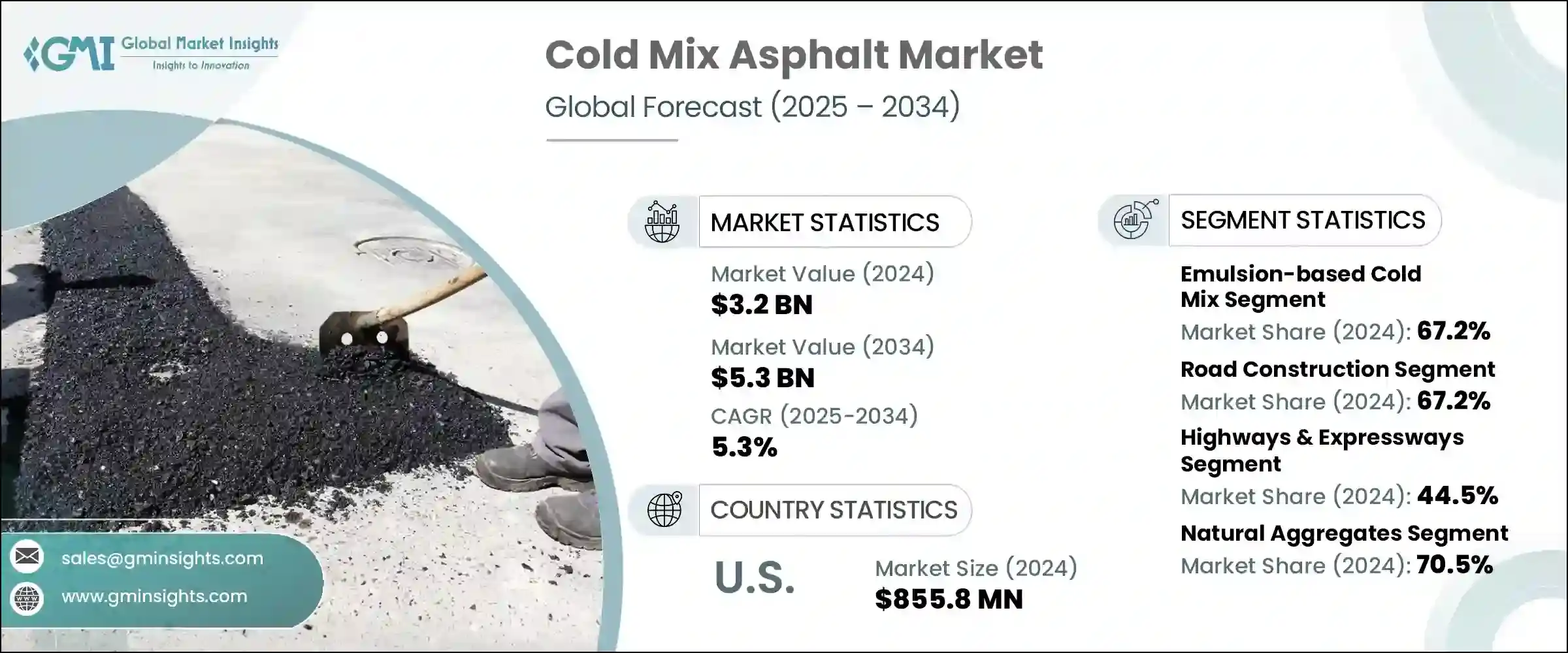

The Global Cold Mix Asphalt Market was valued at USD 3.2 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 5.3 billion by 2034. This growth is being driven by ongoing infrastructure investments, a rising demand for low-emission construction materials, and increasing attention toward road maintenance and rehabilitation projects worldwide. Cold mix asphalt is steadily gaining traction as an alternative to traditional hot mix due to its ease of use, minimal equipment requirements, and ability to be applied in virtually any weather condition. Governments across developing and developed regions are pushing for road connectivity and preservation programs, especially in areas where access to hot mix plants is limited or non-existent. As a result, the cold mix alternative is becoming integral to rural road development and spot repair projects.

This asphalt type also contributes to lower greenhouse gas emissions, making it an attractive option in a regulatory landscape that favors sustainable infrastructure practices. Its use in temporary repairs, utility cut reinstatements, and maintenance of low-traffic roads has made it indispensable in cost-sensitive and logistically challenged scenarios. Furthermore, national policy support and technological advancements in formulation have enhanced its reliability, shelf life, and adherence to modern paving standards. Cold mix asphalt not only reduces labor and energy costs but also enables longer storage, making it a go-to solution for decentralized construction and emergency repairs. This convenience, coupled with its performance efficiency, ensures that cold mix continues to gain preference among public works departments and private contractors alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.2 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 5.3% |

In terms of product segmentation, emulsion-based cold mix dominated the market in 2024, accounting for 67.2% of the total revenue share. This dominance stems from its lower energy consumption during production and safer handling during application, which aligns well with global safety and sustainability goals. Emulsion-based mixes are widely used due to their compatibility with various aggregates and suitability for patchwork and general road surface maintenance. The rising adoption of this formulation is also supported by its ability to be applied in damp conditions, further enhancing its practicality in a range of climates and environments.

The road construction segment represented the largest application area in 2024, holding a market share of 67.2%. The increasing emphasis on efficient, cost-effective solutions for road development projects, particularly in semi-urban and rural regions, continues to boost demand for cold mix asphalt. This material offers logistical advantages, such as easier transport and no need for onsite heating, making it ideal for building access roads, byways, and low-volume traffic corridors. Its capacity to be deployed quickly with minimal resources has also made it a preferred material for initial surface treatments and paving in infrastructure expansion projects.

From an end-use industry perspective, highways and expressways contributed to 44.5% of the market share in 2024. As investments in national and regional roadways intensify, there is a growing need for quick-setting and weather-resistant materials that can withstand frequent vehicle loads while minimizing traffic disruptions. Cold mix asphalt fulfills this requirement well, particularly in areas where continuous repairs, shoulder reinforcement, and surface stabilization are needed. Its rapid deployability ensures minimal downtime, which is critical for busy routes and high-traffic expressways.

The United States led the global cold mix asphalt market in 2024, with a valuation of USD 855.8 million. Federal funding focused on infrastructure modernization, along with a broader shift toward environmentally conscious materials, has played a pivotal role in supporting market growth. The adoption of cold mix in road preservation efforts across state and municipal agencies is increasing, particularly due to its versatility and suitability for emergency repairs, seasonal patching, and long-term surface treatments in areas with extreme weather fluctuations.

Key players shaping the competitive landscape include All States Materials Group, Martin Marietta Materials, Lakeside Industries, UNIQUE Paving Materials, and Cargill. These companies leverage regional expertise and advanced R&D capabilities to offer high-performance products tailored to diverse geographic needs. With a strong focus on reliability, durability, and eco-efficiency, they continue to refine their offerings to support the evolving demands of sustainable road construction. Brands that emphasize polymer-modified cold patch solutions and customer-centric support systems are also expanding their footprint, driven by increasing consumer preference for ready-to-use, all-season pavement solutions that align with modern infrastructure priorities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 End use industry

- 2.2.5 Manufacturing process

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing infrastructure development

- 3.2.1.2 Cost-effectiveness & energy efficiency

- 3.2.1.3 Environmental sustainability focus

- 3.2.1.4 Ease of application & storage

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Quality consistency issues

- 3.2.2.2 Limited awareness in developing regions

- 3.2.2.3 Competition from hot mix asphalt

- 3.2.2.4 Standardization challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging markets infrastructure growth

- 3.2.3.2 Technological advancements

- 3.2.3.3 Sustainable construction trends

- 3.2.3.4 Remote area applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Emulsion-based cold mix

- 5.2.1 Cationic emulsion cold mix

- 5.2.2 Anionic emulsion cold mix

- 5.2.3 Non-ionic emulsion cold mix

- 5.3 Cutback asphalt

- 5.3.1 Rapid curing (RC) cutback

- 5.3.2 Medium curing (mc) cutback

- 5.3.3 Slow curing (SC) cutback

- 5.4 Foamed asphalt

- 5.5 Cold recycled mix

- 5.5.1 Place cold recycling

- 5.5.2 Central plant cold recycling

- 5.6 Other types

- 5.6.1 Polymer modified cold mix

- 5.6.2 Fiber reinforced cold mix

- 5.6.3 Additive enhanced cold mix

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Road construction

- 6.2.1 New road construction

- 6.2.2 Road widening

- 6.2.3 Temporary roads

- 6.3 Road maintenance & repair

- 6.3.1 Pothole patching

- 6.3.2 Crack sealing

- 6.3.3 Surface treatment

- 6.3.4 Emergency repairs

- 6.4 Pavement rehabilitation

- 6.4.1 Full depth reclamation

- 6.4.2 Cold in-place recycling

- 6.4.3 Base course stabilization

- 6.5 Other applications

- 6.5.1 Shoulder construction

- 6.5.2 Utility cuts restoration

- 6.5.3 Bike paths & walkways

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Highways & expressways

- 7.2.1 Interstate highways

- 7.2.2 State highways

- 7.2.3 Expressways

- 7.3 Municipal roads

- 7.3.1 Urban roads

- 7.3.2 Suburban roads

- 7.3.3 Rural roads

- 7.4 Airports

- 7.4.1 Runways

- 7.4.2 Taxiways

- 7.4.3 Aprons

- 7.5 Parking areas

- 7.5.1 Commercial parking lots

- 7.5.2 Residential parking

- 7.5.3 Industrial parking

- 7.6 Others

- 7.6.1 Ports & harbors

- 7.6.2 Industrial areas

- 7.6.3 Recreational areas

Chapter 8 Market Estimates and Forecast, By Aggregate Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Natural aggregates

- 8.2.1 Crushed stone

- 8.2.2 Gravel

- 8.2.3 Sand

- 8.3 Recycled aggregates

- 8.3.1 Reclaimed asphalt pavement (RAP)

- 8.3.2 Recycled concrete aggregate (RCA)

- 8.3.3 Other recycled materials

- 8.4 Synthetic aggregates

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 ExxonMobil Corporation

- 10.2 BASF

- 10.3 Total Energies SE

- 10.4 All States Materials Group.

- 10.5 Martin Marietta Materials

- 10.6 Asphalt Materials

- 10.7 UNIQUE Paving Materials

- 10.8 Arkema Group

- 10.9 Kao Corporation

- 10.10 Ingevity Corporation

- 10.11 Colas SA

- 10.12 Aggregate Industries

- 10.13 Cargill

- 10.14 HEI-Way Premium Asphalt

- 10.15 Simon Team

- 10.16 Heidelberg Materials AG

- 10.17 Reeves Construction Company

- 10.18 Tarmac (CRH Company)

- 10.19 Lakeside Industries