PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773416

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773416

Medical Professional Liability Insurance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

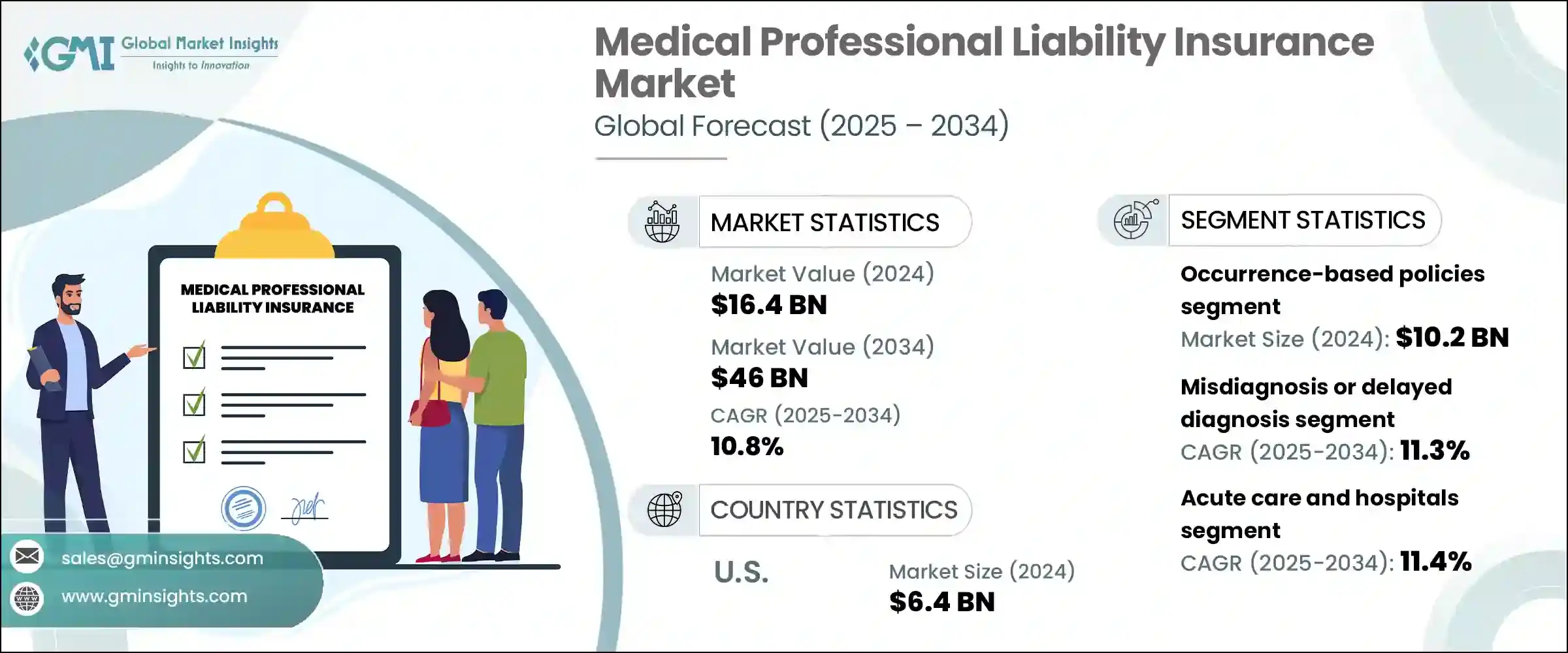

The Global Medical Professional Liability Insurance Market was valued at USD 16.4 billion in 2024 and is estimated to grow at a CAGR of 10.8% to reach USD 46 billion by 2034. This growth is primarily driven by the increasing frequency of medical malpractice claims, which has led healthcare providers to seek stronger insurance coverage. Additionally, there is a rise in awareness about the risks healthcare professionals face, which is pushing them to adopt better risk management practices. Insurance companies are contributing to this shift by offering advanced digital tools and analytics that help predict potential issues and reduce the chances of claims, making these policies even more attractive to healthcare providers. With hospitals and clinics taking more proactive steps to manage risks, the market continues to expand, driven by an overall focus on safety and protection in the healthcare industry.

Medical professional liability insurance protects healthcare providers, such as doctors and nurses, against legal claims made by patients who believe they were harmed due to substandard care. As healthcare becomes increasingly complex and malpractice claims continue to rise, these insurance products have become crucial for safeguarding careers and finances. The market is also benefiting from the adoption of technology to manage risks more effectively and prevent claims from occurring in the first place, thus further driving growth in the industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.4 Billion |

| Forecast Value | $46 Billion |

| CAGR | 10.8% |

Occurrence-based policies accounted for the largest share of the market, valued at USD 10.2 billion in 2024. This segment is favored for its comprehensive coverage, which protects healthcare providers against claims resulting from incidents that happened during the policy period, regardless of when the claim is made. This long-term protection is especially valuable for medical professionals who seek peace of mind. These policies are highly popular, especially in high-risk medical specialties, because they offer more reliable and extended coverage compared to claims-made policies.

The segment dealing with misdiagnosis or delayed diagnosis represented the largest share in 2024 and is expected to grow at a CAGR of 11.3% through 2034. Misdiagnosis or delayed diagnosis is one of the most common and costly forms of malpractice, with cases often involving serious consequences for patients. These claims are more likely to result in significant settlements and prolonged legal proceedings, making them a central focus for insurers. This trend is particularly notable in specialties such as oncology, cardiology, and emergency medicine, where timely and accurate diagnosis is essential.

United States Medical Professional Liability Insurance Market was valued at USD 6.4 billion in 2024. The U.S. remains the dominant player in this market due to its complex legal environment, vast healthcare infrastructure, and high frequency of medical services utilization. Increased litigation, particularly in high-risk areas like surgery and obstetrics, is driving the demand for liability insurance. Healthcare providers in the U.S. are increasingly seeking policies to protect themselves from growing financial risks posed by malpractice suits.

Key players in the Medical Professional Liability Insurance Market include Berkshire Hathaway Specialty Insurance, AXA, Allianz, ProAssurance Group, Coverys, Beazley Group, The Doctors Company, CNA Financial, Tokio Marine HCC, Liberty Mutual Group, Chubb, MagMutual LLC, Ignyte Insurance, CoverWallet, Hiscox. To strengthen their market position, companies in the medical professional liability insurance sector are focusing on expanding their product offerings by introducing more tailored and flexible policies that meet the specific needs of healthcare professionals in various specialties. Many are investing heavily in digital tools that use data analytics and machine learning to predict and mitigate risks, making insurance policies more effective and attractive. Furthermore, companies are forming strategic partnerships with healthcare organizations to expand their client base and improve customer engagement. By focusing on risk management solutions and improving the customer experience, insurers are securing a stronger foothold in an increasingly competitive market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Claim type

- 2.2.4 Healthcare sector

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of medical malpractice claims

- 3.2.1.2 Growing awareness and risk management initiatives

- 3.2.1.3 Increasing healthcare technology adoption

- 3.2.1.4 Expanding scope of professional practice

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High premium cost

- 3.2.2.2 Limited awareness in developing economies

- 3.2.3 Market opportunities

- 3.2.3.1 Opportunities in reinsurance and excess coverage due to rising claim severity

- 3.2.3.2 Growing demand for customizable and bundled policies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Occurrence-based policies

- 5.3 Claims-based policies

Chapter 6 Market Estimates and Forecast, By Claim Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Misdiagnosis or delayed diagnosis

- 6.3 Childbirth injuries

- 6.4 Medication errors

- 6.5 Surgical errors

- 6.6 Other claim types

Chapter 7 Market Estimates and Forecast, By Healthcare Sector, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Acute care and hospitals

- 7.3 Long-term care

- 7.4 Ambulatory and outpatient care

- 7.5 Mental health and behavioral health

- 7.6 Other healthcare sectors

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Agents and brokers

- 8.3 Direct response

- 8.4 Banks

- 8.5 Other distribution channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AXA

- 10.2 Allianz

- 10.3 Beazley Group

- 10.4 Berkshire Hathaway Specialty Insurance

- 10.5 Chubb

- 10.6 CNA Financial

- 10.7 CoverWallet

- 10.8 Coverys

- 10.9 Hiscox

- 10.10 Ignyte Insurance

- 10.11 Liberty Mutual Group

- 10.12 MagMutual LLC

- 10.13 ProAssurance Group

- 10.14 The Doctors Company

- 10.15 Tokio Marine HCC