PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773418

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773418

Image Intensifier Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

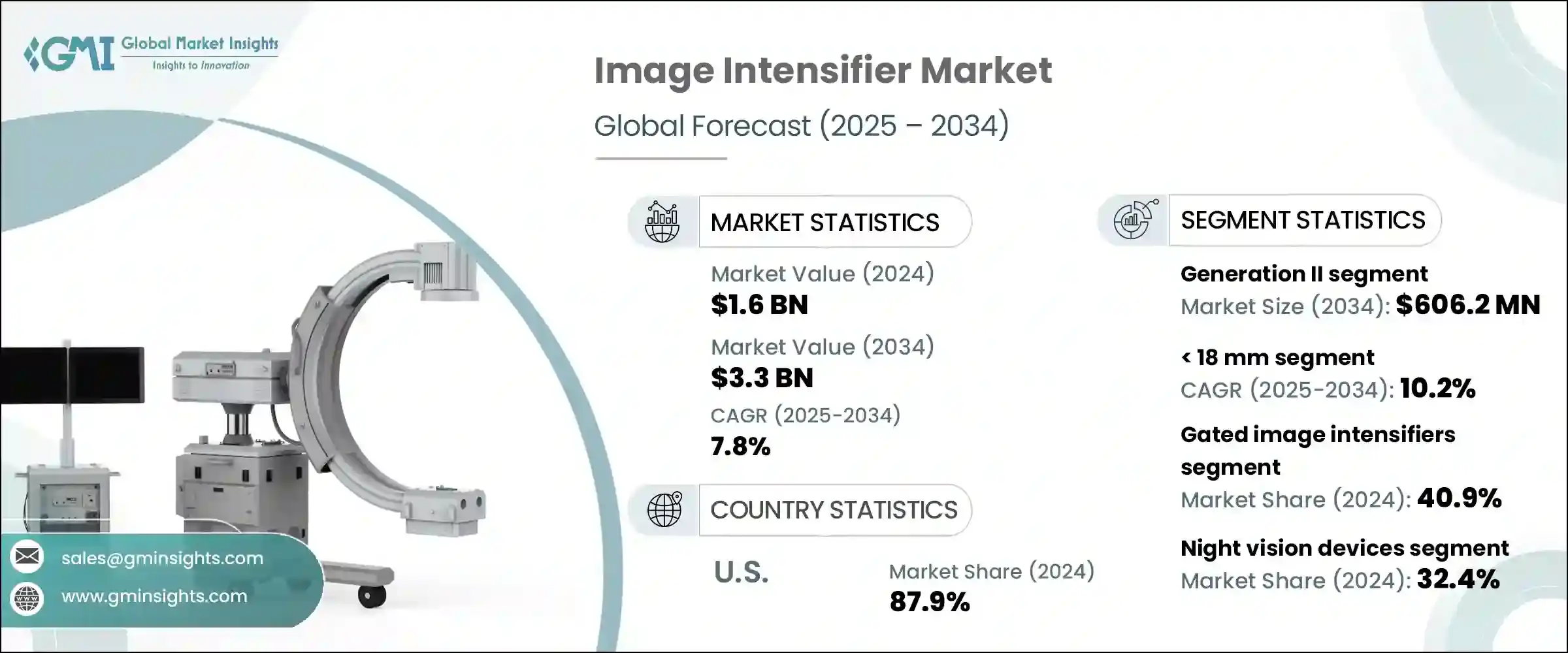

The Global Image Intensifier Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 3.3 billion by 2034. Growth in this sector is primarily fueled by expanding adoption in both medical imaging and defense-related applications. Medical systems such as fluoroscopy units, interventional radiology tools, and C-arms continue to drive demand for these devices, as image intensifiers provide strong real-time imaging capabilities, excellent sensitivity, and cost efficiency. As healthcare providers prioritize high-quality imaging with affordability, demand remains consistently high. Meanwhile, military and security forces across key regions rely heavily on image intensifiers for their low-light operational reliability in surveillance, reconnaissance, and target acquisition tasks.

These devices continue to play a critical role in border surveillance and night-time operations, where reliable visibility in low-light conditions is vital. As geopolitical tensions rise and countries prioritize the modernization of their defense capabilities, there is an increased urgency to enhance tactical infrastructure with cutting-edge technologies. Image intensifiers enable forces to detect threats, conduct reconnaissance, and maintain situational awareness around the clock, ensuring operational readiness and security. Their ability to deliver clear, real-time imagery in challenging environments makes them indispensable for military and security agencies aiming to protect borders, and critical assets, and maintain strategic advantages in evolving conflict scenarios.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $3.3 Billion |

| CAGR | 7.8% |

Generation III image intensifiers segment is expected to grow at a CAGR of 8.7% during 2034. Known for their advanced sensitivity and sharper imaging, this generation is widely used in defense and healthcare environments. Their dependable performance in complex and low-visibility scenarios continues to boost their appeal for critical missions where image clarity and speed are non-negotiable.

The 18 mm category segment is expected to see the highest growth at a CAGR of 10.2% through 2034. Designed to be compact and lightweight, these image intensifiers are ideal for wearable and portable systems including goggles, handheld optics, and helmet-mounted gear. Their small size and powerful performance make them extremely suitable for fast-response tasks in both tactical and clinical settings.

China Image Intensifier Market is projected to grow at a CAGR of 9.8% throughout 2034. This rapid rise is due to increased government investments in both security technologies and healthcare infrastructure. Domestic production of imaging systems is gaining strong momentum, backed by national policies encouraging reduced reliance on imports. Demand from both military procurement and hospital upgrades will continue to strengthen the market in this region.

Major industry players shaping the Image Intensifier Market include Canon, L3Harris, Elbit Systems, Hamamatsu Photonics, Argus, Dantec Dynamics, and Harder Digital. To enhance their market position, key players in the image intensifier industry are heavily investing in R&D to develop advanced generation technologies with higher resolution, longer lifespan, and better low-light performance. Companies are pursuing military contracts and strategic partnerships with healthcare equipment manufacturers to secure long-term supply deals. Additionally, they are focusing on expanding regional manufacturing hubs, especially in Asia-Pacific, to meet growing demand and avoid supply chain disruptions. Product miniaturization and integration into wearable systems are being prioritized to cater to evolving defense and medical applications.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Wood type

- 2.2.3 Entry type

- 2.2.4 End use industry

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Sustained demand in defense and security applications

- 3.2.1.2 Growth in medical imaging applications

- 3.2.1.3 Expansion in industrial and automotive testing

- 3.2.1.4 Integration with CMOS and CCD sensors

- 3.2.1.5 Technological shift toward digital imaging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced image intensifier devices

- 3.2.2.2 Growing competition from solid-state imaging technologies

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 Historical price analysis (2021-2024)

- 3.8.2 Price trend drivers

- 3.8.3 Regional price variations

- 3.8.4 Price forecast (2025-2034)

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Sustainability measures

- 3.12.1 Sustainable materials assessment

- 3.12.2 Carbon footprint analysis

- 3.12.3 Circular economy implementation

- 3.12.4 Sustainability certifications and standards

- 3.12.5 Sustainability ROI analysis

- 3.13 Global consumer sentiment analysis

- 3.14 Patent analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&d

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates & Forecast, By Generation,2021-2034 (USD Million & Thousand Units)

- 5.1 Key trends

- 5.2 Generation I

- 5.3 Generation II

- 5.4 Generation III

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Million & Thousand Units)

- 6.1 Key trends

- 6.2 Gated image intensifiers

- 6.3 Non-gated image intensifiers

- 6.4 Auto-gated image intensifiers

Chapter 7 Market Estimates & Forecast, By Diameter, 2021-2034 (USD Million & Thousand Units)

- 7.1 Key trends

- 7.2 < 18 mm

- 7.3 18 mm to <25 mm

- 7.4 25 mm to <37 mm

- 7.5 ≥ 37 mm

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Thousand Units)

- 8.1 Key trends

- 8.2 Night vision devices

- 8.3 Goggles

- 8.4 Binoculars

- 8.5 Monoculars

- 8.6 Camera systems

- 8.7 Scientific imaging

- 8.8 X-ray imaging

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million & Thousand Units)

- 9.1 Key trends

- 9.2 Defense & security

- 9.3 Industrial

- 9.4 Medical

- 9.5 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Argus

- 11.2 Aselsan

- 11.3 Canon

- 11.4 Dantec Dynamics

- 11.5 Elbit Systems

- 11.6 Hamamatsu Photonics

- 11.7 Harder Digital

- 11.8 Katod

- 11.9 L3Harris Technologies

- 11.10 Lambert Instruments

- 11.11 Photek

- 11.12 Photonis Technologies

- 11.13 Siemens