PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773424

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773424

Prefabricated Bathroom Pods Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

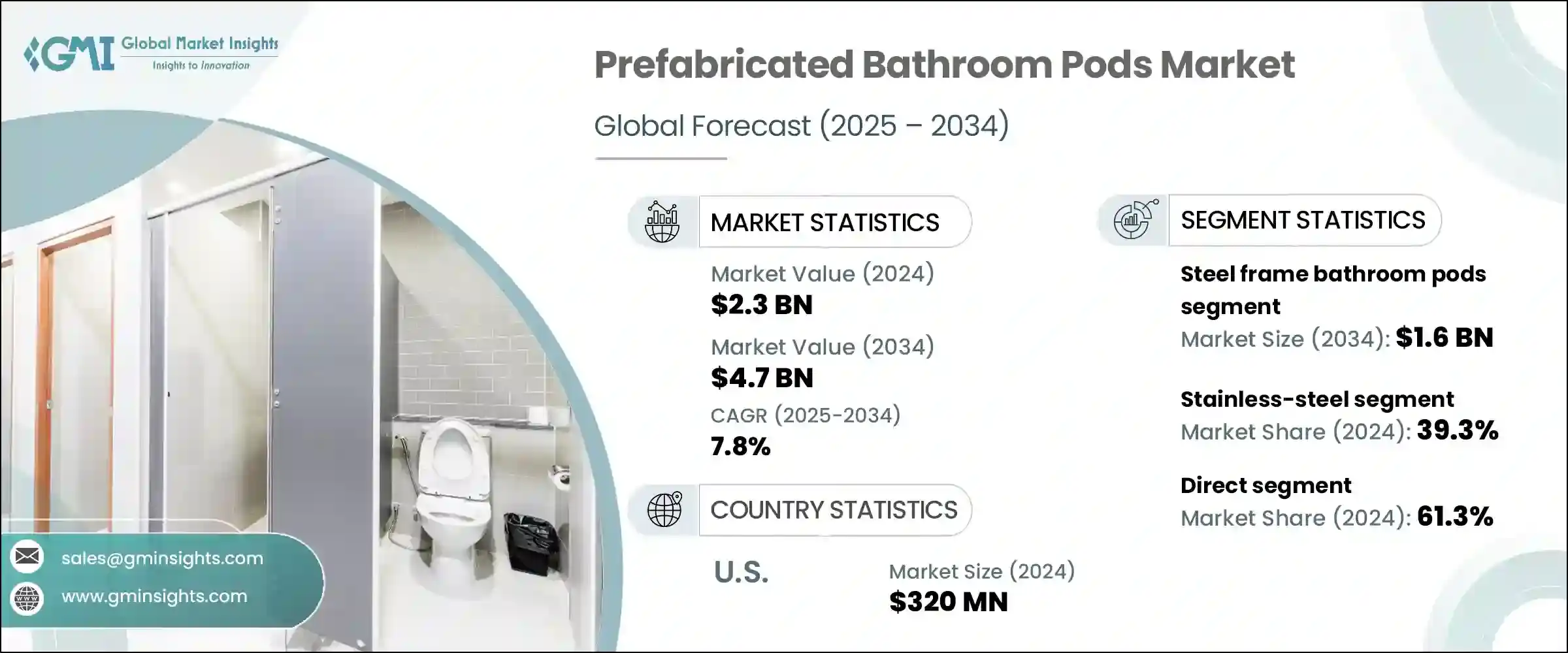

The Global Prefabricated Bathroom Pods Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 4.7 billion by 2034. One of the major growth drivers is the increasing preference for modular construction in time-sensitive projects. Bathroom pods significantly cut down on labor-intensive onsite installation and dramatically reduce assembly times, making them ideal for fast-paced developments.

These pods are manufactured in off-site facilities under controlled conditions, ensuring consistent quality and rapid delivery to construction locations. With construction timelines becoming more compressed, especially in the student housing, healthcare, and hospitality sectors, builders are turning to prefabricated bathroom units as an efficient solution. Modular methods, including bathroom pods, have been shown to reduce overall build times by up to 50% compared to traditional construction.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 7.8% |

Factory-assembled bathroom pods also reduce outdoor labor dependency, helping mitigate the ongoing shortage of skilled construction workers. By producing units off-site, developers can better forecast project costs and minimize material waste, which is increasingly important amid fluctuating prices for basic materials like steel and timber. These benefits make prefabricated pods an attractive option for large-scale developments.

Most manufacturers now embed smart technology and sustainable features into their products. These pods often come equipped with motion-sensing faucets, occupancy-triggered lighting, leak-monitoring systems, and water usage dashboards. Environmentally friendly elements such as low-flow fixtures, LED lighting, and recycled composite materials are also standard in many offerings. These features help developers meet green building certification criteria and align with broader ESG objectives.

Steel-frame bathroom pods segment generated USD 800 million in 2024 and is projected to hit USD 1.6 billion by 2034. Their rising popularity comes from their strong yet lightweight structure and ability to blend with diverse architectural designs. These pods are especially well-suited for projects like residential towers, student dormitories, and luxury hotels, where load restrictions and space optimization are critical. Steel construction also resists corrosion and physical damage, providing a durable, low-maintenance solution for developers looking for long-term performance.

In 2024, the stainless steel segment accounted for a 39.3% share and is projected to grow at a CAGR of 6.7% through 2034. Stainless steel's superior corrosion resistance, ease of cleaning, and sleek appearance make it a preferred material in high-traffic environments. Whether used visibly in fixtures or structurally within the pod frame, stainless steel provides long-term durability under high moisture conditions. It also helps meet hygiene standards demanded by clients, such as hospitals and institutional facilities. The material's non-porous surface actively resists bacterial growth, making it ideal for high-usage applications where sanitary compliance is essential.

United States Prefabricated Bathroom Pods Market was valued at USD 320 million in 2024 and is expected to grow at a CAGR of 8.3% through 2034. Demand is being fueled by rapid urbanization, ongoing labor shortages, and a broader shift toward more efficient construction techniques. Modular units are becoming more widely adopted across hospitality developments, healthcare facilities, and large-scale multifamily housing projects. As U.S. builders continue exploring faster, more sustainable alternatives to conventional builds, bathroom pods are becoming integral to project planning and delivery.

Key manufacturers in the market include Pivotek, Bathsystem, Walker Modular, StercheleGroup, Taplanes, Offsite Solutions, Elements Europe, SurePods, Interpod, Oldcastle SurePods, Modulart, Hydrodiseno, Hellweg Badsysteme, B&T Manufacturing, and Buildom Prefab Systems.

Companies operating in the prefabricated bathroom pod space are strengthening their market position by expanding manufacturing capabilities and investing in design flexibility to meet a wide range of architectural requirements. Many are diversifying their product portfolios to include customizable layouts and features aligned with client demands across various sectors. A strong focus is being placed on integrating smart technology and sustainable materials to meet regulatory and ESG targets. Collaborations with real estate developers, architects, and general contractors have become critical to secure repeat contracts and streamline delivery cycles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Material

- 2.2.4 Application

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code- 940690)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Steel frame bathroom pods

- 5.3 Concrete bathroom pods

- 5.4 GRP (glass reinforced plastic) bathroom pods

- 5.5 Hybrid bathroom pods

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Stainless steel

- 6.3 Ceramics

- 6.4 Glass

- 6.5 Plastic

- 6.6 Composites

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 New construction

- 7.3 Renovation/retrofit

Chapter 8 Market Estimates & Forecast, By End use, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Distribution channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 UAE

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 B&T Manufacturing

- 11.2 Bathsystem

- 11.3 Buildom Prefab Systems

- 11.4 Elements Europe

- 11.5 Hellweg Badsysteme

- 11.6 Hydrodiseno

- 11.7 Interpod

- 11.8 Modulart

- 11.9 Offsite Solutions

- 11.10 Oldcastle SurePods

- 11.11 Pivotek

- 11.12 StercheleGroup

- 11.13 SurePods

- 11.14 Taplanes

- 11.15 Walker Modular