PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773425

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773425

Titanium Aluminides (TiAl) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

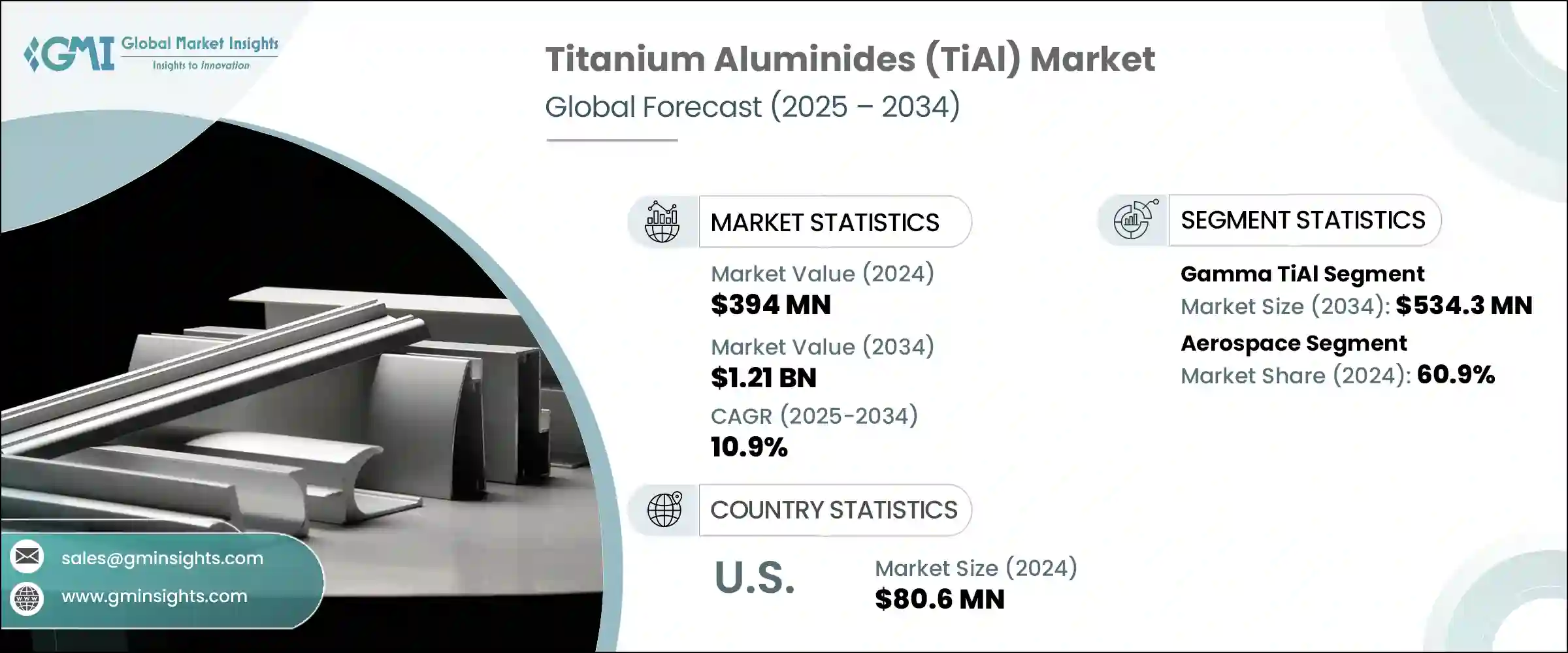

The Global Titanium Aluminides (TiAl) Market was valued at USD 394 million in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 1.21 billion by 2034. Rising demand is driven by the material's exceptional mechanical properties, especially in industries where weight, heat resistance, and durability are critical. Titanium aluminides are far lighter than conventional materials like steel, offering significant advantages in the aerospace and automotive sectors by reducing overall weight and improving energy efficiency. Their superior high-temperature performance enables them to withstand extreme thermal and mechanical stress, making them ideal for applications like aircraft engine parts and high-performance automotive components.

The need for materials that resist oxidation, maintain stiffness under stress, and lower fuel consumption is reinforcing their position in advanced engineering applications. With global defense spending on the rise and automotive manufacturers turning to advanced composites and lighter structures, titanium aluminides are gaining significant ground. The defense sectors in countries including the U.S. and India are experiencing increased investment in technology and materials to enhance performance, and titanium aluminides meet the high standards demanded by these developments, especially in jet turbines and next-gen propulsion systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $394 Million |

| Forecast Value | $1.21 Billion |

| CAGR | 10.9% |

The properties of titanium aluminides such as low density, excellent creep resistance, and outstanding high-temperature strength, are turning them into top-performing materials in multiple demanding fields. Their ability to endure elevated operating conditions, coupled with high corrosion and oxidation resistance, makes them especially suited for aerospace structures, turbine components, and other applications where conventional alloys fall short. Unlike traditional materials, titanium aluminides do not compromise strength for weight, and that balance makes them highly desirable in environments that push material limits. With a rising global emphasis on sustainability, lightweight, and efficiency in both transportation and defense, the performance and reliability of these intermetallic compounds offer manufacturers a competitive advantage.

In 2024, the Gamma TiAl segment generated USD 177.1 million and is forecasted to reach USD 534.3 million by 2034. This specific form of titanium aluminide is highly sought after for its ability to retain mechanical integrity and resist oxidation at temperatures exceeding 600°C. Gamma TiAl alloys offer a high-performance alternative to nickel-based superalloys, particularly in applications where both strength and weight-saving are essential. These alloys are increasingly replacing traditional metals in critical turbine engine parts due to their impressive stability under thermal stress. The push to develop more energy-efficient and lightweight aircraft platforms has elevated the use of gamma TiAl in high-stress environments, with several major manufacturers incorporating it into turbine blade components.

The aerospace segment held a 60.9% share in 2024. The continued preference for lightweight yet heat-resistant materials in aircraft engines and related components has driven widespread adoption. Titanium aluminides are now being used in turbine blades and other parts that face constant exposure to high temperatures, reducing total aircraft weight and improving fuel efficiency. Their high modulus, strength retention under heat, and lower thermal expansion properties make them ideal for aerospace applications. As the defense and commercial aviation sectors demand higher engine performance and lower emissions, titanium aluminides play a critical role in material innovation. Their capacity to withstand harsh environments without compromising performance makes them indispensable in aviation component design and manufacturing, especially where material failure is not an option.

United States Titanium Aluminides (TiAl) Market generated USD 80.6 million in 2024. As one of the major global exporters of defense and aerospace equipment, the country continues to lead in adopting advanced materials that boost aircraft efficiency. Domestic titanium production has kept pace with demand, supplying the raw materials required for the surge in new airframe and engine production. High-volume orders for lighter, fuel-efficient aircraft models are influencing material choices, and titanium aluminides offer superior compatibility with carbon-fiber-reinforced structures increasingly used in next-gen airframes. This compatibility has supported the material's integration into newly engineered platforms, where design emphasis is placed on strength-to-weight optimization and reduced fuel usage.

The top-performing companies in the Titanium Aluminides (TiAl) Market include Howmet Aerospace Inc., Precision Castparts Corp, KBM Affilips B.V., VSMPO-AVISMA Corporation, and ATI. These players lead in developing advanced alloys tailored to specific performance requirements across multiple end-use sectors. Companies in the titanium aluminides market are intensifying R&D efforts to improve alloy compositions for higher thermal stability and manufacturability.

Strategic investments are being made in advanced casting, forging, and additive manufacturing technologies to produce complex parts with enhanced mechanical performance. Firms are also forming alliances with aerospace OEMs and defense contractors to secure long-term supply contracts and streamline innovation cycles. Additionally, global market leaders are expanding production capacity and vertically integrating to secure raw material supply and ensure quality control.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Manufacturing process

- 2.2.4 Application

- 2.2.5 End use industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Type, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Gamma TiAl (γ-TiAl)

- 5.3 Alpha2-Ti3Al (α2-Ti3Al)

- 5.4 Orthorhombic Ti2AlNb (O-Ti2AlNb)

- 5.5 Beta Type (β-TiAl)

- 5.6 Others

Chapter 6 Market Size and Forecast, By Manufacturing Process, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Ingot metallurgy

- 6.2.1 Vacuum arc remelting (VAR)

- 6.2.2 Electron beam melting (EBM)

- 6.2.3 Plasma arc melting (PAM)

- 6.2.4 Vacuum induction melting (VIM)

- 6.3 Powder metallurgy

- 6.3.1 Gas atomization

- 6.3.2 Plasma rotating electrode process (PREP)

- 6.3.3 Mechanical alloying

- 6.4 Additive manufacturing

- 6.4.1 Powder bed fusion (PBF)

- 6.4.2 Direct energy deposition (DED)

- 6.4.3 Others

- 6.5 Others

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Aerospace

- 7.2.1 Low pressure turbine blades

- 7.2.2 High pressure compressor blades

- 7.2.3 Structural components

- 7.2.4 Others

- 7.3 Automotive

- 7.3.1 Turbocharger wheels

- 7.3.2 Valves

- 7.3.3 Exhaust systems

- 7.3.4 Others

- 7.4 Industrial

- 7.4.1 Gas turbines

- 7.4.2 Chemical processing equipment

- 7.4.3 Others

- 7.5 Medical

- 7.5.1 Implants

- 7.5.2 Surgical instruments

- 7.5.3 Others

- 7.6 Others

Chapter 8 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Aerospace & defense

- 8.2.1 Commercial aviation

- 8.2.2 Military aviation

- 8.2.3 Space applications

- 8.3 Automotive

- 8.3.1 Passenger vehicles

- 8.3.2 Commercial vehicles

- 8.3.3 Racing & high-performance vehicles

- 8.4 Industrial

- 8.4.1 Power generation

- 8.4.2 Chemical processing

- 8.4.3 Oil & gas

- 8.4.4 Others

- 8.5 Healthcare

- 8.5.1 Orthopedic implants

- 8.5.2 Dental applications

- 8.5.3 Others

- 8.6 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 ATI

- 10.2 VSMPO-AVISMA Corporation

- 10.3 Precision Castparts

- 10.4 Howmet Aerospace

- 10.5 KBM Affilips

- 10.6 GfE Metalle und Materialien

- 10.7 AMG Advanced Metallurgical Group

- 10.8 Alcoa Corporation

- 10.9 Western Superconducting Technologies

- 10.10 Carpenter Technology Corporation

- 10.11 American Elements

- 10.12 Toho Titanium

- 10.13 Titanium Metals Corporation

- 10.14 Stanford Advanced Materials

- 10.15 Aerospace Alloys

- 10.16 6K

- 10.17 Arconic Corporation

- 10.18 Daido Steel

- 10.19 Kobe Steel