PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773432

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773432

Industrial Wooden Crates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

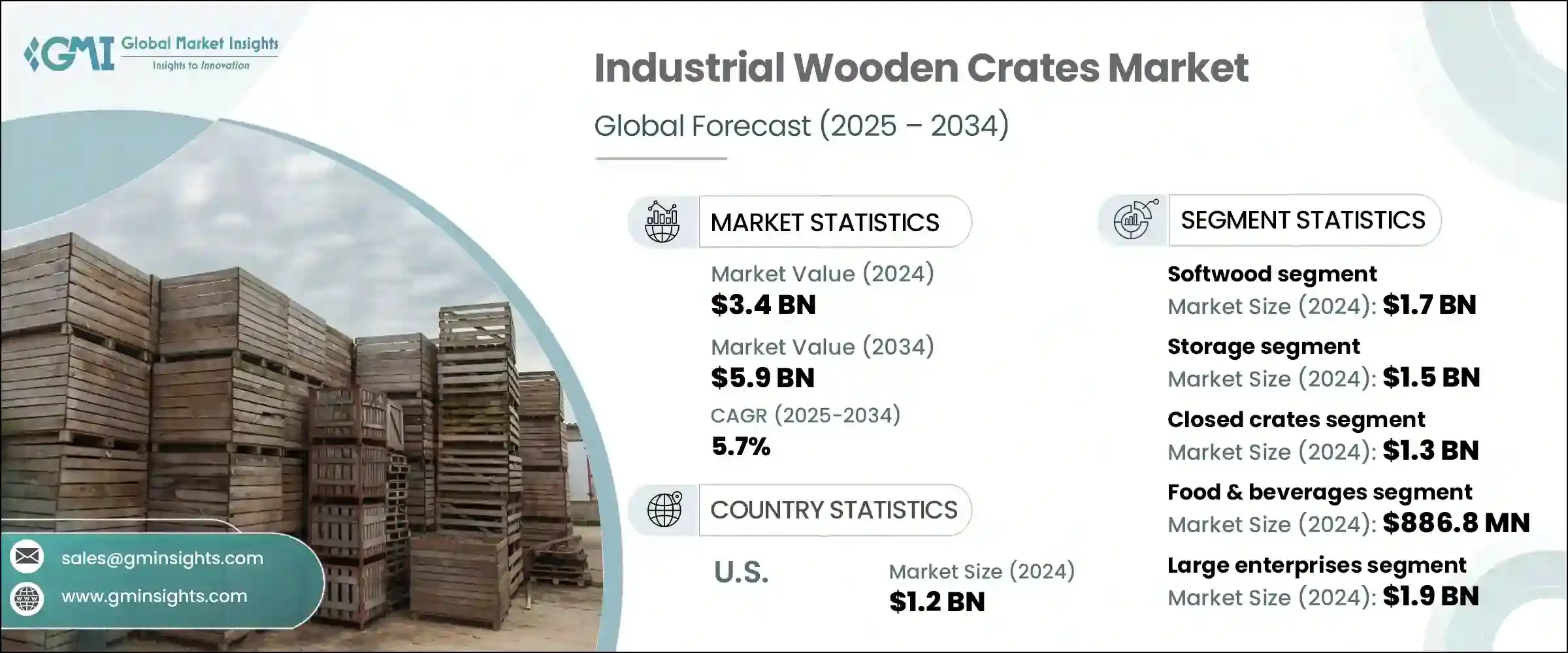

The Global Industrial Wooden Crates Market was valued at USD 3.4 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 5.9 billion by 2034. The growth of the industrial wooden crates market can be attributed to several key factors, including the surge in global trade and export operations, especially in sectors such as agriculture, automotive, and industrial machinery. In these industries, wooden crates are essential for the safe and efficient handling of goods.

Another contributing factor is the growing preference for sustainable packaging solutions, with wooden crates becoming increasingly appealing due to their recyclability and biodegradability. In addition, companies are making significant efforts to reduce their carbon footprints by opting for eco-friendly packaging materials, which is boosting demand for wooden crates. Manufacturers are also benefiting from the rise in the Producer Price Index (PPI) for wood boxes and crates, indicating a growing customer base willing to pay a premium for high-quality packaging solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 5.7% |

This trend highlights the growing emphasis on ensuring that products are transported safely and securely, reducing the risks of damage during transit. As supply chains become more complex and global, businesses are recognizing the importance of using packaging solutions that not only protect their goods but also enhance the overall customer experience. With heightened competition in various industries, there is a growing expectation for packaging to offer both durability and efficiency, ultimately safeguarding the integrity of the product and preventing costly losses.

In 2024, the softwood segment generated USD 1.7 billion. Softwood varieties like pine, fir, and spruce dominate the market due to their abundance, affordability, and lightweight nature, making them ideal for use in wooden crate production. The U.S. Department of Agriculture (USDA) reports a continuous strong supply of softwood lumber, especially from the Southern U.S., ensuring a steady raw material flow for crate manufacturers.

The transportation sector is the fastest-growing segment in the market, expected to grow at a CAGR of 6.1% through 2034. Wooden crates are favored for transporting goods, particularly fresh produce, due to their durability and ability to maintain product quality during transit. As global demand for fresh produce increases, the need for reliable and efficient packaging solutions, like wooden crates, is also on the rise.

United States Industrial Wooden Crates Market generated USD 1.2 billion in 2024 due to its well-developed logistics infrastructure and growing focus on eco-friendly packaging. The U.S. Forest Service has also noted improved availability of hardwood, which supports a steady supply of raw materials for crate manufacturers. Additionally, the USDA's endorsement of wooden packaging for agricultural exports further drives the demand for industrial wooden crates in the country.

Key players in the Industrial Wooden Crates Industry include Brambles Limited (CHEP), Greif Inc., Interlake Mecalux, Poole & Sons, and Universal Forest Products Inc. To strengthen their market position, companies in the industrial wooden crates market are focusing on increasing their production capacity and expanding their raw material supply chains. Strategic partnerships and collaborations with logistics and transportation firms are enhancing their distribution networks, ensuring timely delivery and market reach. Moreover, manufacturers are investing in sustainable production practices, incorporating eco-friendly materials, and complying with evolving environmental regulations, which positions them favorably in an eco-conscious market. To meet the growing demand, companies are also diversifying their product offerings by developing custom packaging solutions tailored to specific industry needs, such as agriculture, automotive, and pharmaceuticals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry snapshot

- 2.2 Key market trends

- 2.2.1 Business trends

- 2.2.2 Product type trends

- 2.2.3 Material trends

- 2.2.4 Function trends

- 2.2.5 Industry trends

- 2.2.6 End use trends

- 2.2.7 Regional

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.2 Disruptions Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising global trade and export activities

- 3.3.1.2 Growing demand from logistics and warehousing sectors

- 3.3.1.3 Sustainability and recyclability of wooden packaging

- 3.3.1.4 Increased use in heavy machinery and automotive shipments

- 3.3.1.5 Cost-effectiveness and high load-bearing capacity

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Fluctuating timber prices and supply chain volatility

- 3.3.2.2 Strict agricultural biosecurity norms and regulatory obligations

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Price trends

- 3.9.1 Historical price analysis (2021-2024)

- 3.9.2 Price trend drivers

- 3.9.3 Regional price variations

- 3.9.4 Price forecast (2025-2034)

- 3.10 Pricing strategies

- 3.11 Emerging business models

- 3.12 Compliance requirements

- 3.13 Sustainability measures

- 3.13.1 Sustainable materials assessment

- 3.13.2 Carbon footprint analysis

- 3.13.3 Circular economy implementation

- 3.13.4 Sustainability certifications and standards

- 3.13.5 Sustainability ROI analysis

- 3.14 Global consumer sentiment analysis

- 3.15 Patent analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Open crates

- 5.3 Closed crates

- 5.4 Slatted crates

- 5.5 Customized crates

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Softwood

- 6.2.1 Pine

- 6.2.2 Spruce

- 6.2.3 Cedar

- 6.2.4 Other

- 6.3 Hardwood

- 6.3.1 Oak

- 6.3.2 Maple

- 6.3.3 Birch

- 6.3.4 Others

- 6.4 Engineered Wood

- 6.4.1 Plywood

- 6.4.2 OSB (Oriented Strand Board)

- 6.4.3 Laminated veneer lumber

Chapter 7 Market Estimates and Forecast, By Function, 2021 - 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Storage

- 7.3 Transportation

- 7.3.1 Domestic logistics

- 7.3.2 International export

Chapter 8 Market Estimates and Forecast, By Industry, 2021 - 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 Agriculture

- 8.3 Manufacturing

- 8.4 Food and beverages

- 8.5 Pharmaceuticals

- 8.6 Logistics and shipping

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 Small & medium enterprises

- 9.3 Large enterprises

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Brambles Limited (CHEP)

- 11.2 C&K Box Company

- 11.3 FoamCraft Packaging Inc

- 11.4 Greif Inc.

- 11.5 Herwood Inc

- 11.6 Interlake Mecalux

- 11.7 LJB Timber Packaging Pty

- 11.8 Loscam Ltd.

- 11.9 Nelson Company LLC

- 11.10 Ongna Wood Products

- 11.11 PalletOne Inc.

- 11.12 PGS Group

- 11.13 Poole & Sons

- 11.14 Tree Brand Packaging

- 11.15 Universal Forest Products Inc.