PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773436

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773436

Soundproof Drywall Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

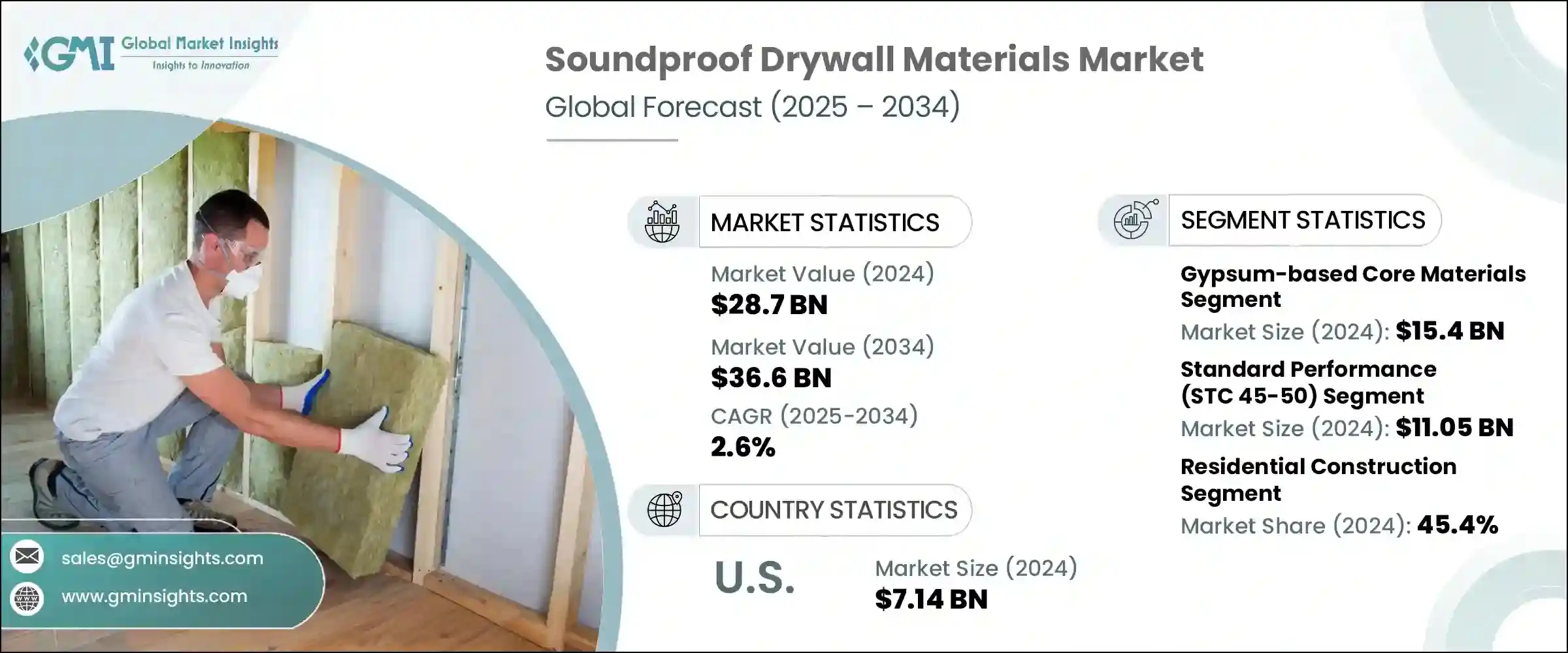

The Global Soundproof Drywall Materials Market was valued at USD 28.7 billion in 2024 and is estimated to grow at a CAGR of 2.6% to reach USD 36.6 billion by 2034. This growth is largely driven by the rising levels of urban noise and the growing awareness around acoustic comfort. As cities expand and urbanization intensifies, noise pollution from heavy traffic, industrial activities, and densely packed residential zones has significantly increased. This has fueled the need for better acoustic solutions in buildings, making soundproof drywall materials a preferred choice among homeowners and builders alike. Consumers today are more conscious of their living and working environments, which has translated into a demand for quieter interiors. The trend is particularly strong in metropolitan areas where noise intrusion is a daily concern, prompting real estate developers to prioritize soundproofing in their construction projects.

Commercial properties are also contributing to the growing demand for soundproof drywall, as building owners recognize the impact of noise control on employee productivity and customer satisfaction. Offices, healthcare centers, hospitality facilities, and educational institutions are increasingly investing in advanced drywall materials to improve interior sound environments. Companies in the construction industry are adapting their offerings to meet these evolving acoustic requirements. Developers are not only integrating soundproof drywall into new projects but are also retrofitting existing structures with improved materials to stay aligned with changing building standards and consumer expectations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.7 billion |

| Forecast Value | $36.6 billion |

| CAGR | 2.6% |

In terms of material, gypsum-based core drywall continues to dominate the market. This segment was valued at USD 15.4 billion in 2024 and is expected to grow at a CAGR of 1.8% during the forecast period. Its popularity stems from its cost-effectiveness and ease of installation. However, to stay competitive and cater to rising expectations, manufacturers are enhancing these materials by incorporating better sound absorption and fire-resistance features. These innovations are helping maintain the demand for gypsum-based cores as a mainstream solution in both residential and commercial construction.

From a performance standpoint, the standard sound transmission class (STC) 45-50 segment remains widely used, especially in projects where cost efficiency is a key factor. This category was valued at USD 11.05 billion in 2024 and is set to grow at a CAGR of 1.3% from 2025 to 2034. Although demand for this standard level of soundproofing remains steady, there is a visible shift toward higher-performance drywall in many applications. Drywall with an improved STC rating of 51-55 is gaining traction, particularly in apartment buildings, office spaces, and renovation projects. It offers an optimal balance between cost and performance, making it a favorable choice for developers looking to boost acoustic performance without significantly raising costs.

The residential construction sector accounted for the largest share of the global market, reaching a value of USD 13 billion in 2024. This segment is expected to expand at a CAGR of 2.9% through 2034, securing a 45.4% share of the market. Rising demand for noise control in urban housing, particularly in high-rise apartments and multi-family units, is a major factor driving this trend. With homeowners placing greater emphasis on comfort and well-being, residential projects are increasingly incorporating soundproof drywall into walls, ceilings, and partitions.

In the United States, the soundproof drywall materials market stood at USD 7.14 billion in 2024 and is anticipated to witness a CAGR of 2.3% from 2025 to 2034. This growth is fueled by the increasing importance of acoustic comfort in both homes and workplaces. Growing urban populations, higher awareness of the health effects of noise, and strict building codes in key states are prompting contractors to adopt drywall products with high STC ratings. Additionally, the continued adoption of remote work practices has increased the need for quieter home office environments, further boosting demand for acoustic drywall solutions.

Top manufacturers in the soundproof drywall materials market maintain their leadership by focusing on continuous innovation, large-scale production, and well-structured distribution systems. These companies are consistently investing in R&D to develop drywall solutions that offer enhanced acoustic, moisture, and fire-resistance properties. Their ability to deliver comprehensive wall systems gives them a competitive edge in both residential and commercial construction segments. To secure early product specifications, these players actively collaborate with architects, builders, and contractors. They also support the adoption of eco-friendly and certified building materials in line with green construction standards. By offering technical support, installer training programs, and targeted marketing strategies, they continue to shape market preferences and uphold their dominance in the global soundproof drywall materials industry.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Performance Class

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Gypsum-based core materials

- 5.2.1 Standard density gypsum

- 5.2.2 High-density gypsum

- 5.2.3 Lightweight gypsum formulations

- 5.3 Viscoelastic damping materials

- 5.3.1 Polymer-based damping compounds

- 5.3.2 Bituminous damping materials

- 5.3.3 Hybrid damping systems

- 5.4 Acoustic membranes and barriers

- 5.4.1 Mass-loaded vinyl (MLV)

- 5.4.2 Polymer acoustic membranes

- 5.4.3 Composite barrier materials

- 5.5 Reinforcement and facing materials

- 5.5.1 Paper facing materials

- 5.5.2 Fiberglass mat facing

- 5.5.3 Non-woven synthetic facings

- 5.6 Additives and performance enhancers

- 5.6.1 Fire retardant additives

- 5.6.2 Moisture resistance additives

- 5.6.3 Acoustic performance enhancers

Chapter 6 Market Estimates & Forecast, By Performance Class, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Standard performance (STC 45-50)

- 6.3 Enhanced performance (STC 51-55)

- 6.4 High performance (STC 56-60)

- 6.5 Premium performance (STC 60+)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential construction

- 7.2.1 Interior partition walls

- 7.2.2 Floor-ceiling assemblies

- 7.2.3 Exterior wall systems

- 7.3 Commercial construction

- 7.3.1 Office buildings and corporate facilities

- 7.3.2 Hotels and hospitality

- 7.3.3 Retail and entertainment venues

- 7.4 Institutional construction

- 7.4.1 Healthcare facilities

- 7.4.2 Educational buildings

- 7.4.3 Government and municipal buildings

- 7.5 Industrial and specialty applications

- 7.5.1 Manufacturing facilities

- 7.5.2 Data centers and technical buildings

- 7.5.3 Recording studios and theaters

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 3A Composites Holding AG

- 9.2 3M Company

- 9.3 Acoustical Surfaces, Inc.

- 9.4 American Gypsum

- 9.5 Continental Building Products

- 9.6 Dow Inc.

- 9.7 Georgia-Pacific LLC

- 9.8 Guardian Building Products

- 9.9 Henkel AG & Co. KGaA

- 9.10 Johns Manville (Berkshire Hathaway)

- 9.11 Kinetics Noise Control, Inc.

- 9.12 Knauf Group

- 9.13 National Gypsum Company

- 9.14 Owens Corning

- 9.15 PABCO Gypsum

- 9.16 Rockwool International A/S

- 9.17 RPG Acoustical Systems

- 9.18 Saint-Gobain (Gyproc/CertainTeed)

- 9.19 Sika AG

- 9.20 Trademark Soundproofing

- 9.21 USG Corporation (Berkshire Hathaway)