PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773446

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773446

Fiber-Metal Laminates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

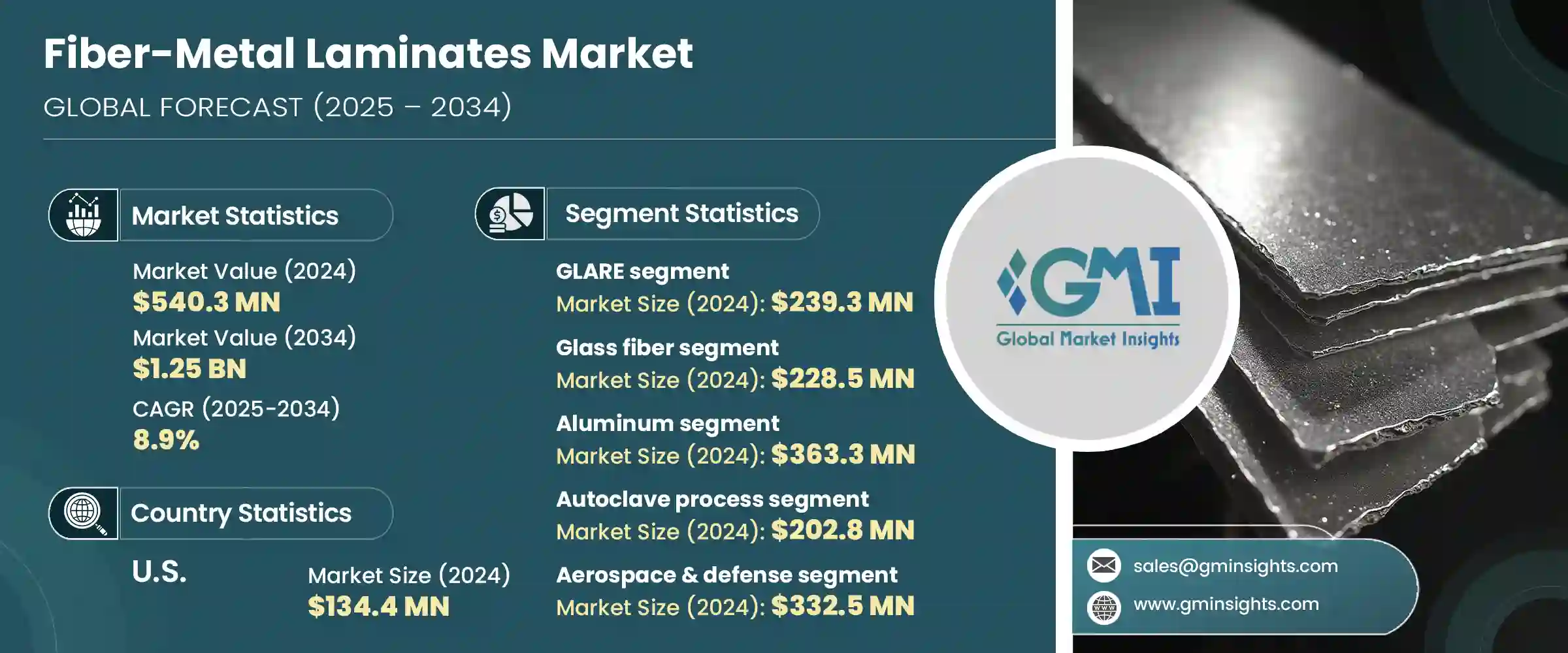

The Global Fiber-Metal Laminates Market was valued at USD 540.3 million in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 1.25 billion by 2034. The rising need for lightweight materials, especially in aerospace, is a key factor fueling this market's expansion. Manufacturers are increasingly turning to FMLs to cut down aircraft weight, enhance fuel efficiency, and increase payload capacity. Their integration in aircraft structures like fuselage panels, wings, and other high-stress components continues to rise due to exceptional fatigue resistance and minimal maintenance requirements. Unlike conventional metals, FMLs offer improved durability and fatigue tolerance, leading to fewer repairs and longer service life. As global sustainability efforts intensify, along with stricter environmental regulations, the role of fuel-efficient materials becomes even more vital, further boosting the adoption of fiber-metal laminates across major sectors.

Recent advancements in manufacturing technology have significantly improved the precision and scalability of FML production. Innovations in autoclaving, vacuum bagging, and digital tooling now enable large-scale manufacturing while maintaining quality. As these processes evolve, applications for FMLs are expanding into the automotive, marine, and wind energy sectors. This shift is supported by the growing trend of hybrid material integration, where composites and metals are combined to meet stringent weight, strength, and adaptability criteria. Such hybridization is pushing FMLs into the spotlight as a preferred material in structural design across diverse industries, especially in mobility and infrastructure, where the performance-to-weight ratio is a primary consideration.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $540.3 million |

| Forecast Value | $1.25 billion |

| CAGR | 8.9% |

The GLARE segment generated USD 239.3 million in 2024 and is expected to grow at a CAGR of 8.3% from 2025 to 2034. This fiber-metal laminate, made using glass fibers and aluminum, is widely used in aerospace due to its resistance to fatigue and corrosion, along with its low overall weight. Its reliability in both defense and commercial aviation continues to sustain demand. Alongside GLARE, other variants like ARALL and CARALL are gaining traction for applications that require higher impact resistance and stiffness. These alternatives contribute to a broader range of engineering solutions, especially where weight reduction and structural integrity must go hand in hand.

The glass fiber-based laminates segment accounted for USD 228.5 million in 2024 and is projected to grow at a CAGR of 8.3% during the forecast period. Glass fiber remains a cornerstone material in this market because of its cost-effectiveness, strength, and corrosion resistance. Industries such as automotive and aerospace prefer glass fiber laminates for their balanced performance and affordability. The established and dependable supply chains maintained by major corporations help ensure consistent access to raw materials, supporting growth and stability within the segment.

United States Fiber-Metal Laminates Market generated USD 134.4 million in 2024 and is anticipated to grow at a CAGR of 8.6% through 2034. The rapid pace of development in the defense and aerospace industries is a major driver for regional growth. With an ecosystem that includes leading aircraft producers and robust government investment in defense and R&D, the U.S. remains at the forefront of FML innovation and deployment. Additionally, increased focus on electric vehicle production and enhancements in manufacturing practices are creating new demand streams for FMLs, particularly as lightweight becomes a primary design objective.

Some of the prominent names competing in the Global Fiber-Metal Laminates Industry include Airbus SE, Lockheed Martin Corporation, Toray Industries, Inc., Boeing Company, and Hexcel Corporation. These companies are actively investing in next-generation FML solutions to stay ahead in a highly technical and competitive field. Companies competing in the fiber-metal laminates space are emphasizing continuous innovation, strategic collaborations, and production scalability to expand their global presence. Key players are investing heavily in R&D to develop FMLs with enhanced fatigue resistance, corrosion protection, and improved thermal properties for emerging applications. Many firms are forming partnerships with aerospace and automotive OEMs to co-engineer materials tailored for high-performance use. Another common approach includes automating production processes and integrating smart manufacturing to reduce cycle time and costs.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Fiber type

- 2.2.4 Metal type

- 2.2.5 Manufacturing process

- 2.2.6 Application

- 2.2.7 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 GLARE (Glass Laminate Aluminum Reinforced Epoxy)

- 5.2.1 GLARE 1

- 5.2.2 GLARE 2

- 5.2.3 GLARE 3

- 5.2.4 GLARE 4

- 5.2.5 GLARE 5

- 5.2.6 GLARE 6

- 5.3 ARALL (ARAMID REINFORCED ALUMINUM LAMINATE)

- 5.3.1 ARALL 1

- 5.3.2 ARALL 2

- 5.3.3 ARALL 3

- 5.3.4 ARALL 4

- 5.4 CARALL (Carbon Reinforced Aluminum Laminate)

- 5.5 TICARALL (Titanium Carbon Reinforced Aluminum Laminate)

- 5.6 Other FML types

Chapter 6 Market Estimates & Forecast, By Fiber Type, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Glass fiber

- 6.2.1 E-glass

- 6.2.2 S-glass

- 6.2.3 Other glass types

- 6.3 Carbon fiber

- 6.3.1 High strength carbon fiber

- 6.3.2 High modulus carbon fiber

- 6.3.3 Ultra-high modulus carbon fiber

- 6.4 Aramid fiber

- 6.4.1 Kevlar

- 6.4.2 Nomex

- 6.4.3 Other aramid types

- 6.5 Natural fiber

- 6.6 Hybrid fiber

Chapter 7 Market Estimates & Forecast, By Metal Type, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Aluminum

- 7.2.1 2024 aluminum alloy

- 7.2.2 7075 aluminum alloy

- 7.2.3 Other aluminum alloys

- 7.3 Titanium

- 7.3.1 Ti-6Al-4V

- 7.3.2 Other titanium alloys

- 7.4 Steel

- 7.4.1 Stainless steel

- 7.4.2 Carbon steel

- 7.5 Magnesium

- 7.6 Other metals

Chapter 8 Market Estimates & Forecast, By Manufacturing Process, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Autoclave process

- 8.3 Press curing

- 8.4 Vacuum bag molding

- 8.5 Filament winding

- 8.6 Pultrusion

- 8.7 Other manufacturing processes

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Aerospace

- 9.2.1 Fuselage

- 9.2.2 Wings

- 9.2.3 Empennage

- 9.2.4 Control surfaces

- 9.2.5 Other aerospace applications

- 9.3 Automotive

- 9.3.1 Body panels

- 9.3.2 Structural components

- 9.3.3 Crash boxes

- 9.3.4 Other automotive applications

- 9.4 Marine

- 9.4.1 Hull structures

- 9.4.2 Deck structures

- 9.4.3 Other marine applications

- 9.5 Wind energy

- 9.5.1 Turbine blades

- 9.5.2 Nacelle components

- 9.5.3 Other wind energy applications

- 9.6 Sports & recreation

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 Aerospace & defense

- 10.2.1 Commercial aviation

- 10.2.2 Military aviation

- 10.2.3 Space applications

- 10.2.4 Defense applications

- 10.3 Automotive

- 10.3.1 Passenger vehicles

- 10.3.2 Commercial vehicles

- 10.3.3 Electric vehicles

- 10.4 Marine

- 10.4.1 Commercial vessels

- 10.4.2 Naval vessels

- 10.4.3 Recreational boats

- 10.5 Energy

- 10.5.1 Wind energy

- 10.5.2 Other energy applications

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East & Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East & Africa

Chapter 12 Company Profiles

- 12.1 Premium AEROTEC GmbH (Airbus Group)

- 12.2 Fokker Technologies

- 12.3 Cytec Solvay Group

- 12.4 Alcoa Corporation

- 12.5 3A Composites

- 12.6 Comtek Advanced Structures Ltd.

- 12.7 Bombardier Inc.

- 12.8 Embraer S.A.

- 12.9 Boeing Company

- 12.10 Airbus SE

- 12.11 Lockheed Martin Corporation

- 12.12 Northrop Grumman Corporation

- 12.13 Saab AB

- 12.14 Leonardo S.p.A.

- 12.15 Mitsubishi Heavy Industries Ltd.

- 12.16 Kawasaki Heavy Industries Ltd.

- 12.17 Toray Industries, Inc.

- 12.18 Hexcel Corporation

- 12.19 Teijin Limited

- 12.20 SGL Carbon SE