PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773448

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773448

Cartoning Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

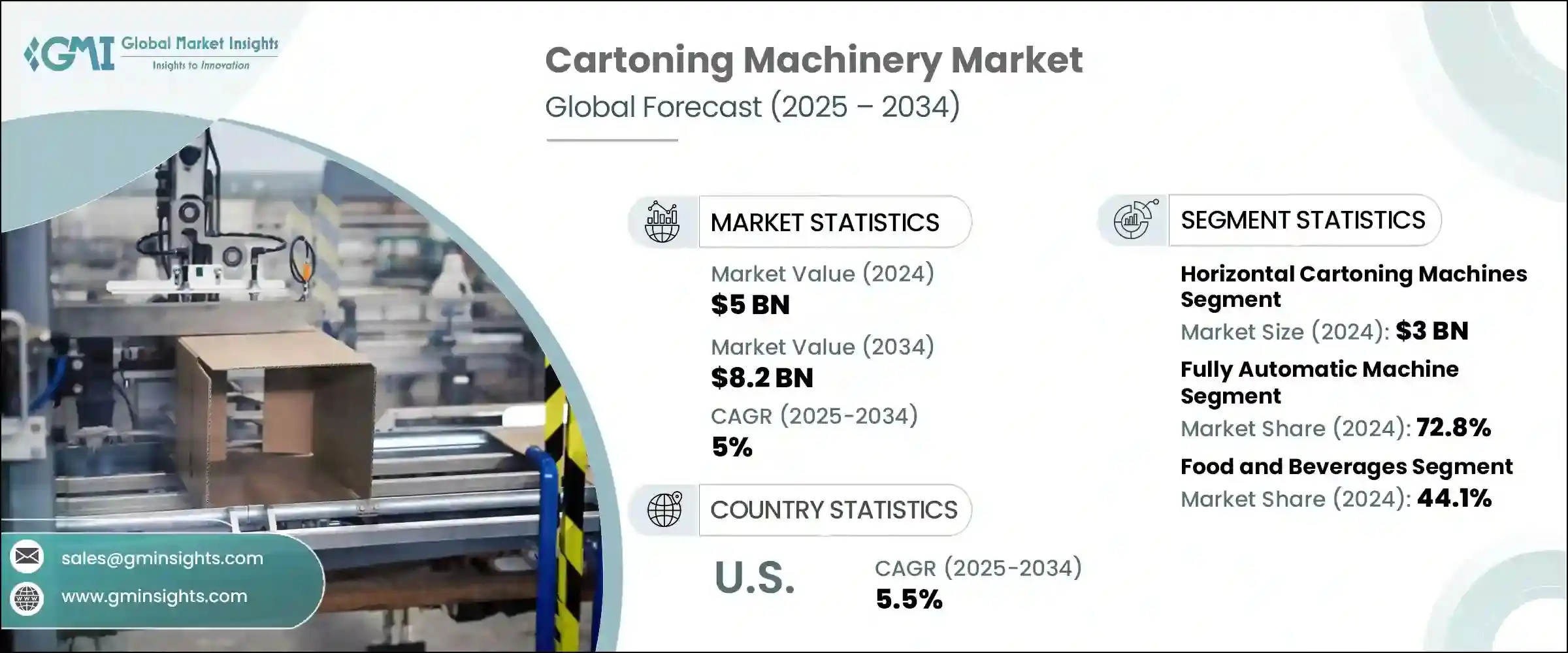

The Global Cartoning Machinery Market was valued at USD 5 billion in 2024 and is estimated to grow at a CAGR of 5% to reach USD 8.2 billion by 2034. As automation becomes a priority across manufacturing sectors, demand for advanced cartooning machines is rising in industries such as food and beverages, pharmaceuticals, and personal care. These sectors rely on high-volume, high-speed packaging, making automated carton systems a logical choice for improved productivity and reduced reliance on manual labor. In parallel, the demand for packaged goods is rising with urbanization and shifting consumer lifestyles, further fueling industry growth.

Government-enforced packaging regulations, particularly in the pharmaceutical and food industries, are accelerating the adoption of secure and traceable packaging technologies. Cartoning machines are being enhanced with Industry 4.0 capabilities, including IoT sensors and AI-based monitoring systems. These features enable predictive maintenance and real-time data tracking, improving operational efficiency. About 40% of packaging firms now use smart automation to streamline their production cycles. Additionally, the market is seeing a growing shift toward eco-conscious operations. More than 75% of consumers now prefer sustainable options, prompting manufacturers to incorporate recyclable paperboard and energy-efficient solutions into cartoning lines.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5 Billion |

| Forecast Value | $8.2 Billion |

| CAGR | 5% |

Horizontal cartoning machines segment generated USD 3 billion in 2024 and is forecasted to grow at a CAGR of 5.2% through 2034. Their popularity lies in their versatility and speed, making them ideal for processing different product forms. These machines are widely used in personal care and food packaging and can handle both automatic and manual loading, thanks to enhanced features like servo-driven systems that increase precision and throughput.

The fully automatic cartoning machines segment held a dominant share of 72.8% in 2024 and is projected to hit USD 6.1 billion by 2034. These systems are preferred for their minimal dependency on human labor and their ability to ensure consistent output in high-volume sectors such as pharmaceuticals and food production. Innovations such as AI-enabled tracking and solvent-free gluing have also contributed to their growing usage, particularly in regions focused on reducing environmental impact.

U.S. Cartoning Machinery Market generated USD 980 million in 2024 and is on track to grow at a 5.5% CAGR through 2034. The country leads with widespread demand for smart cartoning machinery across industries including healthcare, food, and online retail. Strong technological infrastructure and an experienced workforce make it a favorable environment for automation. U.S. packaging firms are also influenced by sustainability regulations, which continue to push the market toward greener operations.

Key players in the Cartoning Machinery Market include Omori Machinery, Marchesini Group, Mpac Group, ShineBen Machinery, IMA Group, Jacob White Packaging, SaintyCo, Econocorp, BW Integrated Systems, Serpa Packaging Solution, Infinity Automated Solutions, Nichrome, ADCO Packaging Solutions, Mespack, and Elite Packaging Machinery. Leading companies in the cartoning machinery market are focusing on technological innovation, product customization, and sustainability to expand their market reach. Many are integrating AI and IoT into their systems to offer smart, connected solutions that provide real-time diagnostics and predictive maintenance. Partnerships with packaging companies help them tailor equipment for specific operational needs, especially in the food, pharma, and personal care sectors. Expanding product lines with energy-efficient systems and eco-friendly features is another priority, aligning with global sustainability goals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Automation

- 2.2.4 Capacity

- 2.2.5 End use industry

- 2.2.6 Distribution channel

- 2.3 CXO Perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behaviour analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behaviour

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 MEA

- 4.2.1.5 LATAM

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Billion)(Thousand Units)

- 5.1 Key trends

- 5.2 Horizontal cartoning machines

- 5.3 Vertical cartoning machines

Chapter 6 Market Estimates & Forecast, By Automation, 2021 - 2034, (USD Billion)(Thousand Units)

- 6.1 Key trends

- 6.2 Manual machine

- 6.3 Semi-automatic machine

- 6.4 Fully automatic machine

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034, (USD Billion)(Thousand Units)

- 7.1 Key trends

- 7.2 Up to 100 cartons/ min

- 7.3 100 to 200 cartons/ min

- 7.4 200 to 400 cartons/ min

- 7.5 Above 400 cartons/ min

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion)(Thousand Units)

- 8.1 Key trends

- 8.2 Pharmaceuticals

- 8.3 Food and beverages

- 8.4 Consumer goods

- 8.5 Cosmetics and personal care

- 8.6 Others (nutraceuticals etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion)(Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion)(Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 ADCO Packaging Solutions

- 11.2 BW Integrated Systems

- 11.3 Econocorp

- 11.4 Elite Packaging Machinery

- 11.5 IMA Group

- 11.6 Infinity Automated Solutions

- 11.7 Jacob White Packaging

- 11.8 Marchesini Group

- 11.9 Mespack

- 11.10 Mpac Group

- 11.11 Nichrome

- 11.12 Omori Machinery

- 11.13 SaintyCo

- 11.14 Serpa Packaging Solution

- 11.15 ShineBen Machinery