PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773452

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773452

Motion Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

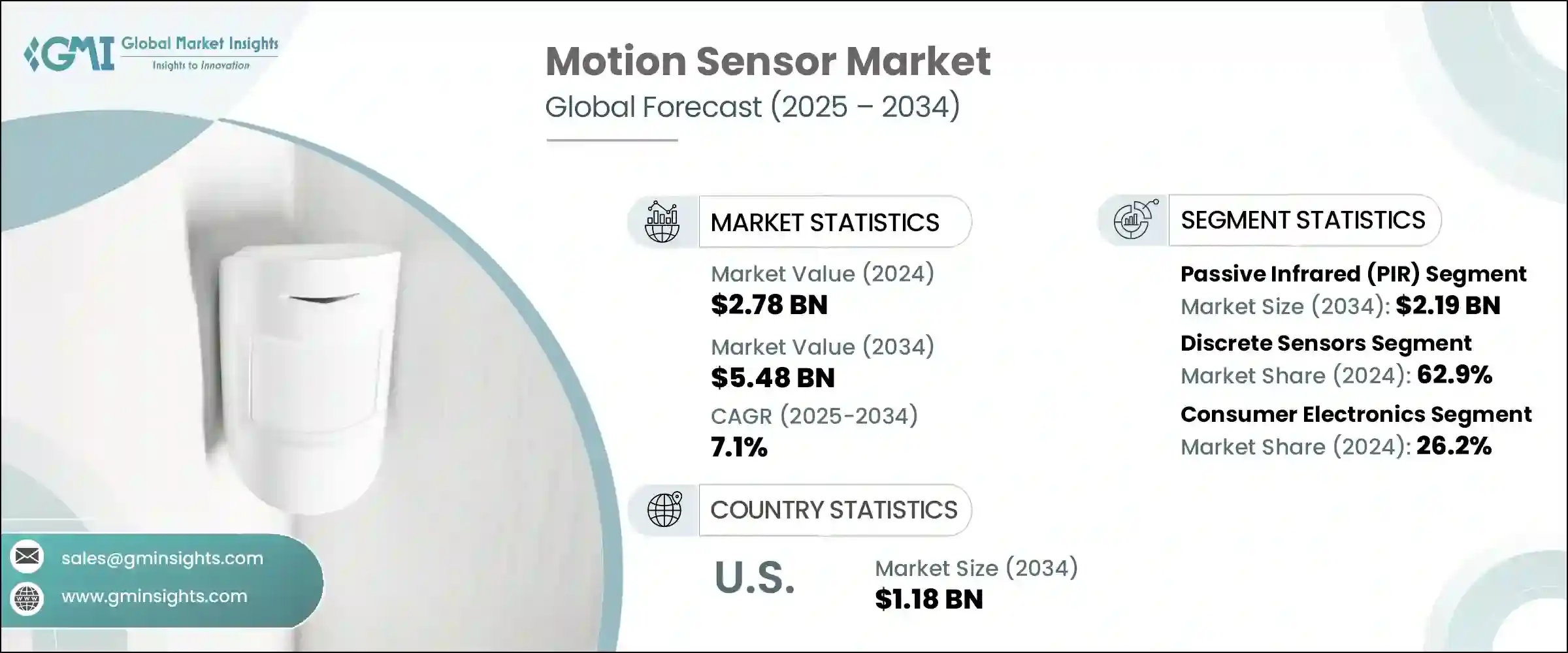

The Global Motion Sensor Market was valued at USD 2.78 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 5.48 billion by 2034. Growth across industry is being propelled by increasing demand for smart electronics and IoT-powered living environments. Motion sensors are now central to innovations across a wide spectrum of industries, especially in smart home automation where detecting unauthorized movement or environmental risks is essential. Their use extends far beyond just lighting or alarms-they're instrumental in building interconnected systems that prioritize security, efficiency, and user responsiveness. With connected ecosystems gaining traction, the need for motion-based sensing solutions in homes, offices, and commercial buildings is only expanding, driven by consumers who demand smarter, faster, and safer tech-enabled spaces.

An important growth driver within this market is the increasing deployment of motion sensors in modern vehicles. Automotive safety is undergoing a rapid transformation with more cars incorporating advanced systems designed to prevent accidents. These safety applications, including lane guidance, collision alerts, and blind-spot monitoring, rely heavily on high-precision sensors to operate effectively. Real-time data provided by motion sensing units allows these intelligent vehicle systems to function autonomously with greater control and accuracy, especially as semi-autonomous features continue to evolve. The integration of such motion technology into vehicle frameworks reflects a deeper trend toward automation and driver assistance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.78 Billion |

| Forecast Value | $5.48 billion |

| CAGR | 7.1% |

The microwave sensor segment is expected to grow at a CAGR of 8.8% through 2034, driven by its effectiveness in demanding and variable environments. These sensors outperform conventional technologies by offering stable motion detection in poor visibility conditions and through physical barriers. Because they can deliver accurate and reliable performance regardless of lighting or weather, microwave motion sensors are gaining ground in security, industrial, and transport infrastructure. Their capacity for long-range detection and compatibility with complex systems has made them highly sought-after for next-generation safety applications and intelligent sensing installations.

Discrete motion sensors segment accounted for a 62.9% share in 2024, supported by widespread use in everyday automation systems such as lighting, security, and industrial controls. Their straightforward architecture and flexible design make them ideal for cost-sensitive projects and retrofitting older infrastructure. These sensors are also preferred for their ease of maintenance and cross-compatibility with existing hardware platforms. While integrated systems are advancing rapidly, discrete sensors continue to dominate where simplicity and cost-effectiveness are paramount, especially in developing or transitional markets.

United States Motion Sensor Market is expected to generate USD 1.18 billion by 2034. In the U.S., expanding interest in home automation, infrastructure upgrades, and connected vehicles is driving significant demand. Motion sensing technology is being deployed not just in consumer gadgets, but also across critical infrastructure networks where reliability and performance are essential. As digital modernization accelerates, these devices are proving vital in enabling automated responses across utilities, transportation systems, and smart energy management. Government efforts to upgrade outdated infrastructure further underscore the importance of motion sensors in monitoring, tracking, and securing physical assets.

Leading companies in the Global Motion Sensor Market include Texas Instruments Incorporated, Honeywell International Inc., Bosch Sensortec GmbH, and STMicroelectronics. To enhance their market position, motion sensor manufacturers are implementing a variety of strategic initiatives. Key players are investing in the development of miniaturized, power-efficient sensors optimized for wearable tech, automotive applications, and IoT-enabled systems. Strengthening global distribution networks and entering emerging markets are also high on the agenda to capitalize on growing urbanization. Strategic alliances with system integrators and OEMs help foster faster adoption of sensor technology into smart devices. Additionally, companies are prioritizing research on hybrid sensor designs that combine multiple detection methods-such as microwave, infrared, and vibration-into compact, multifunctional units.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.3 Technology type

- 2.4 Integration level type

- 2.5 End use type

- 2.6 Regional

- 2.7 TAM Analysis, 2025-2034 (USD Billion)

- 2.8 CXO Perspectives: Strategic imperatives

- 2.8.1 Executive decision points

- 2.8.2 Critical Success Factors

- 2.9 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for smart consumer electronics

- 3.2.1.2 Growth in automation across industrial applications

- 3.2.1.3 Expansion of IoT-enabled smart homes

- 3.2.1.4 Increased adoption in automotive safety systems

- 3.2.1.5 Proliferation of wearable devices and fitness trackers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced motion sensor technologies

- 3.2.2.2 Privacy and data security concerns in smart applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging Business Models

- 3.9 Compliance Requirements

- 3.10 Sustainability Measures

- 3.11 Consumer Sentiment Analysis

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic Presence Comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive Positioning Matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche Players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Passive infrared (PIR)

- 5.3 Ultrasonic

- 5.4 Microwave

- 5.5 Camera-based

- 5.6 Vibration sensors

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Integration Level, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Discrete sensors

- 6.3 Integrated sensors

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Consumer electronics

- 7.3 Automotive

- 7.4 Security & surveillance

- 7.5 Smart homes & buildings

- 7.6 Industrial

- 7.7 Healthcare

- 7.8 Retail

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Allegro MicroSystems, Inc.

- 9.2 Analog Devices, Inc.

- 9.3 Bosch Sensortec GmbH

- 9.4 Elmos Semiconductor SE

- 9.5 Honeywell International Inc.

- 9.6 InvenSense

- 9.7 KEMET Corporation

- 9.8 Littelfuse, Inc.

- 9.9 NXP Semiconductors

- 9.10 Panasonic Holdings Corporation

- 9.11 Schneider Electric

- 9.12 Siemens AG

- 9.13 STMicroelectronics

- 9.14 TE Connectivity

- 9.15 Texas Instruments Incorporated

- 9.16 Vishay Intertechnology, Inc.