PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773453

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773453

Automotive Piezoelectric Fuel Injectors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

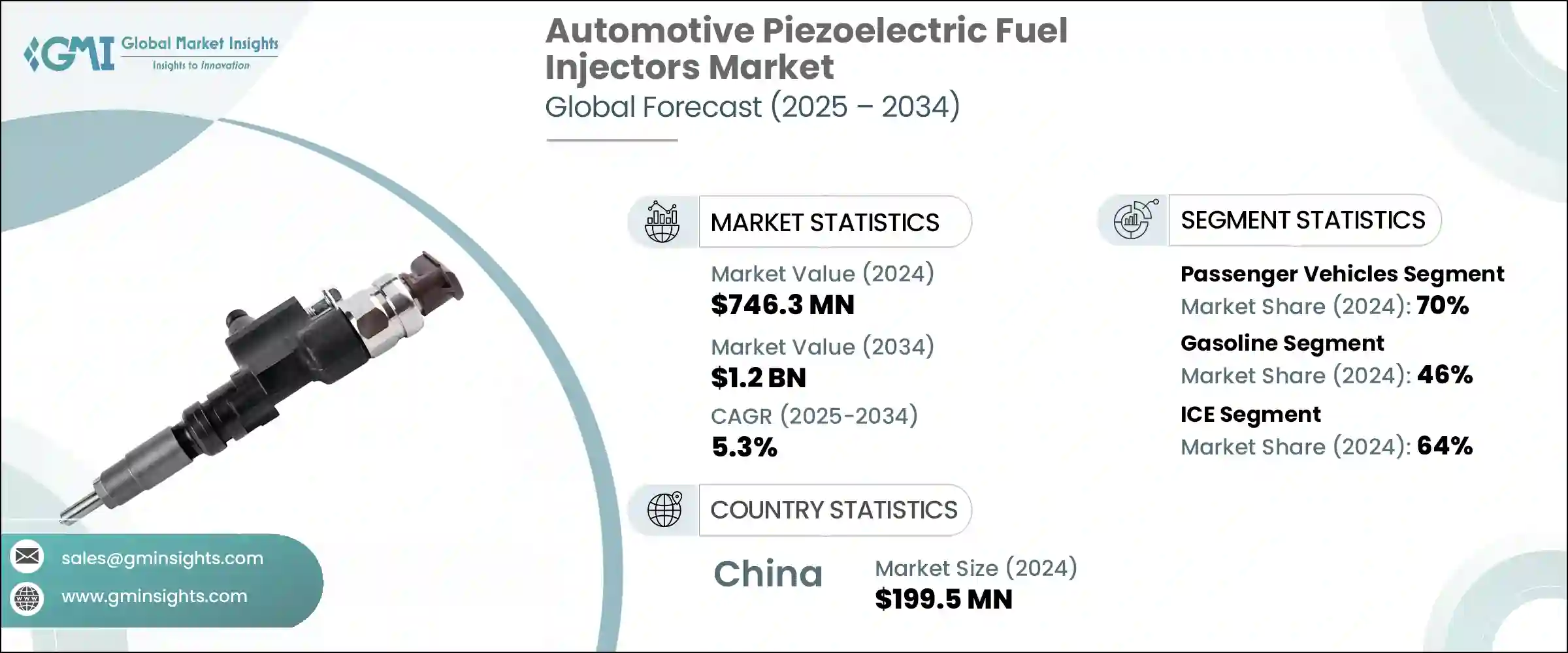

The Global Automotive Piezoelectric Fuel Injectors Market was valued at USD 746.3 million in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 1.2 billion by 2034. Growth in this market is being fueled by the increasing implementation of advanced engine technologies such as CRDI and GDI, alongside stricter global regulations around vehicle emissions. These injectors allow for rapid and extremely precise fuel delivery, which contributes significantly to enhanced combustion efficiency and reduced pollutants.

Piezoelectric injectors are steadily replacing traditional solenoid types in regions with aggressive environmental standards. Their integration with smart electronic control units and advanced diagnostics enables real-time adjustment of fuel flow, allowing for optimized engine performance and fewer particulate emissions. The shift toward cleaner mobility solutions is also accelerating the need for these high-precision components, as they offer greater control and efficiency in internal combustion applications across all types of vehicle platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $746.3 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 5.3% |

Piezoelectric injectors are redefining engine management by enabling multiple ultra-fast fuel injections within a single combustion cycle. This level of control helps engineers fine-tune the air-fuel mixture with unmatched accuracy, boosting fuel efficiency and significantly lowering emissions. These attributes are becoming increasingly important as countries implement tighter regulations like Euro 7, BS-VI Stage II, and EPA Tier 3. The automotive sector is evolving rapidly, with piezo-based systems positioned to address the limitations of solenoid injectors, especially in scenarios demanding faster response times and higher injection precision.

The passenger vehicles segment led the market in 2024, contributing 70% share, and is projected to grow at a CAGR of 5.5% through 2034. This dominance stems from the high global production and sales volumes of cars, light trucks, and utility vehicles. Stringent emission controls in regions like Asia, Europe, and North America are pushing manufacturers toward incorporating advanced fuel injection systems in these vehicle classes. Piezoelectric fuel injectors help meet regulatory thresholds while improving performance and economy, aligning with consumer expectations for both power and environmental consciousness. Their application is expanding in hybrid and plug-in hybrid platforms, where rapid on-off cycles and start-stop operation demand injectors that respond quickly and efficiently-qualities that piezo technology delivers consistently.

The gasoline vehicle segment held a 46% share, and it is projected to grow at a CAGR of 5.7% between 2025 and 2034. As regulatory bodies across multiple continents move to restrict emissions from light-duty vehicles, gasoline engines are becoming more attractive due to their relatively lower particulate and nitrogen oxide output compared to diesel. Automotive manufacturers are leaning into gasoline direct injection systems, enhanced with piezoelectric injectors, to meet both performance goals and emission benchmarks. With gasoline engines favored for their lighter weight, quieter operation, and lower cost of production, piezo injectors help these engines deliver improved combustion and better throttle response, securing their position as a key component in the gasoline segment.

Asia Pacific Automotive Piezoelectric Fuel Injectors Market held a 67% share, generating USD 199.5 million. The country's massive internal combustion vehicle output and increasingly rigorous environmental mandates are driving the widespread integration of high-precision injection technology. China's adoption of advanced emission standards has intensified the focus on cleaner combustion, creating a strong demand for piezoelectric injector systems. Additionally, Tier-1 component manufacturers such as Infineon, KYOCERA, Aptiv, and Siemens are intensifying their efforts in the region by collaborating with domestic firms to tailor solutions for regional market needs. These partnerships focus on optimizing injector performance for both commercial and passenger applications, ensuring durability and efficiency at elevated pressure thresholds while maintaining competitive costs.

Notable companies actively shaping the Global Automotive Piezoelectric Fuel Injectors Market include KYOCERA, Continental, Siemens, Infineon, Hitachi Astemo Indiana, Aptiv, Robert Bosch, Denso, NGK Spark Plug Co, and Murata Manufacturing. These players are innovating and investing to keep pace with the industry's evolving fuel delivery requirements and emissions legislation.

Major manufacturers in the automotive piezoelectric fuel injectors market are focusing on several strategic areas to build a strong competitive position. First, they are investing heavily in research and development to refine injector speed, response precision, and fuel atomization, enabling better emissions control and combustion efficiency. Second, collaborations with vehicle OEMs are being formed to develop application-specific injectors optimized for gasoline direct injection and hybrid systems.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Fuel type

- 2.2.4 Sales channel

- 2.2.5 Propulsions

- 2.2.6 Technology

- 2.2.7 Operating pressure range

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of GDI and CRDI engines

- 3.2.1.2 Technological advancements in Piezo materials

- 3.2.1.3 Growth of premium and luxury vehicle segments

- 3.2.1.4 Stricter emission regulations

- 3.2.1.5 Increased R&D investments by OEMs and Tier-1 suppliers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of piezoelectric injectors

- 3.2.2.2 Competition from improved solenoid injectors

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of hybrid powertrains

- 3.2.3.2 Diesel engine optimization in commercial vehicles

- 3.2.3.3 The widespread shift to gasoline direct injection (GDI) engines

- 3.2.3.4 Digital engine management and AI integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($ Mn, units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUVs

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.1.1 Gasoline

- 6.1.2 Diesel

- 6.1.3 Others

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 ICE

- 8.3 Hybrid

Chapter 9 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Direct injection (DI)

- 9.3 Common rail direct injection (CRDI)

- 9.4 Gasoline direct injection (GDI)

- 9.5 Port fuel injection (PFI)

Chapter 10 Market Estimates & Forecast, By Operating Pressure Range, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 Low pressure (<200 bar)

- 10.3 Medium pressure (200–1000 bar)

- 10.4 High pressure (>1000 bar)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Aptiv

- 12.2 Continental

- 12.3 Delphi Technologies

- 12.4 Denso Corporation

- 12.5 Edelbrock LLC

- 12.6 Fuzhou Ruida Machinery

- 12.7 GB Remanufacturing

- 12.8 Hitachi Astemo Indiana

- 12.9 Infineon

- 12.10 Keihin

- 12.11 KYOCERA

- 12.12 Magneti Marelli Parts and Services.

- 12.13 Mikuni American

- 12.14 Murata Manufacturing

- 12.15 Robert Bosch

- 12.16 Siemens

- 12.17 Stanadyne

- 12.18 Valley Fuel Injection & Turbo

- 12.19 Woodward

- 12.20 WUZETEM