PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773461

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773461

Spin on Carbon Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

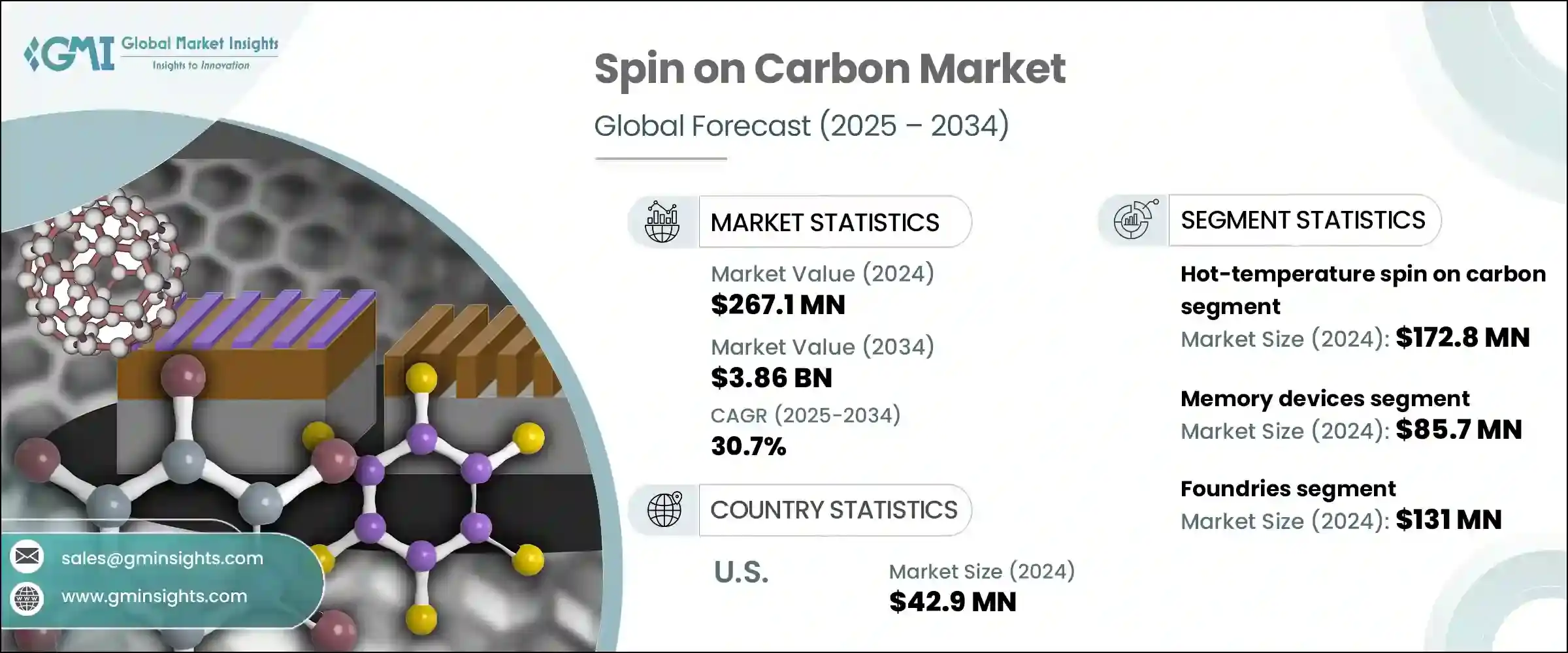

The Global Spin on Carbon Market was valued at USD 267.1 million in 2024 and is estimated to grow at a CAGR of 30.7% to reach USD 3.86 billion by 2034. This rapid expansion is primarily driven by the growing investments in foundries and the increasing adoption of extreme ultraviolet (EUV) lithography. As industries such as artificial intelligence, high-performance computing, and 5G continue to rise, leading foundries are scaling up their manufacturing capabilities, which increases the demand for materials like spin-on carbon.

SoC serves as a crucial component in semiconductor production, especially in advanced chip designs, providing etch resistance and enabling uniform film coating. This evolution in chip design, paired with rising semiconductor manufacturing, propels the demand for spin-on carbon in the market. Additionally, the shift toward EUV lithography in semiconductor fabrication, known for its ability to create ultra-fine features, further fuels the market growth. The adoption of EUV is critical to developing smaller, more powerful semiconductor devices, and SoC materials are essential in enabling accurate pattern transfer and enhancing etching precision in sub-7nm nodes, thus contributing significantly to the market's growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $267.1 Million |

| Forecast Value | $3.86 Billion |

| CAGR | 30.7% |

In 2024, the hot-temperature spin-on carbon segment accounted for the largest market share, valued at USD 172.8 million. As semiconductor applications, particularly high-speed processors and memory chips, demand better thermal stability and low dielectric constant, hot-temperature SoCs have gained momentum. These materials are ideal for advanced packaging technologies and 3D integrated circuits, which require materials capable of enduring high process temperatures without degradation. The increasing miniaturization of semiconductor devices also drives the demand for hot-temperature SoCs, especially in copper interconnect technologies.

The memory device segment was valued at USD 85.7 million in 2024, driven by their essential role in the fabrication of low-k dielectrics and interconnects. These materials are crucial for supporting high-speed data transfer in cutting-edge applications such as cloud computing, AI, and 5G, where performance and efficiency are paramount. As memory architecture continues to shrink and stacked memory technologies evolve, the pressure on materials to meet increasingly stringent demands has grown. The need for SoC materials becomes even more critical as devices move towards smaller nodes and higher-density configurations.

U.S. Spin on Carbon Industry generated USD 42.9 million in 2024. The country's leadership in aerospace innovation drives the demand for advanced materials like spin-on carbon, used in lightweight, high-strength components for defense and aircraft applications. Additionally, the shift toward renewable energy sources, such as wind and solar, is boosting the need for durable and lightweight carbon-based materials in energy storage systems. The growing trend toward vehicle electrification is further fueling demand for spin-on carbon in lightweight battery components and thermal management systems, ensuring the U.S. remains a dominant force in the market.

Key players in the Spin on Carbon Industry include Brewer Science, Inc., DuPont, DONGJIN SEMICHEM CO LTD, Applied Materials, Inc., Merck KGaA, JSR Micro, Inc., Irresistible Materials, Shin-Etsu Chemical Co., Ltd., Nano-C, KOYJ Co., Ltd., YCCHEM CO., Ltd., Samsung SDI Co., Ltd. To strengthen their market position, companies in the spin-on carbon industry are focusing on technological advancements and material innovations.

They are investing heavily in research and development to improve the performance of spin-on carbon in semiconductor manufacturing processes, particularly in ultra-advanced nodes like sub-7nm. Strategic partnerships with foundries and semiconductor manufacturers are also critical to ensure compatibility with the latest fabrication technologies. Additionally, companies are expanding their product offerings to meet the growing demand across diverse industries, including renewable energy and aerospace. Efforts to streamline production processes and reduce costs while maintaining high-quality standards are central to enhancing competitiveness in this rapidly expanding market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Material type trends

- 2.2.2 Application trends

- 2.2.3 End use trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Shrinking node sizes in semiconductor industry

- 3.2.1.2 Increased adoption of EUV lithography

- 3.2.1.3 Growing foundry investments

- 3.2.1.4 Enhanced etch resistance and film uniformity

- 3.2.1.5 Rising use in advanced packaging

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High material and processing costs

- 3.2.2.2 Environmental and waste management concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Sustainability measures

- 3.11 Consumer sentiment analysis

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ Startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hot-temperature spin on carbon

- 5.3 Normal-temperature spin on carbon

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Logic devices

- 6.3 Memory devices

- 6.4 Power devices

- 6.5 Micro-electromechanical systems

- 6.6 Photonics

- 6.7 Advanced packaging

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Foundries

- 7.3 Integrated device manufacturers

- 7.4 Outsourced semiconductor assembly & test

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Applied Materials, Inc.

- 9.2 Brewer Science, Inc.

- 9.3 DONGJIN SEMICHEM CO LTD

- 9.4 DuPont

- 9.5 Irresistible Materials

- 9.6 JSR Micro, Inc.

- 9.7 KOYJ Co., Ltd.

- 9.8 Merck KGaA

- 9.9 Nano-C

- 9.10 Samsung SDI Co., Ltd.

- 9.11 Shin-Etsu Chemical Co., Ltd.

- 9.12 YCCHEM CO.,Ltd.