PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773464

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773464

Sustainable Pet Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

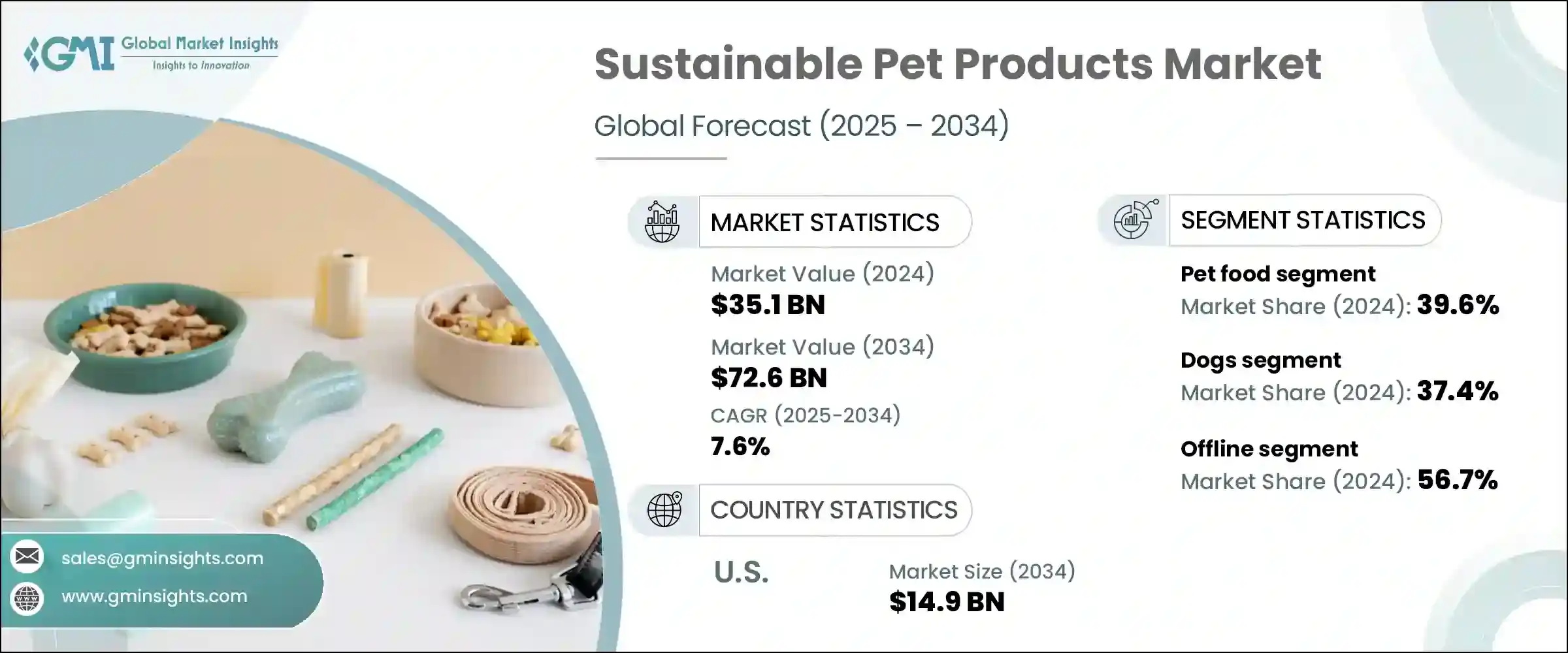

The Global Sustainable Pet Products Market was valued at USD 35.1 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 72.6 billion by 2034. This expansion is driven by increasingly eco-conscious pet owners who treat their pets as family members and are investing more in premium, ethically produced goods. Demand for biodegradable waste bags, non-plastic grooming items, responsibly sourced pet food, and recyclable packaging reflects a broader shift toward environmentally friendly pet care. Rising disposable incomes are fueling spending on health-focused pet products, and both emerging and established brands are innovating in materials, formulations, and packaging to meet these evolving expectations.

This surge in sustainable pet care is reshaping the industry, with health trends, environmental concerns, and lifestyle changes at its core. Consumers are now aligning their values with the products they choose for their pets, prioritizing wellness, ethical sourcing, and minimal environmental impact. As pet owners become more eco-aware, they are actively replacing conventional products with alternatives made from biodegradable, cruelty-free, or recycled materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.1 Billion |

| Forecast Value | $72.6 Billion |

| CAGR | 7.6% |

Additionally, the rising popularity of plant-based diets, clean-label formulations, and toxin-free grooming solutions reflects a broader cultural shift toward holistic, conscious living. This transformation is not just a passing trend-it signals a long-term movement where sustainability becomes a standard expectation in pet care purchasing decisions, influencing product development, packaging design, and marketing strategies across the sector.

In 2024, the sustainable pet food segment held a 39.6% share and is expected to grow at an 8% CAGR. Pet owners are increasingly choosing organic, responsibly sourced, and nutritionally dense food options to support their pets' overall health and well-being. Concerns over the environmental footprint of traditional meat-based diets are boosting interest in alternative proteins like insect-based, plant-based, or lab-grown options. Consumers value brands that practice transparent sourcing, clean labeling, and eco-friendly packaging.

The dog segment dominated pet categories in 2024, capturing 37.4% share, and is forecasted to grow at 8.2% CAGR through 2034. The strong emotional bond between owners and dogs is driving increased spending on sustainable products, including biodegradable waste bags, plant-based foods, and accessories made from recycled materials or eco-friendly textiles. This demand is directly tied to the rising trend of pet humanization.

U.S. Sustainable Pet Products Market held a 60.2% share and is projected to reach USD 14.9 billion by 2034. High pet ownership rates and consumer interest in eco-conscious products-supported by robust retail and e-commerce channels-are propelling this growth. U.S. companies offer plant-based pet foods, biodegradable waste bags, and sustainably packaged goods to meet pet parents' evolving needs.

Leading players in this space include West Paw, Pawz, Beco Pets, Kurgo, Ruffwear, Spectrum Brands, Colgate Palmolive, Jiminy's, Petcurean, Freshpet, Petco, Green Pet Shop, RC Pet Products, Purina, and Hurtta. Top brands in the sustainable pet products arena are investing heavily in eco-friendly innovation and supply chain transparency to capture consumer loyalty. They are expanding their portfolios to include plant-based ingredients, biodegradable materials, and recyclable packaging. Partnerships with sustainable material suppliers and environmental certification bodies ensure product credibility. Many companies are leveraging omnichannel distribution strategies-combining retail presence with strong e-commerce-to reach a wider audience. Storytelling through social media, influencer collaborations, and community engagement helps highlight brand values.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Pet type

- 2.2.3 Price

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing trend of pet humanization

- 3.2.1.2 Higher consumer spending on pet care

- 3.2.1.3 Consumer demand for ethical practices

- 3.2.1.4 Economic opportunities in the circular economy

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Seasonality in pet products demand

- 3.2.2.2 Lack of awareness & low spending in developing and under-developed regions

- 3.2.2.3 High pet care cost

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics (HS code: 33051090)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behaviour analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behaviour

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Pet food

- 5.3 Pet accessories

- 5.4 Pet care products

- 5.5 Pet apparel and bedding

Chapter 6 Market Estimates & Forecast, By Pet Type, 2021-2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Birds

- 6.5 Small animals (e.g., rabbits, hamsters)

- 6.6 Fish & reptiles

- 6.7 Others (e.g., exotic pets)

Chapter 7 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Online retail

- 8.2.1 E-commerce platforms (Amazon, Chewy, etc.)

- 8.2.2 Brand-owned websites

- 8.3 Offline retail

- 8.3.1 Pet specialty stores

- 8.3.2 Supermarkets and hypermarkets

- 8.3.3 Veterinary clinics

- 8.3.4 Eco/organic stores

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Beco Pets

- 10.2 Colgate-Palmolive

- 10.3 Freshpet

- 10.4 Green Pet Shop

- 10.5 Hurtta

- 10.6 Jiminy's

- 10.7 Kurgo

- 10.8 Pawz

- 10.9 Petco

- 10.10 Petcurean

- 10.11 Purina

- 10.12 RC Pet Products

- 10.13 Ruffwear

- 10.14 Spectrum Brands

- 10.15 West Paw