PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773470

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773470

Pet Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

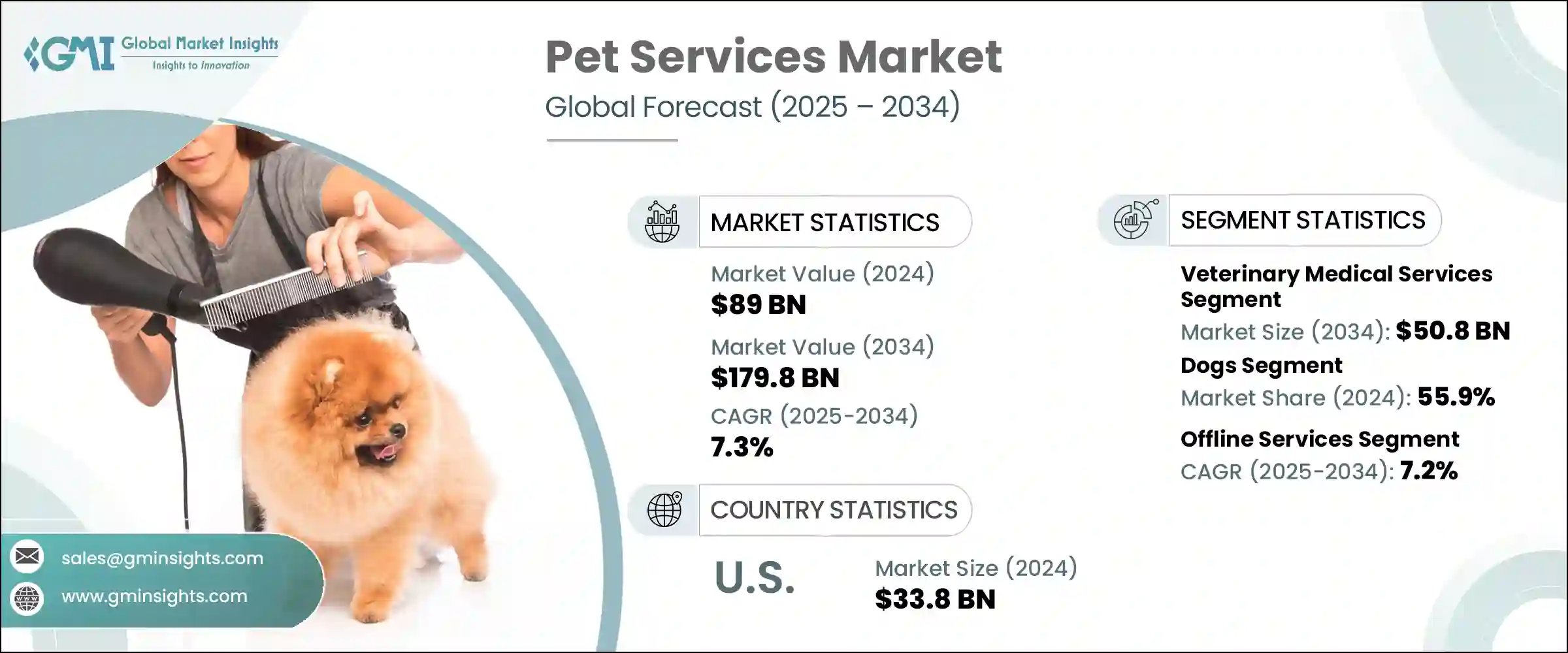

The Global Pet Services Market was valued at USD 89 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 179.8 billion by 2034. This growth is largely driven by the increasing incidence of chronic health issues in pets, such as arthritis, diabetes, and obesity, which prompts a higher demand for routine check-ups, rehabilitation care, and specialty treatments. Pet owners are placing more importance on wellness and hygiene, resulting in a spike in professional grooming, veterinary visits, and insurance enrollments.

Additionally, the shift toward digital tools-such as virtual vet appointments and online booking systems-has enhanced the accessibility of care services. This tech-driven transformation, combined with rising pet ownership and humanization trends, is strengthening the pet care service ecosystem across global markets. Pet services encompass a wide range of offerings tailored to companion animals' needs, both medical and non-medical. These include grooming, veterinary care, daycare, boarding, and training. Expanding insurance coverage has further boosted access to premium services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $89 Billion |

| Forecast Value | $179.8 Billion |

| CAGR | 7.3% |

In parallel, the veterinary healthcare sector is undergoing a digital transformation that is redefining how pet services are delivered and accessed. The growing integration of teleconsultations is not only improving convenience for pet owners but also ensuring timely medical intervention, especially in remote or underserved areas. Smart health tracking devices, including wearable collars and implantable sensors, are enabling real-time monitoring of pets' vital signs, activity levels, and behavioral changes-empowering both veterinarians and owners with actionable insights.

The veterinary medical services segment generated USD 26.4 billion in 2024 and is projected to reach USD 50.8 billion by 2034, growing at a CAGR of 6.8%. This segment includes general medical care, specialized treatments, and emergency services. A growing population of pets combined with increasing occurrences of both infectious and chronic conditions is accelerating the demand for veterinary care. Additionally, rising pet humanization in urban settings is influencing spending patterns, as more households allocate budgets for premium pet services and products. Improvements in healthcare infrastructure are making advanced veterinary care more accessible to pet owners. As a result, medical services remain a foundational pillar in the overall market, supported by growing awareness and willingness to invest in pet health.

The dogs segment held a 55.9% share in 2024 fueled by the widespread adoption of dogs as companion animals and the increasing emotional bond shared between pets and owners. Dog owners are spending more on high-quality services such as daycare, grooming, and health checkups, reinforcing the value of comprehensive pet care. The demand for breed-specific grooming, specialized training, and advanced healthcare options continues to surge. Additionally, the expansion of commercial pet care establishments and the emergence of digital service platforms have made dog-related services more convenient and accessible, solidifying their position in the global market.

North America Pet Services Market generated USD 35.7 billion in 2024 and is expected to reach USD 69.4 billion by 2034, with a CAGR of 6.9%. The region's leadership stems from its highly developed pet care infrastructure, increasing pet ownership, and heightened awareness about pet well-being. Countries across the region are seeing a surge in demand for high-end services such as preventive veterinary care and personalized grooming. The growth is also propelled by widespread access to modern veterinary clinics, premium service chains, and digital pet care solutions. Moreover, pet owners are actively engaging with technology-driven platforms to schedule and manage services. Regional companies are expanding service portfolios and capitalizing on consumer preferences, which is contributing to consistent market expansion.

Prominent players in the Global Pet Services Market include IDEXX Laboratories, Dogtopia, PetIQ, VIP Petcare, Petfirst Healthcare, PetSmart, Hartville Group, Vetcor, Anicom Holding, The Barkley Pet Hotel & Day Spa, DogVacay, Mars, K9 Resorts, Rover, Figo Pet Insurance, Hollard, Ethos Veterinary Health. To strengthen their market positioning, companies in the pet services space are investing in service diversification and digital transformation.

Many are adopting app-based platforms and telehealth services to streamline customer experiences and increase service convenience. Strategic partnerships with veterinary networks, insurance providers, and tech firms help expand their service footprint while also improving care quality. Firms are also launching wellness programs and subscription-based models to enhance customer loyalty and recurring revenue streams. Moreover, continuous training programs for veterinary and care staff are elevating service standards.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service type

- 2.2.3 Pet type

- 2.2.4 Delivery mode

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet ownership rate

- 3.2.1.2 Pet humanization trend

- 3.2.1.3 Increasing health awareness among pet owners

- 3.2.1.4 Growing technological advancements in veterinary services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High service costs

- 3.2.2.2 Regulatory challenges on animal welfare

- 3.2.3 Market opportunities

- 3.2.3.1 Growth in digital transformation and online booking

- 3.2.3.2 Expanding pet insurance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pet population statistics 2024

- 3.5 Regulatory landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Key developments

- 4.5.1 Mergers and acquisitions

- 4.5.2 Partnerships and collaborations

- 4.5.3 Expansion plans

Chapter 5 Market Estimates and Forecast, By Service Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pet grooming

- 5.3 Pet boarding and daycare

- 5.4 Pet training services

- 5.5 Pet insurance

- 5.6 Veterinary medical services

- 5.6.1 General services

- 5.6.2 Specialty services

- 5.6.3 Emergency services

- 5.7 Other service types

Chapter 6 Market Estimates and Forecast, By Pet Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dogs

- 6.3 Cats

- 6.4 Birds

- 6.5 Fishes

- 6.6 Horses

- 6.7 Other pet types

Chapter 7 Market Estimates and Forecast, By Delivery Mode, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Online services

- 7.3 Offline services

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anicom Holding

- 9.2 Dogtopia

- 9.3 DogVacay

- 9.4 Ethos Veterinary Health

- 9.5 Figo Pet Insurance

- 9.6 Hartville Group

- 9.7 Hollard

- 9.8 IDEXX Laboratories

- 9.9 K9 Resorts

- 9.10 Mars

- 9.11 Petfirst Healthcare

- 9.12 PetIQ

- 9.13 PetSmart

- 9.14 Rover

- 9.15 The Barkley Pet Hotel & Day Spa

- 9.16 Vetcor

- 9.17 VIP Petcare