PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773471

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773471

Companion Animal Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

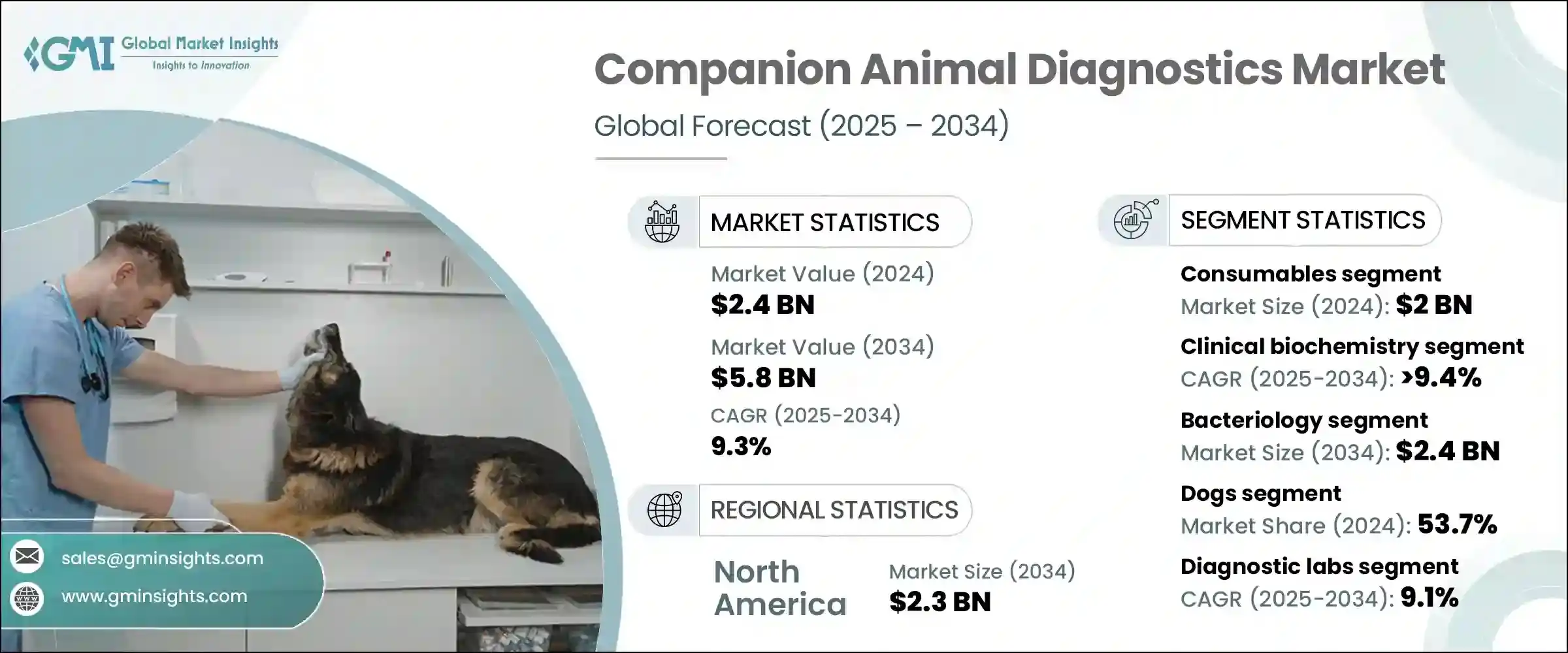

The Global Companion Animal Diagnostics Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 9.3% to reach USD 5.8 billion by 2034. This growth is driven by a rising number of pet owners worldwide, a growing inclination toward pet companionship, and a surge in the diagnosis of chronic and infectious diseases in animals. With pet care becoming an integral part of households, spending on veterinary services continues to climb. Pet owners are increasingly treating animals as part of the family, which results in regular health checks, preventive care, and timely diagnosis. This cultural shift has led to a stronger focus on animal wellness, significantly pushing up the demand for advanced diagnostic tools and services.

The market expansion is also underpinned by the increasing awareness of zoonotic diseases and the importance of early diagnosis in avoiding complications. Veterinary professionals are relying more on diagnostics to assess conditions like organ dysfunction, metabolic issues, and infections, which has further fueled the growth of this sector. Moreover, technological advancements are reshaping the landscape by enabling fast, accurate, and less invasive diagnostic techniques. Innovations in veterinary diagnostics are allowing faster turnaround times and better integration with treatment strategies, making diagnostics a critical component of animal healthcare. As veterinary care infrastructure strengthens globally, the demand for diagnostic products and services is expected to remain on an upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 9.3% |

In terms of product segmentation, the market is divided into instruments and consumables. In 2024, the consumables segment dominated with a value of USD 2 billion. This dominance is due to the essential role of consumables like reagents, testing kits, slides, and tubes in each diagnostic process. Unlike instruments, consumables are required for every test, resulting in recurring purchases and consistent market revenue. As the frequency of animal testing increases across clinics and hospitals, the demand for consumables is expected to follow suit. The trend toward regular checkups and preventive screenings further boosts usage. Additionally, with more diagnostic procedures moving toward rapid and point-of-care formats, consumables tailored for single-use applications are becoming standard, pushing segmental growth.

When analyzed by application, the bacteriology segment emerged as the leading category in 2024 and is expected to reach USD 2.4 billion by 2034. This segment plays a crucial role in detecting bacterial infections in companion animals, which are commonly seen across a wide range of health conditions. From skin and urinary infections to respiratory and gastrointestinal issues, accurate identification of bacterial pathogens is essential for treatment planning. Modern advancements in bacteriological diagnostics, including improved culturing methods and rapid antigen detection, have significantly elevated diagnostic efficiency. The increasing availability of such technologies at both central labs and point-of-care facilities strengthens the position of bacteriology in the diagnostics landscape.

Based on animal type, the dogs segment led the market with a commanding share of 53.7% in 2024. This dominance is attributed to the widespread ownership of dogs as companion animals and the rising investment in their healthcare. The higher frequency of chronic diseases in dogs has resulted in increased demand for diagnostic tests for conditions such as diabetes, kidney disorders, arthritis, and cardiovascular problems. Routine diagnostics have become essential for disease management in dogs, further driving the demand within this segment.

Regarding end use, diagnostic labs held the largest market share in 2024 and are anticipated to expand at a CAGR of 9.1% from 2025 to 2034. These labs are equipped with high-end diagnostic systems and staffed with trained professionals, allowing them to handle large sample volumes efficiently. Their ability to deliver accurate, quick, and comprehensive results makes them a preferred choice for veterinarians seeking reliable diagnostic support. As the number of pet owners increases and more people opt for regular health assessments for their animals, the role of diagnostic labs becomes even more central.

Regionally, North America led the global companion animal diagnostics market with a value of USD 1 billion in 2024, projected to reach USD 2.3 billion by 2034, growing at a CAGR of 8.8%. The U.S. alone accounted for USD 893.3 million in 2024. High pet ownership rates and the widespread availability of cutting-edge diagnostic services drive demand in the region. Additionally, a strong veterinary healthcare network and rising consumer expenditure on animal wellness continue to bolster market performance in North America.

The competitive landscape is shaped by several global and regional players, with key companies such as IDEXX Laboratories, Thermo Fisher Scientific, Zoetis, and Heska Corporation collectively holding around 60% to 65% of the global market. These firms maintain their leadership through broad product portfolios, geographic reach, and continuous investment in research and development. Alongside them, numerous local players are intensifying competition by offering cost-effective diagnostic solutions and expanding their product lines through partnerships, acquisitions, and new product development.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 Animal type

- 2.2.6 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing trend of adopting pet animals

- 3.2.1.2 Rising prevalence of infectious and zoonotic diseases

- 3.2.1.3 Favorable government initiatives

- 3.2.1.4 Advancements in companion diagnostics

- 3.2.1.5 Increasing adoption of pet insurance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Prohibitive cost associated with animal tests

- 3.2.2.2 Low out of pocket expenditure on veterinary care

- 3.2.3 Market opportunities

- 3.2.3.1 Technological advancements and point-of-care molecular tools

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Instruments

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Clinical biochemistry

- 6.2.1 Glucose monitoring

- 6.2.2 Blood gas and electrolyte analysis

- 6.2.3 Other clinical biochemistry tests

- 6.3 Immunodiagnostics

- 6.3.1 Lateral flow assays

- 6.3.2 ELISA

- 6.3.3 Immunoassay analyzers

- 6.3.4 Other immunodiagnostic tests

- 6.4 Molecular diagnostics

- 6.4.1 PCR

- 6.4.2 Microarrays

- 6.4.3 Other molecular diagnostic tests

- 6.5 Hematology

- 6.6 Urinalysis

- 6.7 Other technologies

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Bacteriology

- 7.3 Pathology

- 7.4 Parasitology

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Dogs

- 8.3 Cats

- 8.4 Horses

- 8.5 Other animal types

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Veterinary hospitals and clinics

- 9.3 Diagnostic labs

- 9.4 Home care settings

- 9.5 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Poland

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Colombia

- 10.5.5 Peru

- 10.5.6 Chile

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

- 10.6.5 Egypt

- 10.6.6 Israel

Chapter 11 Company Profiles

- 11.1 bioMerieux

- 11.2 BioNote

- 11.3 Bio-Rad Laboratories

- 11.4 Boehringer Ingelheim International

- 11.5 Heska Corporation (Mars)

- 11.6 Idexx laboratories

- 11.7 KogeneBiotech

- 11.8 Median Diagnostics

- 11.9 Neogen Corporation

- 11.10 Randox

- 11.11 Thermo Fischer Scientific

- 11.12 Virbac

- 11.13 VetAll Laboratories

- 11.14 Qiagen

- 11.15 Zoetis