PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773472

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773472

Lactose-Free Probiotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

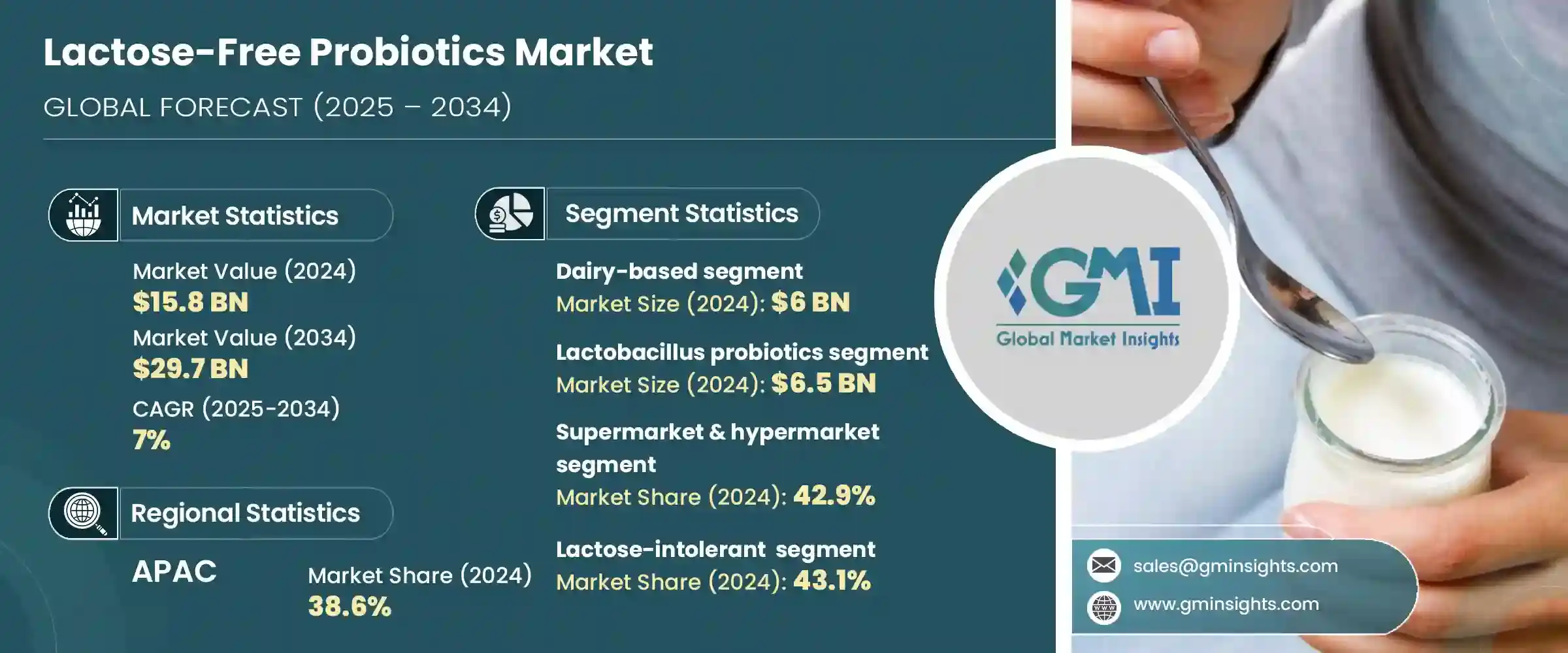

The Global Lactose-Free Probiotics Market was valued at USD 15.8 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 29.7 billion by 2034. These probiotics support digestive and immune health without containing lactose, making them ideal for lactose-intolerant individuals, those allergic to dairy, or people following plant-based diets. The expanding functional food and nutraceutical sector has embraced this category due to consumer interest in gut health and the prevalence of lactose malabsorption. Products such as yogurts, beverages, supplements, and snacks offer probiotic benefits without digestive discomfort. With consumers in North America and Asia-Pacific increasingly demanding healthy, dairy-free alternatives, brands are innovating using plant-based bases like almond, soy, oat, and coconut. There's also growth in shelf-stable capsules and powders featuring strains such as Lactobacillus acidophilus and Bifidobacterium3lactis. The rise of clean-label, allergen-free options, and personalized nutrition is fueling demand.

As awareness around health grows, lactose-free probiotics are becoming essential for wellness-focused consumers. These products not only cater to individuals with lactose intolerance but also appeal to those actively seeking digestive support, immune system benefits, and overall gut health without the discomfort associated with dairy. Consumers are increasingly prioritizing clean-label products and natural ingredients, making lactose-free probiotics a preferred option in daily nutrition. The trend toward preventive healthcare and functional foods has further fueled this demand, as more people view probiotics as a foundational part of a balanced lifestyle. With rising interest in plant-based and allergen-free alternatives, lactose-free probiotics are positioned as a key element in modern dietary habits, reflecting a shift toward more inclusive and health-conscious food choices across age groups.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.8 Billion |

| Forecast Value | $29.7 Billion |

| CAGR | 7% |

Dairy-based lactose-free probiotics segment held a 38.2% share in 2024, representing USD 6 billion. This segment includes lactose-free versions of traditional dairy products like yogurt and kefir, offering familiar textures and flavors enhanced with beneficial strains like Lactobacillus acidophilus and Bifidobacterium lactis. Consumers often choose these options because they provide digestive benefits without sacrificing taste.

The Lactobacillus strain segment generated USD 6.5 billion or 41.1% in 2024. This dominance stems from its proven digestive health benefits and its extensive use in dairy-free yogurts, beverages, and supplement products. Among its varieties, Lactobacillus acidophilus is especially popular for supporting gut wellness and aiding digestion in lactose-sensitive individuals.

Asia-Pacific Lactose-Free Probiotics Market held 38.6% in 2024, propelled by widespread lactose intolerance and growing awareness of gut health, rising urbanization, and increased disposable income. Countries in this region are investing in nutritional research and product development, especially in probiotic-rich foods and baby nutrition. The combination of scientific innovation, regulatory incentives, and consumer demand has positioned the region at the forefront of lactose-free probiotic growth.

Key players in the industry include Danone S.A., Probi AB, Nestle S.A., Chr. Hansen Holding A/S, and Yakult Honsha Co., Ltd., are all known for their leadership in product innovation and distribution. Leading companies in the lactose-free probiotics market are pursuing innovation, portfolio expansion, and strategic partnerships to enhance their footprint. Firms are investing in R&D to develop new strains and delivery formats-such as plant-based yogurts, ready-to-drink formulations, and eco-friendly packaging-to meet clean-label and personalized nutrition demands. Collaboration with research institutions and clinical trials helps validate health claims, strengthening consumer trust. Manufacturers are also forging alliances with retailers and direct-to-consumer channels to expand market access. Geographic expansion into emerging markets is supported by localized product lines and culturally tailored marketing.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly Initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dairy-based lactose-free probiotics

- 5.2.1 Yogurt

- 5.2.2 Kefir

- 5.2.3 Cheese

- 5.2.4 Ice cream

- 5.2.5 Others

- 5.3 Plant-based probiotics

- 5.3.1 Soy-based

- 5.3.2 Almond-based

- 5.3.3 Coconut-based

- 5.3.4 Oat-based

- 5.3.5 Others

- 5.4 Fruit-based probiotics

- 5.4.1 Juices

- 5.4.2 Smoothies

- 5.4.3 Others

- 5.5 Probiotic supplements

- 5.5.1 Capsules

- 5.5.2 Tablets

- 5.5.3 Powders

- 5.5.4 Liquids

- 5.5.5 Others

Chapter 6 Market Estimates and Forecast, By Probiotic Strain, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Lactobacillus

- 6.2.1 L. acidophilus

- 6.2.2 L. rhamnosus

- 6.2.3 L. plantarum

- 6.2.4 Others

- 6.3 Bifidobacterium

- 6.3.1 B. bifidum

- 6.3.2 B. longum

- 6.3.3 B. lactis

- 6.3.4 Others

- 6.4 Streptococcus

- 6.4.1 S. thermophilus

- 6.4.2 Others

- 6.5 Bacillus

- 6.5.1 B. coagulans

- 6.5.2 B. subtilis

- 6.5.3 Others

- 6.6 Saccharomyces

- 6.6.1 S. boulardii

- 6.6.2 Others

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Supermarkets & hypermarkets

- 7.3 Specialty stores

- 7.4 Pharmacies & drugstores

- 7.5 Online retail

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Lactose-intolerant individuals

- 8.3 Health-conscious consumers

- 8.4 Elderly population

- 8.5 Children & infants

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Digestive health

- 9.3 Immune support

- 9.4 Weight management

- 9.5 Women's health

- 9.6 Pediatric health

- 9.7 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Nestle S.A.

- 11.2 Danone S.A.

- 11.3 Yakult Honsha Co., Ltd.

- 11.4 Chr. Hansen Holding A/S

- 11.5 Probi AB

- 11.6 BioGaia AB

- 11.7 Lifeway Foods, Inc.

- 11.8 General Mills, Inc. (Yoplait)

- 11.9 Fonterra Co-operative Group

- 11.10 Kerry Group

- 11.11 Lallemand Inc.

- 11.12 DSM

- 11.13 DuPont (IFF)

- 11.14 Morinaga Milk Industry Co., Ltd.

- 11.15 Bifodan A/S

- 11.16 Probiotical S.p.A.

- 11.17 Winclove Probiotics

- 11.18 Biosearch Life

- 11.19 Culturelle (i-Health, Inc.)

- 11.20 GoodBelly (NextFoods, Inc.)

- 11.21 Ganeden, Inc. (Kerry)

- 11.22 Attune Foods

- 11.23 Valio Ltd.

- 11.24 Arla Foods

- 11.25 Organic Valley

- 11.26 Stonyfield Farm, Inc.

- 11.27 Meiji Holdings Co., Ltd.

- 11.28 Chobani, LLC

- 11.29 Yili Group

- 11.30 Mengniu Dairy