PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773475

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773475

Chalcogenides (MoS2, WS2, WSe2) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

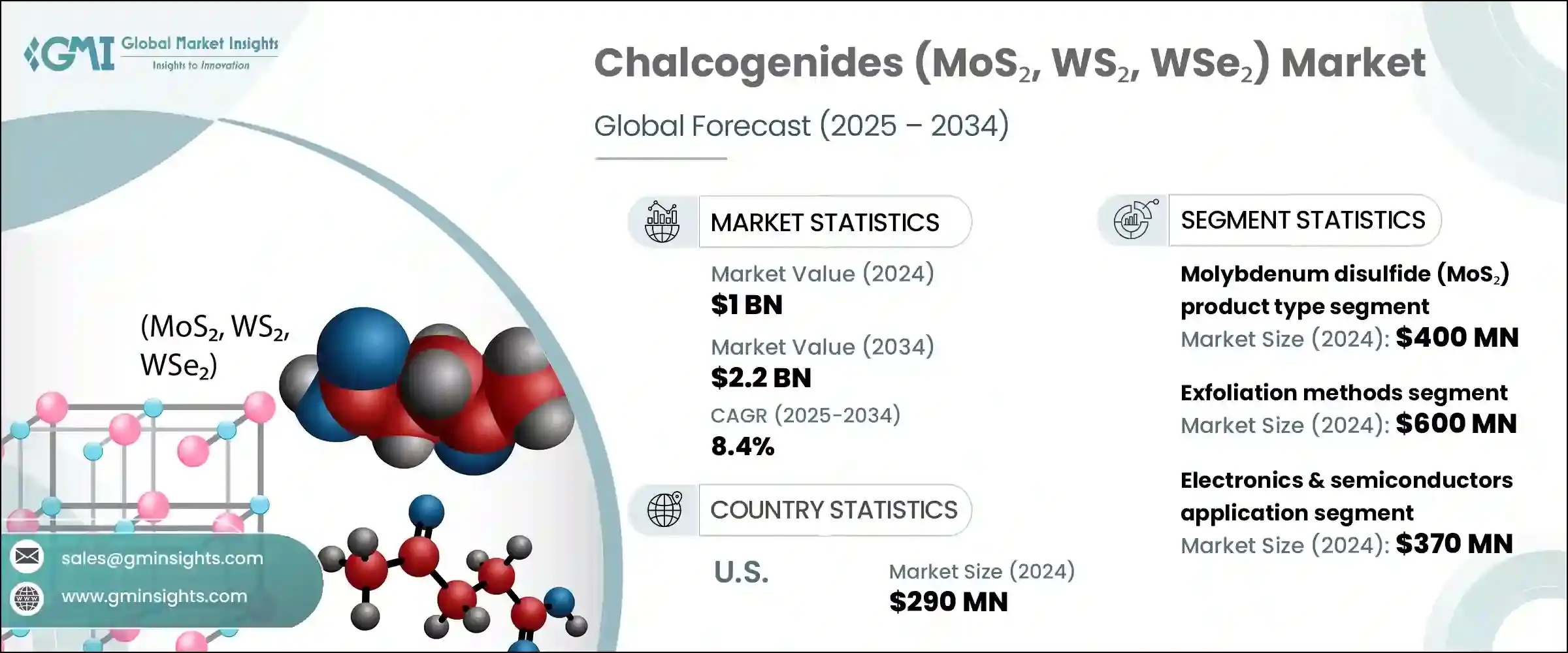

The Global Chalcogenides (MoS2, WS2, WSe2) Market was valued at USD 1 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 2.2 billion by 2034. This steady growth reflects broader momentum in the advanced materials sector, which is being propelled by developments in nanotechnology and the increasing demand for high-performance, energy-efficient solutions across several verticals. These layered transition metal dichalcogenides have become key enablers in future electronics due to their exceptional electrical, mechanical, and optical behavior. As traditional silicon-based technologies encounter physical and scaling limitations, these 2D materials are emerging as promising alternatives in applications such as miniaturized electronics, flexible devices, and high-speed transistors. The growing interest in compact and power-efficient hardware is particularly relevant in sectors like aerospace, defense, telecommunications, and medical devices.

Government-backed R&D initiatives across regions, including the US, Asia-Pacific, and the EU, are providing crucial financial and institutional support to push next-generation material innovation. This includes establishing national innovation centers, funding pilot manufacturing hubs, and supporting the commercialization of lab-scale research. Public-private partnerships are intensifying, particularly in the semiconductor and renewable energy domains, where the integration of 2D semiconductors into flexible substrates is becoming more feasible. The industry is responding to the growing demand for faster, smaller, and energy-optimized chips, where materials such as MoS2 and WS2 offer considerable performance advantages over legacy materials due to their tunable bandgap and superior carrier mobility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 billion |

| Forecast Value | $2.2 billion |

| CAGR | 8.4% |

Among fabrication techniques, the exfoliation methods segment generated USD 0.6 billion in 2024 and is predicted to grow at a CAGR of 7.9% through 2034. While exfoliation remains critical for research-grade materials and prototypes, chemical vapor deposition (CVD) is increasingly dominating scalable production due to its ability to yield uniform and high-quality thin films compatible with commercial-grade semiconductor processes. CVD enables precise layer control, broad substrate compatibility, and reproducibility at industrial volumes, which positions it as the technology of choice for transitioning from R&D to high-throughput electronics manufacturing. Many fabrication labs and pilot facilities have adopted CVD, underlining its pivotal role in bridging lab innovations with commercial-scale applications in nanomaterials.

The electronics & semiconductor segment generated notable revenues in 2024. Their unique band structure and semiconducting properties make them excellent candidates for advanced field-effect transistors, memory devices, and thin-film logic circuits. These materials allow for unprecedented flexibility and ultra-thin architectures, making them highly desirable for next-gen wearable technology, integrated photonics, and soft robotics. Researchers have already reported switching behaviors and threshold performances that match or exceed those of scaled silicon-based devices, which is pushing major semiconductor manufacturers to explore these 2D alternatives as they approach post-Moore's Law design eras.

United States Chalcogenides (MoS2, WS2, and WSe2) Market is estimated to grow at a notable CAGR during 2025-2034, driven by R&D, especially for applications in quantum technology and defense-grade semiconductors. Although bulk materials like MoS2 and WSe2 are largely imported from Asia, the U.S. leads in downstream development and integration, exporting value-added derivatives to international markets. High-tech industries in the U.S. utilize these materials in cutting-edge prototyping, pushing boundaries in optoelectronics, photonics, and next-generation transistor architecture. Companies such as ACS Material and 2D Tech play a critical role in enabling domestic research efforts, while large defense contractors and electronics manufacturers drive demand for these high-performance nanomaterials.

Prominent industry players operating in the Global Chalcogenides (MoS2, WS2, WSe2) market include SixCarbon Technology, Graphene Laboratories Inc., American Elements, ACS Material LLC, and XFNANO Materials Tech Co., Ltd. These companies are integral to both material synthesis and supply chain development. To enhance their market position and expand global reach, leading firms in the chalcogenides industry are leveraging several strategies. They are scaling up production capabilities to meet growing industrial and commercial demand while continuing to invest in high-precision material characterization and customization. Collaborations with academic institutions and national laboratories help foster cutting-edge innovation, particularly in quantum applications and flexible electronics. Key players are also entering strategic partnerships with device manufacturers to co-develop application-specific solutions using 2D materials.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Molybdenum Disulfide (MoS2)

- 5.3 Tungsten Disulfide (WS2)

- 5.4 Tungsten Diselenide (WSe2)

- 5.5 Heterostructures & Hybrids

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Synthesis & Manufacturing Technologies, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Exfoliation methods

- 6.2.1 Mechanical exfoliation

- 6.2.2 Liquid-phase exfoliation

- 6.2.3 Electrochemical exfoliation

- 6.2.4 Intercalation-assisted exfoliation

- 6.2.5 Others

- 6.3 Chemical vapor deposition (CVD)

- 6.3.1 Conventional CVD processes

- 6.3.2 Metal-organic CVD (MOCVD)

- 6.4 Physical vapor deposition (PVD)

- 6.4.1 Sputtering techniques

- 6.4.2 Pulsed laser deposition

- 6.4.3 Scalable production methods

- 6.5 Chemical synthesis routes

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Electronics & semiconductors

- 7.2.1 Field-effect transistors (FETs)

- 7.2.2 Logic gates & circuits

- 7.2.3 Memory devices

- 7.2.4 Flexible electronics

- 7.2.5 Others

- 7.3 Optoelectronics & photonics

- 7.3.1 Photodetectors

- 7.3.2 Light-emitting diodes (LEDs)

- 7.3.3 Electroluminescent devices

- 7.3.4 Solar cells / photovoltaics

- 7.3.5 Others

- 7.4 Energy storage & conversion

- 7.4.1 Rechargeable batteries

- 7.4.2 Supercapacitors

- 7.4.3 Hydrogen evolution reaction (HER) catalysts

- 7.4.4 Co2 reduction catalysts

- 7.4.5 Thermoelectric devices

- 7.4.6 Fuel cells

- 7.4.7 Others

- 7.5 Sensors & detectors

- 7.5.1 Gas sensors

- 7.5.2 Biosensors

- 7.5.3 Pressure & strain sensors

- 7.5.4 Others

- 7.6 Quantum technologies

- 7.7 Tribology & lubricants

- 7.8 Biomedical applications

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 2D Semiconductors

- 9.2 6Carbon Technology

- 9.3 ACS Material, LLC

- 9.4 Applied Nanolayers B.V.

- 9.5 Grolltex Inc.

- 9.6 HQ Graphene

- 9.7 Muke Nano

- 9.8 Nanoshel LLC

- 9.9 SixCarbon Technology

- 9.10 Ossila Ltd.

- 9.11 SVT Associates, Inc.

- 9.12 Tungsten Compounds GmbH

- 9.13 XFNANO Materials Tech Co., Ltd.

- 9.14 Intelligent Materials Pvt. Ltd.

- 9.15 American Elements

- 9.16 Graphene Laboratories Inc.

- 9.17 MSE Supplies LLC

- 9.18 Sigma-Aldrich (Merck KGaA)

- 9.19 Stanford Advanced Materials

- 9.20 Edgetech Industries LLC