PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773477

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773477

Shotcrete Spray Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

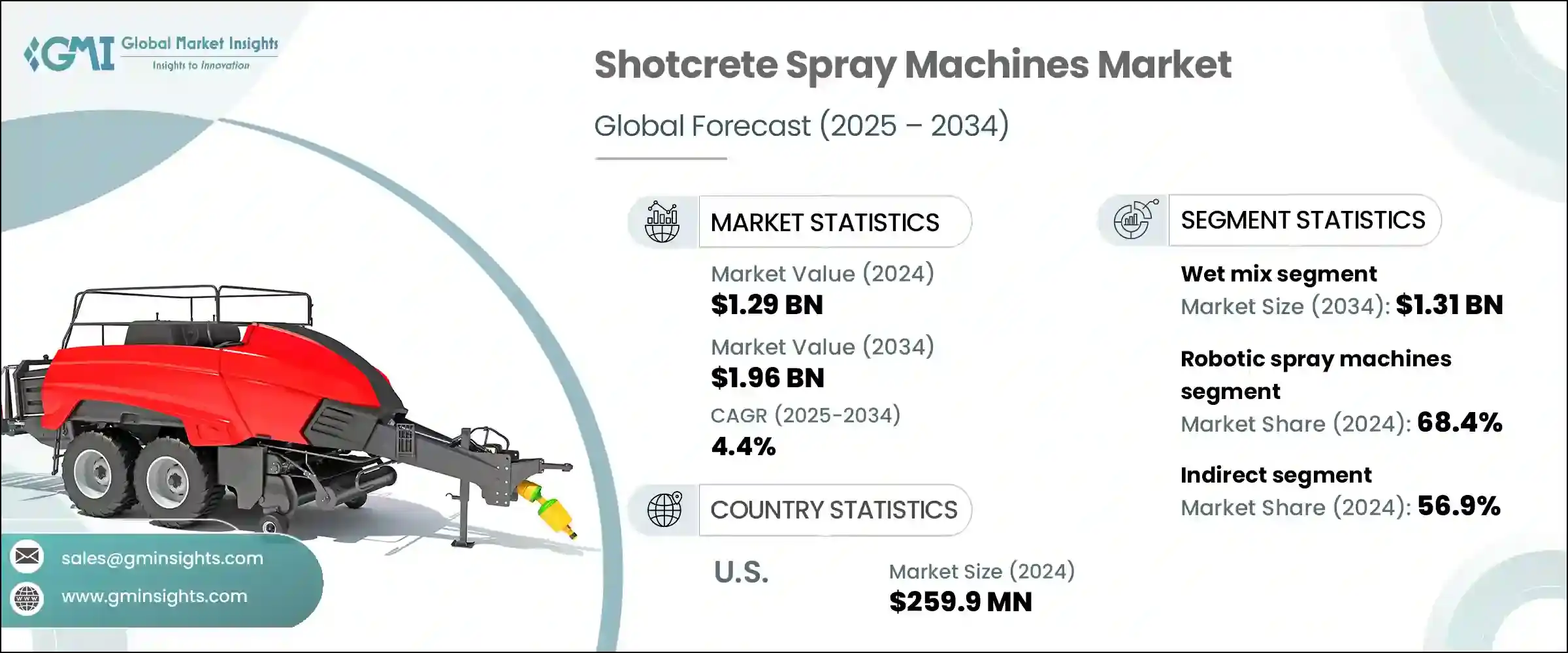

The Global Shotcrete Spray Machines Market was valued at USD 1.29 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 1.96 billion by 2034. This growth is fueled by accelerating urban development and robust infrastructure investments. With the United Nations projecting that nearly two-thirds of the global population will live in urban settings by 2050, governments and builders are focusing on efficient, space-saving construction methods. Shotcrete spray machines have become critical in meeting these demands, especially in tunnel lining and underground stabilization applications.

Countries across Asia and Europe are significantly funding transit tunnels, underground utilities, and infrastructure corridors. As a result, demand is rapidly shifting toward robotic shotcrete sprayers that deliver fast application, superior surface adhesion, and access to confined zones. These automated solutions offer consistent spraying accuracy while minimizing manual labor requirements and improving safety standards. Labor shortages and stricter safety regulations in regions like North America and Europe are further driving the adoption of robotic systems. The rise of automated and remote-controlled shotcrete equipment is transforming worksite operations by boosting speed, precision, and overall job site efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.29 Billion |

| Forecast Value | $1.96 Billion |

| CAGR | 4.4% |

The wet-mix process segment generated USD 846.3 million in 2024 and is expected to reach USD 1.31 billion by 2034. Wet-mix shotcrete has rapidly become the preferred application method across large-scale projects due to its uniform consistency and enhanced compressive strength, which typically ranges between 4,000 to 7,000 psi. Since all materials are pre-mixed before spraying, this process ensures a smooth and even application with minimal material loss. Rebound rates stay well below 10%, resulting in cleaner job sites, better quality output, and reduced waste, which together contribute to project cost savings and safer environments.

The robotic spray machines segment held a 68.4% share in 2024 and is projected to grow at a CAGR of 4.7% from 2025 through 2034. These advanced systems are setting new benchmarks in the industry by delivering highly uniform layers and reducing operator exposure to hazardous overhead zones. Many systems offer positioning precision within +-5 mm, ensuring consistent quality. Capable of spraying up to 20 cubic meters per hour, robotic sprayers can shorten project timelines by nearly a quarter while lowering labor costs. Suppliers like Normet and Aliva are integrating smart features that automate nozzle movement and provide live data feedback to optimize performance and surface finish.

U.S. Shotcrete Spray Machines Market was valued at USD 259.9 million in 2024 and is forecast to grow at a CAGR of 4.4% through 2034. Aging infrastructure and a focus on repair and rehabilitation continue to drive demand across transportation and public works sectors. In parallel, steady activity in housing and commercial development has supported additional demand for efficient spraying systems. The market shows a clear preference for robotic wet-mix equipment in large-scale construction projects, underpinned by an increasing focus on productivity and workplace safety. Within North America, Canada is also gaining traction due to growing investments in underground urban development and resource mining projects.

Prominent companies shaping the Shotcrete Spray Machines Industry include YG Machinery, Normet, Filamos, Sika, Reed, JUHE Group, Putzmeister, Gunite Supply & Equipment, CIFA, Epiroc Deutschland, Tunelmak, Gengli, Leadcrete, Blastcrete, and MacLean Engineering. Leading manufacturers in the shotcrete spray machines market are focusing on expanding their product portfolios with automation-driven models that enhance safety and efficiency. Strategic collaborations with infrastructure contractors allow them to deliver application-specific solutions that meet evolving regulatory standards. Companies are also investing in R&D to integrate AI-based control systems, improve precision spraying, and reduce operator dependency. Global players are strengthening their supply chains in high-growth regions through distributor partnerships and service networks to ensure quicker delivery and post-sale support. Some firms are offering modular equipment designs and remote diagnostics to optimize maintenance and lifespan.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Mechanism

- 2.2.4 Mobility

- 2.2.5 Application

- 2.2.6 End use

- 2.2.7 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and Innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's five forces analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Wet mix

- 5.3 Dry mix

Chapter 6 Market Estimates & Forecast, By Mechanism, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual spray machines

- 6.3 Robotic spray machines

Chapter 7 Market Estimates & Forecast, By Mobility, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Stationary

- 7.3 Mobile

- 7.3.1 Trailer mounted

- 7.3.2 Truck mounted

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Mining

- 8.3 Tunneling

- 8.4 Building construction

- 8.5 Water retaining structures

- 8.6 Repair works

- 8.7 Others (slope stabilization, military installation, etc.)

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Construction & mining companies

- 9.3 Government agencies

- 9.4 Others (rental agencies, contractors, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution channel, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 UAE

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Blastcrete

- 12.2 CIFA

- 12.3 Epiroc Deutschland

- 12.4 Filamos

- 12.5 Gengli

- 12.6 Gunite Supply & Equipment

- 12.7 JUHE Group

- 12.8 Leadcrete

- 12.9 MacLean Engineering

- 12.10 Normet

- 12.11 Putzmeister

- 12.12 Reed

- 12.13 Sika

- 12.14 Tunelmak

- 12.15 YG Machinery