PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773478

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773478

Plenoptic Camera Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

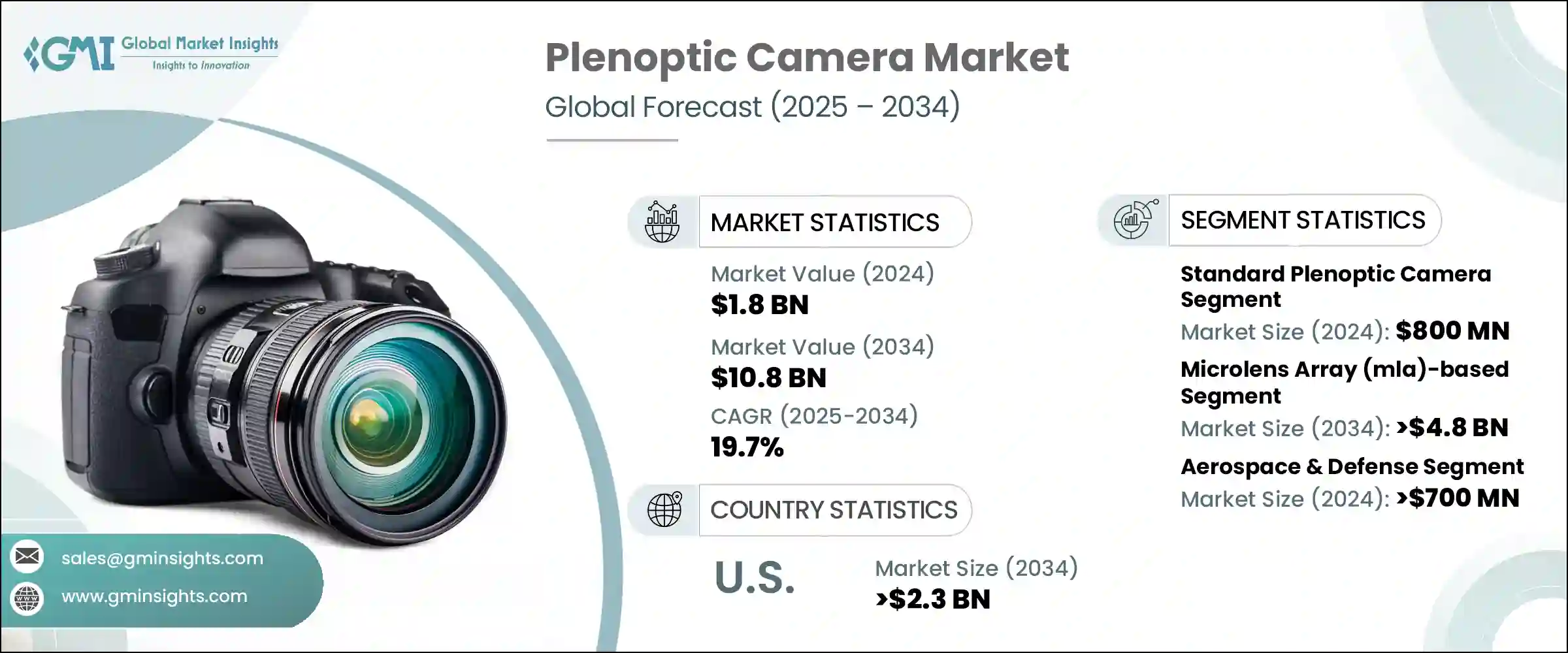

The Global Plenoptic Camera Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 19.7% to reach USD 10.8 billion by 2034. Advancements in imaging systems, especially in microlens and camera array technologies, are reshaping how high-resolution visuals with deep spatial information are captured. Growing adoption across industrial automation, consumer electronics, medical diagnostics, and immersive media is fueling market growth. These cameras empower users with unique features like post-capture refocusing and 3D imaging, making them attractive for applications in AR/VR, robotics, and machine vision.

As computational photography gains ground, integration into smartphones and medical devices is becoming more common. Additionally, ongoing investments in R&D by startups and tech leaders are pushing the boundaries of plenoptic imaging systems, further driving momentum. The tariff conflict initiated during the Trump administration has created pricing challenges for manufacturers relying on imported components. As the cost of essential parts rises, manufacturers in the U.S. either face reduced margins or must pass price increases to customers. Without viable domestic alternatives, these companies are under pressure to optimize production costs or shift sourcing strategies to remain competitive.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $10.8 Billion |

| CAGR | 19.7% |

The standard plenoptic cameras segment was valued at USD 800 million in 2024. These cameras feature a microlens array placed between the main lens and the sensor to record both spatial and angular light data. This configuration produces 4D plenoptic data, enabling users to adjust focus or perspective after capture. These capabilities make standard plenoptic cameras ideal for research, creative media, and photography, where image depth and post-processing flexibility matter. However, the need to balance angular and spatial resolution continues to influence image clarity.

The microlens array (MLA)-based camera segment is poised to reach USD 4.8 billion by 2034. These systems use a microlens array placed between the primary lens and sensor to trap light from multiple directions, transforming flat 2D captures into detailed plenoptic images. This imaging method supports functions like post-capture refocusing and depth mapping, which are essential in fields such as film production, scientific research, and virtual visualization. The ability to replicate light ray pathways through MLA offers users a rich, immersive viewing experience with enhanced depth and precision.

United States Plenoptic Camera Market is expected to reach USD 2.3 billion by 2034. The country remains a vital contributor to global demand thanks to its robust technological landscape and innovation-driven ecosystem. Strong interest in AR and VR technologies continues to elevate the demand for cameras capable of creating immersive and responsive visual environments. With advanced research centers and the rapid adoption of futuristic imaging tools, the U.S. is expected to maintain its dominance in this space.

Key players influencing the market include Canon Inc., Adobe Inc., Apple Inc., Raytrix GmbH, and Google LLC, who collectively drive innovation and technological leadership. Leading companies in the plenoptic camera market are strengthening their foothold by prioritizing innovation and expanding their application scope. They are increasing R&D investments to develop next-generation imaging solutions that offer enhanced depth mapping, real-time 3D rendering, and post-capture editing capabilities. Strategic partnerships with firms in the AR/VR, healthcare, and autonomous systems sectors are also gaining traction. These collaborations allow companies to tailor their plenoptic technologies for specific use cases. Additionally, firms are focusing on software integration and edge computing compatibility to boost real-time performance.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Advancements in imaging technology

- 3.3.3 Growing demand for immersive content (VR/AR)

- 3.3.4 Increasing use in medical imaging

- 3.3.5 Rising adoption in industrial applications (machine vision, robotics)

- 3.3.6 Integration into consumer electronics

- 3.3.7 Industry pitfalls and challenges

- 3.3.8 High production costs

- 3.3.9 Limited consumer awareness and understanding of the technology

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Standard plenoptic camera (e.g., lytro illum)

- 5.2 Focused plenoptic camera

- 5.3 Coded aperture plenoptic camera

- 5.4 Stereo plenoptic camera

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion)

- 6.1 Microlens array (mla)-based

- 6.2 Multi-aperture imaging

- 6.3 Plenoptic imaging

- 6.4 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 7.1 Aerospace & defense

- 7.2 Automotive & transportation

- 7.3 Electronics & semiconductors

- 7.4 Healthcare & life sciences

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Adobe Inc.

- 9.2 Apple Inc.

- 9.3 Avegant Corporation

- 9.4 Canon Inc.

- 9.5 FoVI 3D, Inc.

- 9.6 Google LLC

- 9.7 Japan Display Inc.

- 9.8 OTOY Inc.

- 9.9 Panasonic Corporation

- 9.10 Raytrix GmbH (Germany)

- 9.11 Ricoh Innovations Corporation

- 9.12 Samsung Electronics Co., Ltd.

- 9.13 Sony Group Corporation

- 9.14 Xiaomi Corporation