PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773482

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1773482

Planting and Fertilizing Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

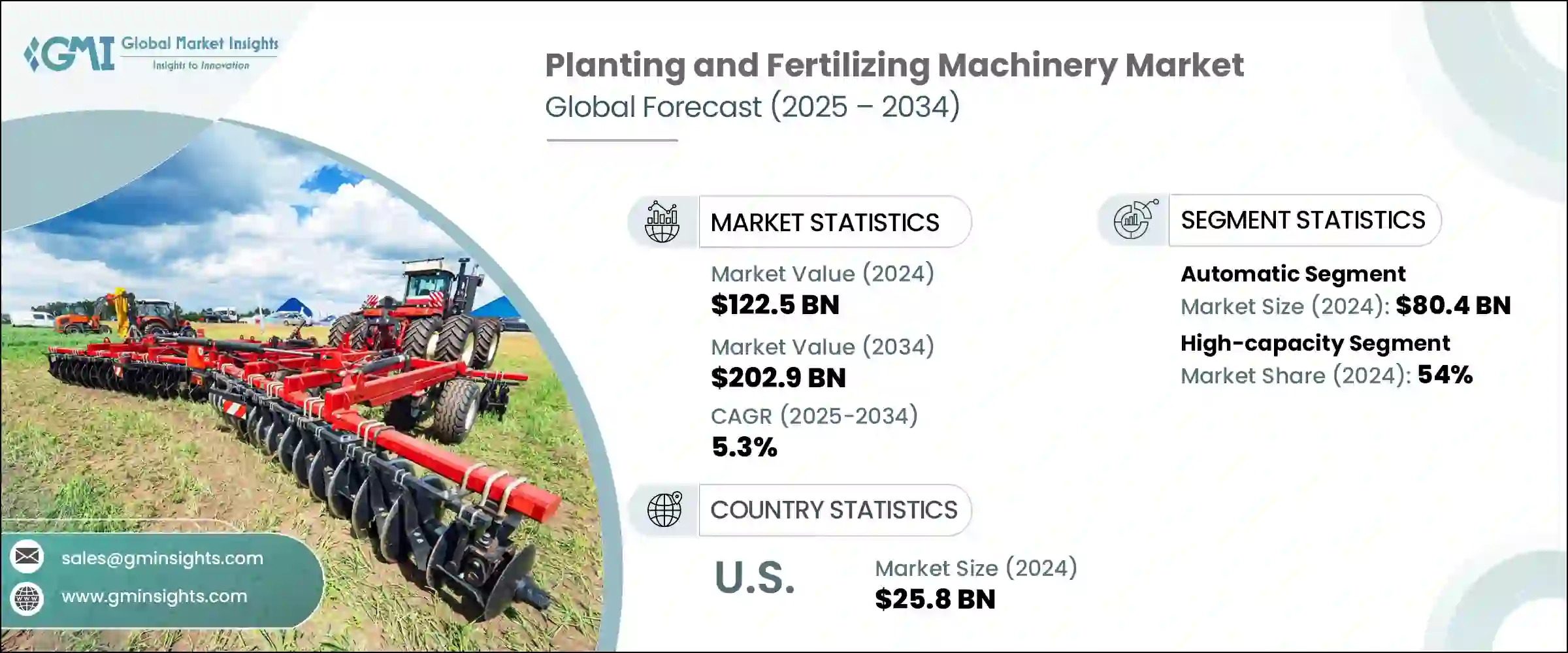

The Global Planting and Fertilizing Machinery Market was valued at USD 122.5 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 202.9 billion by 2034. This growth is primarily attributed to the ongoing transformation of agricultural practices, as traditional manual methods are increasingly being replaced by modern mechanized systems. In many developing and transitioning economies, rising labor costs and persistent labor shortages are compelling farm operators to shift towards machinery that can perform tasks more efficiently and with greater accuracy. The demand for equipment that can accelerate seeding and fertilization while reducing human input is growing rapidly, driven by the need for timely operations and higher yields.

Mechanization is also playing a vital role in promoting sustainable agricultural practices. Advanced planting and fertilizing machines reduce seed and fertilizer waste through precise application, minimizing environmental impact while improving overall productivity. The appeal of mechanized tools lies not just in labor savings, but in their ability to enhance input efficiency-helping growers produce more using fewer resources. As agriculture becomes increasingly data-driven, stakeholders across the value chain-including manufacturers, farm operators, and policymakers-are showing stronger interest in adopting machinery that supports high-efficiency and precision farming. The integration of digital technologies, such as smart control systems and GPS guidance, is further enhancing the capabilities of this equipment, making it a cornerstone of modern agriculture. Increased global food demand, coupled with the need to produce more with less, is making investment in planting and fertilizing machinery a strategic priority for many countries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $122.5 Billion |

| Forecast Value | $202.9 Billion |

| CAGR | 5.3% |

Within the market, in 2024, automatic planting and fertilizing machinery led the market with a revenue of USD 80.4 billion and is projected to grow at a CAGR of 5.7% over the forecast period. This segment continues to gain traction as farm businesses adopt solutions that offer greater precision and less margin for error. Automatic machines are equipped with advanced technologies that support real-time decision-making, variable-rate application, and geolocation-based operations. These features contribute to more uniform planting, optimized fertilizer distribution, and increased crop yields, making automation an appealing option for farms aiming to scale sustainably.

Farmers are steadily favoring automated machinery due to its ability to reduce labor dependency and operational inefficiencies. These systems allow better control over field conditions, promote smart input use, and support a higher level of crop management, which translates into better returns and long-term cost savings. As a result, this segment is expected to capture even greater market share in the coming years.

Based on capacity, in 2024, high-capacity machinery accounted for the largest share of the market, commanding 54%, and is forecasted to grow at a CAGR of 5.6% between 2025 and 2034. The growing preference for high-capacity equipment reflects the ongoing trend toward large-scale farming operations that demand faster execution and higher throughput. These machines are designed to operate efficiently across vast tracts of land, reducing downtime and maximizing field coverage. Their superior design and integration with modern control systems allow for rapid deployment and enhanced field performance, making them essential tools for commercial farms looking to meet increasing production targets.

From a regional perspective, the United States represented a dominant force in the North American market in 2024, holding approximately 76% of the regional share and generating USD 25.8 billion in revenue. The domestic market has embraced the transition to precision-based agriculture with strong enthusiasm, supported by infrastructure, research, and policy that promote agricultural innovation. Farmers in the U.S. are adopting advanced machinery that features real-time sensors, GPS-enabled tracking, and semi-autonomous autonomous systems that make operations less labor-intensive and more productive. The shift toward technology-driven agriculture is also helping producers minimize costs associated with excess seed and fertilizer usage while meeting regulatory expectations around environmental conservation and resource use.

Key players in the global planting and fertilizing machinery market are actively pursuing strategic initiatives such as mergers, acquisitions, and collaborative ventures to stay ahead of market trends. They are also investing significantly in R&D to develop machinery that aligns with evolving customer needs and technological advancements. By expanding their product portfolios and global reach, these companies are working to meet the growing demand for smarter, more efficient agricultural solutions. Their efforts are helping drive innovation and offer scalable solutions that support global food security objectives.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Operation

- 2.2.4 Capacity

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global food demand

- 3.2.1.2 Mechanization of agriculture

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial capital investment

- 3.2.2.2 Environmental and regulatory pressure

- 3.2.3 Opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Planting machinery

- 5.2.1 Broadcast seeders

- 5.2.2 Air seeders

- 5.2.3 Planters

- 5.2.4 Drill seeders

- 5.2.5 Others(transplanters, etc.)

- 5.3 Fertilizing machinery

- 5.3.1 Broadcast spreaders

- 5.3.2 Drop spreaders

- 5.3.3 Liquid sprayers

- 5.3.4 Granular applicators

- 5.3.5 Others(fertigation systems, etc.)

Chapter 6 Market Estimates & Forecast, By Operation, 2021 - 2034 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Automatic

Chapter 7 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Low capacity

- 7.3 Mid capacity

- 7.4 High capacity

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Family-owned farms

- 8.3 Large-scale commercial farms

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Billion, Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AGCO

- 11.2 Amazon

- 11.3 CLAAS

- 11.4 CNH Industrial

- 11.5 Deutz-Fahr Group

- 11.6 CNH Industrial

- 11.7 Kinze Manufacturing

- 11.8 Kubota

- 11.9 Kverneland

- 11.10 Lemken

- 11.11 Mahindra & Mahindra

- 11.12 Maschio Gaspardo

- 11.13 Salford Group

- 11.14 Vaderstad

- 11.15 Yanmar