PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782087

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782087

Sales Enablement Platform Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

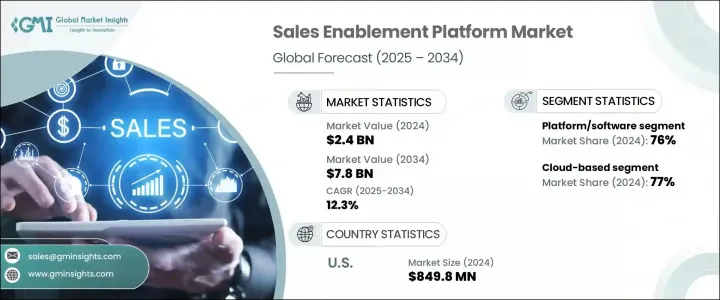

The Global Sales Enablement Platform Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 12.3% to reach USD 7.8 billion by 2034. As enterprises increasingly prioritize empowering their sales teams with intelligent tools, actionable insights, and personalized content, this market continues to gain traction. Sales enablement platforms are now essential for creating alignment between marketing and sales by delivering contextual messaging across each stage of the buyer journey. These solutions are being embraced to drive consultative selling, improve deal conversion rates, and accelerate sales cycles in a landscape where B2B buyers are more digitally informed than ever. Companies are leveraging these platforms not only to increase efficiency but also to remain agile and competitive in rapidly evolving markets.

The evolution of sales enablement platforms into AI-enhanced ecosystems is changing the way organizations manage sales execution. These platforms now offer dynamic coaching capabilities, CRM integration, and predictive analytics that support smarter selling strategies. Sellers benefit from automated content delivery, opportunity scoring, and intelligent workflows that allow them to take fast, informed actions. This intelligent automation is fueling demand across global businesses, reshaping how sales teams engage buyers, shorten pipelines, and maintain consistency in customer interactions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $7.8 Billion |

| CAGR | 12.3% |

In 2024, the software/platform solutions segment captured 76% share, expected to grow at 13% CAGR through 2034. This growth is rooted in rising dependence on digital solutions that simplify sales training, centralize sales assets, and deliver performance metrics in real time. Businesses are increasingly adopting cloud-based tools that require minimal infrastructure while allowing flexible access to scalable enablement strategies.

The cloud-based deployment models segment accounted for 77% share in 2024. Cloud solutions are preferred due to their seamless scalability, faster implementation, and ability to support globally distributed sales teams. They are particularly suited to hybrid and remote work environments, enabling 24/7 access to tools and fostering collaboration across regions without the burden of heavy IT support.

U.S. Sales Enablement Platform Market generated USD 849.8 million and held 85% share in 2024. This dominance stems from the country's rapid adoption of enterprise tech, mature business ecosystem, and the growing emphasis on sales performance and digital-first engagement strategies. From manufacturing and finance to tech and telecom, businesses across the U.S. are integrating enablement platforms that combine training, real-time analytics, personalized content, and coaching into one streamlined system. The market here remains a benchmark for global innovation and enablement leadership.

Key players dominating the Global Sales Enablement Platform Industry include Allego, MindTickle, Outreach, Seismic, and Showpad. Key strategies used by companies to strengthen their foothold in the sales enablement platform market include expanding their product ecosystems through AI-powered features, enhancing CRM and third-party software integrations, and focusing on hyper-personalized user experiences. Leading firms are also investing in acquisitions, strategic alliances, and global expansions to increase their platform visibility and market penetration. Continuous innovation in training tools, content automation, and performance analytics has helped top players stay competitive and attract enterprise clients across varied sectors. Tailored deployment options, multilingual support, and scalable onboarding workflows further support customer retention and global reach.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment Mode

- 2.2.4 Organization Size

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Remote and hybrid work models

- 3.2.1.2 Integration with CRM and marketing automation

- 3.2.1.3 Analytics and performance insights

- 3.2.1.4 Demand for personalized buyer experiences

- 3.2.1.5 Digital transformation in sales

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High implementation costs

- 3.2.2.2 Data privacy and security concerns

- 3.2.3 Market opportunities

- 3.2.3.1 AI and automation integration

- 3.2.3.2 Remote and hybrid workforce support

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability and environmental aspects

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly initiatives

- 3.9.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Platform/software

- 5.2.1 Content management

- 5.2.2 Training and coaching

- 5.2.3 Sales analytics and reporting

- 5.2.4 CRM integration

- 5.2.5 Communication tools

- 5.2.6 AI-powered recommendations

- 5.3 Services

- 5.3.1 Professional services

- 5.3.2 Managed services

- 5.3.3 Support & maintenance

- 5.3.4 Training & education

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Cloud-based

- 6.3 On-premises

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Large enterprise

- 7.3 SME

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 Healthcare & life sciences

- 8.4 IT & telecom

- 8.5 Manufacturing

- 8.6 Media & entertainment

- 8.7 Consumer goods and retail

- 8.8 Education

- 8.9 Travel & hospitality

- 8.10 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Allego

- 10.2 Bigtincan

- 10.3 Brainshark

- 10.4 ClearSlide

- 10.5 Cloze

- 10.6 DocSend

- 10.7 Guru

- 10.8 Highspot

- 10.9 Mediafly

- 10.10 Mindtickle

- 10.11 Outreach

- 10.12 Pitcher G

- 10.13 Qstream

- 10.14 Sales Gravy

- 10.15 SalesHood

- 10.16 Seismic

- 10.17 Showpad

- 10.18 Upland Software