PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782095

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782095

Thrust Vector Control Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

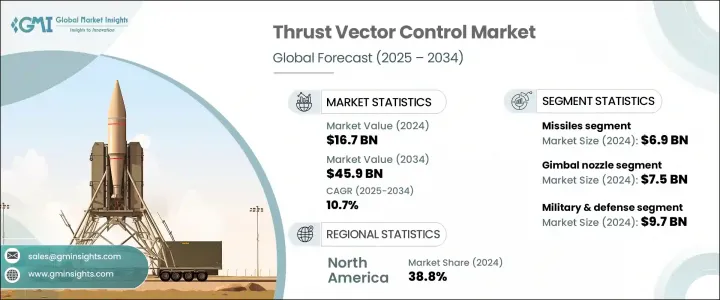

The Global Thrust Vector Control Market was valued at USD 16.7 billion in 2024 and is estimated to grow at a CAGR of 10.7% to reach USD 45.9 billion by 2034. The increasing adoption of advanced propulsion systems across the aerospace and defense industries is a primary factor driving the growth of this market. Governments and defense agencies worldwide are increasing their investments in technologies that enhance missile precision, launch flexibility, and in-flight maneuverability. As countries continue to prioritize modern warfare capabilities and space exploration programs, the demand for efficient and responsive flight control systems has intensified. TVC systems, which allow for real-time redirection of engine thrust, are becoming essential in both atmospheric and exo-atmospheric missions.

One of the significant forces behind this growth is the continued emphasis on precision-guided munitions and high-speed flight capabilities. Modern warfare increasingly relies on fast, responsive missile systems that can evade enemy defenses and strike with accuracy. Thrust vector control technologies make these abilities possible by allowing mid-flight directional changes, trajectory adjustments, and improved aerodynamic performance. Additionally, growing private sector participation in satellite deployment and orbital missions has fueled demand for launch systems that rely heavily on TVC for stage separation and orbital insertion accuracy. Innovations in aerospace propulsion are also pushing manufacturers to adopt more sophisticated vectoring technologies that reduce drag, enhance fuel efficiency, and provide greater navigational control in challenging conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.7 Billion |

| Forecast Value | $45.9 Billion |

| CAGR | 10.7% |

In 2024, missiles represented the largest application segment in the market, accounting for USD 6.9 billion. The increasing need for accurate target engagement, improved control during atmospheric reentry, and the deployment of next-gen interceptor systems is accelerating the use of TVC mechanisms in missile platforms. These systems enable fast redirection and adaptive movement in air-to-air, surface-to-air, and ground-launched projectiles. They also enhance missile survivability and responsiveness in combat scenarios, making them indispensable in strategic and tactical defense operations.

Launch vehicles are anticipated to expand at the fastest CAGR of 12.4% over the forecast period. The growing number of commercial and government-backed satellite missions has resulted in the deployment of launch systems that demand high precision in thrust management. Thrust vectoring is essential in ensuring multi-payload handling, accurate trajectory alignment, and achieving mission-specific orbital configurations. Especially with the rise of small satellite deployments and reusable rockets, vector control solutions are evolving to meet new requirements in payload dynamics and mission agility.

By technology, the gimbal nozzle segment dominated the global market in 2024, generating USD 7.5 billion in revenue. Gimbal nozzles, which operate by pivoting to redirect engine thrust, play a critical role in fine-tuning the direction and attitude of flight vehicles. Their mechanical simplicity and ability to offer precise control make them ideal for both vertical launches and high-speed missile maneuvers. As demand increases for flexible and accurate flight systems, these nozzles are gaining more traction in newly developed aerospace and defense programs. They provide key advantages in dynamic stability, trajectory correction, and altitude control.

The end-use landscape is primarily split between space agencies and military & defense institutions. The military & defense sector emerged as the leading segment, valued at USD 9.7 billion in 2024. Armed forces worldwide are ramping up strategic modernization programs that include the integration of advanced TVC systems for faster response times, greater target adaptability, and improved mission outcomes. From high-speed interceptors to next-generation combat platforms, the role of TVC in enabling precise strike capabilities and operational flexibility continues to grow. In particular, evolving threats are pushing defense manufacturers to incorporate adaptive propulsion systems that rely heavily on advanced thrust vectoring solutions.

Regionally, North America maintained the dominant market share, accounting for 38.8% of global revenue in 2024, supported by robust aerospace manufacturing infrastructure, steady research and development funding, and the presence of major defense contractors. The region is projected to expand at a CAGR of 10.8%, driven by large-scale procurement programs and the adoption of next-generation aircraft platforms that require superior maneuverability and thrust control. The United States remained the single largest market, reaching USD 5.7 billion in 2024. The country's focus on building advanced air and space combat systems is a major contributor to TVC market growth.

Key industry players in the thrust vector control space include BAE Systems, BPS Space, Collins Aerospace, Honeywell International, JASC Corporation, Moog, and Parker Hannifin. These companies are consistently investing in next-gen TVC systems that offer improved control precision, reliability, and integration flexibility across multiple platforms. As the aerospace and defense landscape continues to evolve, the role of thrust vector control technologies is expected to remain central to mission success and operational superiority.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Technology trends

- 2.2.2 Application trends

- 2.2.3 End Use trends

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increased defense spending on missile systems

- 3.2.1.2 Growing satellite launch activities in LEO

- 3.2.1.3 Advancements in aerospace propulsion technologies

- 3.2.1.4 Shift toward electrification in aerospace propulsion architectures

- 3.2.1.5 Emergence of unmanned aerial vehicles and autonomous platforms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development costs and prolonged certification cycles

- 3.2.2.2 Integration complexity with legacy platforms

- 3.2.3 Market opportunities

- 3.2.3.1 Electromechanical actuator retrofits for legacy systems

- 3.2.3.2 AI-enabled control system integration

- 3.2.3.3 TVC standardization for modular aerospace platforms

- 3.2.3.4 Lightweight composite nozzle materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2021-2024)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Gimbal nozzle

- 5.3 Flex nozzle

- 5.4 Thrusters

- 5.5 Rotating nozzle

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Launch vehicles

- 6.3 Missiles

- 6.4 Satellites

- 6.5 Fighter aircraft

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Space agencies

- 7.3 Military & defense

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Nordics

- 8.3.7 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BAE Systems

- 9.2 BPS Space

- 9.3 Collins Aerospace

- 9.4 Honeywell International

- 9.5 JASC Corporation

- 9.6 Moog

- 9.7 Parker Hannifin

- 9.8 SABCA

- 9.9 Wickman Spacecraft and Propulsion Company

- 9.10 Woodward