PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782099

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782099

Magnetostrictive Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

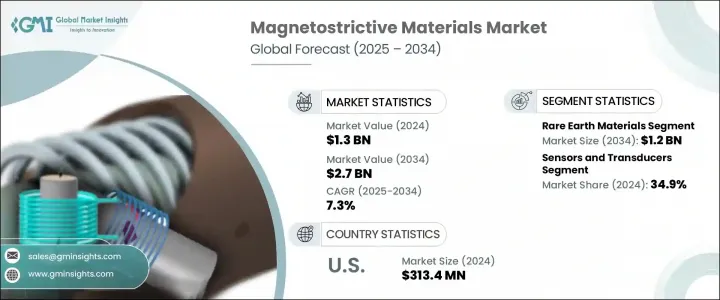

The Global Magnetostrictive Materials Market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 2.7 billion by 2034. Demand for magnetostrictive materials is rising due to their unique ability to change shape or size when subjected to magnetic fields, making them indispensable in advanced technological applications. Their usage spans a variety of sectors such as automotive, healthcare, aerospace, and consumer electronics. In the automotive field, these materials enhance vehicle performance, efficiency, and safety by being integral in sensors and actuators, particularly in power steering systems.

The growth of electric and hybrid vehicles is further propelling this market. Healthcare applications benefit greatly from their exceptional precision, enabling more accurate diagnostics and targeted treatments that improve patient outcomes. Meanwhile, aerospace companies rely on these materials for effective vibration control and continuous structural health monitoring, ensuring safety and performance in critical components. This dual utility across sectors not only broadens their application scope but also significantly amplifies market demand as industries seek reliable, high-performance solutions to meet evolving technological challenges.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.7 Billion |

| CAGR | 7.3% |

The rare earth materials segment generated USD 589.5 million in 2024 and is expected to reach USD 1.2 billion by 2034. This segment dominates because rare earth elements like terbium provide superior magnetic properties and high magnetic coefficients. These qualities make them ideal for applications requiring precision and efficiency, including sensors, actuators, and transformers. The increasing adoption of advanced technology in the automotive, aviation, and consumer electronics sectors fuels the growth of rare earth-based magnetostrictive materials.

The sensors and transducers accounted for a 34.9% share in 2024, making this the largest application segment. Magnetostrictive materials are prized for their ability to convert magnetic energy into mechanical energy and vice versa, lending themselves perfectly to sensor and transducer manufacturing. Their high sensitivity, durability, and accuracy make them essential components in automotive and consumer electronics devices.

United States Magnetostrictive Materials Market generated USD 313.4 million in 2024. This growth is driven by the increased use of these materials in various industrial applications, including sensors, actuators, and transformers. Industries such as manufacturing, automotive, and aerospace rely on magnetostrictive materials to improve operational accuracy and efficiency. In industrial automation, magnetostrictive sensors are widely used for precise position and displacement measurements. The ongoing focus on automation and the demand for advanced sensing technologies are expected to boost market growth throughout the forecast period.

Leading companies in the Magnetostrictive Materials Market include Cedrat Technologies, TdVib LLC, Grirem Advanced Materials Co., Ltd., Metglas Inc., and Aperam S.A. To strengthen their market positions and gain competitive advantages, these manufacturers pursue strategies such as launching innovative products, expanding production capacity, and engaging in mergers and acquisitions.

To solidify their foothold and expand market presence, companies in the magnetostrictive materials sector focus on several key strategic approaches. These include investing heavily in research and development to introduce innovative, higher-performance materials that meet evolving industry needs. They also prioritize capacity expansion to handle growing demand, especially from rapidly developing sectors like automotive and aerospace. Mergers and acquisitions help companies broaden their product portfolios and geographic reach, while strategic partnerships enable access to new technologies and markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Form

- 2.2.4 Application

- 2.2.5 End use industry

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Material Type, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Rare earth materials

- 5.2.1 Terfenol-D (Tb-Dy-Fe)

- 5.2.2 Samarium-iron compounds

- 5.2.3 Other rare earth materials

- 5.3 Iron-based alloys

- 5.3.1 Galfenol (Fe-Ga)

- 5.3.2 Alfenol (Fe-Al)

- 5.3.3 Other iron-based alloys

- 5.4 Nickel-based alloys

- 5.4.1 Nickel-iron alloys

- 5.4.2 Other nickel-based alloys

- 5.5 Cobalt-based alloys

- 5.6 Other materials

Chapter 6 Market Size and Forecast, By Form, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Bulk materials

- 6.2.1 Rods

- 6.2.2 Plates

- 6.2.3 Blocks

- 6.2.4 Other bulk forms

- 6.3 Thin films

- 6.4 Composites

- 6.4.1 Particulate composites

- 6.4.2 Laminated composites

- 6.4.3 Other composite forms

- 6.5 Powders

- 6.6 Other forms

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Sensors and transducers

- 7.2.1 Force and torque sensors

- 7.2.2 Position and displacement sensors

- 7.2.3 Stress and strain sensors

- 7.2.4 Magnetic field sensors

- 7.2.5 Acoustic and ultrasonic transducers

- 7.2.6 Other sensors and transducers

- 7.3 Actuators and motion control

- 7.3.1 Linear actuators

- 7.3.2 Rotary actuators

- 7.3.3 Precision positioning systems

- 7.3.4 Vibration control systems

- 7.3.5 Other actuator applications

- 7.4 Energy harvesting systems

- 7.4.1 Vibration energy harvesters

- 7.4.2 Acoustic energy harvesters

- 7.4.3 Other energy harvesting applications

- 7.5 Sonar and underwater acoustics

- 7.6 Structural health monitoring

- 7.7 Other applications

Chapter 8 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Automotive

- 8.2.1 Engine and powertrain applications

- 8.2.2 Suspension and chassis applications

- 8.2.3 Sensor applications

- 8.2.4 Other automotive applications

- 8.3 Aerospace and defense

- 8.3.1 Aircraft systems

- 8.3.2 Defense applications

- 8.3.3 Space applications

- 8.3.4 Other aerospace and defense applications

- 8.4 Energy and power

- 8.4.1 Energy harvesting

- 8.4.2 Power generation

- 8.4.3 Other energy and power applications

- 8.5 Industrial

- 8.5.1 Manufacturing equipment

- 8.5.2 Process control

- 8.5.3 Other industrial applications

- 8.6 Consumer electronics

- 8.7 Healthcare and medical

- 8.8 Marine

- 8.9 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 TdVib

- 10.2 Grirem Advanced Materials

- 10.3 Metglas

- 10.4 Cedrat Technologies

- 10.5 Aperam

- 10.6 Arnold Magnetic Technologies

- 10.7 Sensor Technology

- 10.8 AK Steel Holding Corporation

- 10.9 Xinetics