PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782109

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1782109

Ureteroscope Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

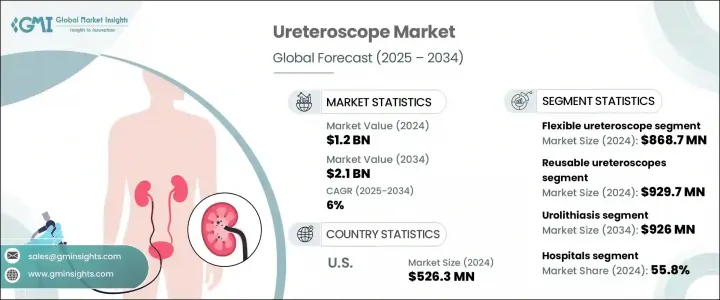

The Global Ureteroscope Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 2.1 billion by 2034. This growth trajectory is primarily being driven by the rising global incidence of kidney stones and other urinary tract-related conditions. Alongside this, the broader healthcare trend of adopting minimally invasive technologies continues to gain pace, fueled by better clinical outcomes, reduced post-operative complications, and shorter hospital stays. These advantages are pushing both healthcare providers and patients to prefer endoscopic interventions over traditional surgery. Ureteroscopes-devices designed to diagnose and treat ureteral and renal conditions-have become increasingly important as their designs evolve to offer improved flexibility and advanced imaging. These innovations allow for more precise treatments with greater patient comfort and enhanced safety, supporting their growing adoption across healthcare systems worldwide.

The increase in urinary tract infections and renal calculi can be attributed to a mix of modern lifestyle habits, rising obesity rates, genetic influences, and poor hydration in certain populations. As these health issues become more common, the medical community is turning to ureteroscopy as an effective and less invasive solution. These scopes are engineered to address a wide range of urological concerns such as strictures, tumors, and calculi. Equipped with cutting-edge visualization and maneuverability, they enable thorough diagnosis and minimally invasive treatment across the urinary tract.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.1 Billion |

| CAGR | 6% |

The flexible ureteroscopes segment was valued at USD 868.7 million in 2024. Their adaptability and ease of navigation through the intricate urinary pathways make them ideal for diagnosing and managing complex urological cases. Technological advancements in materials and visualization further enhance the performance of these devices, leading to widespread clinical acceptance. The demand for flexible ureteroscopes is increasing as urologists seek precision instruments that allow for safer and more efficient procedures.

In terms of clinical application, the urolithiasis segment commanded the highest market share in 2024 and is expected to reach USD 926 million by 2034. Urolithiasis affects a broad demographic and can result in serious complications if untreated. The precision and efficiency of ureteroscopes make them essential tools in treating this condition, particularly when stone removal or fragmentation is required through less invasive surgical means.

U.S. Ureteroscope Market was valued at USD 526.3 million in 2024 due to its strong healthcare infrastructure and high awareness of urological disorders. Advanced medical technology, combined with a significant patient population dealing with kidney stones and urinary tract issues, drives consistent demand. Additionally, the presence of top-tier medical device manufacturers and the rapid adoption of newer imaging tools solidify the country's leadership in this space.

Key players contributing to the competitive landscape of the Ureteroscope Market include Boston Scientific, STORZ, Ambu, PUSEN, Coloplast, BD, Stryker, Dornier MedTech, Neoscope, OLYMPUS, OPCOM Medical, and RICHARD WOLF. To strengthen their market position, companies in the ureteroscope industry are investing heavily in innovation, focusing on enhancing device flexibility, miniaturization, and optical clarity. They are actively expanding their product portfolios through strategic partnerships and product launches tailored to meet the demands of both developed and emerging healthcare markets. Continuous improvement in disposable and digital ureteroscope technology is also a key focus area. Additionally, players are ramping up their global distribution networks and engaging in training programs to support clinical adoption, thereby ensuring long-term competitiveness and sustained market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Usability

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of kidney stones and urinary tract diseases

- 3.2.1.2 Technological advancements in ureteroscopy

- 3.2.1.3 Growing adoption of minimally invasive devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced and digital ureteroscopes

- 3.2.3 Opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Integration of ureteroscopes with robotic surgical systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends, by product

- 3.7 Future market trends

- 3.8 Reimbursement scenario

- 3.9 Consumer behaviour analysis

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 MEA

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Flexible ureteroscope

- 5.3 Rigid ureteroscope

Chapter 6 Market Estimates and Forecast, By Usability, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Reusable ureteroscopes

- 6.3 Disposable ureteroscopes

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Urolithiasis

- 7.3 Urethral stricture

- 7.4 Urinary tract infections

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ambu

- 10.2 BD

- 10.3 Boston Scientific

- 10.4 Coloplast

- 10.5 Dornier MedTech

- 10.6 neoscope

- 10.7 OLYMPUS

- 10.8 OPCOM Medical

- 10.9 PUSEN

- 10.10 RICHARD WOLF

- 10.11 STORZ

- 10.12 Stryker